Life insurance for children is a permanent life insurance policy that provides a fixed death benefit to the beneficiary if the insured child dies while covered. It can also be used as a long-term savings mechanism, as the policy typically includes a cash value component that grows over time. There are a few instances where it may be a good idea to explore a child life insurance policy, such as if your child has a medical condition that will impact them for the rest of their life, or if your family has a medical history that may put your child at risk early in life.

| Characteristics | Values |

|---|---|

| Type of insurance | Term or whole life insurance |

| Insured | Minor |

| Policyholder | Parent, grandparent or guardian |

| Beneficiary | Parent, guardian or grandparent |

| Coverage | Fixed death benefit, lifelong coverage as long as premiums are paid |

| Coverage amount | $5,000 to $500,000, depending on the insurer and policy |

| Premium | Locked in, will not increase over time |

| Cash value | Grows over time, can be accessed for any reason |

| Age limit | 14 to 17 years old, depending on the insurer |

| Ownership transfer | To the insured child once they become an adult |

What You'll Learn

Child life insurance pros and cons

Pros

- Guarantees future insurability: Child life insurance policies typically include or offer a guaranteed purchase option, meaning the child can buy additional coverage without a medical exam. This is useful if the child develops a chronic health condition or chooses a risky career.

- Acts as a savings vehicle for your child: You can withdraw or borrow money from the cash value account, which grows tax-deferred. The money can be used to cover costs like school fees or a down payment on a home.

- Covers costs in the worst-case scenario: Child life insurance policies pay out a lump sum in the event of a child's death, which can be used for burial costs or grief counselling.

Cons

- Low rate of return: Whole life insurance policies build cash value slowly compared to other investments, such as a 529 college savings plan.

- Long-term commitment: Whole life insurance policies require decades of premium payments. If you cancel, you lose the money you've paid.

- Low coverage amounts: Coverage amounts for child life insurance policies are typically low, often under $50,000, and may not meet your child's needs as an adult.

- Money could be spent elsewhere: It is statistically unlikely that your child will die at a young age, so your money might be better spent on other financial priorities, such as an emergency fund or retirement savings.

Family Life Insurance: Do Children Get Covered for Free?

You may want to see also

When to buy child life insurance

Financial Situation

If you're dependent on your child's income, it may be worth considering child life insurance. This could include situations where your child is an actor, model, or social media star bringing in a substantial income, or if they contribute financially to the household. In these cases, the insurance can help cover final expenses and provide financial flexibility if the unthinkable happens.

Family Medical History

If your family has a history of genetic medical conditions, such as diabetes, insuring your child early can guarantee their future insurability. This is especially relevant if your child is likely to develop a health condition later in life that could make it challenging or expensive for them to get insured as an adult.

Age of the Child

The younger the child, the lower the insurance rate will be. Buying life insurance for a child locks in low rates, and the premium will not increase over time. Most companies offer coverage for children from 14 days old, with the cutoff age varying between 14 and 17 years old.

Type of Policy

Child life insurance policies are typically whole life insurance policies, which provide lifelong coverage as long as premiums are paid. However, some insurers offer term life insurance for children, which only provides coverage for a fixed term but is cheaper. Consider your purpose for obtaining the insurance to determine which type of policy is most suitable.

Cost and Affordability

While child life insurance premiums are generally low, you should also consider the opportunity cost of purchasing the insurance. There may be alternative ways to save for your child's future, such as investment options or college savings plans, that could provide higher returns. Evaluate your financial priorities and ensure you can afford the premium payments before purchasing child life insurance.

Life Insurance for Farmers: Is It Worth the Harvest?

You may want to see also

Child life insurance costs

Child life insurance is typically purchased by a parent, guardian or grandparent. It covers the life of a minor and is usually a whole life product, meaning coverage lasts for the child's entire life as long as the premiums are paid.

The average annual premium for a $25,000 policy on a newborn is $166. The younger the child, the cheaper the premium will be. The premium is locked in and won't increase over time.

The pros of child life insurance include:

- It guarantees future insurability, even if the child develops a health condition or chooses a risky career.

