Life insurance stocks offer a unique investment opportunity for those seeking both financial security and long-term growth. These stocks are typically issued by life insurance companies, which are known for their strong financial positions and ability to navigate economic cycles. Investing in life insurance stocks can provide a steady income stream through dividends, and many of these companies have a history of consistent dividend payments, making them attractive to income-seeking investors. Additionally, the life insurance industry plays a vital role in providing financial protection and wealth accumulation, which can be appealing to investors who value the potential for long-term wealth creation. Understanding the factors that drive the performance of these stocks can help investors make informed decisions and potentially build a robust investment portfolio.

What You'll Learn

- Financial Security: Life insurance stocks offer stable returns, providing financial security for policyholders and investors

- Long-Term Growth: These stocks often have a history of steady growth, making them attractive for long-term investment strategies

- Dividend Income: Investors can earn consistent dividend income, a key benefit of investing in life insurance companies

- Regulatory Stability: Life insurance stocks are typically less volatile due to strict industry regulations, ensuring a more secure investment

- Market Resilience: Life insurance companies often show resilience during economic downturns, making them a reliable investment option

Financial Security: Life insurance stocks offer stable returns, providing financial security for policyholders and investors

Life insurance stocks have gained attention as a unique investment opportunity, particularly for those seeking financial security and stability. These stocks are an intriguing option for investors who want to diversify their portfolios and potentially earn consistent returns. The appeal lies in the inherent nature of life insurance companies, which are known for their strong financial positions and long-term stability.

When you invest in life insurance stocks, you are essentially supporting the operations of these companies. Life insurance providers offer policies to individuals and families, providing financial protection in the event of the insured person's death. These companies then invest the premiums collected in various financial instruments, including stocks, bonds, and real estate. The key to their success is the ability to manage these investments while ensuring the financial security of policyholders.

One of the primary reasons to invest in life insurance stocks is the stability they offer. Unlike some other investment vehicles, life insurance companies are not heavily influenced by market volatility. Their investment strategies are typically long-term-oriented, focusing on building a robust financial foundation. This approach often results in more predictable and consistent returns, making them an attractive choice for risk-averse investors. Over time, these companies have demonstrated the ability to provide steady growth, ensuring that policyholders and investors can rely on their financial commitments.

The financial security provided by life insurance stocks is a result of the companies' strong risk management and diversified investment portfolios. They employ experienced professionals who carefully select investments, ensuring a balanced approach. This strategy minimizes the impact of market downturns and provides a more stable environment for policyholders' funds. As a result, investors can have confidence in the longevity and reliability of their investments.

In summary, investing in life insurance stocks offers a unique avenue for financial security. The stability and consistent returns associated with these investments are particularly appealing to those seeking a more secure and predictable financial future. By supporting life insurance companies, investors contribute to a network that provides essential financial protection while also benefiting from the companies' strategic investment management. This combination of stability and financial security makes life insurance stocks an attractive option for investors looking to diversify their portfolios.

Life Insurance Annual Charges: What You Need to Know

You may want to see also

Long-Term Growth: These stocks often have a history of steady growth, making them attractive for long-term investment strategies

Investing in life insurance stocks can be a strategic move for those seeking long-term growth and stability in their portfolios. These stocks, often associated with the financial services industry, have a unique and attractive quality that makes them appealing to investors with a forward-thinking mindset.

One of the key advantages of life insurance stocks is their historical performance, which often demonstrates steady and consistent growth over extended periods. This is particularly appealing to investors who adopt a long-term investment approach. The life insurance sector has a proven track record of resilience and growth, even during economic downturns. This is primarily due to the essential nature of life insurance and the inherent value it provides to policyholders and their beneficiaries. As a result, these stocks tend to be less volatile compared to other sectors, making them a reliable choice for investors aiming to build wealth over time.

