Whole life insurance policies offer lifelong coverage, a death benefit, and a cash value component. They may also pay dividends to policyholders when the insurer performs well financially. Policyholders can use dividends for nearly anything, and in many cases, they aren't taxable. Dividends are not guaranteed but may be paid out if the insurer has strong financial performance. Whole life insurance policies are sometimes referred to as participating policies, as customers can participate in the success of an insurance provider.

What You'll Learn

Dividends as a return of premium

Dividends from whole life insurance policies are considered a return of premium. They are not guaranteed and are based on the insurer's financial performance. If the insurance company keeps expenses down and its investments do well, it may declare a dividend, returning a portion of the surplus to policyholders.

The dividend amount is based on the price of the premiums paid by the policyholder. The higher the dividend, the more expensive the policy. Dividends can be distributed as cash, used to purchase additional paid-up insurance, or to reduce premiums due.

Policyholders can choose to receive dividends as a cash payment, with the insurance company sending a check or making an ACH payment to the policyholder's bank account. This option provides the most flexibility, as the funds can be used for anything. Policyholders can also leave their dividends in a separate savings account with the insurer, earning interest at a specified rate. This option offers liquidity and convenience, as the funds can be withdrawn at any time.

Another option is to use dividends to pay for future premiums, reducing the amount owed. This can be particularly helpful in years when the insurer has strong financial performance. Policyholders can also use dividends to purchase additional insurance coverage, known as paid-up coverage, which adds to the death benefit without increasing premiums.

Dividends from whole life insurance policies are generally not taxable, as they are considered a refund of overpaid premiums. However, if the policyholder chooses to leave the dividends in the policy to earn interest, the gains may be taxable.

Life Insurance and Blood Type: What's the Connection?

You may want to see also

Dividends as a tax-free cash payment

Dividends from whole life insurance policies are generally not subject to income tax. The Internal Revenue Service (IRS) treats dividend payments as a distribution from the contract, similar to how traditional investment dividends are treated. These dividends are seen as a refund for overpayment of the premium, and the IRS considers them a return of the policyholder's unused premiums. This means that the dividends are not considered profit and are therefore not taxed as income.

However, it is important to note that if the dividends are left in the policy to earn interest, the gains from this interest may be subject to taxation. This is because the interest is considered separate from the dividend payment and is treated as taxable income. To avoid this, policyholders can choose to receive their dividends as a cash payment or use them to purchase additional insurance coverage.

Additionally, while dividends are not guaranteed, if they are paid out, they can be used for various purposes. Policyholders can choose to receive their dividends as a cash payment, use them to reduce their future premium payments, or leave them with the insurance company to accumulate interest. Policyholders can also use dividends to purchase additional insurance coverage, increasing the cash value and death benefits of their policy.

When deciding how to use their dividends, policyholders should consider their financial goals and needs. For example, receiving dividends as a cash payment provides the most flexibility, as the funds can be used for anything, including discretionary spending or saving. On the other hand, using dividends to reduce future premium payments can help lower the overall cost of the policy. Leaving dividends with the insurance company to accumulate interest can provide liquidity and convenience, as the funds can be withdrawn at any time, but the interest earned may be subject to taxation.

Overall, while whole life insurance dividends are generally not taxable, policyholders should be mindful of how they utilize their dividends to avoid potential tax implications.

Life Insurance Expiry: Understanding the Fine Print

You may want to see also

Dividends to reduce premium costs

Whole life insurance dividends can be used to reduce premium costs. This option is available to policyholders who have paid more than the total amount of premium payments into their life insurance policy. By choosing this option, the insurance company will automatically apply any dividends to reduce future premiums, thereby lowering the amount the policyholder needs to pay out of pocket. Over time, as dividends increase and compound, they can eventually exceed the amount of the premiums, eliminating the need for the policyholder to make any further out-of-pocket payments. This option is particularly beneficial in years when the insurer has strong financial performance.

It is important to note that dividends are not guaranteed and are dependent on the insurer's financial performance. They are considered a return of unused premiums, and the amount received is based on the insurer's divisible surplus, which is calculated by taking into account the company's investment performance, mortality claims, and expenses. While dividends can be a great way to reduce premium costs, policyholders should not choose an insurance company or policy based solely on potential dividend payments. Instead, it is recommended to select a financially stable insurer with a history of consistent dividend payments to maximize the chances of receiving dividends while keeping costs lower.

Additionally, policyholders should carefully review the terms of their policy, as dividend options and tax implications may vary. In some cases, taxes may apply if withdrawals exceed payments. Therefore, it is essential to understand the tax consequences associated with receiving dividends and making withdrawals to make informed decisions.

