Purchasing life insurance for someone else is legal, but there are specific requirements that must be met. The person buying the insurance must prove they have an insurable interest, meaning they would suffer financial loss if the insured person died. The insured person must also give their consent and be involved in the application process, including undergoing a medical exam and signing the application. It is not possible to take out a life insurance policy on a stranger or casual acquaintance. Common scenarios where someone might buy life insurance for another person include insuring a spouse, business partner, parent, or child.

| Characteristics | Values |

|---|---|

| Can you buy life insurance for someone else? | Yes, but only if you have their consent and can prove "insurable interest" |

| What is "insurable interest"? | The ability to prove to an insurance provider that the insured person's death would cause you financial harm |

| Who can you buy life insurance for? | Spouse, former spouse, parent, child, business partner, key employee, or a sibling who is caring for your parents |

| Who can't you buy life insurance for? | A stranger, a casual acquaintance, or anyone without your financial dependence |

| Do you need the insured person's consent? | Yes, they must be involved in the application process and will have to go through the underwriting process and sign the application |

| What type of life insurance can you buy for someone else? | Term life insurance or permanent life insurance |

What You'll Learn

Proving insurable interest

To purchase a life insurance policy for someone else, you must prove that you have an insurable interest in them. This means that you must demonstrate that you would experience financial loss and hardship if the insured person were to pass away. The insurance company will ask for proof and investigate the relationship between the beneficiary and the insured before signing off on the policy.

- Spouse/spouse relationship: People are generally considered to have an insurable interest in their spouse, as one would likely have to settle final expenses for the other.

- Parent/child relationship: Parents would suffer financial hardship in the form of medical bills and final expenses if their child passes away.

- Grandparent/grandchild relationship: Grandparents often have a financial interest in their grandchildren, and their death could result in unpaid expenses.

- Business partners: Life insurance can be used to fund a buy-sell agreement, where business partners buy life insurance on each other to buy out the late partner's share of the business.

To prove insurable interest, the insurance company will often conduct interviews with the policy owner, insured, and beneficiary to confirm their relationship and determine if there is a valid financial interest. Additionally, legal documentation may be required to prove the relationship, such as a marriage certificate, birth certificate, business license, or partnership agreement.

It is important to note that you cannot purchase a life insurance policy for someone without their consent. The insured person must sign the life insurance application and cooperate throughout the application process, including agreeing to a medical exam and providing their medical history.

Life Insurance and SSI: Is It Possible?

You may want to see also

Getting the insured person's consent

Involvement of the Insured Person:

The person whose life is being insured must actively participate in the process and provide their consent. This includes signing the necessary documents, such as the life insurance application, and agreeing to share their personal and medical information with the insurance company. The insured person's consent is a legal requirement and ensures that the process is transparent and authorised by the individual whose life is being insured.

Medical Examination and Underwriting Process:

In most cases, the insured person will be required to undergo a medical examination as part of the underwriting process. This examination helps the insurance company assess the individual's health and determine the appropriate coverage and premium rates. The insured person must consent to and cooperate with this medical examination. This step is crucial in ensuring an accurate assessment of the individual's health and determining the appropriate insurance plan to meet their needs.

Answering Application Questions:

The insured person will also need to answer questions on the application form. These questions typically cover various aspects of the individual's health, lifestyle, and personal history. It is important for the insured person to provide accurate and honest answers to ensure the insurance company can offer the most suitable coverage. By consenting to answer these questions, the insured person plays a vital role in tailoring the policy to their specific circumstances.

Maintaining Cooperation Throughout:

Obtaining the insured person's consent is not a one-time step but an ongoing process. The insured individual must be willing to cooperate throughout the entire application process. This includes providing any additional information or documentation that the insurance company may request. Their continued consent and participation are essential to finalising the life insurance policy and ensuring it accurately reflects their needs and circumstances.

Exceptions for Children:

It is important to note that there is an exception when it comes to purchasing life insurance for children. In most cases, children do not need to undergo a medical examination or sign the policy themselves. However, the buyer must still have the child's consent and involvement to the extent that they are capable of understanding the process. This exception recognises that children may not have the same decision-making capacity as adults but still require the protection offered by life insurance.

In summary, getting the insured person's consent is a fundamental and non-negotiable aspect of purchasing a life insurance policy for someone else. The insured person must actively participate in the process, provide their consent at each step, and be willing to share their personal and medical information. This ensures that the insurance policy is authorised by the individual and accurately reflects their needs and circumstances.

Who Gets Life Insurance Benefits After a Divorce?