The steady growth of life insurance stocks can be attributed to several factors. Firstly, the industry benefits from a strong regulatory environment, ensuring stability and consumer protection. This regulatory oversight often leads to a more predictable and controlled business environment, which is favorable for long-term planning. Additionally, life insurance companies have a diverse revenue stream, including premiums, investment returns, and various financial services, which contributes to their overall financial health and growth potential.

For investors, this steady growth translates into a more predictable and secure investment. Over time, these stocks can provide a reliable source of income through dividends and capital appreciation. The consistent performance makes them an excellent addition to a well-diversified portfolio, offering a hedge against market volatility. Moreover, the life insurance industry's focus on long-term financial planning and risk management aligns with the principles of long-term investing, making it a natural fit for investors seeking sustained growth.

In summary, life insurance stocks offer a compelling opportunity for long-term investors. Their historical performance, characterized by steady growth, provides a sense of security and stability in an ever-changing market. By investing in this sector, individuals can benefit from the industry's resilience, regulatory support, and diverse revenue streams, all of which contribute to a robust and predictable investment strategy. This makes life insurance stocks an attractive choice for those looking to build wealth over an extended period.

Transamerica Life Insurance: THC Testing and You

You may want to see also

Dividend Income: Investors can earn consistent dividend income, a key benefit of investing in life insurance companies

Investing in life insurance stocks can be an attractive option for those seeking a steady and reliable source of income. One of the primary advantages of this investment strategy is the potential for consistent dividend income. Life insurance companies, as part of the financial services industry, often have a strong financial position and a history of paying dividends to their shareholders.

Dividend income is a crucial benefit for investors as it provides a regular cash flow, which can be particularly valuable for long-term wealth accumulation. When you invest in life insurance stocks, you become a shareholder in these companies, and they may distribute a portion of their profits as dividends. These dividends are typically paid out on a quarterly or annual basis, offering investors a predictable and consistent return. This is especially appealing in today's market, where many other investment avenues may offer less stability.

The key advantage of this dividend income is its reliability. Life insurance companies, due to their business nature, often have a steady stream of revenue from premiums collected from policyholders. This stable income allows them to consistently pay dividends, providing investors with a secure and recurring financial benefit. Over time, these dividends can accumulate, and investors may also benefit from the potential growth in the value of the stock itself.

Additionally, investing in life insurance stocks can offer diversification to an investment portfolio. Life insurance companies are often part of a broader financial sector, which includes banks, asset management firms, and other insurance providers. Diversifying your investments across different sectors can help spread risk and provide a more stable overall return. This is a strategic approach to investing, ensuring that your portfolio is not overly exposed to any single industry or market segment.

In summary, the potential for consistent dividend income is a compelling reason to consider investing in life insurance stocks. This investment strategy can provide a reliable cash flow, especially during economic downturns when other investments may be less stable. With a strong financial position and a history of dividend payments, life insurance companies offer investors an opportunity to build a diversified portfolio with a steady income stream.

Life Insurance and Social Security: What's the Connection?

You may want to see also

Regulatory Stability: Life insurance stocks are typically less volatile due to strict industry regulations, ensuring a more secure investment

Life insurance stocks have gained attention as a relatively stable investment option, offering a unique blend of financial security and potential growth. One of the primary reasons for their appeal is the regulatory environment in which they operate. The life insurance industry is heavily regulated, which means that these stocks are subject to strict oversight and compliance measures. This regulatory stability is a key factor in attracting investors seeking a more secure and predictable investment.

The regulatory framework surrounding life insurance companies is designed to protect policyholders and ensure the financial stability of the industry. Insurance regulators impose stringent rules and guidelines, which often result in conservative investment strategies for these companies. This approach to investment management leads to a more cautious and less speculative approach, reducing the likelihood of significant market fluctuations. As a result, life insurance stocks tend to exhibit lower volatility compared to other financial instruments, making them an attractive choice for risk-averse investors.

