Group life insurance can provide a sense of security and peace of mind for employees, but it may not be sufficient for comprehensive coverage. While it offers a convenient and cost-effective way to protect a large number of individuals, it often has limitations in terms of coverage amount, flexibility, and long-term financial planning. This paragraph will explore why group life insurance alone might not be enough to ensure adequate protection for individuals and their families, and how it can be complemented by other insurance products and financial strategies.

What You'll Learn

- Limited coverage: Group policies often have lower limits compared to individual plans

- No customization: They don't offer personalized benefits or riders

- No control: Policyholders have no say in the terms or conditions

- Higher costs: Group insurance can be more expensive for individuals over time

- No legacy planning: It doesn't provide tools for estate distribution

Limited coverage: Group policies often have lower limits compared to individual plans

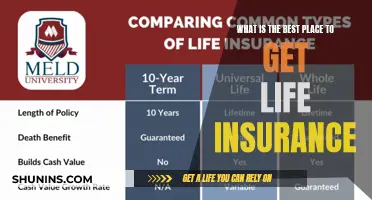

Group life insurance policies, while convenient and often provided by employers, may not offer the comprehensive coverage that individuals require. One of the primary concerns is the limited coverage amount, which can leave policyholders vulnerable in the event of a significant loss. These group plans typically have lower limits compared to individual life insurance policies, which are tailored to meet specific personal needs.

The coverage amount in a group policy is usually set by the employer or the insurance company and may not reflect the actual financial obligations of the individual and their family. For instance, if a group policy offers a base coverage amount of $50,000, this might be insufficient for a family with substantial financial responsibilities, such as mortgage payments, children's education, or other long-term commitments. In such cases, the group policy's limited coverage could result in a substantial financial gap when the insured person passes away.

To address this issue, individuals should carefully review the terms of their group life insurance policy and consider the following: First, assess your family's financial situation and determine the actual coverage needed. This involves calculating potential expenses and ensuring that the policy's death benefit will cover these costs. Second, explore the option of purchasing an additional individual life insurance policy to supplement the group coverage. This way, you can customize the coverage amount to fit your specific requirements.

Furthermore, it is essential to understand that group life insurance policies may have restrictions or limitations on certain benefits. For example, some policies might not provide coverage for pre-existing conditions or may have waiting periods before benefits are paid out. These factors can further reduce the overall value of the group policy, making it less adequate for long-term financial security.

In summary, while group life insurance can provide a basic level of coverage, it is crucial to recognize its limitations. The lower limits and potential restrictions may not adequately protect individuals and their families from financial hardship in the event of a tragic loss. Therefore, it is advisable to supplement group coverage with an individual life insurance policy to ensure comprehensive protection.

Physician Life Insurance: A Necessary Safety Net

You may want to see also

No customization: They don't offer personalized benefits or riders

Group life insurance plans, while convenient and often provided by employers, have a significant limitation: a lack of customization. Unlike individual life insurance policies, group plans are standardized, offering a one-size-fits-all approach to coverage. This means that the benefits and riders available may not align with the specific needs and circumstances of each employee.

In a group policy, the coverage is typically determined by the employer and may not take into account individual risk factors, health conditions, or financial goals. For instance, an employee with a pre-existing health condition might not receive the same level of coverage as a healthy individual, even though they may be at a higher risk. This lack of personalization can result in inadequate protection for those who need it most.

Furthermore, group life insurance often restricts the ability to add or remove riders, which are additional benefits that enhance the policy. Riders can provide valuable coverage for situations like critical illness, accidental death, or long-term care. However, in a group plan, these options might be limited or non-existent, leaving employees with less flexibility to tailor their insurance to their unique circumstances.

The absence of customization in group life insurance can lead to several issues. Firstly, it may result in employees feeling that their insurance needs are not being met, potentially causing them to seek additional coverage elsewhere. Secondly, it can create a sense of dissatisfaction and a lack of trust in the employer's benefits package, impacting employee morale and retention.

To address this limitation, individuals should consider the following steps. Firstly, assess their personal insurance needs and understand their risk profile. This can be done through online risk assessment tools or by consulting a financial advisor. Secondly, explore the option of purchasing an individual life insurance policy, which offers more flexibility and customization. By taking these steps, employees can ensure they have adequate coverage that aligns with their specific requirements.

Life Insurance Proceeds: NIIT Exempt Status

You may want to see also

No control: Policyholders have no say in the terms or conditions

Group life insurance can be a convenient and cost-effective way to secure coverage for yourself and your family, especially if offered through your employer. However, it's important to understand the limitations of this type of policy. One significant drawback is the lack of control that policyholders have over the terms and conditions of the insurance.

When you purchase a group life insurance policy, the terms are typically set by the insurance company and the employer. This means that policyholders have little to no input on the coverage details. The policy may not align with your specific needs or preferences, and any changes or additions to the coverage are often at the discretion of the employer or the insurance provider. This lack of control can be a major concern for individuals who want more personalized and tailored insurance solutions.

For instance, you might want a higher death benefit or additional riders to protect against critical illnesses or accidental death. However, these requests may not be accommodated, and you are left with a policy that doesn't fully meet your expectations. Moreover, if you change jobs or leave the company, the group insurance policy may no longer be available, leaving you without coverage at a critical time.

