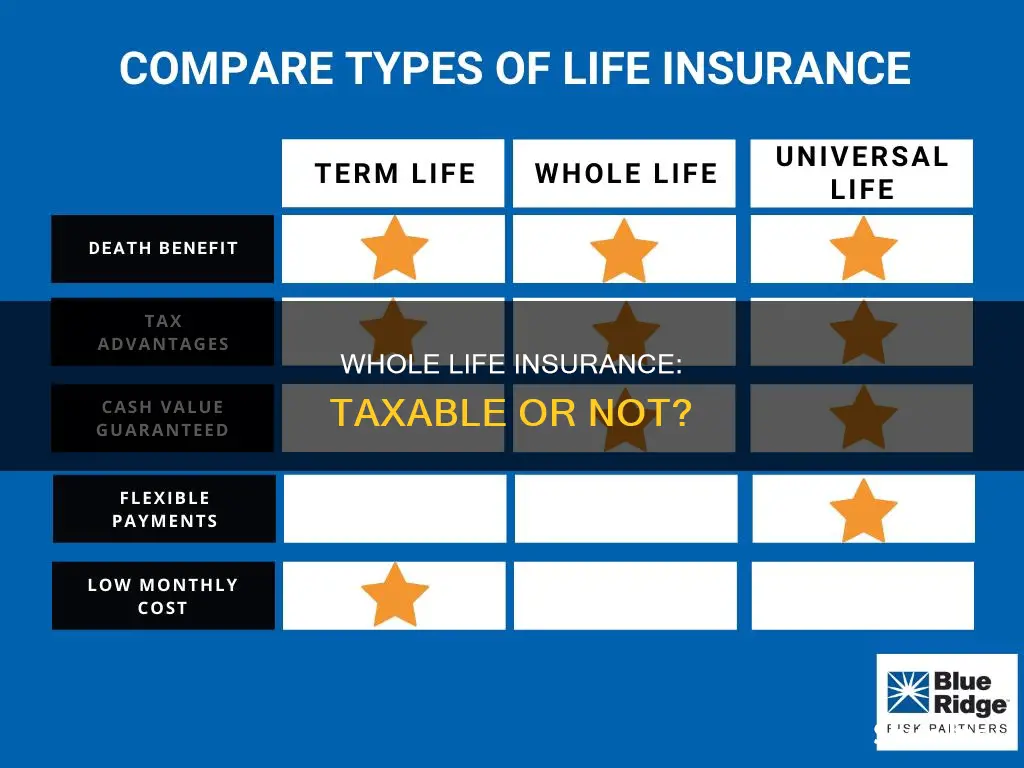

Life insurance is a financial product that provides a lump-sum payout to beneficiaries in the event of the policyholder's death. The Internal Revenue Service (IRS) treats life insurance differently from other financial products because it is intended to support beneficiaries. The tax implications of life insurance depend on the type of policy and various other factors. Whole life insurance, for example, is a type of permanent plan that lasts for the policyholder's entire life, provided they continue to pay premiums. It has a death benefit and a secure cash value account that grows tax-free. While the cash value of whole life insurance is not usually taxable, there are certain cases where taxes may apply. Understanding the tax treatment of life insurance proceeds is crucial when planning for the future, especially when considering estate planning and potential tax implications.

| Characteristics | Values |

|---|---|

| Tax on cash value | Grows tax-free but may be taxed when cashed out |

| Tax on loan | Not taxable unless the policy terminates before repayment |

| Tax on withdrawal | Not taxable up to the total premiums paid; gains are taxed as ordinary income |

| Tax on death benefit | Not taxable but exceptions exist |

| Tax on monthly installments | Accrued interest is taxable |

What You'll Learn

- Interest on whole life insurance policies is not taxed until the policy is cashed out

- Whole life insurance death benefits are not taxable income

- Whole life insurance premiums are not tax-deductible

- Whole life insurance cash value is not taxed annually

- Whole life insurance cash value is taxed on withdrawal

Interest on whole life insurance policies is not taxed until the policy is cashed out

For example, if you take out a loan from your life insurance policy and the policy terminates before you've repaid it, you will be taxed on the outstanding loan amount. Similarly, if you withdraw any gains, such as dividends, you will need to pay taxes on them as ordinary income.

It's important to note that the death benefit of a whole life insurance policy is generally not taxable income for the beneficiaries. However, if the policy is included in the estate's value and the value exceeds a certain threshold, it may be subject to estate taxes.

Additionally, if you choose to receive the life insurance payout in installments, the interest accrued will be taxable.

To summarize, while the interest on a whole life insurance policy is not taxed until it is cashed out, there are certain situations where taxes may apply. These include taking out loans against the policy, withdrawing gains, including the policy in your estate, and choosing installment payments. Consulting a financial advisor or tax professional can help you better understand the tax implications of your specific situation.

Term Life Insurance: Understanding Its Characterization

You may want to see also

Whole life insurance death benefits are not taxable income

Firstly, if the policy is paid out in installments, the interest accrued on the benefit will be taxable. Secondly, if the beneficiary takes out a loan against the policy's cash value and the policy lapses before the loan is repaid, the outstanding loan amount will be taxed. Thirdly, if the insured person's employer pays the premiums, the benefit may be taxable. Finally, if the death benefit is included in the value of the estate and the value exceeds a certain threshold, the benefit may be subject to federal estate taxes.

