Many parents consider life insurance for their children as a way to provide financial security and peace of mind. While children are often considered invincible, life can be unpredictable, and unforeseen circumstances can arise. Parents may want to ensure that their children are protected in the event of their untimely death, providing financial support for education, medical expenses, or other essential needs. This can be a way to safeguard the child's future and offer them a safety net, even when the parent is no longer around. The decision to purchase life insurance for a child is often driven by a desire to protect and provide for their well-being, offering a sense of security that can be invaluable.

What You'll Learn

- Financial Security: Parents want to ensure their children's financial stability in case of their untimely death

- Education Funding: Life insurance can provide funds for education expenses, like college tuition

- Medical Expenses: Coverage can cover unexpected medical costs, ensuring access to necessary healthcare

- Debt Management: It helps pay off debts, preventing financial strain on the family

- Legacy Planning: Parents may want to leave a financial legacy for their children's future

Financial Security: Parents want to ensure their children's financial stability in case of their untimely death

Many parents consider life insurance for their children as a way to provide financial security and peace of mind. The primary concern for parents is often the well-being and future of their children, especially in the event of their own untimely death. By obtaining life insurance, parents can take a proactive approach to safeguarding their children's financial future.

The purpose of this insurance is to provide a financial safety net for the child in case the primary breadwinner (usually the parent) passes away. It ensures that the child has access to funds for essential expenses, education, and other needs that may arise. For instance, the policy can cover living expenses, such as rent or mortgage payments, utilities, and groceries, allowing the child to maintain a stable living environment. Additionally, it can provide funds for education, including tuition fees, books, and other educational resources, ensuring the child's academic pursuits are not disrupted.

Life insurance for children can also be a valuable tool for long-term financial planning. Parents can choose policies with investment components, allowing the premiums to grow over time. This can help build a substantial fund that the child can access in the future for various purposes, such as starting a business, purchasing a home, or funding higher education. The investment aspect provides an opportunity for the policy to accumulate value, offering financial security that can last for decades.

When selecting a life insurance policy for a child, parents should consider their specific needs and future goals. They should evaluate the child's age, health, and any existing medical conditions to determine the appropriate coverage amount. It is also essential to choose a reputable insurance provider with a strong financial rating to ensure the policy's reliability and longevity. Parents can also explore different types of policies, such as term life insurance or permanent life insurance, to find the best fit for their family's circumstances.

In summary, parents obtain life insurance for their children to provide financial security and stability in the event of their death. This insurance ensures that the child's basic needs are met and can access funds for education and other future goals. By taking this proactive step, parents can offer their children a sense of security and peace of mind, knowing they have planned for their financial well-being.

Concerta and Life Insurance: Impact on Premium Rates

You may want to see also

Education Funding: Life insurance can provide funds for education expenses, like college tuition

Life insurance is a powerful tool that parents can utilize to ensure their children's future is financially secure, especially when it comes to education funding. The primary purpose of life insurance is to provide financial protection and peace of mind for the family in the event of the insured's untimely death. However, it can also be a strategic investment for the long-term financial well-being of their children.