You may want to see also

Understanding the different types of life insurance

Life insurance is meant to provide a safety net for those who depend on another person financially. If the insured person dies, life insurance can pay out benefits that cover end-of-life expenses like a funeral, as well as ongoing expenses such as a mortgage or tuition, so their loved ones aren’t burdened by the costs.

There are five main types of life insurance: term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. Each type of life insurance is designed to fill a specific coverage need.

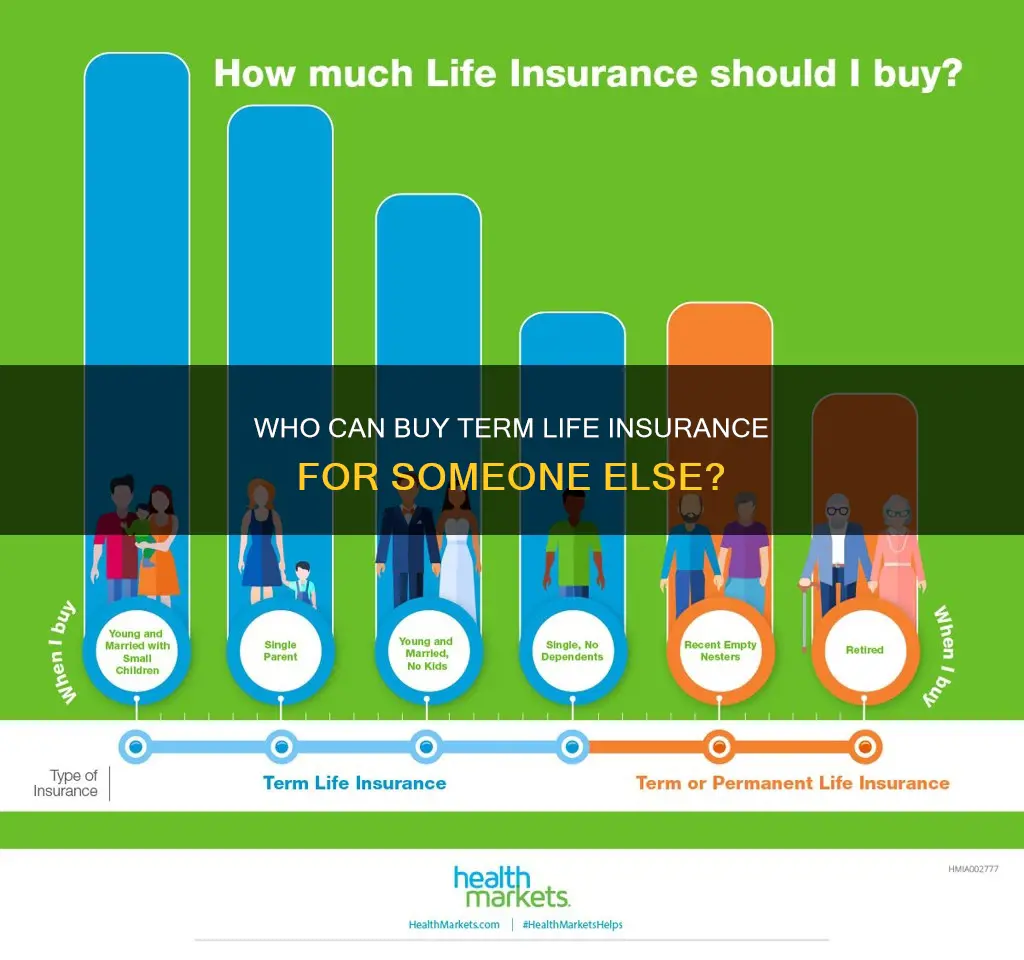

Term life insurance is geared toward those who just need coverage for a certain number of years, typically 10–30 years. It is generally more affordable than permanent life insurance.

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, paying your benefit no matter when you pass away — as long as you keep paying your bill. Whole life insurance also includes a savings component that a portion of your premium will pay into.

Universal life insurance is another permanent life insurance option, providing coverage for your entire life as long as you pay the premiums. It's sometimes called adjustable life insurance because it offers more flexibility than a whole life policy. For example, universal life policies allow you to increase or decrease your death benefit and even adjust or skip your monthly premium (within certain limits).

Variable life insurance is a riskier type of permanent life insurance. It is tied to investment accounts, and the cash value will rise and fall based on your payments and the performance of your selected investments.