It is important to note that while the death benefit itself is not taxable, the interest calculated from the date of the insured person's death to the date the insurance company sends the death benefit check to the beneficiary is taxable. This interest is reported to the Internal Revenue Service (IRS) by the insurance company.

The tax implications of whole life insurance can be complex and depend on individual circumstances. It is always recommended to consult a financial advisor or tax professional for personalized advice.

Life Insurance: Exploring Unique Characteristics and Features

You may want to see also

Whole life insurance premiums are not tax-deductible

In the case of employer-paid life insurance, the IRS considers it income, making the employee subject to taxes. However, these taxes only apply when the employer-paid insurance coverage exceeds $50,000. The premium cost for the first $50,000 is exempt from taxation.

For example, if an employer provides an employee with $50,000 in life insurance coverage, the employee doesn't have to pay taxes on the benefit as it does not exceed the threshold set by the IRS. On the other hand, if the employer pays for a $100,000 life insurance policy, the employee must pay taxes on the portion above the $50,000 threshold. The taxable amount is based on IRS tables and will vary depending on the age of the insured and the actual premium paid.

It is important to note that life insurance premiums are generally not subject to sales tax, but states typically charge insurers a tax on the premiums they collect, which may be passed on to the consumer.

Ezlynx Life Insurance Support: What You Need to Know

You may want to see also

Whole life insurance cash value is not taxed annually

Life insurance is a financial product that provides a lump sum payout to beneficiaries in the event of the policyholder's death. The death benefit remains in effect as long as the policyholder pays the insurance premiums, which depend on the insured's age and health, the size of the death benefit, and the type of coverage. While life insurance is intended to support beneficiaries after the policyholder's death, the Internal Revenue Service (IRS) treats it differently from other financial products in terms of taxation.

Whole life insurance is a type of permanent life insurance policy that lasts for the rest of the policyholder's life, provided they continue to pay premiums. It offers a death benefit and a secure cash value account that grows tax-free. This means that the cash value of whole life insurance is not taxed annually. The premiums and death benefit also remain the same throughout the duration of the policy.

The tax-deferred nature of whole life insurance means that policyholders do not have to pay taxes on the growth of their policy's cash value each year. Similar to retirement accounts like 401(k) plans and IRAs, the accumulation of cash value in a whole life insurance policy is tax-exempt until it is withdrawn. Policyholders can access the cash value through loans, withdrawals, or by surrendering the policy. However, it is important to note that if the policy is surrendered, the cash value received above the total premiums paid may be subject to taxation.

Additionally, if a loan is taken against the policy's cash value and the policy lapses before the loan is repaid, the outstanding loan amount may be taxed. It is also worth mentioning that interest generated from whole life insurance policies is not taxed until the policy is cashed out.

In summary, the cash value of whole life insurance policies grows tax-free, providing a tax-advantaged way to accumulate savings over time. Policyholders can access their cash value without annual tax implications, but certain actions, such as surrendering the policy or failing to repay loans, may trigger taxable events.

Marriage Annulment: Impact on Life Insurance Policies

You may want to see also

Whole life insurance cash value is taxed on withdrawal

The cash value of a whole life insurance policy is not taxed until withdrawal. This means that, although the cash value of the policy grows over time, the policyholder does not have to pay taxes on it until they cash out the policy. When a policyholder withdraws the cash value of their whole life insurance policy, the amount they are taxed on is the difference between the cash value they receive and the total they paid in premiums during the time the policy was in force. For example, if they pay $100 per month for 20 years, or $24,000, and then cash out the policy and receive $30,000, the amount subject to taxes is $6,000.

It is important to note that there are some instances where the cash value of a life insurance policy may be taxable prior to withdrawal. For example, if the policyholder takes out a loan from their life insurance plan, the loan is generally not taxable. However, if the policy terminates before the loan is repaid, the policyholder may be subject to a tax bill on the outstanding loan amount.

Additionally, in some cases, the death benefit of a life insurance policy may be taxable to the beneficiary. While the death benefit is generally not considered taxable income, if it is included as part of the insured's estate and the value exceeds a certain threshold, it may be subject to estate taxes. As of 2023, this threshold is $12.92 million for individuals and $25.84 million for married couples.

Furthermore, if the life insurance payout is made in installments, the interest accrued on the installments will be taxable. It is also important to consider any state-level inheritance taxes, which are separate from federal estate taxes and may apply in certain states.

Consulting a financial advisor or tax professional can help individuals understand the tax implications of their life insurance policies and make informed decisions about their coverage and beneficiary designations.

Life Insurance Underwriter: Your Career Guide

You may want to see also

Frequently asked questions

Whole life insurance is not taxable, but the interest generated is taxed when the policy is cashed out.

Yes, states typically charge a tax on the premiums collected by insurers, which is likely passed on to the consumer.

Yes, the cash value of whole life insurance grows tax-free.

No, life insurance premiums are not tax-deductible under most circumstances.

Yes, you may be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy.