Accelerated death benefits are typically not taxed as income. However, there are certain conditions under which they may be taxed. For example, if the accelerated death benefit is paid to a chronically ill individual, there is a limitation of $330 per day in benefits that may be tax-free. If the benefit exceeds this per-diem limitation, the excess amount must be included in the taxable income. Additionally, accelerated death benefits paid to any taxpayer other than the insured if the taxpayer has an insurable interest in the insured due to their position or financial interest in the taxpayer's trade or business are received tax-free.

What You'll Learn

- Accelerated death benefits are typically not taxed as income

- Death benefits are not taxable if the insured dies within two years

- Chronically ill insured individuals have a $330 daily benefit limit

- Terminally ill individuals must be certified by a physician

- Accelerated death benefits are tax-free if the insured is a director, officer or employee

Accelerated death benefits are typically not taxed as income

To qualify for an accelerated death benefit, a policy owner needs to provide proof that they are chronically or terminally ill. A physician’s certificate is required, showing a reasonable expectation of death within 24 months.

Accelerated death benefits allow someone with a life insurance policy who is terminally ill to access a portion of the policy's death benefit while they are alive. The money can be used for treatments, other costs needed to stay alive, or long-term care services.

While accelerated death benefits are typically not taxed as income, there may be some cases where they are taxable. For example, if the amount received exceeds the policyholder's total investment, that excess amount may be taxable. Additionally, the cost of a living benefit can vary according to the insurance company and policy. If the coverage is not included in the original policy, the policyholder may have to pay a fee or a percentage of the death benefit to add it.

It is important to carefully review the terms of your insurance policy and consult with a tax professional or advisor to determine the specific tax implications of accelerated death benefits in your situation.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

Death benefits are not taxable if the insured dies within two years

Accelerated death benefits are typically not taxed as income. This is especially true for individuals with a terminal illness who are expected to die within two years. In such cases, death benefits are not taxable.

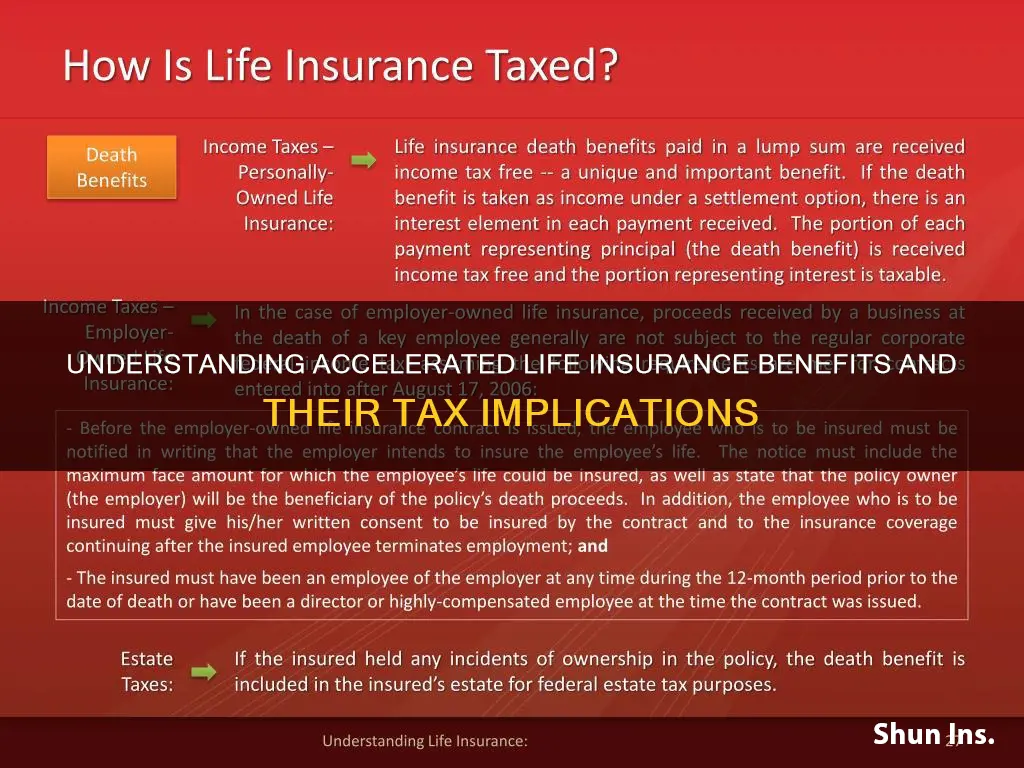

Death benefits are a payout to the beneficiary of a life insurance policy when the insured person dies. They are typically not subject to income tax and beneficiaries usually receive the benefit as a lump-sum payment. However, if beneficiaries receive the benefit in installments that include interest, then the interest will be taxable.

In the United States, the IRS does not consider death benefit proceeds as taxable income, and beneficiaries do not have to report the payout on their taxes. However, there are a few exceptions. If the beneficiary receives interest, the interest is taxable. If the money is paid to the insured's estate instead of an individual or entity, it could be taxable. Additionally, if the owner of the policy is different from the insured, the payout to the beneficiary could be considered a taxable gift.

To avoid paying taxes on a life insurance payout, you may consider transferring ownership of the policy. However, note that any value beyond what was paid for the policy will be considered taxable. If you transfer ownership within three years of your death, the IRS will treat it as if it still belongs to you. Another option is to create an irrevocable life insurance trust (ILIT) and transfer ownership of the policy from yourself to the ILIT, thereby removing it from your estate. However, this type of trust cannot be revoked once it is set up.

