Choosing the right life insurance can be a challenging decision, especially when comparing options like Globr and Colonial Penn. Both companies offer unique features and benefits, making it essential to understand their differences to determine which one aligns better with your financial goals and needs. This comparison will delve into the key aspects of each policy, including coverage options, pricing, customer service, and overall reputation, to help you make an informed decision.

What You'll Learn

- Cost Comparison: Globr vs. Colonial Penn: Which is more affordable

- Coverage Options: Explore the different policies and benefits offered by each

- Customer Service: Compare the support and assistance provided by the companies

- Financial Stability: Assess the financial health and ratings of Globr and Colonial Penn

- Claims Process: Evaluate the efficiency and transparency of the claims handling process

Cost Comparison: Globr vs. Colonial Penn: Which is more affordable?

When considering life insurance options, it's essential to evaluate the costs associated with each policy to determine which one offers better value. In this comparison, we'll delve into the cost structures of Globr and Colonial Penn, two insurance providers, to help you make an informed decision.

Globr, a relatively new player in the market, offers a range of whole life insurance policies with various coverage options. Their pricing structure is designed to be competitive, often appealing to those seeking affordable life insurance. Globr's policies typically have lower monthly premiums compared to some traditional life insurance companies, making them an attractive choice for budget-conscious individuals. The company's focus on simplicity and transparency in pricing may contribute to its affordability.

On the other hand, Colonial Penn, a well-established insurance provider, has been offering life insurance policies for many years. They are known for their guaranteed acceptance policies, which can be advantageous for individuals with pre-existing health conditions who might face challenges in obtaining coverage from other insurers. Colonial Penn's pricing strategy often involves higher monthly premiums, especially for those with health issues, as they provide coverage to a broader range of applicants. However, their policies may offer more comprehensive benefits, which could justify the higher costs.

To determine which provider offers more affordable rates, a detailed comparison of premium costs is necessary. Globr's competitive pricing model suggests that their premiums might be lower, especially for healthier individuals. In contrast, Colonial Penn's guaranteed acceptance policies could result in higher premiums, particularly for those with health concerns. It's crucial to consider individual health status, desired coverage amount, and policy features when assessing the overall cost.

Additionally, it's worth noting that the cost of life insurance can vary based on factors such as age, gender, smoking status, and the specific policy term chosen. Both companies may offer discounts or incentives for healthy habits or longer policy terms, which can further impact the overall affordability. Therefore, a personalized analysis considering these factors will provide a clearer picture of which insurance provider aligns better with your budget and coverage needs.

In summary, while Globr's competitive pricing model suggests it could be more affordable, especially for healthier individuals, Colonial Penn's guaranteed acceptance policies may come at a higher cost. A thorough cost analysis, taking into account individual circumstances, is essential to make an informed decision regarding the most cost-effective life insurance option between Globr and Colonial Penn.

Weed and Life Insurance: What UK Smokers Need to Know

You may want to see also

Coverage Options: Explore the different policies and benefits offered by each

When considering life insurance, it's crucial to understand the coverage options provided by different companies to make an informed decision. In the comparison between Globe Life and Colonial Penn, exploring their policies and benefits is essential.

Globe Life:

This company offers a range of life insurance policies tailored to various needs. One of their primary products is the Globe Life Insurance Policy, which provides a straightforward and comprehensive coverage option. The policy offers a guaranteed death benefit, ensuring a fixed amount is paid out upon the insured's passing. This can be particularly appealing for those seeking a predictable and reliable financial safety net for their loved ones. Globe Life also provides term life insurance, which offers coverage for a specified period, often with the option to convert it to a permanent policy later. Additionally, they cater to specific demographics, such as senior citizens, with tailored policies that may include additional benefits like long-term care or critical illness coverage.

Colonial Penn:

Colonial Penn specializes in providing affordable and accessible life insurance, particularly catering to the elderly population. Their primary offering is the Colonial Penn Whole Life Insurance Policy, designed to provide lifelong coverage with a guaranteed death benefit. This policy is often more affordable for older individuals as it doesn't require a medical exam for qualification, making it easier to obtain. Colonial Penn also offers term life insurance, which can be a more cost-effective option for those seeking coverage for a specific period. Furthermore, they provide a range of riders and add-ons, allowing policyholders to customize their coverage and potentially include benefits like accidental death coverage or waiver of premium.