Final expense life insurance, also known as funeral or burial insurance, is a type of whole life insurance that offers a smaller and more affordable death benefit designed to help cover your end-of-life expenses like funeral costs, medical bills, or outstanding debt.

Kansas Withholding Tax on Life Insurance: What You Need to Know

You may want to see also

Choosing the right insurance company

Yes, it is possible to purchase a life insurance policy for someone else, but you must be able to prove that their death would cause you significant financial hardship. This is called having an "insurable interest" in the person being insured. You must also get the consent of the insured person.

When choosing the right insurance company, there are a few key factors to consider:

- Coverage amounts: Different companies offer different coverage amounts, so it is important to find a company that offers a policy that meets your needs.

- Term lengths: Term life insurance policies are available in a range of term lengths, from 10 to 40 years. Choose a company that offers a term length that fits your needs.

- Age restrictions: Some companies have age restrictions on their policies, so make sure to choose a company that offers coverage to people in your age group.

- Conversion options: Some term life insurance policies can be converted to permanent coverage. If this is important to you, be sure to choose a company that offers this option.

- Financial strength: It is important to choose a financially stable company that is likely to be able to pay out claims in the future. You can check the financial strength of a company through rating firms such as AM Best.

- Customer satisfaction: Look for a company with high marks for customer satisfaction and fewer complaints than expected to state regulators. This will help ensure a smooth customer experience.

- Additional riders: Consider what additional riders you may want to add to your policy and choose a company that offers these riders for a fee.

- Price: Get quotes from multiple companies to compare prices and choose a company that offers a competitive rate.

- Guardian Life: Best for applicants with health conditions, especially those living with HIV.

- MassMutual: Best for term length options, with policies available in 10-, 15-, 20-, 25-, and 30-year increments.

- Northwestern Mutual: Best for customer experience, with very few complaints relative to its size.

- New York Life: Best for high coverage amounts, with two term products available, including one that can be renewed annually.

- Pacific Life: Best for conversion flexibility, with term life insurance that can be converted to permanent coverage and a cash credit for policyholders.

- State Farm: Best for customer satisfaction, ranking first in J.D. Power's 2023 U.S. Individual Life Insurance Study.

- AARP: Best for older applicants, with no medical exams required and coverage available to people aged 50 and up.

Life Insurance: Sickness Coverage and Your Options

You may want to see also

Knowing when to buy life insurance for someone else

It is perfectly legal to take out a life insurance policy on someone else, and there are circumstances where it makes good financial sense. However, you need to meet certain conditions to be able to do so.

The rules

Firstly, you must have the person's consent. Secondly, you must be able to prove that you have an "insurable interest" in the person. This means that you would experience financial loss and hardship if they were to die. The insurance company will investigate your relationship with the insured person before signing off on the policy.

When to buy life insurance for someone else

- Managing your parents' coverage as they age: If you rely on your parents financially or need additional funds to pay for their final expenses, you can buy life insurance for your parents to help cover costs when they die.

- You co-signed a loan: If you are the co-signer on someone else’s loan, you may be responsible for the remainder of the debt if the borrower dies.

- You have children with an ex-spouse or former partner: If you receive alimony or child support from an ex, you may want life insurance to help replace that money in the event your former partner dies.

- You have business partners: Life insurance can fund a buy-sell agreement, which allows business partners to buy life insurance on each other and name themselves as beneficiaries. If one partner dies, the surviving partner can use the life insurance payout to buy out the late partner’s share of the business.

Portable Life Insurance: Rates Rising, What to Know

You may want to see also

Frequently asked questions

No, you can't take out a life insurance policy on just anyone. You must have a financial stake in their life and be able to prove that their death will have a negative financial impact on you.

Yes, you need their consent. They must be involved in the application process and will have to go through the underwriting process, which involves answering questions and, in most cases, taking a life insurance medical exam.

You can take out a life insurance policy on someone else if you have the following relationships, as long as you would suffer a financial loss or undergo a financial hardship if they passed away:

- Former spouse or life partner

- Minor child (under age 18)

- Spouse or life partner

- Parent or grandparent

- Business partner

- Sibling

There are two main types of life insurance plans: term and permanent. Term life insurance provides coverage for a specified time period (typically 10–30 years). Permanent life insurance coverage lasts for the insured’s lifetime and also comes with a cash value component that allows the policy to gain value over time.

You will need to prove that you have an insurable interest and get consent from the person you want to insure. Then, you can select a type of life insurance policy (term or permanent) and shop around for quotes from different carriers. Once you've found a policy that meets your needs, you'll need to fill out an application form and provide any required medical information or exams.