- It acts as a savings vehicle for the child, which can be accessed at certain ages.

- It covers costs if the child dies.

The cons include:

- It is an unnecessary expense, as it is uncommon for a child to die.

- The coverage amounts are usually low, often under $50,000.

- The rate of return is low compared to other investment types.

Child life insurance is best suited to families with a history of genetic medical conditions or those with high incomes who wish to transfer wealth to their children.

Life Insurance Benefits: Are They Considered Income?

You may want to see also

Child life insurance companies

Child life insurance covers the life of a minor and is typically purchased by a parent, guardian, or grandparent. It is usually a whole life insurance product, which means coverage lasts for the child's entire life as long as the premiums are paid. Coverage amounts are typically low, often under $50,000, and premiums are locked in. This type of insurance is heavily promoted, but it is important to carefully consider the pros and cons before purchasing.

- Protective: Protective offers a wide range of options for children's coverage, including term, whole, universal, and indexed universal life policies. They have the highest term conversion limits for children and offer affordable term policies. They also have a strong financial strength rating from AM Best.

- Nationwide: Nationwide receives high marks for customer satisfaction and financial stability. They offer whole, term, and universal life insurance coverage for children and have had fewer complaints than expected. They are also ranked highly by J.D. Power for customer satisfaction.

- Mutual of Omaha: Mutual of Omaha offers a variety of riders, including a disability income rider and a return of premium option for term coverage. Most policies include at least two living benefits, and some have three—for terminal, critical, and chronic illnesses. They also offer standalone whole life coverage for children and a guaranteed insurability rider.

- Penn Mutual: Penn Mutual offers the most options for permanent coverage for children, including universal, variable universal, indexed universal, whole life, and one-year term policies. They have a strong history of paying dividends to eligible policyholders and have had fewer complaints than expected.

- State Farm Life Insurance: State Farm has the highest possible financial strength rating from AM Best. They offer children's riders, universal, and whole life policies. They are also highly ranked for customer satisfaction and have had fewer complaints than expected.

These companies offer a range of coverage options and features, so be sure to carefully review their policies and choose the one that best meets your needs and budget.

Life Insurance: Engagements and Policy Changes Explained

You may want to see also

Child term life insurance

- Guaranteed future insurability: The child can purchase additional coverage without a medical exam, which is useful if they develop health issues or choose a high-risk career.

- Acts as a savings vehicle: The policy builds cash value, which the child can access for school fees, a down payment on a home, etc.

- Covers costs in the event of the child's death: The payout can help with burial costs, grief counseling, and other expenses.

However, there are also some drawbacks to consider:

- Low probability of payout: It is uncommon for a child to pass away, so the risk of going without coverage may not outweigh the policy cost.

- Low coverage amounts: The coverage amounts may not meet the child's needs later in life.

- Alternative investment options: Other investment types, such as 529 college savings plans, may offer higher interest rates.

Federal Employee Life Insurance: Age Limit and Benefits

You may want to see also

Frequently asked questions

It depends on your financial situation and family medical history. A policy will cover final expenses if your child dies and can provide financial flexibility to take time off work. It can also be beneficial if your child has a medical condition or if your family has a history of medical issues.

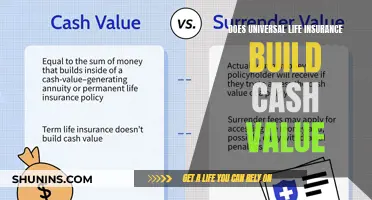

There are two main types of life insurance: term and whole life insurance. Term life insurance provides coverage for a set amount of time, while whole life insurance provides coverage for the child's entire life. Whole life insurance is more expensive but offers more policy features, like cash value, and the ability for your child to maintain coverage as an adult.

Some pros include guaranteed future insurability, access to cash value, and help with final expenses in the event of death. On the other hand, cons include a poor rate of return and long-term expenses, such as lifelong premium payments.

The cost depends on age, medical history, lifestyle, and location. You can expect to pay around $5 to $10 for a $10,000 policy with a choice of payouts between $5,000 to $50,000.