Term life insurance can be a valuable financial tool for individuals, especially those in their later years, to ensure their loved ones are protected in the event of their passing. For a 77-year-old man, finding suitable term life insurance coverage can be a challenge due to age-related health considerations. However, it is still possible to secure a policy that provides financial security for beneficiaries. This paragraph will explore the options available for older individuals seeking term life insurance, including the benefits and potential challenges of obtaining coverage at this age.

What You'll Learn

- Cost: Term life insurance for older men can be expensive due to age-related health risks

- Coverage: Determine the appropriate coverage amount based on financial needs and dependents

- Health: Underwriting may be challenging; pre-existing conditions can impact eligibility and rates

- Alternatives: Consider whole life or universal life for long-term financial security

- Age Limits: Some insurers have maximum age limits for term life policies

Cost: Term life insurance for older men can be expensive due to age-related health risks

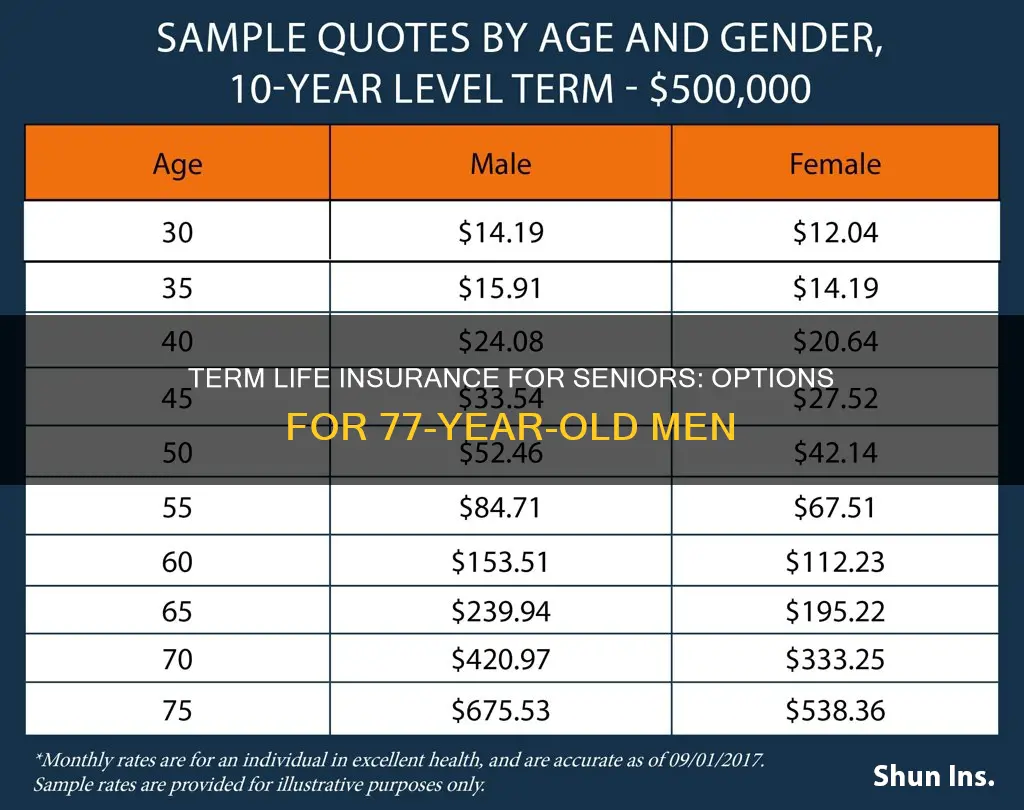

Term life insurance for older individuals, especially those in their late 70s, can be a significant financial commitment and often comes with a higher price tag. This is primarily due to the increased health risks associated with advancing age. As we grow older, the likelihood of developing chronic illnesses or facing serious health conditions rises, which can directly impact the cost of insurance. For a 77-year-old man, the insurance provider will consider him a high-risk candidate due to the potential for various health issues, such as heart disease, cancer, or Alzheimer's, which could lead to an early death.

The insurance industry uses complex risk assessment models to determine premiums. These models take into account various factors, including age, gender, medical history, lifestyle choices, and family medical history. For older individuals, especially those with pre-existing conditions, the risk assessment will likely be higher, resulting in more expensive premiums. The older a person is, the more they are likely to pay for term life insurance, as the insurance company aims to cover potential financial losses due to premature death.

Additionally, the type of term life insurance policy chosen can also influence the cost. For instance, a 10-year term policy might be more affordable than a 30-year term, as the insurance company's risk is lower over a shorter period. However, for a 77-year-old, even a 10-year term can be costly, and the premiums may be a significant expense, especially if other financial commitments or savings are limited.

It is essential for older individuals to carefully consider their insurance options and shop around for the best rates. Some insurance companies offer specialized policies for seniors, which might provide more affordable coverage. Additionally, improving one's health through regular exercise, a balanced diet, and regular medical check-ups can also help reduce insurance costs, as it demonstrates a lower risk profile to the insurance provider.

