When it comes to finding the best place to get life insurance, there are several factors to consider. Many people opt for traditional insurance companies, which offer a wide range of policies and coverage options. However, with the rise of digital platforms and online insurance providers, the options have expanded significantly. Online insurance marketplaces, for instance, allow you to compare quotes from multiple insurers, making it easier to find the best deal. Additionally, some insurance companies now offer direct-to-consumer policies, cutting out the middleman and potentially saving you money. Ultimately, the best place to get life insurance depends on your individual needs, budget, and preferences.

What You'll Learn

- Cost Comparison: Research and compare rates from various insurers to find the most affordable policy

- Coverage Needs: Assess your financial obligations and choose a policy that adequately covers your dependents

- Term Length: Decide on a term length (e.g., 10, 20, 30 years) based on your long-term goals

- Health Factors: Consider your health and lifestyle, as these can impact premium costs and eligibility

- Agent Recommendations: Seek advice from insurance agents or brokers to find the best fit for your needs

Cost Comparison: Research and compare rates from various insurers to find the most affordable policy

When it comes to finding the best place to get life insurance, cost comparison is a crucial step in the decision-making process. Life insurance can provide financial security for your loved ones in the event of your passing, but it's essential to ensure you're getting the best value for your money. Here's a detailed guide on how to research and compare rates from various insurers to find the most affordable policy:

- Understand Your Needs: Before diving into the comparison, it's essential to understand your life insurance needs. Consider factors such as your age, health, lifestyle, and the amount of coverage required. Younger individuals and those in good health often qualify for lower rates. Additionally, the type of policy you choose (term life, whole life, or universal life) will impact the cost.

- Gather Information: Start by gathering information from multiple insurers. You can obtain quotes and rates by visiting their websites, calling their customer service, or using online comparison platforms. Make sure to provide accurate and up-to-date personal details during the quote process. The more comprehensive your information, the more accurate the quotes will be.

- Compare Quotes: Obtain quotes from at least three to five different insurers. Compare the annual premiums, coverage amounts, and policy terms. Look for any additional benefits or discounts offered by each insurer. For instance, some companies may provide discounts for non-smokers, healthy individuals, or those with a clean driving record.

- Analyze Policy Details: When comparing quotes, pay close attention to the policy details. Understand the coverage period, any conversion options, and the conditions under which you can increase or decrease the coverage amount. Some policies may offer a higher death benefit initially but require regular premium payments, while others might have lower initial benefits but more flexible payment options.

- Consider Additional Costs: Life insurance policies may come with various fees and charges. These can include medical exams, policy administration fees, and surrender charges (if applicable). While not always the primary factor, these additional costs can impact the overall affordability of the policy. Ensure you understand all associated expenses before making a decision.

- Review and Negotiate: After comparing rates and policy details, review the quotes and choose the most competitive option. However, don't be afraid to negotiate. Insurance companies often have some flexibility in their pricing, especially if you're purchasing a larger policy or have a long-term commitment. You can inquire about any potential discounts or adjustments to lower the cost further.

- Long-Term Considerations: Remember that life insurance is a long-term commitment. Consider your future plans and financial goals when making a decision. If you anticipate significant life changes, such as starting a family or purchasing a home, you may want to review your policy periodically to ensure it still meets your needs.

By following these steps, you can effectively research and compare life insurance rates, making an informed decision to secure the most affordable and suitable policy for your circumstances.

Understanding Tax Implications: Average Life Insurance Payouts Explained

You may want to see also

Coverage Needs: Assess your financial obligations and choose a policy that adequately covers your dependents

When considering life insurance, one of the most crucial aspects is ensuring that your policy provides adequate coverage for your dependents. This involves a careful assessment of your financial obligations and the needs of your loved ones. Here's a step-by-step guide to help you navigate this process:

- Calculate Your Financial Obligations: Begin by making a comprehensive list of all your financial commitments. This includes regular expenses such as mortgage or rent payments, car loans, student loans, credit card debts, and any other ongoing financial responsibilities. Also, consider one-time expenses that your dependents might incur in the future, such as college tuition or a down payment on a house. The goal is to estimate the total financial impact you would have on your family if you were no longer around.

- Determine the Duration of Coverage: Life insurance policies typically offer coverage for a specific period, often 10, 20, or 30 years. Consider your dependents' needs over this period. For instance, if your children are young and you want to ensure they have financial support until they become financially independent, a longer-term policy might be more suitable. Alternatively, if your mortgage is nearly paid off and other major expenses are minimal, a shorter-term policy could be more cost-effective.

- Assess the Policy's Death Benefit: The death benefit is the amount of money your policy will pay out upon your death. It should be sufficient to cover the financial obligations you've identified and provide for your dependents' future needs. A common approach is to aim for a death benefit that is 10 to 15 times your annual income. This ensures that your family can maintain their current standard of living and cover essential expenses for several years. For example, if your annual income is $100,000, you might consider a policy with a death benefit of $1 million to $1.5 million.

- Consider Additional Benefits: Some life insurance policies offer additional features that can enhance your coverage. For instance, you might opt for a policy that includes an investment component, allowing your death benefit to grow over time. Alternatively, some policies offer an option to increase the death benefit periodically to account for inflation. These additional benefits can provide extra security and peace of mind, especially if your financial obligations are expected to increase over time.

- Review and Adjust Regularly: Life circumstances change, and so should your life insurance coverage. It's essential to review your policy periodically, especially after significant life events like getting married, having children, or purchasing a home. Adjust your coverage to reflect any changes in your financial obligations and the needs of your dependents. Regularly assessing and updating your policy ensures that you maintain adequate protection throughout your life.

By following these steps, you can make informed decisions about your life insurance coverage, ensuring that your dependents are financially protected in the event of your passing. Remember, the goal is to provide a safety net for your loved ones, so take the time to thoroughly assess your unique financial situation and choose a policy that aligns with your specific needs.

Whole Life Insurance Cash Values: Are They Flexible?

You may want to see also

Term Length: Decide on a term length (e.g., 10, 20, 30 years) based on your long-term goals

When considering term life insurance, the duration of coverage, or term length, is a critical decision that directly impacts your financial security. It's essential to choose a term that aligns with your long-term goals and responsibilities. Here's a guide to help you determine the appropriate term length:

Assess Your Needs: Begin by evaluating your current and future financial obligations. Consider your family's needs, such as mortgage payments, children's education expenses, or any other long-term commitments. If you have a substantial amount of debt or financial dependents who rely on your income, a longer term might be more suitable. For instance, a 30-year term could provide coverage until your children finish their education or your mortgage is paid off. On the other hand, if your financial obligations are minimal, a shorter term like 10 years might be more appropriate.

Long-Term Goals: Your long-term goals play a significant role in determining the term length. If you plan to have a family or start a business in the near future, a longer term ensures that your loved ones are protected during these critical life stages. For example, a 20-year term could cover the years when your children are growing up and your family's expenses are higher. Conversely, if your goals include financial independence or retirement planning, a shorter term might be more aligned with your timeline.

Flexibility and Cost: Term life insurance offers flexibility in term lengths, typically ranging from 10 to 30 years. Longer terms often come with higher premiums, which is an essential factor in your decision-making process. If you opt for a 30-year term, you'll have coverage for an extended period, providing peace of mind for your family's long-term needs. However, it will also be more expensive. Conversely, a 10-year term is generally more affordable but may not offer the same level of security for your family's future.

Review and Adjust: Life circumstances can change over time, and so should your insurance coverage. Regularly review your term life insurance policy to ensure it remains appropriate. If you start a family, buy a home, or experience other life events, you may need to adjust your term length accordingly. For instance, if you have a growing family, you might consider extending your term to 30 years to ensure comprehensive coverage.

In summary, the term length of your life insurance policy should be a strategic decision, reflecting your current and future financial obligations, long-term goals, and the level of security you want to provide for your loved ones. It's a personalized choice, and consulting with an insurance advisor can help you make an informed decision based on your unique circumstances.

