Stress testing in life insurance is a crucial risk management technique used by insurers to evaluate the resilience of their policies under adverse economic conditions. It involves simulating extreme scenarios, such as severe market downturns, natural disasters, or financial crises, to assess how well the insurance company can withstand and recover from such events. By subjecting their portfolios to these hypothetical stress tests, insurers can identify potential vulnerabilities, ensure adequate reserves, and maintain the financial stability necessary to honor their commitments to policyholders during challenging times. This process is essential for maintaining the trust and confidence of customers and regulators, as it demonstrates the insurer's ability to manage risks effectively.

What You'll Learn

- Stress Testing: Simulating adverse scenarios to assess policyholder resilience

- Risk Assessment: Identifying potential threats to financial stability

- Policy Performance: Evaluating policy effectiveness under extreme conditions

- Regulatory Compliance: Ensuring adherence to industry standards and guidelines

- Customer Impact: Assessing the effect on policyholders during stressful events

Stress Testing: Simulating adverse scenarios to assess policyholder resilience

Stress testing is a critical process in the life insurance industry, designed to evaluate the resilience of insurance policies and the financial stability of insurance companies during adverse economic conditions. It involves simulating extreme and challenging scenarios to assess how well an insurance policy or a company can withstand and recover from potential financial shocks. The primary goal is to ensure that insurance policies remain viable and that the insurer can meet its obligations to policyholders even in the most difficult circumstances.

In the context of life insurance, stress testing typically focuses on the policyholder's financial well-being and the insurer's ability to honor their commitments. It involves creating hypothetical scenarios that mimic real-world crises, such as economic recessions, market crashes, or natural disasters. These scenarios are designed to push the policy and the insurer's financial resources to their limits, allowing for a comprehensive assessment of their performance. For instance, a stress test might involve modeling a prolonged period of low interest rates, which could impact the insurer's investment portfolio and their ability to pay out claims.

The process of stress testing often includes several key steps. Firstly, it requires a thorough understanding of the insurance policy's structure, including the coverage provided, the premium structure, and any associated benefits or riders. This knowledge is crucial for accurately simulating the policy's behavior under stress. Secondly, historical data and market trends are analyzed to identify potential risks and vulnerabilities. This data-driven approach helps in creating realistic and relevant stress test scenarios.

During the simulation, various financial metrics are monitored to assess the policyholder's resilience. These metrics may include the policy's net worth, cash flow, and the ability to meet financial obligations. For instance, a stress test might analyze how a policyholder's investment portfolio performs during a market downturn and whether they can maintain their premium payments. The insurer also evaluates its own financial health, including its capital adequacy, liquidity, and the effectiveness of its risk management strategies.

The results of stress testing provide valuable insights into the insurer's risk exposure and the policyholder's ability to withstand adverse events. It helps identify potential weaknesses in the policy structure or the insurer's operations, allowing for proactive measures to be taken. Stress testing is an essential tool for regulators and insurance companies alike, ensuring that the life insurance industry operates with a robust risk management framework, ultimately protecting the interests of policyholders and maintaining the stability of the financial system.

Life Insurance Bank Account: What's the Deal?

You may want to see also

Risk Assessment: Identifying potential threats to financial stability

Stress testing is a critical component of risk management in the life insurance industry, designed to evaluate the resilience of an insurer's financial position under adverse conditions. It involves simulating extreme but plausible scenarios to assess how well an insurance company can withstand financial shocks. The primary objective is to identify potential threats to financial stability and ensure that the insurer has adequate capital and risk management strategies in place to mitigate these risks.

