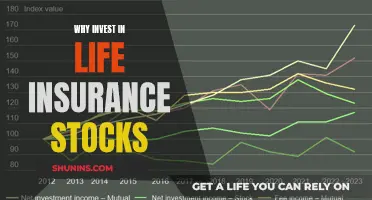

Units-based life insurance is a unique form of life insurance that operates on a different principle compared to traditional insurance policies. Instead of paying out a fixed amount upon the insured's death, this type of insurance is structured as an investment product. It is linked to an underlying investment fund, often a mutual fund or an investment trust, which holds the policy's assets. Policyholders invest in the policy by paying premiums, which are then used to purchase units in the investment fund. The value of these units fluctuates based on the performance of the investment portfolio. Upon the insured's death, the policy's value is determined by the number of units held, and the beneficiary receives the corresponding value, which can be in cash or used to purchase more units in the fund. This approach offers policyholders the potential for investment growth while also providing a safety net through insurance coverage.

What You'll Learn

- Definition: Units-based life insurance is a type of whole life insurance with an investment component

- Structure: It combines insurance coverage with an investment account, allowing for potential growth

- Benefits: Offers guaranteed death benefit, cash value accumulation, and investment options

- Flexibility: Policyholders can adjust their investment strategy and insurance coverage over time

- Risk: Carries investment risks, but provides long-term financial security

Definition: Units-based life insurance is a type of whole life insurance with an investment component

Units-based life insurance is a unique financial product that combines the security of whole life insurance with the potential for investment growth. It is designed to provide both a death benefit and an investment opportunity for the policyholder. This type of insurance is structured around a policy that includes a cash value component, which acts as an investment account. The cash value grows over time, and the policyholder can access this value through loans or withdrawals, providing a source of funds that can be used for various financial needs.

In a units-based life insurance policy, the death benefit is typically guaranteed, meaning that the beneficiary will receive a specified amount upon the insured's death. This guaranteed aspect ensures that the policyholder's loved ones are financially protected even if the investment portion of the policy underperforms. The investment component is structured as a series of units, which represent shares in a fund or portfolio of investments. These units are allocated based on the policyholder's investment choices, and the performance of the underlying investments directly impacts the growth of the cash value.

One of the key features of units-based life insurance is its flexibility. Policyholders can choose from various investment options, allowing them to align the policy with their financial goals and risk tolerance. This flexibility enables individuals to customize their insurance coverage while also managing their investments. For example, an individual might opt for a more conservative investment strategy, ensuring a steady growth of the cash value, or they could choose a more aggressive approach to potentially higher returns.

The investment aspect of this insurance type is often compared to mutual funds or unit trusts, as it involves investing in a diversified portfolio. The policyholder's investments are typically managed by the insurance company or a third-party investment manager, ensuring a level of professional oversight. This professional management can provide a sense of security, especially for those who prefer a more hands-off approach to their investments.

In summary, units-based life insurance offers a comprehensive solution for individuals seeking both insurance protection and investment growth. It combines the guaranteed death benefit of whole life insurance with the potential for investment returns, providing a flexible and customizable financial tool. This type of insurance allows policyholders to manage their investments while also ensuring the financial security of their loved ones.

Invest Life Insurance Payouts: A Guide for Surviving Children

You may want to see also

Structure: It combines insurance coverage with an investment account, allowing for potential growth

Units-linked life insurance, often referred to as unit-linked life insurance or UL, is a financial product that offers a unique blend of insurance and investment benefits. This type of insurance is designed to provide both a safety net in the form of death coverage and an opportunity for long-term wealth accumulation. Here's a detailed breakdown of its structure and how it works:

Combining Insurance and Investment: At its core, units-linked life insurance combines two essential components. Firstly, it provides a death benefit, which ensures that a predetermined amount is paid out to the policyholder's beneficiaries in the event of the insured's death. This aspect is similar to traditional life insurance policies. Secondly, it incorporates an investment account, which is a feature that sets it apart from conventional insurance products. This investment account is designed to grow the policyholder's money over time, offering the potential for increased value.

Investment Account Features: The investment account within the policy can be customized to suit the policyholder's financial goals and risk tolerance. Policyholders can choose from various investment options, such as stocks, bonds, or a mix of both. These investment choices are typically offered by the insurance company and may include mutual funds, index funds, or other investment vehicles. The performance of these investments directly impacts the growth of the policy's cash value.

Potential Growth and Flexibility: One of the key advantages of this structure is the potential for growth. The investment account allows the policyholder's money to grow, and any gains can be reinvested within the policy. Over time, this can lead to substantial growth in the policy's value. Additionally, policyholders often have the flexibility to make premium payments and adjust their investment strategies according to their financial situation and market conditions.