Life Insurance Payouts for Suicide: What You Need to Know

You may want to see also

Health Factors: Consider your health and lifestyle, as these can impact premium costs and eligibility

When considering life insurance, your health and lifestyle are crucial factors that can significantly influence the cost of premiums and your eligibility for coverage. Insurance companies often use health assessments to determine the risk associated with insuring an individual, which directly affects the premium rates. Here's a detailed breakdown of how health factors come into play:

Medical History and Current Health: Your medical history is a critical piece of information for insurers. They will review any pre-existing conditions, chronic illnesses, or past medical procedures. For instance, individuals with a history of heart disease, diabetes, or cancer may face higher premium costs or even be deemed uninsurable by some companies. Similarly, current health status is vital; recent surgeries, ongoing treatments, or severe health issues can impact your eligibility and premium rates.

Age and Gender: Age is a significant determinant of life insurance premiums. Generally, younger individuals are considered lower-risk, and insurance companies offer more competitive rates to this demographic. As you age, the risk of health-related issues increases, leading to higher premiums. Additionally, gender can play a role, as statistics show that men and women have different life expectancies and mortality rates, which are reflected in the insurance rates.

Lifestyle Choices: Insurance providers also consider your lifestyle choices, which can either enhance or detract from your overall health and, consequently, your insurance rates. Smoking, for example, is a major risk factor for various health issues, including lung cancer and heart disease. As a result, smokers often pay higher premiums. Similarly, excessive alcohol consumption, drug use, or extreme sports participation can impact your health and insurance costs. Maintaining a healthy weight, regular exercise, and a balanced diet are generally associated with lower insurance rates.

Family Medical History: The medical history of your immediate family can also come into play. Insurance companies may review the health records of your parents, siblings, or children to assess genetic predispositions or family trends. Certain genetic conditions or hereditary diseases can affect your eligibility and premium rates. It's essential to be transparent about family medical history to ensure accurate assessments and appropriate coverage.

Regular Health Check-ups: Regular health check-ups and maintaining a healthy lifestyle can positively impact your life insurance journey. Insurance companies often prefer individuals who have a proactive approach to health. By staying on top of your health, managing any existing conditions, and adopting a healthy lifestyle, you can potentially secure more favorable terms and lower premiums.

Term Life Insurance: Renewing Your Policy and Options

You may want to see also

Agent Recommendations: Seek advice from insurance agents or brokers to find the best fit for your needs

When it comes to finding the best life insurance policy, seeking professional advice from insurance agents or brokers can be an invaluable step. These experts play a crucial role in helping individuals navigate the complex world of insurance and make informed decisions. Here's why consulting an agent or broker is a wise choice:

Personalized Guidance: Insurance agents and brokers are trained professionals who understand the various types of life insurance policies available. They can assess your unique financial situation, health status, and personal goals to recommend the most suitable coverage. Whether you're looking for term life insurance, whole life insurance, or a combination of both, these agents can provide tailored advice. They will consider factors such as your age, income, family responsibilities, and long-term financial objectives to ensure you receive a policy that aligns perfectly with your needs.

Market Knowledge: The insurance market can be vast and often confusing for those unfamiliar with it. Agents and brokers have extensive knowledge of the insurance industry and stay updated on the latest products and trends. They can educate you about different policy options, benefits, and potential pitfalls, ensuring you make an informed choice. Additionally, they can provide insights into various insurance providers, their reputation, and the quality of their customer service, helping you select a reliable and trustworthy company.

Comparative Analysis: One of the key advantages of consulting an agent is their ability to compare different insurance policies from various companies. They can present you with a range of options, allowing you to compare premiums, coverage amounts, policy terms, and additional benefits. This comprehensive comparison ensures you get the best value for your money and find a policy that meets your specific requirements. Moreover, agents can negotiate on your behalf, potentially securing discounts or additional perks that may not be readily available to the general public.

Claims and Support: Insurance agents and brokers often provide ongoing support even after you've purchased a policy. They can assist with understanding your coverage, filing claims, and ensuring a smooth claims process if the need arises. This level of support can be particularly beneficial during challenging times, providing peace of mind and ensuring you receive the full benefits you're entitled to.