Strict industry regulations often require life insurance companies to maintain substantial reserves, ensuring they can meet their financial obligations to policyholders. These reserves are typically invested in a diversified portfolio, which further contributes to the stability of the company's financial position. The regulated nature of the industry also encourages companies to focus on long-term financial health, reducing the temptation to engage in short-term, high-risk ventures that could potentially harm policyholders.

For investors, this regulatory stability translates into a more predictable investment experience. Life insurance stocks are less likely to experience dramatic price swings, providing a sense of security and control. This predictability is particularly appealing in today's volatile market environment, where investors are constantly seeking ways to safeguard their portfolios. By investing in life insurance stocks, individuals can benefit from a more stable and secure investment option, which can be a valuable component of a well-rounded investment strategy.

In summary, the regulatory stability of the life insurance industry is a significant advantage for investors. The strict oversight and compliance measures ensure that these companies operate within a well-defined framework, leading to more conservative investment practices. This, in turn, results in lower volatility and a more secure investment, making life insurance stocks an attractive choice for those seeking financial stability and growth. Understanding this regulatory aspect can empower investors to make informed decisions and potentially build a more resilient investment portfolio.

Canada Life Insurance: Is It Worth the Hype?

You may want to see also

Market Resilience: Life insurance companies often show resilience during economic downturns, making them a reliable investment option

Life insurance companies have a unique position in the financial markets, and their stocks can be an attractive investment option, especially during challenging economic times. One of the key reasons for this is their inherent market resilience. When the economy faces a downturn, many sectors suffer, but life insurance companies often demonstrate remarkable stability. This resilience is primarily due to the nature of their business and the products they offer.

During economic recessions, people tend to prioritize essential expenses and often seek financial security. This shift in consumer behavior means that life insurance companies experience increased demand for their products. People are more inclined to purchase or renew life insurance policies to protect their loved ones and assets. As a result, these companies can maintain a steady revenue stream, ensuring their financial health and stability. This stability is a significant draw for investors who seek reliable and consistent returns.

The business model of life insurance companies is designed to provide long-term financial security. They offer policies that span decades, and during economic downturns, these long-term commitments can act as a buffer against short-term market fluctuations. Policyholders are more likely to honor their commitments to pay premiums, even during challenging economic periods, as they understand the value of the coverage provided. This loyalty and the company's ability to manage cash flow effectively contribute to their resilience.

Furthermore, life insurance companies have a diversified revenue stream, which is another factor in their market resilience. They earn income from various sources, including premium payments, investment returns, and interest income. During economic downturns, while investment returns may be affected, the steady inflow of premium payments ensures a consistent cash flow. This diversification reduces the impact of market volatility and provides a more stable foundation for the company's financial performance.

Investing in life insurance stocks can be an attractive strategy for those seeking reliable investments. The sector's resilience during economic downturns is a significant advantage, offering investors a sense of security and consistency. While no investment is entirely risk-free, the life insurance industry's ability to weather economic storms makes it a valuable addition to a diversified investment portfolio. This market resilience is a powerful incentive for investors to consider life insurance companies as a stable and profitable venture.

