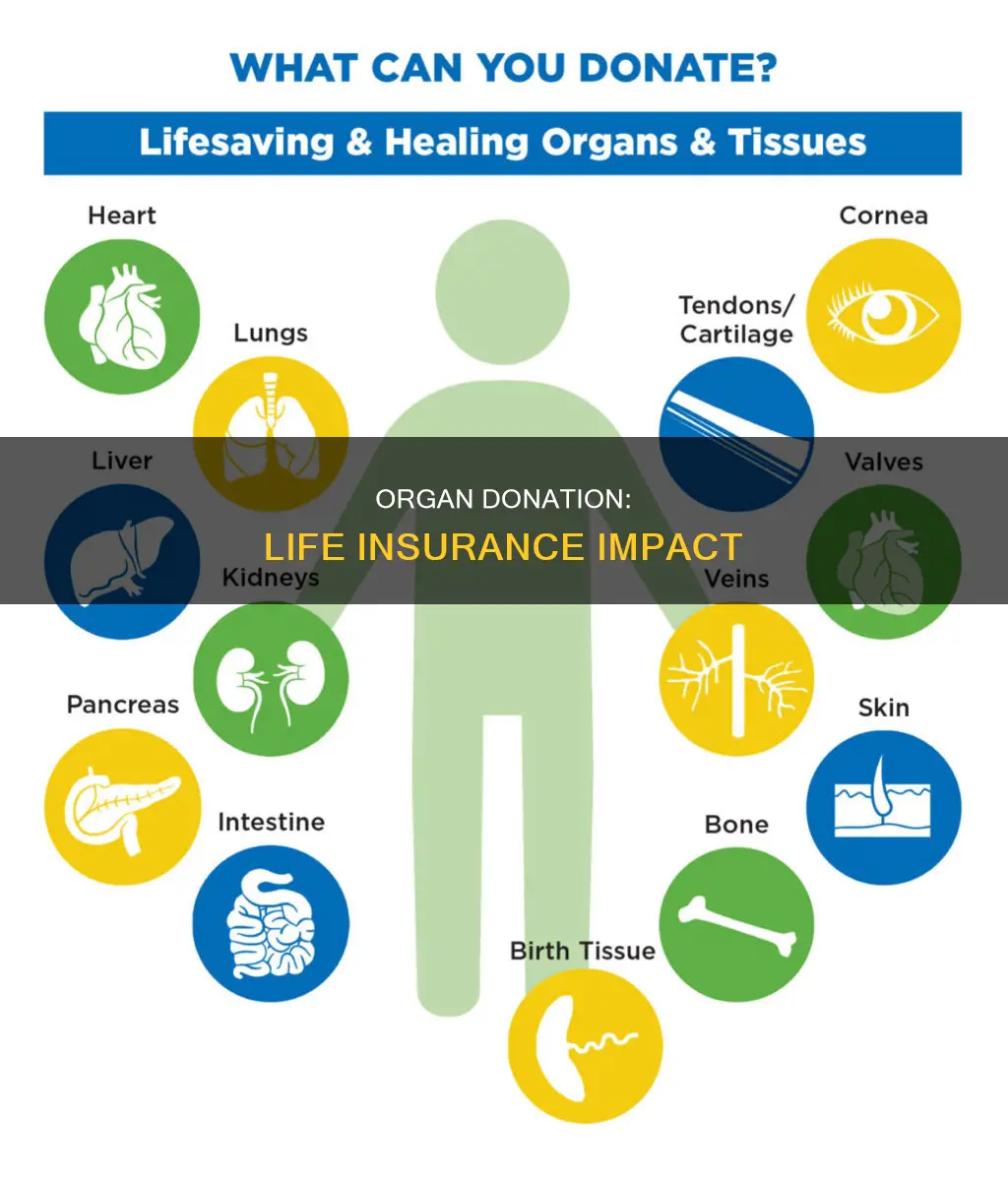

Organ donation is a life-saving procedure, with over 100,000 people in the US awaiting a transplant. While organ donation is a noble act, it raises several questions, such as whether it affects life insurance. This is an important consideration, as life insurance provides financial stability for families in the event of an untimely death. So, does organ donation impact life insurance?

| Characteristics | Values |

|---|---|

| Number of people waiting for a lifesaving organ transplant | Over 100,000 |

| Number of people who receive an organ transplant daily in the US | 80 |

| Number of people who perish daily while on the waiting list | 16 |

| Number of people currently awaiting organ transplants in the US as of March 27, 2024 | 103,223 |

| Number of people whose lives can be saved from one donor's organs | Up to 8 |

| Number of people who can be healed by one tissue, eye, and organ donor | Over 75 |

| Percentage of patients on the transplant list who are people of color | Over 50% |

| Number of living organ donation transplants annually | 6,500 |

What You'll Learn

Life insurance for organ donors

Organ donation is a life-saving procedure, with over 100,000 people in the US awaiting a transplant. Signing up to be an organ donor is extremely important and can save up to eight lives per donor. Living organ donation is also possible and has advantages for the donor, such as deciding who will receive their organ.