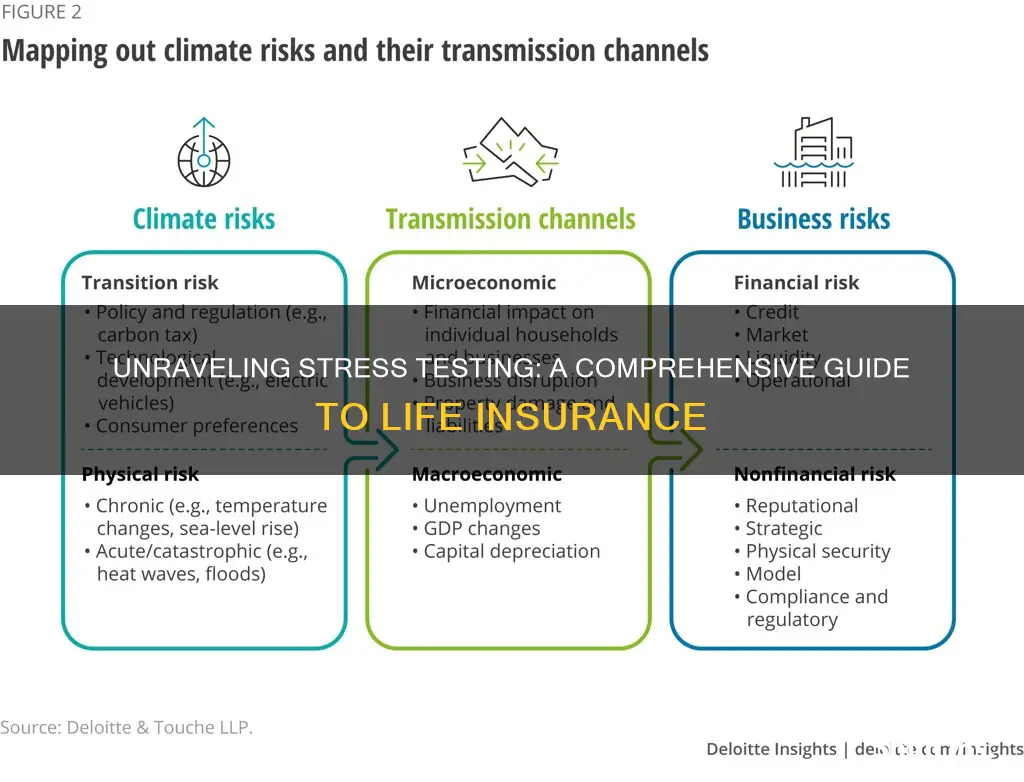

In the context of life insurance, stress testing typically focuses on various factors that could impact the insurer's liabilities and assets. These factors often include economic downturns, market volatility, changes in interest rates, and demographic shifts. For instance, a stress test might involve modeling a severe recession, during which the insurer would need to assess the impact on policyholder behavior, investment returns, and the overall financial health of the company. By doing so, insurers can identify potential gaps in their risk management frameworks and take proactive measures to strengthen their financial stability.

One of the key benefits of stress testing is its ability to provide a comprehensive view of an insurer's risk exposure. It allows companies to challenge their existing risk assumptions and identify potential blind spots. For example, a stress test might reveal that a significant portion of the insurer's portfolio is concentrated in a particular sector or region, making it vulnerable to specific risks. This insight enables the insurer to diversify its investments or adjust its underwriting strategies to reduce potential losses.

The process of stress testing often involves a detailed analysis of historical data and the development of sophisticated models. These models simulate various stress scenarios, such as a prolonged economic downturn or a significant increase in mortality rates, and measure the impact on the insurer's financial statements. By comparing the results of these simulations to the insurer's current and projected financial position, risk managers can identify areas of concern and develop appropriate mitigation strategies.

Effective stress testing requires a thorough understanding of the insurer's business, including its products, customer base, and investment portfolio. It also demands a robust risk management infrastructure, including data analytics capabilities and a culture that encourages proactive risk identification and management. By implementing comprehensive stress testing practices, life insurance companies can enhance their risk assessment processes, improve decision-making, and ultimately ensure the long-term sustainability of their operations.

Who Can Buy Term Life Insurance for Someone Else?