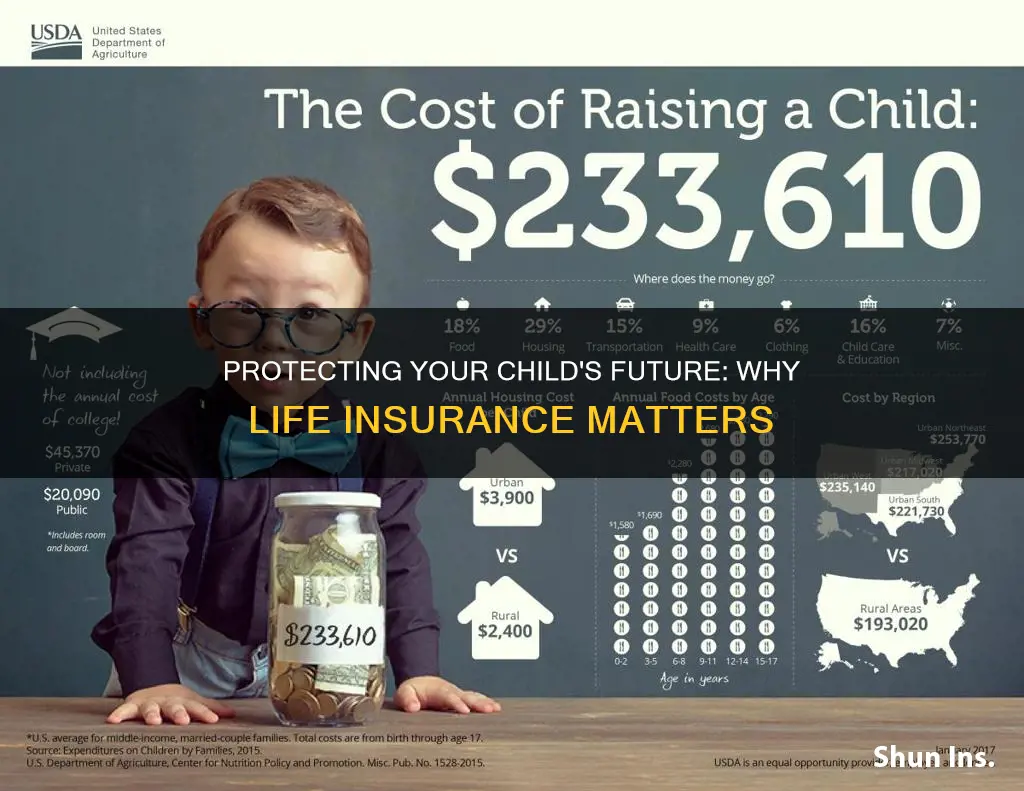

When it comes to education expenses, college tuition fees can be a significant burden for families. The cost of higher education has been steadily rising, and many parents want to ensure that their children have the financial means to pursue their academic goals without incurring substantial debt. This is where life insurance can step in as a valuable resource. By taking out a life insurance policy, parents can allocate a portion of the premium payments towards a dedicated education fund. This fund can be invested over time, allowing it to grow and accumulate interest, ensuring that the money is available when the child is ready to start their higher education journey.

The beauty of using life insurance for education funding is that it provides a guaranteed source of money, free from the typical market volatility associated with other investment options. Parents can choose a policy with a death benefit that will be paid out as a lump sum or in installments, providing the necessary financial support for their child's education. This approach ensures that the funds are available when needed, providing a sense of security and stability for the family.

Furthermore, life insurance policies often offer flexibility in terms of policy customization. Parents can adjust the coverage amount and term length to align with their financial goals and the estimated cost of their child's education. For instance, they might opt for a higher coverage amount if they anticipate the child's education expenses being particularly high, or they may choose a longer term policy to ensure the child's needs are met throughout their college years.

In summary, life insurance is a practical and thoughtful way for parents to contribute to their children's education. It provides a reliable financial safety net, allowing parents to plan for the future with confidence. By utilizing life insurance strategically, families can ensure that their children have access to the necessary resources for a quality education, setting them up for success in their academic pursuits and beyond.

Life Insurance Surrender Charges: Do They Expire?

You may want to see also

Medical Expenses: Coverage can cover unexpected medical costs, ensuring access to necessary healthcare

Many parents opt for life insurance as a safety net for their children's future, especially when considering the potential financial burden of medical expenses. Unexpected illnesses or accidents can arise at any age, and the costs associated with these events can be overwhelming. For instance, a child might require specialized medical treatment, such as a rare disease diagnosis, which could lead to extensive hospital stays, surgeries, and long-term care. These treatments often come with high price tags, and without adequate insurance coverage, families may struggle to afford the necessary care.

Life insurance for children can provide a financial cushion to cover these unforeseen medical costs. It ensures that even if the worst happens, the family has the resources to access the best healthcare available. This coverage can include expenses related to emergency room visits, specialist consultations, diagnostic tests, and any required medications. By having this financial protection, parents can make decisions regarding their child's health without the added stress of financial constraints.

Furthermore, life insurance can also cover routine medical expenses, ensuring that regular check-ups, vaccinations, and preventative care are not overlooked. These preventative measures are crucial for maintaining a child's overall health and well-being. With the right insurance policy, parents can rest assured that their child's medical needs will be met, even in the absence of the primary caregiver.

The peace of mind that comes with knowing your child is protected is invaluable. It allows parents to focus on their child's recovery and well-being without constantly worrying about the financial implications. This type of insurance is a long-term investment in your child's future, providing a safety net that can be relied upon when it's needed most.

In summary, life insurance for kids is a thoughtful consideration for parents, offering financial security and access to quality healthcare. It empowers families to navigate unexpected medical challenges with confidence, knowing that their child's health and future are protected.

Unraveling Stress Testing: A Comprehensive Guide to Life Insurance

You may want to see also

Debt Management: It helps pay off debts, preventing financial strain on the family

Life insurance for children is a financial tool that parents often consider to ensure their kids' well-being and future security. While the primary reasons might include providing for education, covering medical expenses, or establishing a savings plan, one crucial aspect that often gets overlooked is debt management. This is especially relevant in today's world, where families often face various financial obligations and debts.

When parents purchase life insurance for their children, they are essentially creating a financial safety net. This safety net can be utilized to manage and pay off debts, which is a significant concern for many families. Here's how it works: upon the unfortunate passing of a parent, the life insurance policy's death benefit is paid out to the designated beneficiary, which in this case, is the child. This financial sum can then be strategically used to settle any outstanding debts the family might have.