Death Benefit and Payouts: When the insured individual passes away, the death benefit is paid out to the designated beneficiaries. This amount is typically based on the policy's face value and can provide financial security for loved ones. Moreover, the investment account's value can also be utilized to make additional payouts or to increase the death benefit, depending on the policy's terms and the policyholder's choices.

Long-Term Financial Planning: Units-linked life insurance is particularly attractive for long-term financial planning. It allows individuals to secure their family's financial future while also building wealth over time. The combination of insurance and investment makes it a versatile tool for those seeking both protection and growth in their financial portfolio.

Essential Life Insurance: Cash Surrender Value Explained

You may want to see also

Benefits: Offers guaranteed death benefit, cash value accumulation, and investment options

Units-linked life insurance, often referred to as UL, is a type of life insurance that combines the security of a death benefit with the potential for investment growth. It offers a unique blend of insurance and investment features, providing both a safety net for your loved ones and an opportunity to grow your money. Here's a breakdown of its key benefits:

Guaranteed Death Benefit: One of the primary advantages of units-linked life insurance is the guaranteed death benefit. This means that if the insured individual passes away during the term of the policy, the beneficiary will receive a fixed amount of money. This guarantee provides financial security to your family, ensuring they have the necessary funds to cover expenses, pay off debts, or achieve their financial goals. The death benefit is typically set at the time of policy inception and remains constant throughout the policy's duration.

Cash Value Accumulation: UL policies also accumulate cash value over time. This is similar to how a savings account grows. A portion of your premium payments goes towards building this cash value, which can be used for various purposes. You can access this cash value through policy loans or withdrawals, providing financial flexibility. As the cash value grows, it can be used to pay future premiums, ensuring the policy remains in force even if you encounter financial challenges. This feature is particularly beneficial for those who want to build a financial reserve while also having insurance coverage.

Investment Options: Units-linked life insurance offers investment options that allow you to potentially grow your money. The policy typically includes an investment component, where a portion of your premium is invested in a separate account. This investment account can be managed by the insurance company or, in some cases, by an external fund manager. The performance of this investment account can vary, and it may offer different investment options such as stocks, bonds, or a mix of both. By providing investment options, UL policies allow you to potentially increase your money's value over time, which can be a significant advantage for long-term financial planning.

The combination of a guaranteed death benefit, cash value accumulation, and investment options makes units-linked life insurance a versatile and attractive financial product. It provides insurance coverage while also offering the potential for wealth accumulation and growth. This type of policy can be a valuable tool for individuals seeking both financial security and investment opportunities within a single product.

Life Insurance Beneficiaries: How and When They Get Paid

You may want to see also

Flexibility: Policyholders can adjust their investment strategy and insurance coverage over time

Units-based life insurance offers a unique level of flexibility to policyholders, allowing them to adapt their insurance and investment plans as their needs and goals evolve. This type of policy is structured as a combination of life insurance and an investment component, typically a unit-linked fund. Here's how this flexibility can benefit you:

Customizable Investment Strategy: One of the key advantages of units-based life insurance is the ability to tailor your investment strategy. Policyholders can choose from a variety of investment options, such as stocks, bonds, or a mix of both. This flexibility enables you to align your investments with your risk tolerance and financial objectives. Over time, as your financial situation changes, you can adjust your investment strategy accordingly. For instance, if you initially opted for a more conservative approach but later decided to pursue higher-risk, higher-reward investments, you can modify your policy to reflect this new strategy. This customization ensures that your investment plan remains dynamic and responsive to market conditions and your personal preferences.

Adjustable Insurance Coverage: Along with investment flexibility, units-based life insurance also allows for adjustments in insurance coverage. Policyholders can increase or decrease the death benefit, which is the amount paid to the beneficiary upon your passing, based on their changing needs. For example, if you start with a higher death benefit to cover immediate financial obligations and later decide to reduce it as these obligations are met, you can make the necessary changes. This flexibility is particularly useful for those who want to ensure their insurance coverage aligns with their current financial responsibilities while also having the option to increase it if new significant commitments arise.

Regular Reviews and Updates: The flexibility in units-based life insurance encourages regular policy reviews. As your life circumstances, financial goals, and market conditions change, you can reassess your policy and make informed decisions. This might involve adjusting the investment allocation, changing the death benefit, or even taking advantage of any policy loans or withdrawals. Regular reviews ensure that your insurance and investment strategy remain aligned with your current needs and goals, providing a sense of control and peace of mind.