You may want to see also

Policy Performance: Evaluating policy effectiveness under extreme conditions

Stress testing in the context of life insurance is a critical process that evaluates the resilience and effectiveness of insurance policies under extreme and adverse conditions. It is a comprehensive assessment designed to measure how well a policy can withstand financial shocks and market volatility, ensuring that the insurance provider can meet its obligations to policyholders even in the most challenging scenarios. This evaluation is essential for maintaining the stability and integrity of the insurance industry, especially during economic downturns or unforeseen crises.

The primary objective of stress testing is to identify potential weaknesses in insurance policies and the overall risk management strategy of the insurer. By simulating extreme events, such as severe economic recessions, natural disasters, or rapid market declines, stress testing can reveal how the policy's value and the insurer's financial health are affected. This analysis helps in understanding the potential impact of such events on policyholders and the insurer's ability to honor its commitments.

In the context of 'Policy Performance: Evaluating policy effectiveness under extreme conditions', stress testing involves several key steps. Firstly, it requires the identification of relevant extreme events and their potential impact on the insurance policy. This includes analyzing historical data, market trends, and economic indicators to predict and model these extreme scenarios. For instance, a stress test might involve simulating a prolonged period of high unemployment, which could affect the policy's performance in terms of death benefit payouts and premium collection.

Secondly, the policy's performance metrics are defined and measured. These metrics could include the policy's net worth, capital adequacy ratios, and the ability to meet regulatory requirements. For instance, the insurer might assess how the policy's assets can be liquidated to meet the expected claims and whether the policy's structure allows for effective risk management during a financial crisis. The stress test should also consider the policy's flexibility and adaptability to changing market conditions.

Finally, the results of the stress test are interpreted and used to make informed decisions. If the policy fails to perform adequately under stress, adjustments can be made to improve its effectiveness. This might involve modifying the policy's structure, increasing capital reserves, or implementing new risk management strategies. Stress testing also helps insurers identify areas where additional regulatory oversight or industry-wide standards may be necessary to ensure the stability of the insurance market.

In summary, stress testing in life insurance is a vital tool for assessing the resilience of insurance policies and the insurer's overall risk management capabilities. By evaluating policy performance under extreme conditions, insurers can identify potential vulnerabilities and take proactive measures to safeguard their policyholders and the industry as a whole. This process is essential for maintaining public trust and ensuring the long-term sustainability of the life insurance sector.

Who Can Be a Life Insurance Beneficiary?

You may want to see also

Regulatory Compliance: Ensuring adherence to industry standards and guidelines

Regulatory compliance in the life insurance industry is a critical aspect of ensuring the stability and integrity of the financial sector. It involves adhering to a comprehensive set of rules, regulations, and guidelines established by regulatory bodies and industry standards. Stress testing is a key component of this compliance framework, designed to evaluate the resilience of insurance companies and their products under adverse economic conditions.

The primary objective of stress testing is to assess how well life insurance companies can withstand financial shocks and maintain their ability to meet policyholder obligations during challenging economic scenarios. This process involves simulating various stress events, such as economic downturns, market crashes, or natural disasters, and analyzing the potential impact on the insurer's financial health. By doing so, regulators and insurance companies can identify vulnerabilities and ensure that appropriate measures are in place to mitigate risks.

Industry standards and guidelines play a vital role in defining the parameters and methodologies for stress testing. These standards provide a framework for insurers to conduct comprehensive stress tests, covering various aspects of their operations, including investment portfolios, underwriting practices, and risk management strategies. Adherence to these standards ensures that stress tests are conducted consistently and comparably across the industry, allowing for a more accurate assessment of risk exposure.

Regulatory bodies often mandate that life insurance companies perform stress tests as part of their regular compliance procedures. These tests should be comprehensive and cover a wide range of potential risks, including market risk, credit risk, and operational risk. By identifying and addressing potential weaknesses, insurers can enhance their risk management capabilities and ensure they are better prepared for unforeseen events.