In summary, term life insurance for a 77-year-old man can be expensive due to age-related health risks, and it is crucial to understand these costs to make informed financial decisions. Exploring different insurance providers and policies can help older individuals find suitable coverage without breaking the bank.

Life Insurance Lapse: Understanding the Risks and Consequences

You may want to see also

Coverage: Determine the appropriate coverage amount based on financial needs and dependents

When considering term life insurance for a 77-year-old man, determining the appropriate coverage amount is crucial to ensure financial security for both the individual and their loved ones. This decision should be based on a comprehensive assessment of their unique financial situation and future needs. Here's a detailed guide to help navigate this process:

Evaluate Financial Needs: Start by considering the individual's current and future financial obligations. For a 77-year-old, this might include any remaining mortgage payments, ongoing medical expenses, or specific goals like funding a child's education. Calculate the total value of these obligations to understand the immediate financial impact of a potential loss. For instance, if the individual has a substantial mortgage remaining, the insurance coverage should ideally cover this debt to prevent financial strain on beneficiaries.

Consider Dependents: The presence of dependents, such as a spouse or children, is a significant factor. These individuals rely on the 77-year-old's income and financial support. Determine the number and age of dependents, as younger dependents may require longer-term financial backing. For example, if the individual is the primary breadwinner for a family, a higher coverage amount might be necessary to ensure their dependents can maintain their standard of living in the event of their passing.

Assess Long-Term Goals: While term life insurance typically provides coverage for a specific period, it's essential to consider the individual's long-term goals. For a 77-year-old, this could include ensuring that any remaining debt is paid off, providing funds for estate distribution, or even covering potential future medical expenses. The coverage amount should be sufficient to address these goals, providing a safety net for the beneficiaries.

Review and Adjust: Life circumstances can change, and so should the insurance coverage. Regularly review the policy to ensure it remains aligned with the individual's financial situation and goals. As the individual ages, their health may change, impacting insurance rates. It's essential to periodically reassess and adjust the coverage to maintain its relevance and effectiveness.

In summary, determining the right coverage amount for term life insurance for a 77-year-old involves a careful analysis of financial obligations, dependents, and long-term goals. By tailoring the policy to these specific needs, individuals can provide financial security and peace of mind for themselves and their loved ones. This process ensures that the insurance serves its purpose effectively, offering protection when it's needed most.

S Corp Life Insurance: Spouse Coverage Options

You may want to see also

Health: Underwriting may be challenging; pre-existing conditions can impact eligibility and rates

Underwriting for term life insurance can be a complex process, especially for individuals over the age of 77, as insurance companies often consider age and health history when assessing risk. At this age, the likelihood of pre-existing health conditions increases, and these conditions can significantly impact the underwriting process and the final insurance rates.

For a 77-year-old man, certain health factors may raise concerns for insurance providers. Common pre-existing conditions that could affect eligibility and premium costs include heart disease, cancer, diabetes, and respiratory issues. These conditions may require additional medical information and a thorough review of the individual's health history. During the underwriting process, insurers will likely ask for detailed medical records, including any recent diagnoses, treatments, and ongoing medications. This information is crucial in determining the level of risk associated with insuring the individual.

The presence of pre-existing conditions can lead to two main outcomes. Firstly, the insurer may decline the application, especially if the conditions are severe or recently diagnosed. In such cases, the individual might need to explore alternative insurance options or consider a limited-term policy with a higher premium. Secondly, if the insurer decides to offer a policy, the rates will likely be higher due to the increased risk. This is because older individuals with health issues are statistically more likely to make insurance claims.

To navigate this process successfully, it is essential to be transparent and provide accurate medical information. Hiding pre-existing conditions can lead to serious consequences, including policy rejection or future claim denials. It is advisable to consult with an independent insurance advisor who can guide you through the underwriting process and help find suitable coverage options. They can also assist in understanding the various factors that influence insurance rates and help negotiate the best possible terms.

In summary, for a 77-year-old man seeking term life insurance, the underwriting process may present unique challenges. Pre-existing health conditions are a critical factor, and individuals should be prepared to provide detailed medical information. By understanding the potential impact of these conditions, one can make informed decisions and explore appropriate insurance solutions.

Who Gets Your Life Insurance Money: Contingent Beneficiaries Explained

You may want to see also

Alternatives: Consider whole life or universal life for long-term financial security

When it comes to life insurance for older individuals, such as a 77-year-old man, the term "term life insurance" might not always be the best fit due to its limited coverage period. In this case, exploring alternative insurance options can provide more comprehensive financial security. Two popular alternatives to consider are whole life and universal life insurance.