Life Insurance, Suboxone, and You: What to Expect

You may want to see also

Dividends to purchase additional insurance

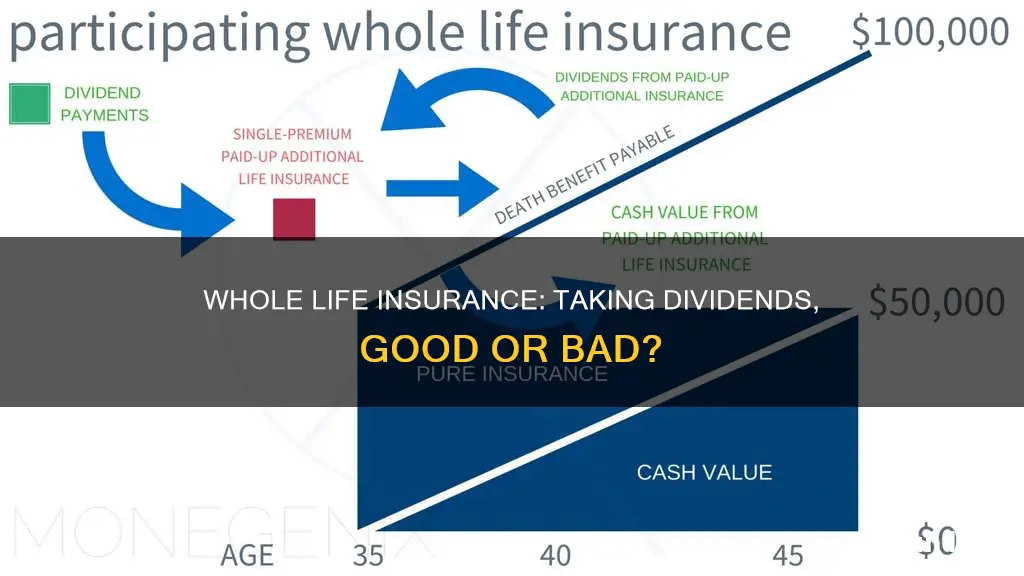

Dividends from whole life insurance policies can be used to purchase additional insurance, also known as paid-up coverage. This option allows policyholders to increase their death benefit without a corresponding increase in premiums. It is a good way to mitigate the effects of inflation or increase the death benefit if their financial circumstances necessitate it.

When using dividends to purchase additional insurance, only a small portion (5-10%) of the dividend payout is used to buy the paid-up insurance. The remaining amount is rolled back into the policy's cash value, increasing the guaranteed growth rate and helping to secure a larger share of future dividend payouts.

The amount of dividend received is based on the insurer's financial performance, including interest rates, investment returns, and new policies sold. Dividends are not guaranteed but are often paid out when the insurer has strong financial performance. The dividend amount is also tied to the price of premiums paid by the policyholder, with higher dividends corresponding to more expensive policies.

Policyholders should carefully review the details of their whole life insurance policies to understand how dividends are calculated and whether they are guaranteed. They should also consider the insurer's credit rating to assess the sustainability of dividend payments in the future.

Life Insurance: Estate Planning and Beneficiary Considerations

You may want to see also

Dividends to reduce policy loans

Dividends from whole life insurance policies can be used to reduce any outstanding policy loan balance. This can help the policyholder pay off their loan without using their regular income.

Whole life insurance dividends are generally not taxable since they are considered a return of premium. However, if the policyholder chooses to leave their dividends in the policy to earn interest, the interest generated may be taxable. Therefore, it is often more financially beneficial to take the dividends as tax-free cash and reinvest them in investments that may offer higher returns.

There are several other ways to use whole life insurance dividends:

- Cash or check: The policyholder can request that the insurer send them a check for the dividend amount, which can then be reinvested or used for discretionary spending.

- Premium deductions: The policyholder can request that the dividend be put towards future premiums, reducing the amount they owe.

- Additional insurance: The policyholder can use the dividend to purchase additional insurance or prepay on their existing policy.

- Savings account: The policyholder can keep the dividend with the insurance company, allowing it to earn interest.

It is important to carefully review the details of a whole life insurance policy before purchasing it, as dividend structures can vary. Whole life insurance policies may offer guaranteed or non-guaranteed dividends, and the premiums and benefits of each type of policy differ.

Guardian Life: A Comprehensive Health Insurance Provider?

You may want to see also

Frequently asked questions

No, whole life insurance dividends are not guaranteed. They are based on the insurer's financial performance and depend on factors such as investment returns, claims paid out, and operational costs.

You have several options for receiving your dividends, including cash payments, reducing future premiums, leaving dividends with the insurer to collect interest, or purchasing additional insurance.

Generally, life insurance dividends are not subject to income tax as they are considered a return of unused premiums. However, if you leave dividends in the policy to earn interest, the gains may be taxable.

You can use your life insurance dividends in several ways, including discretionary spending, saving, investing, or paying off debts. You can also use them to purchase additional insurance coverage or reduce your policy loans.