However, being a living donor may affect your ability to obtain life insurance. A study by Johns Hopkins University School of Medicine found that 25% of donors who changed or initiated life insurance after donation experienced difficulty, with some donors being denied coverage, charged higher premiums, or told they had a pre-existing condition due to their donor status.

The impact of organ donation on life insurance varies depending on the type of organ donated and the individual's situation. Some organs can be donated by living donors, while others come from deceased donors. The mortality risk is different for each type of organ transplant and depends on the reason for the transplant. For example, a kidney transplant due to trauma has a better prognosis than one due to chronic kidney disease.

Living donors are carefully screened to ensure they are healthy, and studies suggest that people can live a normal, healthy life with one kidney. Donors are encouraged to have regular check-ups and follow a healthy lifestyle. There is no evidence that living donation shortens lifespan.

If you are considering becoming a living organ donor, it is important to be aware of the potential impact on your life insurance. Work with an independent life insurance broker who has contracts with multiple companies, as not all insurers view risks in the same way, and your chances of getting coverage may be higher.

Additionally, under the Patient Protection and Affordable Care Act (ACA), discrimination by health insurance providers based on pre-existing conditions is illegal. This means that insurance companies cannot refuse health insurance to live organ donors or charge them higher rates.

In conclusion, while organ donation is a valuable and life-saving act, it is important to consider the potential impact on your life insurance coverage. The best course of action is to consult with an independent broker who can advise you based on your individual circumstances.

Life Insurance Application: Location, Location, Location?

You may want to see also

Health insurance for organ donors

Organ donation is a life-saving procedure, with more than 100,000 people in the United States awaiting a transplant. Signing up to be an organ donor is extremely important to help save lives, as there are currently more people on the transplant list than there are organs available. Living organ donation has an advantage for donors, as they can decide who will receive their organ, and recipients tend to have improved health outcomes.

However, being a living donor may affect your ability to get health or life insurance. While the direct expenses related to the donation procedure are generally covered by the recipient's insurance, donors are typically responsible for their long-term health care.

A 2014 study by Johns Hopkins University School of Medicine surveyed 1,046 individuals who donated a kidney between 1970 and 2011. Among the donors who changed or initiated health insurance after donation, 7% reported difficulty, with 15 people being denied altogether, 12 charged a higher premium, and 8 told they had a pre-existing condition due to being kidney donors. For life insurance, 25% of donors who changed or initiated a policy reported difficulty, with 23 denied, 27 charged a higher premium, and 17 told they had a pre-existing condition.

Despite these findings, there is no evidence that living donation shortens a donor's lifespan. Studies suggest that people can live a normal, healthy life with one kidney, and living donors are carefully screened to ensure they remain healthy. Donors are encouraged to have regular check-ups and follow a healthy lifestyle.

In the United States, the Affordable Care Act (ACA) has made it illegal for insurance companies to discriminate based on pre-existing conditions, including live kidney donation. However, attempts have been made to repeal this law, and the ACA does not cover life insurance, which was a more common source of difficulty for donors in the Johns Hopkins study.

Therefore, while organ donors may face challenges in obtaining health and life insurance, the impact appears to be mixed, and regulations like the ACA can help protect donors from discrimination.

Life Insurance Payouts: Are They Taxed in Minnesota?

You may want to see also

Kidney donation and insurance

Who Pays for Kidney Donation?

The kidney recipient's Medicare or private health insurance will cover the direct costs of kidney donation, such as medical testing, surgery, and some medicines for the recipient. However, there are indirect costs that may not be covered, such as travel expenses and lost wages.

Insurance Coverage for Kidney Donors

Medicare or the recipient's private insurance will cover the medical costs of testing and surgery for both the donor and recipient. However, most insurance plans do not cover time off from work, childcare, or hotel costs during testing, surgery, and recovery.

Impact on Life Insurance for Kidney Donors

Kidney donation may impact a donor's ability to obtain life insurance. Some living donors have reported difficulties obtaining life insurance or facing higher premiums. This may be due to the perception of increased mortality risk, even though studies show that living kidney donors have a higher quality of life and similar or improved psychosocial health after donation.

