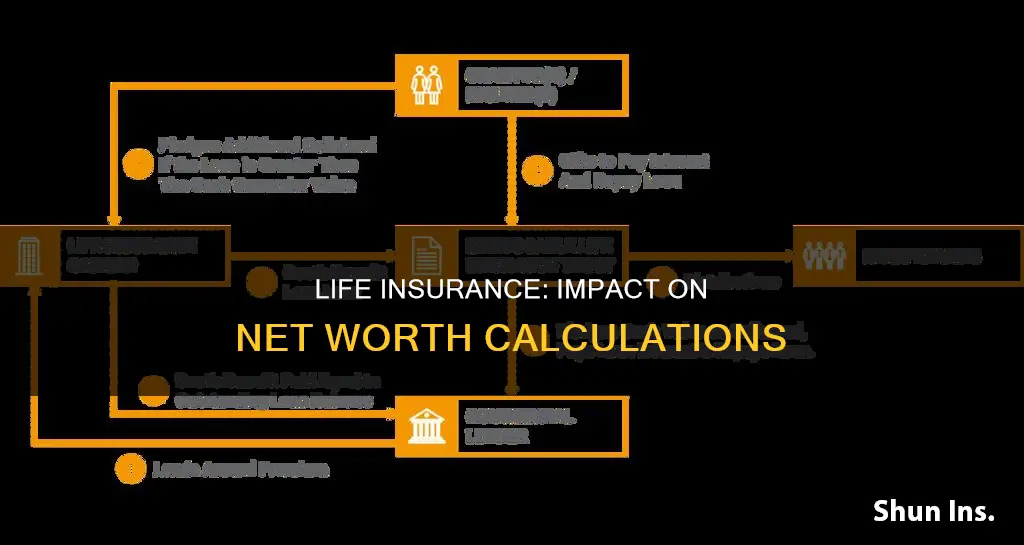

Life insurance is a necessity for most people, but only some types are classified as an asset. Term life insurance, which only pays out to your dependents in the event of your death, is not considered an asset. However, permanent life insurance policies, such as whole life insurance, are considered assets because they have a cash value component that you can withdraw funds from while you are alive. This cash value is included in the value of your estate and can be used to protect wealth and transfer it to heirs. Therefore, when calculating your net worth, which is the value of your assets minus your liabilities, the cash value of permanent life insurance policies is included as an asset.

| Characteristics | Values |

|---|---|

| Does life insurance count towards net worth? | It depends on the type of coverage. Only permanent life insurance counts towards net worth. |

| What is permanent life insurance? | Permanent life insurance is a type of coverage that lasts for the rest of the insured person's life. |

| What is term life insurance? | Term life insurance is a type of coverage that lasts for a set period, usually 10-30 years. |

| Does term life insurance count as an asset? | No, term life insurance does not count as an asset because it does not have a cash value component and does not provide financial benefits to the insured person during their lifetime. |

| Does permanent life insurance count as an asset? | Yes, permanent life insurance is considered an asset because it has a cash value component that the policyholder can access during their lifetime. |

| How does permanent life insurance work? | Permanent life insurance policies accumulate cash value over time, which can be accessed by the policyholder. This cash value is considered an asset because it has monetary value and can be used for various purposes such as starting a business, paying bills, or investing. |

What You'll Learn

Term life insurance is not an asset

Term life insurance is not considered an asset because it doesn't have any cash value. It is designed to provide a death benefit for a specified period, usually 10 to 30 years, and the policyholder's beneficiaries will receive the benefit only if the insured person dies during this period. If the policy expires before the insured person's death, there is no payout. Term life insurance is purely a protection tool and doesn't accumulate any cash value, which is a key characteristic of an asset.

An asset is something you buy today that is expected to have value in the future. In the financial sense, assets are concrete things of monetary value that are owned at a particular time. Examples include tangible assets like a house, a car, or gold, and liquid assets like money in a bank account, stocks, or investment holdings. An asset class is a collection of assets with shared characteristics, such as stocks, bonds, and real estate holdings.

Life insurance, in general, can be considered an asset in some cases. The death benefit of a life insurance policy is not considered an asset, but some policies have a cash value component, which is considered an asset. This cash value is an additional living benefit that accumulates over time and can be accessed by the policyholder. However, withdrawing the cash value may reduce the death benefit and available cash surrender value and may also incur surrender charges.

Term life insurance, specifically, is rarely considered an asset by financial institutions. It doesn't have a cash surrender value, and the only financial benefit is the death payout, which is contingent on the insured person's death. While term life insurance has mathematical value and can provide peace of mind, it doesn't conform to a traditional asset class due to its distinct distribution of risk and return.

In summary, term life insurance is not typically classified as an asset because it lacks cash value and doesn't provide any financial benefit unless the insured person passes away during the policy term.

Life Insurance Payouts After Suicide: What Spouses Need to Know

You may want to see also

Whole life insurance is an asset

Whether or not life insurance counts towards net worth depends on the type of policy. Whole life insurance and other types of permanent life insurance with a cash value component are considered assets because you can withdraw funds from your policy while you’re alive.

