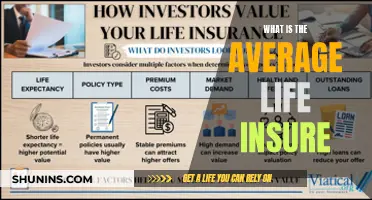

Subrogation is a legal concept that allows an insurer to pursue a third party that caused a loss to an insured person. This enables the insurer to recover the amount of the claim it paid to the insured for the loss. In most cases, the insured person's insurance company pays the claim for losses directly and then seeks reimbursement from the third party or their insurance company. Subrogation is most common in auto insurance policies but also occurs in property, casualty, and healthcare policy claims. Unlike property insurance, life insurance does not permit subrogation.

| Characteristics | Values |

|---|---|

| Whether life insurance permits subrogation | No |

| Whether property insurance permits subrogation | Yes |

| Whether liability insurance permits subrogation | Yes |

What You'll Learn

- Life insurance does not permit subrogation

- Subrogation is the substitution of one person for another in pursuit of a legal claim

- Subrogation is based on the principle of indemnity

- Subrogation is most common in auto insurance policies

- Subrogation also occurs in property/casualty and healthcare policy claims

Life insurance does not permit subrogation

Subrogation is the term for the right of an insurance carrier to pursue a third party that caused a loss to an insured person. This allows the insurance carrier to recover the amount of the claim it paid to the insured for the loss. In most cases, the insurance company will pay its client's claim directly and then seek reimbursement from the other party or their insurance company. Subrogation is most common in auto insurance policies but also occurs in property/casualty and healthcare policy claims.

In the case of life insurance, the insurer must pay the claim when the insured person dies and cannot take legal action against any person or party responsible for the death. This is because the principle of subrogation is complemented by the principle of indemnity, which states that a person may recover no more than the actual cash loss. In the case of death, there is no question of recovering more than the insured amount, and there is no risk of the insured person recovering twice (for example, from two separate policies) if the total amount exceeds the true value of the property insured.

The requirement for subrogation also stems from the public policy against wagering. If insurers could sue any person or party responsible for the death of an insured person, it would effectively be betting on an accident.

Group Term Life Insurance: Cash Value or Not?

You may want to see also

Subrogation is the substitution of one person for another in pursuit of a legal claim

In most subrogation cases, the insurance company pays its client's claim directly and then seeks reimbursement from the other party or their insurance company. This enables accident victims to receive claim payments more quickly after a loss. Subrogation also makes it easier to obtain a settlement under an insurance policy.

When an insurance company pursues a third party for damages, it is said to "step into the shoes of the policyholder". This means that the carrier will have the same rights and legal standing as the policyholder when seeking compensation for losses. If the insured party does not have the legal standing to sue the third party, the insurer will also be unable to pursue a lawsuit.

Subrogation is based on the principle of indemnity, which ensures that the insured is indemnified completely but not more than that. It is important to note that the insured may have to give up all their rights and will no longer be able to sue the wrongdoer on their own account.

Subrogation is most common in auto insurance policies but also occurs in property, casualty, and healthcare policy claims. For example, if an insured driver's car is totaled due to the fault of another driver, the insurance carrier reimburses the covered driver and then pursues legal action against the at-fault driver.

It is worth mentioning that subrogation is not permitted in life insurance. Unlike property insurance, life insurance does not allow the insurer to step into the shoes of the insured or the beneficiary to file a wrongful death claim.

Life Insurance: Pre-existing Conditions and Coverage Explained

You may want to see also

Subrogation is based on the principle of indemnity

Subrogation is a fundamental aspect of insurance policies, and it is based on the principle of indemnity. This principle guarantees that the insured will be restored to the position they were in before the incident that caused their loss. In other words, the insurer (provider) compensates the insured (policyholder) for the amount of the loss, up to the amount agreed upon in the contract.

The principle of indemnity is essential to ensure that the insured is indemnified completely but not more than that. Subrogation allows insurance companies to seek reimbursement for the compensation they have paid out due to an insured loss. This prevents the insured party from gaining an undue advantage through insurance claims and ensures a fair and equitable resolution of financial responsibilities.