Understanding Michigan's Life Insurance Tax Rules: A Comprehensive Guide

You may want to see also

Frequently asked questions

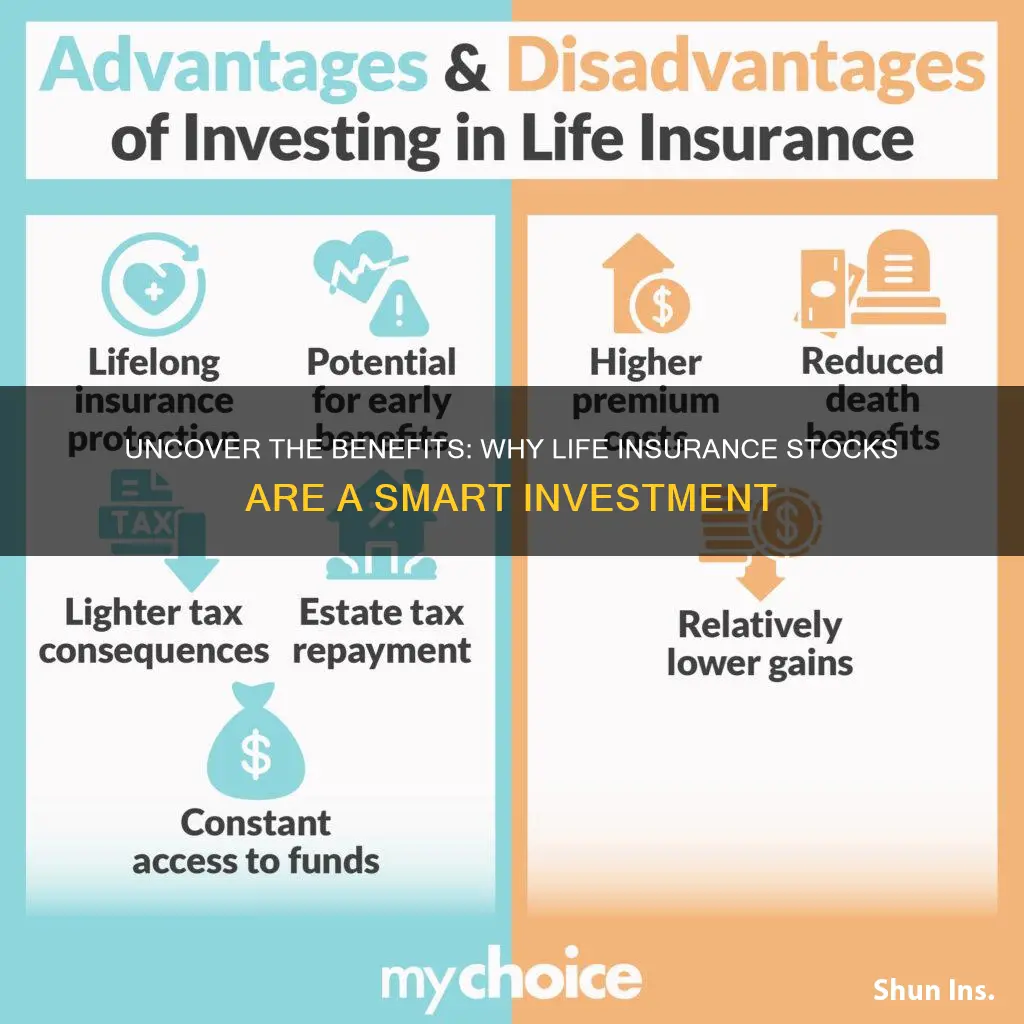

Investing in life insurance companies can offer several advantages. Firstly, life insurance stocks often provide a steady income stream through dividends, which can be attractive to income-seeking investors. These dividends are typically paid out regularly, providing a reliable source of cash flow. Secondly, life insurance companies have a diversified business model, offering various financial products such as term life insurance, whole life insurance, and investment products. This diversification can help mitigate risks and provide a more stable investment over time.

During periods of market volatility, life insurance stocks can exhibit resilience. Life insurance companies have a strong interest in maintaining and growing their policyholder base, which often leads to consistent investment in various sectors. This strategic focus can result in stable performance, even when the broader market is uncertain. Additionally, life insurance companies may have a more conservative investment approach, prioritizing capital preservation and long-term growth, which can benefit investors seeking a more stable investment strategy.

While investing in life insurance stocks can be a solid choice, it's essential to consider potential risks. One risk is the possibility of policyholder behavior changes, as life insurance companies rely on a steady stream of new policies and renewals. Economic downturns or shifts in consumer behavior could impact the industry. Another risk is the regulatory environment, as life insurance companies are subject to various regulations, and any changes in legislation could affect their operations. It's crucial to research and understand the specific risks associated with each life insurance company before making investment decisions.