In summary, regulatory compliance in the life insurance industry is essential for maintaining the stability and trustworthiness of the financial system. Stress testing, as a critical component of this compliance, helps insurers assess their resilience and take proactive measures to manage risks. Adherence to industry standards and guidelines ensures a consistent and comprehensive approach to stress testing, ultimately contributing to the overall health and stability of the life insurance sector.

How to Increase Your Term Life Insurance Coverage

You may want to see also

Customer Impact: Assessing the effect on policyholders during stressful events

Stress testing in the context of life insurance is a crucial risk management technique that evaluates the financial impact of adverse events on an insurance company's policyholders. This process involves simulating various stressful scenarios, such as economic downturns, natural disasters, or sudden health crises, to assess how these events might affect the policyholders and the insurer's ability to meet their financial obligations. The primary goal is to ensure that the insurance company can withstand challenging circumstances and continue providing coverage to its customers during times of crisis.

When conducting stress testing, insurers analyze the potential consequences for policyholders, including the likelihood of policy cancellations, increased mortality rates, or reduced premium payments. For instance, during a severe economic recession, stress tests might predict a higher incidence of policyholders defaulting on their premiums due to financial strain. This analysis helps insurers understand the potential customer impact and take proactive measures to mitigate risks.

One critical aspect of stress testing is its ability to identify vulnerable policyholder segments. By applying stress scenarios, insurers can determine which groups are more susceptible to adverse events. For example, stress tests might reveal that older policyholders are more likely to face financial difficulties during a prolonged illness or retirement. This information allows insurers to tailor their products and support services to better assist these customers during stressful times.

Moreover, stress testing enables insurers to assess the effectiveness of their risk management strategies. By comparing the predicted outcomes with actual results, insurers can evaluate the success of their risk mitigation measures. This iterative process ensures that insurance companies continuously improve their risk assessment and management practices, ultimately benefiting policyholders by providing more stable and reliable coverage.

In summary, stress testing in life insurance is a powerful tool for assessing the impact of stressful events on policyholders. It helps insurers identify potential risks, understand customer vulnerabilities, and refine their risk management approaches. By implementing these stress tests, insurance companies can better prepare for challenging situations, ensuring that they remain financially stable and capable of fulfilling their commitments to policyholders during times of crisis. This process ultimately contributes to the overall resilience and sustainability of the life insurance industry.

Term Life Insurance: Cash Value Accumulation?

You may want to see also

Frequently asked questions

Stress testing is a risk management technique used by insurance companies to assess the potential impact of adverse events or economic scenarios on their financial stability. In the context of life insurance, it involves evaluating how well an insurer's policyholders and the company itself would withstand financial shocks, such as economic downturns, market volatility, or natural disasters.

Stress testing provides a comprehensive view of an insurer's risk exposure and resilience. By simulating extreme but plausible scenarios, insurance companies can identify potential vulnerabilities in their portfolios, assess the adequacy of their capital reserves, and ensure they can meet policyholder obligations during challenging times. This process helps in maintaining the insurer's financial strength and stability.

Stress test scenarios in life insurance typically include economic downturns, recessions, market crashes, pandemics, natural disasters, and changes in interest rates. For example, a scenario might involve a prolonged recession leading to increased unemployment, which could result in more policyholder defaults on life insurance loans or increased mortality rates due to financial stress.

The frequency of stress testing can vary depending on the insurer's policies, regulatory requirements, and business needs. However, it is generally recommended to perform stress tests at least annually or whenever there are significant changes in the market or the insurer's operations. Regular stress testing ensures that the insurer is well-prepared for potential risks and can adapt its strategies accordingly.

Stress testing helps ensure that life insurance companies maintain sufficient financial resources to honor their commitments to policyholders. By identifying and managing risks effectively, insurers can provide stable and reliable coverage, even during challenging economic periods. This reassurance can build trust with policyholders and contribute to the long-term success of the insurance business.