Long-Term Financial Planning: The flexibility inherent in units-based life insurance facilitates long-term financial planning. Policyholders can take advantage of market opportunities and adjust their strategy accordingly. For instance, during periods of market growth, you might allocate more funds to stocks to potentially increase your returns. Conversely, in a more stable market, you could opt for a more balanced approach. This adaptability is crucial for navigating the ever-changing financial landscape and ensuring that your insurance and investment plans remain effective over the long term.

In summary, units-based life insurance provides policyholders with the freedom to customize their investment and insurance strategies, ensuring that their financial plans remain relevant and effective throughout their lives. This flexibility is a powerful tool for those seeking to manage their finances proactively and adapt to changing circumstances.

Life Insurance Surrender: Tax Implications and You

You may want to see also

Risk: Carries investment risks, but provides long-term financial security

Units-based life insurance, often referred to as unit-linked life insurance, is a type of life insurance that offers a unique combination of insurance coverage and investment opportunities. This financial product is designed to provide both a safety net in the form of a death benefit and a potential return on investment through various investment options. Here's an in-depth look at the risk associated with this type of insurance and how it can offer long-term financial security:

Investment Risks:

- Market Volatility: One of the primary risks associated with units-based life insurance is the investment risk. The value of the policy's investments can fluctuate based on market conditions. These investments are often diversified, including stocks, bonds, and other securities. During periods of market downturn, the value of these investments may decrease, potentially impacting the policy's cash value and the death benefit.

- Interest Rate Risk: Life insurance companies often invest in fixed-income securities to generate returns. If interest rates fall, the income from these investments may become less attractive, affecting the overall performance of the policy. Conversely, rising interest rates could lead to lower investment returns.

- Credit Risk: The insurance company's investment portfolio may include bonds and other fixed-income instruments. Credit risk arises if the insurer's investments in these securities default, potentially impacting the policyholder's returns.

Long-Term Financial Security:

Despite the investment risks, units-based life insurance offers several advantages for long-term financial planning:

- Flexibility: Policyholders can choose from a range of investment options tailored to their risk tolerance and financial goals. This flexibility allows individuals to align their insurance policy with their investment strategy.

- Potential for Growth: The investment component of this insurance can provide an opportunity for wealth accumulation over time. If the investments perform well, the policy's cash value can grow, and the death benefit can increase accordingly. This can be particularly beneficial for those seeking to build a substantial financial reserve.

- Tax Advantages: In many jurisdictions, life insurance policies offer tax benefits. Premiums paid may be tax-deductible, and the growth of the policy's value can be tax-deferred until it is withdrawn or the policy is surrendered.

- Customization: Units-based life insurance policies can be tailored to individual needs. Policyholders can adjust their investment allocations, add riders for additional coverage, or make other customizations to suit their financial objectives.

In summary, while units-based life insurance carries investment risks due to market volatility, interest rate fluctuations, and credit risk, it also provides a structured approach to long-term financial security. The potential for wealth accumulation, flexibility in investment choices, and tax advantages make it an attractive option for those seeking both insurance coverage and investment growth. As with any financial product, careful consideration of one's risk tolerance and financial goals is essential before making a decision.

Term vs Permanent Life Insurance: Which Offers Better Protection?

You may want to see also

Frequently asked questions

Units-based life insurance, also known as participating life insurance, is a type of whole life insurance policy that offers additional benefits beyond the basic death benefit. It is structured as a participating policy, which means it is linked to an investment fund or a unit value policy. This type of insurance provides policyholders with the potential for additional returns based on the performance of the underlying investment.

In units-based life insurance, a portion of the premium paid by the policyholder is invested in a separate account or an investment fund. This investment component allows the policy to grow over time, and the value of the policy can increase based on the performance of the investments. The policyholder can choose from various investment options offered by the insurance company, such as stocks, bonds, or a mix of both. The policy's cash value and death benefit are linked to these investments, providing potential for growth and dividends.

There are several benefits to considering units-based life insurance:

- Flexibility: Policyholders can customize their investment strategy by choosing different investment options, allowing for a tailored approach to meet their financial goals.

- Potential for Growth: The investment component can provide an opportunity for the policy's value to increase, offering a higher death benefit and potential cash value accumulation.

- Dividend Participation: Policyholders may be entitled to dividends, which can be reinvested or taken as cash, providing an additional source of returns.

- Long-Term Financial Planning: This type of insurance can serve as a valuable tool for long-term financial planning, offering both insurance coverage and investment growth.