Whole life insurance offers a permanent coverage option, providing a guaranteed death benefit for the entire life of the insured individual. This type of policy builds cash value over time, which can be borrowed against or withdrawn, offering financial flexibility. For a 77-year-old, whole life insurance can be a valuable long-term investment, ensuring that the policyholder's beneficiaries receive the intended financial support even in the event of the insured's passing. The cash value accumulation also allows for potential tax advantages and a means to build wealth over time.

Universal life insurance is another excellent alternative, offering flexibility and adaptability. This policy provides permanent coverage and allows policyholders to adjust their premiums and death benefits over time. For older individuals, universal life insurance can be tailored to fit changing financial needs. It offers the advantage of potential dividend participation, where a portion of the policy's profits can be allocated to increase the cash value. This feature can be particularly beneficial for those seeking to maximize their insurance benefits while also building a financial reserve.

Both whole life and universal life insurance policies offer a range of riders and optional benefits that can be customized to suit the specific needs of the 77-year-old individual. These alternatives provide a more permanent and flexible approach to life insurance, ensuring that financial security is maintained for the long term. It is essential to carefully review and compare different policies to find the best fit, considering factors such as premium costs, coverage amounts, and the overall financial goals of the policyholder.

In summary, for a 77-year-old man seeking long-term financial security, exploring whole life or universal life insurance options can be a wise decision. These alternatives offer permanent coverage, potential cash value accumulation, and the flexibility to adapt to changing circumstances. By carefully evaluating the available policies, individuals can make informed choices to protect their loved ones and ensure their financial well-being.

Unraveling Fortune Life Insurance: A Comprehensive Guide

You may want to see also

Age Limits: Some insurers have maximum age limits for term life policies

When considering term life insurance for older individuals, such as a 77-year-old man, it's important to understand the age-related policies and limitations set by insurance companies. Age is a critical factor in determining the terms and conditions of life insurance, especially for term life policies.

Many insurance providers have maximum age limits for term life insurance, which means they will not offer coverage beyond a certain age. For instance, a 77-year-old individual may find that the majority of term life insurance companies will not provide coverage beyond the age of 75 or 80. This limitation is primarily due to the increased health risks associated with older age, which can significantly impact the insurer's assessment of risk. As we age, the likelihood of developing health conditions or facing critical illnesses increases, making it more challenging to secure favorable insurance rates.

The age limit for term life insurance is a crucial consideration for older applicants. It is essential to research and compare different insurance providers to find those that offer coverage for individuals in their late 70s. Some insurers may have specific policies tailored to older adults, providing coverage for a limited term, such as 10 or 20 years, which can still offer valuable financial protection during this stage of life.

When evaluating term life insurance options for a 77-year-old, it is advisable to consider the following:

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and coverage options. Some insurers may offer more competitive rates for older individuals.

- Review Policy Details: Carefully examine the policy terms, including the age limit, coverage period, and any exclusions or limitations.

- Consider Health Factors: Older individuals may need to provide detailed medical information to secure coverage. Some insurers may offer policies with higher premiums but more comprehensive coverage.

- Term Length: Choose a term length that aligns with the individual's needs. A shorter term may be more affordable, while a longer term can provide extended coverage.

In summary, while age limits can present challenges when seeking term life insurance for a 77-year-old man, it is still possible to find suitable coverage. Researching and comparing insurance providers, understanding policy details, and considering individual health factors can help older adults secure the financial protection they need during this stage of life.

Life Insurance Payouts: When to Expect Proceeds

You may want to see also

Frequently asked questions

Term life insurance for older individuals, such as a 77-year-old man, typically refers to a specific type of coverage that provides financial protection for a set period, known as the "term." This term can vary, but it often ranges from 10 to 30 years. The key advantage is that it offers a straightforward and potentially more affordable way to secure financial support for beneficiaries during a defined period.

At 77, an individual might consider term life insurance to ensure financial security for their loved ones. This could include covering expenses like funeral costs, outstanding debts, mortgage payments, or providing an income replacement for dependents. It's a way to offer peace of mind, knowing that the financial responsibilities of the insured individual will be managed even after their passing.

Yes, older individuals may face certain challenges when applying for term life insurance. Insurers often consider age as a significant factor, and older applicants might be classified as "seniors" or "high-risk" clients. This can lead to higher premiums or even denial of coverage. However, there are still options available, and some insurers specialize in providing term life insurance for seniors, though the coverage and terms may differ from those for younger individuals.

The cost of term life insurance for a 77-year-old man is generally higher compared to younger individuals. As people age, the risk to insurers increases due to potential health issues and a longer life expectancy. This results in higher premiums, which can make term life insurance more expensive for older applicants. However, it's essential to compare quotes from different insurers to find the best rates and coverage options.

Here are some tips to consider:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Consider Specialized Insurers: Look for insurers that specialize in senior life insurance, as they may offer more competitive rates.

- Review Policy Details: Carefully read the policy terms, coverage duration, and exclusions to ensure it meets your needs.

- Seek Professional Advice: Consult a financial advisor or insurance specialist who can provide tailored recommendations based on your specific circumstances.