For example, if an insured driver's car is totaled due to the fault of another driver, the insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the at-fault driver. If successful, the insurance carrier must divide the amount recovered after expenses proportionately with the insured to repay any deductible paid by the insured.

Subrogation also occurs in the healthcare sector. For instance, if a health insurance policyholder is injured in an accident and the insurer pays $20,000 to cover the medical bills, the same health insurance company is allowed to collect $20,000 from the at-fault party to reconcile the payment.

In the context of insurance, subrogation enables insurers to exercise certain rights to recover costs paid out to policyholders. These rights include the right to pursue legal action against the at-fault party, the right to receive full reimbursement for damages paid out, and the right to take over any rights belonging to the policyholder in relation to the claim.

Kentucky Farm Bureau: Offering Life Insurance and More

You may want to see also

Subrogation is most common in auto insurance policies

Subrogation is a legal right held by most insurance carriers to pursue a third party that caused an insurance loss to the insured. This allows the insurance carrier to recover the amount of the claim it paid to the insured for the loss. Subrogation is most common in auto insurance policies, but it also occurs in property/casualty and healthcare policy claims.

In the context of auto insurance, subrogation occurs when an insurance provider has to pay for damages or injuries caused by someone else. The insurance company may then pursue a subrogation claim against the party at fault for the loss to recover the costs of the claim. This process helps keep insurance premiums low by shifting the costs to the at-fault party and their insurer.

For example, if a driver is rear-ended by another driver who is at fault, the driver would report the accident to the other person's insurance company and file a claim. The other driver's insurance company would then pay for the repairs and medical bills. If the insurance company is taking too long to pay, the driver's insurance company may step in and file a subrogation claim to seek reimbursement for the money paid out, including the driver's deductible.

It's important to note that subrogation is a passive process for the insured, as the insurance companies handle most of the work behind the scenes. The insured typically receives prompt payment from their insurance company, and then the insurance company pursues reimbursement from the at-fault party or their insurance company.

While subrogation is common in auto insurance, it is not permitted in life insurance. Life insurance does not allow the insurer to step into the shoes of the insured or their beneficiaries and file a claim against a third party responsible for the insured's death.

Life Insurance Tax Withholding: Indiana's Unique Case

You may want to see also

Subrogation also occurs in property/casualty and healthcare policy claims

Subrogation is a legal right held by most insurance carriers to pursue a third party that caused an insurance loss to an insured person. This allows the insurance carrier to recover the amount claimed and paid to the insured for the loss. Subrogation is most common in auto insurance policies but also occurs in property/casualty and healthcare policy claims.

Property/Casualty Insurance Claims

In the context of property/casualty insurance, subrogation allows an insurance company to "step into the shoes" of its insured client and pursue the third party responsible for the damage or loss. For example, if a wrecking company negligently destroys an insured person's home, the insurance company may sue the wrecking company to recover the sum it was obligated to pay out under the homeowner's policy.

Healthcare Policy Claims

In the healthcare sector, subrogation occurs when a health insurance company seeks reimbursement from the insured person for payments made on their behalf for medical expenses. This typically happens when the insured collects money from a negligent third party responsible for their injuries. The health insurance company argues that it should be reimbursed by the insured because it paid for the original costs of their injury.

Life Insurance: Maturing and Your Benefits

You may want to see also

Frequently asked questions

No, life insurance does not permit subrogation. The insurer must pay the claim when the insured dies and may not step into the shoes of anyone entitled to file a wrongful death claim against a person who caused the death.

Subrogation is the legal right held by most insurance carriers to pursue a third party that caused an insurance loss to an insured. This allows the insurance carrier to recover the amount of the claim it paid to the insured for the loss.

Subrogation allows your insurer to recover the costs associated with a claim, such as medical bills, repair costs, and your deductible, from the at-fault party's insurer. This means that both you and your insurer can recoup the costs of damage or harm caused by somebody else.