Recommendations for Kidney Donors

It is recommended that potential kidney donors obtain health and life insurance before donating. Donors should carefully review their insurance contracts to understand how donation may affect their coverage. Consulting with a lawyer knowledgeable about insurance law can also provide valuable insights. Additionally, donors can explore options like the Living Organ Donor Network, which offers life, disability, and medical insurance for complications arising from kidney donation.

Financial Assistance for Kidney Donors

Financial assistance is available for kidney donors through various programs. The National Living Donor Assistance Center (NLDAC) helps cover lost wages and travel costs for eligible donors. The National Living Donor Assistance Program provides financial support for travel and subsistence expenses. The American Transplant Foundation offers grants of up to $700 to assist with expenses like mortgage, rent, utilities, and insurance. Additionally, donors may qualify for tax deductions or credits at the state level, and there is pending federal legislation for a tax credit of up to $5,000 for unreimbursed expenses.

Life Insurance: Child Coverage and Your Options

You may want to see also

Liver donation and insurance

Liver donation is a life-saving procedure, but it's important to consider the potential impact on insurance coverage. The insurance implications of liver donation can be complex, and it's essential to understand how it may affect your coverage. This article will provide a detailed and instructive guide on liver donation and insurance, covering evaluation costs, surgery expenses, and the potential impact on health, disability, and life insurance.

Evaluation Costs

The medical expenses associated with the living donor evaluation are typically covered by either the recipient's insurance or, in certain circumstances, by the Transplant Centers Organ Acquisition Fund (OAF). This means that donors should not have to incur any costs for the evaluation itself. However, it's important to note that if other health concerns are identified during the evaluation process, these expenses will not be covered by the recipient's insurance or the OAF.

Surgery Expenses

The actual donation surgery expense is usually covered by the recipient's insurance. The transplant center will charge the recipient's insurance an "acquisition fee" for the transplant procedure, which includes the medical costs related to the donor's procedure. In some cases, the itemized bill for the donor's procedure may be submitted to the recipient's insurance company.

Impact on Health, Disability, and Life Insurance

Liver donation may have implications for the donor's ability to obtain, maintain, or afford health, disability, and life insurance. It is crucial to discuss the potential impact on insurance coverage with both the transplant center and the donor's current insurance provider(s). While it is against the law to pay a living donor for their organ, the recipient may cover certain donor expenses, such as annual physicals, travel, lodging, and lost wages. The National Living Donor Assistance Program also offers financial assistance to those who want to donate an organ. Additionally, federal employees in the US receive 30 days of paid leave for organ donation, on top of their regular sick and annual leave.

While liver donation can be a life-saving act, it's important to be aware of the potential financial implications. By understanding the coverage provided by the recipient's insurance and the support available through assistance programs, donors can make informed decisions about their role in this life-changing procedure.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

Transplant waiting lists

The number of people on the national transplant waiting list in the United States varies depending on the source. According to OrganDonor.gov, there are over 116,000 people on the list, while another source states that there are over 103,000 people waiting for a transplant. The list is diverse, including individuals of all ages, ethnicities, and genders. Every eight minutes, another person is added to the waiting list, and each day, 17 people die while waiting for an organ transplant.

The United Network for Organ Sharing (UNOS) uses a computer system to generate a ranked list of transplant candidates who are suitable to receive each organ from a deceased donor. This system helps match individuals waiting for a transplant with compatible donor organs. The ranking is not simply based on who has been waiting the longest but on a range of factors to ensure patient safety, equity, and the efficient use of donated organs.

The Organ Procurement and Transplantation Network (OPTN) maintains a national database that contains information on the candidate waiting list, organ donation and matching, and transplantation. This database is critical in helping organ transplant institutions manage time-sensitive, life-critical data for all candidates before and after their transplants. OPTN data can be used to explore current and historical U.S. donation and transplant trends at the national and regional levels.

Life Insurance and Doctor Visits: What's the Connection?

You may want to see also

Frequently asked questions

Being an organ donor may affect your ability to get life insurance. A survey of 1,046 live kidney donors found that 25% had difficulty changing or initiating life insurance. Some donors were denied altogether, while others were charged a higher premium.

Insurance companies may view organ donors as high-risk due to reduced organ function. For example, kidney donors may have a reduced glomerular filtration rate (GFR) because they only have one kidney, even if there is no evidence of kidney disease or injury.

It is recommended that you work with an independent life insurance broker who has contracts with multiple life insurance companies. This increases your chances of getting coverage as not all companies view certain risks in the same way.

Under the Patient Protection and Affordable Care Act (ACA), insurance companies can no longer refuse health insurance to live kidney donors or charge them higher rates based on pre-existing conditions. However, this law does not apply to life insurance.