In contrast, individual life insurance policies offer more flexibility and customization. With an individual policy, you can choose the coverage amount, term length, and additional benefits that suit your financial goals and personal circumstances. You have the power to make changes and adjustments as your life situation evolves, ensuring that your insurance remains relevant and valuable over time.

To address this limitation, consider exploring individual life insurance options alongside your group coverage. This way, you can have the peace of mind that comes with comprehensive protection while still having control over the terms and conditions of your insurance. It's a proactive approach to ensuring that your insurance needs are met effectively.

Alcoa's Broken Promise: Canceling Life Insurance Policies

You may want to see also

Higher costs: Group insurance can be more expensive for individuals over time

Group life insurance, while convenient and often offered by employers, may not provide the comprehensive coverage individuals need over their lifetime. One significant drawback is the potential for higher costs for individuals compared to individual life insurance policies. Here's an explanation of why this can be a concern:

When an employer offers group life insurance, the cost is typically shared between the employer and the employees. While this can make it more affordable for individuals in the short term, it might not always be the most cost-effective option in the long run. Group insurance policies often have a limited coverage amount, and as individuals age, their insurance needs tend to increase. As a result, the employer's contribution might not cover the rising costs of individual life insurance, which can be tailored to meet specific needs. Over time, this could lead to higher out-of-pocket expenses for employees, especially if they require more substantial coverage.

Additionally, group insurance plans may have restrictions or limitations on coverage amounts, especially for high-risk individuals or those with pre-existing health conditions. This can further drive up costs for employees who require more extensive protection. In contrast, individual life insurance policies offer flexibility, allowing policyholders to choose the coverage amount and features that best suit their needs, often at a potentially lower cost per dollar of coverage.

Another factor to consider is the potential for increased premiums as individuals age. Group insurance policies might not offer the same level of flexibility in adjusting coverage as individual plans, which can result in higher premiums for older individuals who may have higher life insurance needs. This could be a significant financial burden for those who rely on group insurance and later discover that their coverage is insufficient or too costly to maintain.

In summary, while group life insurance can be a convenient and cost-effective option for basic coverage, it may not provide the necessary protection for individuals over their entire lifetime. The potential for higher costs, limited coverage options, and age-related premium increases highlights the importance of carefully considering individual life insurance policies to ensure long-term financial security.

New York Life Insurance: Making Money, Explained

You may want to see also

No legacy planning: It doesn't provide tools for estate distribution

Group life insurance, while a valuable benefit offered by many employers, is often seen as a short-term financial safety net rather than a comprehensive financial planning tool. One of the critical limitations of group life insurance is its lack of legacy planning capabilities. This means that, despite providing financial security in the event of the insured's death, it does not offer any mechanisms for estate distribution, which is a crucial aspect of long-term financial planning.

Estate distribution refers to the process of dividing a deceased person's assets according to their wishes, as outlined in their will or trust. This process ensures that the deceased's assets are distributed fairly and according to their intentions, providing financial security and peace of mind for beneficiaries. However, group life insurance policies typically do not include provisions for estate distribution. They are designed to pay out a lump sum to the designated beneficiaries upon the insured's death, which may not align with the specific distribution needs of the estate.

Without proper estate distribution planning, the lump sum payout from group life insurance can lead to several issues. Firstly, it may not be sufficient to cover all the deceased's debts and obligations, such as mortgages, loans, or outstanding taxes. Secondly, it might not be divided equally among all beneficiaries, potentially causing disputes and legal battles. Moreover, the lump sum may not be invested or managed effectively, leading to a loss of value over time.

To address this limitation, individuals should consider additional financial planning tools. One effective approach is to create a will or establish a trust, which provides detailed instructions for estate distribution. These legal documents can specify how different assets, including the proceeds from group life insurance, should be allocated to beneficiaries. By combining group life insurance with comprehensive estate planning, individuals can ensure that their financial goals are met, their loved ones are protected, and their assets are distributed according to their wishes.

In summary, while group life insurance offers valuable financial protection, it lacks the estate distribution tools necessary for long-term financial planning. By integrating estate planning strategies, such as wills and trusts, individuals can maximize the benefits of group life insurance and ensure a smooth transition of their assets to their intended beneficiaries. This holistic approach to financial planning provides a more comprehensive solution for individuals and their families.

Life Insurance Proceeds: Tax-Free or Not?

You may want to see also

Frequently asked questions

Group life insurance, while beneficial, typically provides coverage only up to a certain amount, often linked to your income or job title. It may not be sufficient to cover all your family's expenses and long-term financial goals, especially if you have a large family or specific financial obligations.

Consider supplementing group life insurance with an individual term life policy. This additional coverage can provide a larger payout and offer more flexibility to tailor the policy to your family's unique needs. Individual policies also allow for potential tax advantages and the ability to build cash value over time.

Group insurance may have limitations, such as a maximum age limit for coverage or the possibility of being canceled if your employer changes. It might not provide the same level of customization and control as an individual policy, which could be crucial for long-term financial security.

While group insurance is valuable, it is generally not a replacement for an individual life insurance policy. Individual policies offer more control over coverage amounts, policy terms, and potential investment options. They can also be tailored to your specific financial goals and provide a more comprehensive safety net for your loved ones.

Combining group and individual life insurance can provide a well-rounded approach to financial planning. Group insurance offers employer-sponsored benefits, while individual policies ensure personalized coverage. This combination can provide enhanced financial protection, allowing you to address both short-term and long-term financial objectives.