Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their loved ones. However, not all life insurance policies are created equal, and understanding the importance of life insurance ratings is essential for making informed decisions. In this paragraph, we will explore why life insurance ratings matter and how they can significantly impact your financial well-being. From assessing the financial strength and stability of insurance companies to evaluating the policy's coverage and benefits, ratings play a vital role in ensuring you receive the best protection for your needs. By delving into the significance of these ratings, we will uncover the reasons why they are a critical factor in your life insurance journey.

What You'll Learn

- Financial Security: Life insurance ratings indicate the financial strength of insurers, ensuring policyholders' claims are honored

- Risk Assessment: Ratings reflect insurers' ability to assess and manage risks, impacting policy terms and premiums

- Trust and Reliability: High ratings signify trustworthiness, allowing policyholders to rely on insurers for long-term coverage

- Cost Efficiency: Ratings influence premium costs, helping individuals choose affordable and comprehensive insurance

- Long-Term Planning: Understanding ratings aids in making informed decisions for long-term financial security and peace of mind

Financial Security: Life insurance ratings indicate the financial strength of insurers, ensuring policyholders' claims are honored

Understanding the importance of life insurance ratings is crucial for anyone considering purchasing a policy. These ratings provide an essential insight into the financial stability and reliability of insurance companies, which directly impacts the security of your investment and the fulfillment of your claims. When you purchase life insurance, you are essentially entrusting a significant amount of money to the insurer, and their ability to honor their commitments is paramount.

Life insurance ratings are assigned by independent credit rating agencies, such as A.M. Best, Moody's, and Standard & Poor's. These agencies evaluate the financial strength and stability of insurance companies based on various factors, including their assets, liabilities, capital, and management practices. The ratings typically range from 'A' (excellent) to 'D' (poor), with 'A' being the highest and most desirable rating. A higher rating indicates that the insurer has a strong financial position, making it more likely that they can meet their obligations to policyholders.

The primary purpose of these ratings is to provide assurance to policyholders that their claims will be honored in the event of a covered death. If an insurer receives a high rating, it suggests that they have sufficient resources to pay out claims promptly and reliably. This is especially important for families who rely on the financial support provided by life insurance policies. Knowing that your insurer is financially strong gives you peace of mind, ensuring that your loved ones will receive the intended financial assistance when needed.

Moreover, life insurance ratings can also impact the cost of your policy. Insurers with higher ratings often offer more competitive rates because they are considered less risky. This means you can secure the same level of coverage at a potentially lower cost. On the other hand, insurers with lower ratings may charge higher premiums to compensate for the perceived higher risk. Therefore, checking the ratings of insurers can help you make an informed decision and potentially save money in the long run.

In summary, life insurance ratings play a vital role in ensuring financial security for policyholders. They provide an objective assessment of an insurer's financial strength, allowing you to choose a reliable company that will honor your claims. By considering these ratings, you can make a wise decision when selecting a life insurance provider, ultimately protecting your loved ones and your financial interests.

Who Should You Name as Your Life Insurance Beneficiary?

You may want to see also

Risk Assessment: Ratings reflect insurers' ability to assess and manage risks, impacting policy terms and premiums

Life insurance ratings are a critical aspect of the insurance industry, providing valuable insights into the financial strength and stability of insurance companies. These ratings play a pivotal role in assessing the risk associated with insuring an individual's life, and they significantly influence the terms and premiums of life insurance policies. When considering life insurance, understanding the importance of ratings is essential for making informed decisions.

Risk assessment is at the heart of life insurance ratings. Insurance companies, through their risk management departments, employ sophisticated methodologies to evaluate the likelihood of various events, such as death or critical illness, occurring. This assessment process involves analyzing statistical data, demographic trends, and historical information to determine the risk profile of the insured individual. Ratings are a direct reflection of this risk assessment, indicating the insurer's ability to accurately predict and manage potential risks.

The impact of these ratings on policy terms is significant. A higher rating signifies a stronger financial position and a more robust risk assessment capability. As a result, insurers with excellent ratings often offer more competitive premiums, as they are confident in their ability to honor policy obligations. Conversely, lower-rated insurers may charge higher premiums due to the perceived higher risk associated with their financial stability. For instance, a highly-rated insurer might provide a term life policy with a competitive rate, ensuring the policyholder's family receives the intended financial benefit in the event of the insured's death.

Moreover, ratings influence the overall policy terms, including coverage amounts, policy durations, and rider options. Insurers with superior ratings may offer more comprehensive coverage options, extended policy periods, and additional benefits like critical illness riders. These terms provide policyholders with greater flexibility and peace of mind, knowing that their insurance provider has the financial strength to deliver on its promises.