Long-Term Financial Planning: Life insurance is not just about providing financial security for your loved ones; it's also a crucial component of long-term financial planning. Agents can help you understand how life insurance fits into your overall financial strategy, including retirement planning, estate planning, and wealth accumulation. They can guide you in making informed decisions that will benefit you and your family in the long run.

In summary, consulting insurance agents or brokers is a strategic approach to finding the best life insurance policy. Their expertise, market knowledge, and personalized guidance can help you make a well-informed decision, ensuring you and your loved ones are protected. Remember, the right agent will take the time to understand your unique circumstances and provide solutions tailored to your needs.

Canceling FEGLI Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

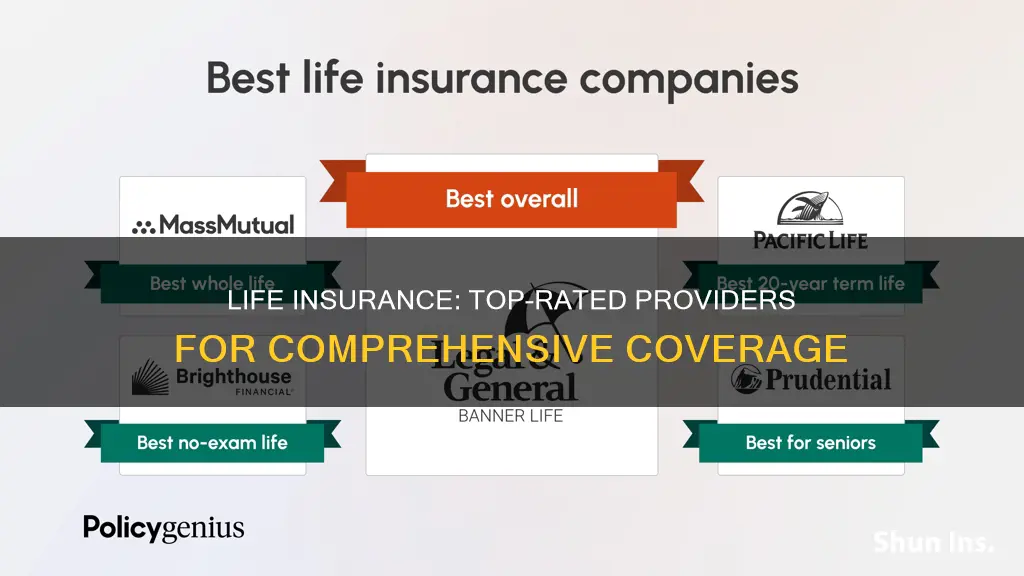

The best place to get life insurance depends on your individual needs and preferences. It's essential to consider several factors when choosing a provider. Firstly, research and compare different insurance companies to find those with a strong financial rating, a good reputation, and a wide range of coverage options. Look for companies that offer competitive rates, flexible payment plans, and a variety of policy types to suit your requirements. Additionally, consider the level of customer service and support provided by the insurer, as this can be crucial in times of need.

Finding affordable life insurance involves several strategies. Firstly, consider your coverage needs and opt for a policy that provides adequate protection without unnecessary add-ons. Term life insurance, for instance, offers pure coverage for a specified period, which can be more cost-effective than permanent life insurance. Shopping around and getting quotes from multiple insurers is also crucial, as prices can vary significantly. Additionally, maintaining a healthy lifestyle by quitting smoking, exercising regularly, and managing any pre-existing health conditions can lead to lower premiums.

Yes, there are numerous online platforms and insurance brokers that can assist in finding the best life insurance deal. These platforms often provide a comparison service, allowing you to input your details and receive quotes from various insurers. They can help you navigate the complex world of life insurance and offer personalized recommendations based on your needs. Online brokers can also provide valuable advice and guidance, ensuring you make an informed decision. However, it's essential to verify the credibility and reliability of these platforms to ensure you receive accurate information and suitable coverage.