Life Insurance and Drug Use: What's the Verdict?

You may want to see also

Chronically ill insured individuals have a $330 daily benefit limit

In the United States, accelerated death benefits are typically not taxed as income. This includes accelerated death benefits paid to terminally ill insured individuals and those used for a chronically ill insured individual's long-term care services. However, amounts in excess of the policyholder's total investment are taxable.

According to the IRS, individuals are responsible for determining the amount to be taxed in the case of accelerated death benefit payouts. While these benefits are usually tax-exempt for individuals expected to die within two years, they are not meant to substitute for long-term care insurance coverage. Instead, they are meant to supplement expenses not covered by a long-term care policy.

When filing taxes, it is important to consult with a tax professional or a CPA to ensure that the correct amount is reported and to understand any potential tax implications.

As for the daily benefit limit for chronically ill insured individuals, the information provided does not directly state a $330 daily benefit limit. However, it mentions that the per diem limitation for qualified long-term care services is $175 per day, which can be adjusted for inflation. This amount is specified in the 26 U.S.C. § 7702B, which outlines the treatment of qualified long-term care insurance.

In summary, while accelerated death benefits are typically tax-exempt, individuals should consult with tax professionals and refer to the IRS guidelines to determine the correct taxable amount. Additionally, the per diem limitation for qualified long-term care services for chronically ill individuals is specified by law and may be subject to inflation adjustments.

Life Insurance and Suicide: Understanding the Payout

You may want to see also

Terminally ill individuals must be certified by a physician

To qualify for accelerated life insurance benefits, a terminally ill individual must be certified by a physician. This certification should indicate that the individual has an illness or physical condition that is reasonably expected to result in death within 24 months of certification. In other words, the individual must have a life expectancy of two years or less. This requirement ensures that the benefits are provided to those who need them the most and are used to cover critical healthcare and living expenses during the final stages of their lives.

The certification by a physician is a crucial step in the process of obtaining accelerated life insurance benefits. It serves as medical proof or evidence of the individual's terminal illness and imminent death. This certification is typically provided in the form of a physician's report or statement, which includes relevant medical information and the doctor's professional opinion. This document plays a vital role in supporting the individual's claim for accelerated benefits and ensuring that the benefits are allocated appropriately.

The process of obtaining a physician's certification typically involves the individual's treating doctor. This doctor is usually a specialist who is familiar with the patient's medical history and current condition. The physician will conduct a thorough evaluation of the individual's health, considering their diagnosis, prognosis, and overall functionality. This evaluation may include various medical tests, examinations, and reviews of existing medical records. The physician will then use their medical expertise and judgement to determine if the patient meets the criteria for a terminal illness, including the expected timeframe until death.

Once the physician has made their assessment, they will provide a written certification or statement indicating their findings. This document will typically include the physician's name, medical qualifications, and contact information, along with the patient's name, date of certification, and relevant medical details. It is important for the physician to provide a clear and concise summary of the patient's condition, including the nature of the illness, the expected prognosis, and any relevant medical history. This information helps insurance providers understand the patient's situation and make informed decisions regarding the allocation of accelerated benefits.

It is worth noting that the specific requirements for physician certification may vary depending on the insurance provider and the individual's location. Some insurance companies may have their own forms or processes for obtaining medical certification, while different states or countries may have unique regulations and definitions regarding terminal illness. Therefore, it is essential for individuals seeking accelerated benefits to carefully review the requirements of their insurance policy and consult with their healthcare providers to ensure they meet the necessary criteria.

Understanding Life Insurance Cash Value and Net Worth

You may want to see also

Accelerated death benefits are tax-free if the insured is a director, officer or employee

Accelerated death benefits are typically not taxed as income. They are generally treated as an amount paid by reason of the death of the insured and are, therefore, not included in the gross income. However, there is an exception to this rule. Accelerated death benefits are received on a tax-free basis if the beneficiary is a taxpayer other than the insured and has an insurable interest in the life of the insured because the insured is a director, officer, or employee of the taxpayer. In other words, if the insured is a director, officer, or employee, the accelerated death benefits are tax-free.

It is important to note that there are specific requirements to qualify for accelerated death benefits. The policy owner needs to provide proof of being chronically or terminally ill, with a physician's certificate showing a reasonable expectation of death within 24 months. Additionally, the cost of a living benefit can vary depending on the insurance company and policy. It may be included in the policy or require an additional fee or percentage of the death benefit.

While accelerated death benefits are typically tax-exempt, amounts in excess of the policyholder's total investment are taxable. This means that if the accelerated death benefit payout exceeds the policyholder's investment, the excess amount will be subject to taxation.

Receiving an accelerated death benefit can also impact an individual's eligibility for certain government benefits, such as Medicaid and SSI. It is important for individuals to carefully consider their specific circumstances and consult with a tax professional or financial advisor to understand the tax implications and how it may affect their overall financial situation.

Xanax and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Generally, accelerated life insurance benefits are not taxed as income.

To qualify for accelerated life insurance benefits, a policy owner needs to provide proof that they are chronically or terminally ill.

The amount of the accelerated death benefit can vary depending on the insurance company and policy. It may be included in the cost of the policy, or you may need to pay an additional fee or a percentage of the death benefit.

Taking accelerated death benefits will reduce the amount of money received by beneficiaries.

You can access accelerated death benefits by providing proof of your illness and submitting a claim to your insurance company. The insurance company will review your claim and may offer a lump-sum payment.