The cash value of whole life insurance can be used in a variety of ways to help with liquidity and estate planning. It can be particularly helpful during retirement, when your life insurance needs may decrease and you will be able to access your cash value before dipping into other retirement savings.

Whole life insurance can also provide a hedge against market risk and volatility, offering a stable, non-correlated asset. The cash value growth is guaranteed, and you may never be taxed on this growth if you utilize policy loans.

In addition, life insurance loans are not considered income and are not subject to income tax. Most states also offer creditor protection for life insurance, meaning that the cash value in your policy may be protected from creditors and judgments.

Smoking Status: Life Insurance and Your Health

You may want to see also

Permanent life insurance counts towards net worth

The two main types of life insurance are permanent and term. Term life insurance is designed for temporary coverage and does not have cash value. On the other hand, permanent life insurance policies, such as whole life insurance, can grow cash value over time. This cash value is considered an asset because it has monetary value and can be accessed by the policyholder while they are alive.

The cash value of permanent life insurance can be used for various purposes, such as starting a business, paying off bills, or funding education. It can also be used to protect wealth and transfer it to heirs. The cash value of permanent life insurance is a true financial asset that contributes to the policyholder's net worth.

It is important to note that the face value of a life insurance policy, which is the amount paid out to beneficiaries in the event of the policyholder's death, is not considered an asset. Only the cash value, which is the monetary value accumulated within the policy, is considered when calculating net worth.

Haven Life Insurance: Exciting Career Opportunities and Benefits

You may want to see also

Death benefit is not an asset

The death benefit of a life insurance policy is not considered an asset. This is because it does not count as a tangible or intangible asset. Tangible assets are concrete things of monetary value that you own, such as a home, a car, or gold. Intangible assets are those that cannot be touched but still have value, such as use rights to land, air, or water.

The death benefit of a life insurance policy is a payout to the beneficiary of the policy when the insured person dies. It is not something that the policyholder can benefit from while they are alive, and therefore, it is not considered an asset.

Term life insurance, which only pays out to dependents in the event of the policyholder's death, is not considered an asset. This is because it does not have a cash value component and only lasts for a specified term.

On the other hand, permanent life insurance, such as whole life insurance, is considered an asset due to its cash value accumulation. The cash value of permanent life insurance can be accessed by the policyholder during their lifetime and is, therefore, considered an asset.

In summary, the classification of life insurance as an asset depends on the specific policy type. Term life insurance is not an asset, while permanent life insurance, such as whole life insurance, is considered an asset due to its cash value component.

Kratom Users: Life Insurance Testing and You

You may want to see also

Cash value is an asset

Whether or not life insurance counts towards net worth depends on the type of coverage you have. Only permanent life insurance policies, such as whole life insurance, are considered assets because they have a cash value component. Term life insurance, on the other hand, does not have a cash value and is therefore not considered an asset.

Permanent life insurance policies have an additional living benefit called cash value, which is a monetary value that policyholders can access while they are alive. This cash value grows over time, funded by the policyholder's payments plus interest credited by the insurer. Policyholders can use the cash value for anything they want, such as starting a business, paying off bills, or investing in other opportunities. Because it has monetary value and can provide a future financial benefit, the cash value of permanent life insurance policies is considered an asset that contributes to the policyholder's net worth.

The cash value of permanent life insurance policies can be accessed in several ways. One way is through a policy loan, where the policyholder borrows against their cash value from the insurer. Another way is through a partial withdrawal, where the policyholder pays a fee to withdraw a portion of their cash value. Additionally, many insurers allow policyholders to use their cash value to make premium payments, which can be useful during retirement when income may be lower. If a policyholder no longer needs their policy and wants to cancel it, they can surrender the policy and receive the cash value minus any surrender fees.

It is important to note that the face value of a life insurance policy, which is the death benefit paid out to beneficiaries after the policyholder's death, is not considered an asset. This is because the money is not realized until the policyholder passes away. However, once the beneficiaries receive the death benefit, it is then considered a liquid asset of theirs.

In summary, the cash value of permanent life insurance policies is considered an asset that contributes to net worth because it has monetary value and can provide financial benefits to the policyholder during their lifetime.

Life Insurance: Understanding Conversion Clause Benefits

You may want to see also

Frequently asked questions

It depends on the type of coverage you have. Only permanent life insurance, which lasts for the rest of your life, has a component that counts toward your overall net worth. Term life insurance, which lasts for a set amount of time, does not have a cash value component and therefore does not count towards net worth.

Permanent life insurance policies contain a cash value account, funded over time by money from your payments plus interest credited by your insurer. This cash value is considered an asset and contributes to your net worth. Term life insurance, on the other hand, does not have a cash value component and is therefore not considered an asset.

The cash value of permanent life insurance is a true financial asset because it has monetary value. It is real cash that can be used for anything, such as starting a business, paying off a bill, or investing in other opportunities. The cash value grows over time, similar to a type of savings account.