Both companies offer unique advantages, and the choice between them depends on individual preferences and specific requirements. Globe Life provides a wide array of policies, ensuring flexibility and customization, while Colonial Penn focuses on accessibility and affordability, making life insurance more attainable for a broader demographic. It is recommended to review the specific terms, conditions, and benefits of each policy to determine which aligns best with your needs and financial goals.

Maximize Savings: Top Cashback Life Insurance Plans Revealed

You may want to see also

Customer Service: Compare the support and assistance provided by the companies

When it comes to choosing between GLOBR and Colonial Penn for life insurance, customer service and support are crucial factors to consider. Both companies offer different approaches to assisting their policyholders, and understanding these differences can help you make an informed decision.

GLOBR, known for its comprehensive coverage, provides a robust customer service system. They offer multiple channels for support, including a dedicated customer service team that can be reached via phone, email, and online chat. This 24/7 availability ensures that policyholders can get immediate assistance whenever needed. GLOBR's representatives are trained to handle a wide range of inquiries, from policy explanations to claims processing. Additionally, they provide online resources and a knowledge base, allowing customers to find answers to common questions independently.

On the other hand, Colonial Penn takes a more personalized approach to customer service. They focus on building long-term relationships with their clients, offering a dedicated agent system. Each policyholder is assigned a specific agent who becomes their primary point of contact. This agent is responsible for understanding the customer's needs and providing tailored advice. Colonial Penn's agents are often praised for their expertise and ability to simplify complex insurance concepts. They also offer a customer service hotline and an online portal for policy management, ensuring accessibility and convenience.

In terms of assistance, GLOBR provides a streamlined claims process, making it relatively straightforward for policyholders to file claims. They offer a user-friendly online platform for submitting and tracking claims, which can be particularly helpful during challenging times. Colonial Penn, however, emphasizes a more empathetic and supportive approach to claims processing. Their agents guide policyholders through the process, ensuring a more personalized experience. This can be especially beneficial for those who prefer a more human-centric and empathetic support system.

Both companies have their strengths in customer service. GLOBR's comprehensive support system and multiple channels cater to a wide range of customer preferences. It provides efficient and accessible assistance. Colonial Penn, with its dedicated agent model, focuses on building long-term relationships and offering personalized guidance. This approach may appeal to those seeking a more tailored and empathetic experience. Ultimately, the choice between the two depends on your specific needs and preferences regarding customer service and support.

Life Insurance: Can Someone Else Purchase It for You?

You may want to see also

Financial Stability: Assess the financial health and ratings of Globr and Colonial Penn

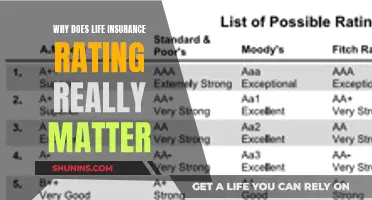

When considering life insurance options, it's crucial to evaluate the financial stability and ratings of the companies to ensure you're making an informed decision. In this comparison, we'll delve into the financial health of Globr and Colonial Penn, two insurance providers, to help you understand their reliability and trustworthiness.

Globr, a relatively new player in the insurance market, has been making waves with its innovative approach to life insurance. While they offer competitive rates and unique features, it's essential to assess their financial stability. Globr has received positive reviews for its customer service and digital platform, but as a newer company, they might not have the extensive financial history that more established insurers possess. However, they have been steadily growing and expanding their offerings, which could indicate a strong financial trajectory.

On the other hand, Colonial Penn has been in the life insurance business for several decades and has built a solid reputation. They are known for their simplified underwriting process and affordable policies, making them an attractive choice for many. Colonial Penn has consistently maintained a strong financial rating from reputable agencies. For instance, A.M. Best, a leading insurance rating company, has assigned Colonial Penn an 'A' (Excellent) financial strength rating, indicating a high level of financial stability and the ability to meet policy obligations. This rating provides reassurance to potential customers, especially those seeking long-term financial security.

In terms of financial health, Colonial Penn's long-standing presence in the market and positive ratings give it an edge. Their consistent performance and ability to maintain a strong financial position over the years showcase their commitment to customer satisfaction and financial responsibility. Additionally, Colonial Penn's focus on simplified policies and competitive pricing makes it an appealing choice for those seeking affordable life insurance options without compromising on financial stability.