Debt management is a critical aspect of financial planning, and it becomes even more crucial when it comes to families. Unsecured debts, such as credit card balances, personal loans, or even student loans, can accumulate quickly and become a significant burden. For instance, if a family is facing medical emergencies or unexpected expenses, these debts can quickly spiral out of control, leading to financial strain and potential long-term consequences. By utilizing the life insurance payout, parents can proactively address these debts, ensuring that their children are not burdened with financial obligations.

The process involves a careful assessment of the family's financial situation and creating a strategy to tackle debts. The life insurance money can be used to pay off high-interest debts first, as these can quickly accumulate and become unmanageable. For example, if a family has accumulated credit card debt with high-interest rates, the insurance payout can be directed towards clearing these debts, reducing the overall financial burden. This strategic approach allows the family to regain control over their finances and prevent further financial strain.

In summary, life insurance for children is not just about providing financial security for the future; it also plays a vital role in debt management. By utilizing the death benefit to pay off debts, parents can ensure that their children are protected from financial strain and potential long-term damage. It is a proactive step towards financial stability and a wise decision for any family facing financial challenges.

Manulife Term Life Insurance: A Comprehensive Guide

You may want to see also

Legacy Planning: Parents may want to leave a financial legacy for their children's future

Legacy planning is an essential aspect of financial strategy for parents who want to ensure their children's long-term well-being and security. It involves making thoughtful decisions about how to provide for their offspring's future, even after their passing. One powerful tool in legacy planning is life insurance, which can be a valuable asset in building a financial legacy for your children.

The primary reason parents consider life insurance for their kids is to provide financial security during their absence. Life insurance policies can be structured to pay out a lump sum or regular payments to the beneficiaries, which in this case, would be the children. This financial support can cover various expenses, such as education costs, living expenses, or even future investments to help the children build their own wealth. By setting up a life insurance policy, parents can offer their children a safety net and a head start in life, ensuring they have the resources to make important decisions and pursue their goals.

In the context of legacy planning, life insurance can be a versatile tool. It allows parents to customize the policy to fit their specific needs and goals. For instance, they can choose the amount of coverage based on the children's anticipated expenses and future plans. Some policies even offer flexible payment options, allowing parents to adjust the premium according to their financial situation. This flexibility ensures that the insurance remains accessible and affordable, providing a consistent legacy for the children over time.

Furthermore, life insurance can be a strategic way to pass on wealth and values. Parents can use the policy to teach their children about financial responsibility and the importance of planning for the future. By involving their children in the process, parents can educate them about the benefits of insurance and the long-term value of financial security. This approach not only provides financial support but also instills a sense of financial literacy and responsibility in the children.

When considering life insurance for children, parents should explore different types of policies to find the best fit. Term life insurance, for example, provides coverage for a specific period, which can be tailored to the children's age and anticipated needs. Permanent life insurance, on the other hand, offers lifelong coverage and a cash value component, allowing for potential tax-advantaged growth. Consulting with a financial advisor can help parents navigate these options and make informed decisions to create a robust legacy plan.

In summary, legacy planning through life insurance is a thoughtful way for parents to provide for their children's future. It offers financial security, flexibility, and the opportunity to impart valuable financial lessons. By carefully considering their options and seeking professional guidance, parents can ensure their children receive a meaningful legacy that supports their long-term goals and well-being.

Becoming a Life Insurance Producer: Steps to Success

You may want to see also

Frequently asked questions

Life insurance for children is an important consideration for parents as it provides financial security and peace of mind. The primary reason is to ensure that the child's future needs are met in the event of the parent's untimely death. This includes covering expenses like education, medical costs, and everyday living expenses, ensuring the child's well-being and a stable upbringing.

Life insurance for minors can offer several advantages. Firstly, it can help secure the child's future by providing a financial safety net. This policy can be used to pay for college tuition, cover medical expenses, or even provide a lump sum for the child's personal use when they reach adulthood. Additionally, it can be a way to teach financial responsibility and the value of planning for the future.

Life insurance for children typically has different features compared to adult policies. It often has a lower death benefit, as the primary focus is on securing the child's future rather than providing a substantial inheritance. Term life insurance is a common choice for children, offering coverage for a specific period, usually until the child reaches a certain age or milestone. The premiums are also generally lower, making it more affordable for parents.

Absolutely. While the primary purpose is financial security, life insurance for children can also serve as a way to leave a legacy. Parents may choose to name a beneficiary, such as a grandparent or a trusted individual, who can then use the proceeds for specific purposes, like starting a business or funding a trust for the child's education. It provides a means to ensure the child's future is protected and can also be a meaningful way to honor the parents' values and intentions.