When assessing the financial stability of these insurers, it's also worth considering their market presence and customer satisfaction. While Globr is making strides, Colonial Penn's extensive experience and positive ratings make it a more established and reliable choice. However, it's always advisable to review individual needs, policy details, and compare multiple options before making a final decision.

In summary, when it comes to financial stability, Colonial Penn's long-standing presence, positive financial ratings, and commitment to customer satisfaction give it a slight advantage over Globr. Nonetheless, both companies have their unique strengths, and the decision should be based on personal preferences, policy features, and individual financial goals.

Understanding Cash Value Life Insurance in Canada

You may want to see also

Claims Process: Evaluate the efficiency and transparency of the claims handling process

When it comes to choosing between GLOBR and Colonial Penn for life insurance, one crucial aspect to consider is the claims process. The efficiency and transparency of how a company handles claims can significantly impact your overall experience and peace of mind. Here's an evaluation of the claims process for both insurers:

GLOBR's Claims Process: GLOBR, a relatively newer player in the insurance market, has been making strides in improving its claims handling procedures. They aim to provide a streamlined and efficient process for their policyholders. GLOBR's website often highlights their commitment to quick claim settlements, which is a positive sign for policyholders. The company typically provides an online portal or a dedicated customer service team to facilitate the claims process. This digital approach can be advantageous, allowing policyholders to submit necessary documents and track the progress of their claims conveniently. However, it is essential to review the specific terms and conditions of GLOBR's policy to understand the requirements and potential challenges.

Colonial Penn's Claims Handling: Colonial Penn, a well-established insurance provider, has a more traditional approach to claims processing. They have a robust network of local agents who assist policyholders throughout the claims journey. This personalized touch can be beneficial, especially for those who prefer direct communication and guidance during difficult times. Colonial Penn's claims process often involves a more traditional paper trail, where policyholders need to submit physical documents. While this may be less convenient in the digital age, it ensures a more human-centric approach, which some individuals might prefer. Transparency is a key aspect of Colonial Penn's claims handling, as they provide clear guidelines and frequently ask for feedback from policyholders to improve their services.

Efficiency is a critical factor in the claims process. GLOBR's focus on speed and digital accessibility could be advantageous for those seeking swift claim resolutions. On the other hand, Colonial Penn's traditional methods might take a bit longer but could offer a more personalized experience. It is essential to consider your own preferences and the level of convenience you desire when evaluating these options. Additionally, comparing the average claim settlement times and customer satisfaction ratings of both insurers can provide valuable insights.

Transparency is another vital aspect. GLOBR's online portal and clear communication can make the claims process more transparent, allowing policyholders to understand the status of their claims at any given time. Colonial Penn's local agents and feedback mechanisms also contribute to a transparent environment, ensuring that policyholders are well-informed and can provide input during the claims journey.

In summary, when evaluating GLOBR and Colonial Penn for life insurance, the claims process is a significant consideration. GLOBR's efficiency and digital approach might appeal to those seeking speed, while Colonial Penn's traditional methods and personalized service could cater to individuals who value human interaction. Ultimately, reviewing the specific policies, comparing efficiency and transparency, and choosing the insurer that aligns best with your preferences is essential.

Military Kids and Life Insurance: What's the Deal?

You may want to see also

Frequently asked questions

The primary distinction lies in their coverage types and target audiences. GlobR offers a range of term life insurance plans, providing coverage for a specified period, while Colonial Penn specializes in guaranteed acceptance whole life insurance, designed for individuals who may face challenges in obtaining standard life insurance coverage.

Costs can vary significantly between the two. GlobR's term life insurance policies typically offer more flexibility in terms of coverage duration and amount, allowing for customization. This flexibility often comes at a higher cost compared to Colonial Penn's guaranteed acceptance policies, which provide fixed coverage amounts with no medical underwriting.

Yes, Colonial Penn's guaranteed acceptance whole life insurance is an excellent option for those with pre-existing health conditions or those who have been declined by other insurers. This policy type offers immediate coverage without medical questions or exams, ensuring acceptance regardless of health status. However, the trade-off is often higher premiums and less flexibility in terms of policy customization.

Yes, you can typically switch between life insurance providers, but it's essential to consider the terms and conditions of your current policy. Some policies may have surrender charges or other penalties if you cancel or switch. It's advisable to review the specific terms of your policy and consult with a financial advisor to understand the implications of any changes to your insurance coverage.