In summary, life insurance ratings are a vital tool for assessing an insurer's risk management capabilities. They directly impact the terms and premiums of life insurance policies, influencing the overall value and suitability of the coverage. When evaluating life insurance options, considering the ratings of the insurers is crucial to ensure a reliable and financially secure partnership. This approach empowers individuals to make well-informed decisions, ensuring their loved ones are protected with appropriate and affordable insurance coverage.

Selling Life Insurance After Bankruptcy: What You Need to Know

You may want to see also

Trust and Reliability: High ratings signify trustworthiness, allowing policyholders to rely on insurers for long-term coverage

In the complex world of insurance, trust and reliability are paramount, especially when it comes to life insurance. A high rating from reputable agencies serves as a powerful indicator of an insurance company's trustworthiness and financial stability. When you purchase life insurance, you are entrusting a significant amount of money and your family's future to the insurer. This trust is further solidified by the insurer's commitment to providing long-term coverage, ensuring that your loved ones are protected even in your absence.

For policyholders, a high rating signifies that the insurance company has a proven track record of fulfilling its obligations. It means that the insurer is likely to honor claims, provide timely payouts, and maintain the policy's coverage over the long term. This reliability is crucial, as life insurance is often a long-term commitment, and policyholders need to know that their insurer will be there for them and their beneficiaries throughout the years.

A highly rated insurance company is more likely to have a robust financial infrastructure, allowing them to meet their financial obligations consistently. This financial strength is particularly important during challenging economic times or when policyholders need to make a claim. A financially stable insurer is better equipped to handle large payouts and maintain its operations, ensuring that policyholders receive the promised coverage.

Moreover, a high rating can provide peace of mind to policyholders, knowing that they have made a wise choice in selecting an insurance provider. It reduces the risk of unexpected issues and allows individuals to focus on the primary purpose of life insurance: providing financial security for their loved ones. With a trusted and reliable insurer, policyholders can rest assured that their family's best interests are protected.

In summary, life insurance ratings play a critical role in establishing trust and reliability between insurers and policyholders. High ratings indicate that an insurance company is financially stable, trustworthy, and committed to providing long-term coverage. This trustworthiness empowers policyholders to make informed decisions, knowing that their insurer will be there to support them and their beneficiaries when it matters most.

Health Insurance: A Life Insurance Add-on in the US?

You may want to see also

Cost Efficiency: Ratings influence premium costs, helping individuals choose affordable and comprehensive insurance

Life insurance ratings play a crucial role in the financial planning process, especially when it comes to cost efficiency and making informed decisions. These ratings are essentially a measure of an insurance company's financial strength and stability, providing valuable insights to policyholders and prospective buyers. When you purchase life insurance, the rating assigned to the insurer is a key factor in determining the cost of your premium. Insurance companies use these ratings to assess the likelihood of financial losses and the ability to honor claims, which directly impacts the price you pay for coverage.

A higher-rated insurance company is often considered more financially stable and reliable, as it has a proven track record of meeting its financial obligations. This stability translates to lower risk for the insurer, and as a result, they can offer more competitive premium rates. Conversely, lower-rated companies may charge higher premiums due to the perceived higher risk associated with them. For instance, a highly-rated insurer with an 'A' or 'A+' rating from reputable agencies like A.M. Best or Standard & Poor's is likely to provide more affordable policies, ensuring that individuals can access comprehensive coverage without breaking the bank.

When considering life insurance, it is essential to understand that ratings are not the sole factor in decision-making. While they provide valuable information about cost efficiency, other aspects such as policy features, coverage options, and customer service should also be evaluated. However, ratings serve as a powerful tool to quickly narrow down the options and identify insurers that offer both quality and affordability. By researching and comparing ratings, individuals can make informed choices, ensuring they receive the best value for their money.

Furthermore, life insurance ratings contribute to the overall transparency and fairness in the market. Higher ratings often indicate better customer service, faster claim settlements, and more competitive pricing. This transparency empowers consumers to make choices that align with their financial goals and risk tolerance. For those seeking cost-effective solutions without compromising on coverage, ratings provide a clear path to finding suitable insurance providers.

In summary, life insurance ratings are a vital consideration for individuals aiming to optimize cost efficiency while securing comprehensive coverage. These ratings enable consumers to compare insurers objectively, ensuring they receive affordable premiums without sacrificing the quality of the policy. By understanding and utilizing insurance ratings, individuals can make well-informed decisions, ultimately leading to better financial management and peace of mind.

Understanding Whole Life Insurance: A Beginner's Guide

You may want to see also

Long-Term Planning: Understanding ratings aids in making informed decisions for long-term financial security and peace of mind

When it comes to long-term financial planning, understanding the importance of life insurance ratings is crucial. These ratings provide valuable insights into the financial strength and stability of insurance companies, which can significantly impact your long-term financial security. By evaluating the ratings, you can make informed decisions that will benefit you and your loved ones in the future.

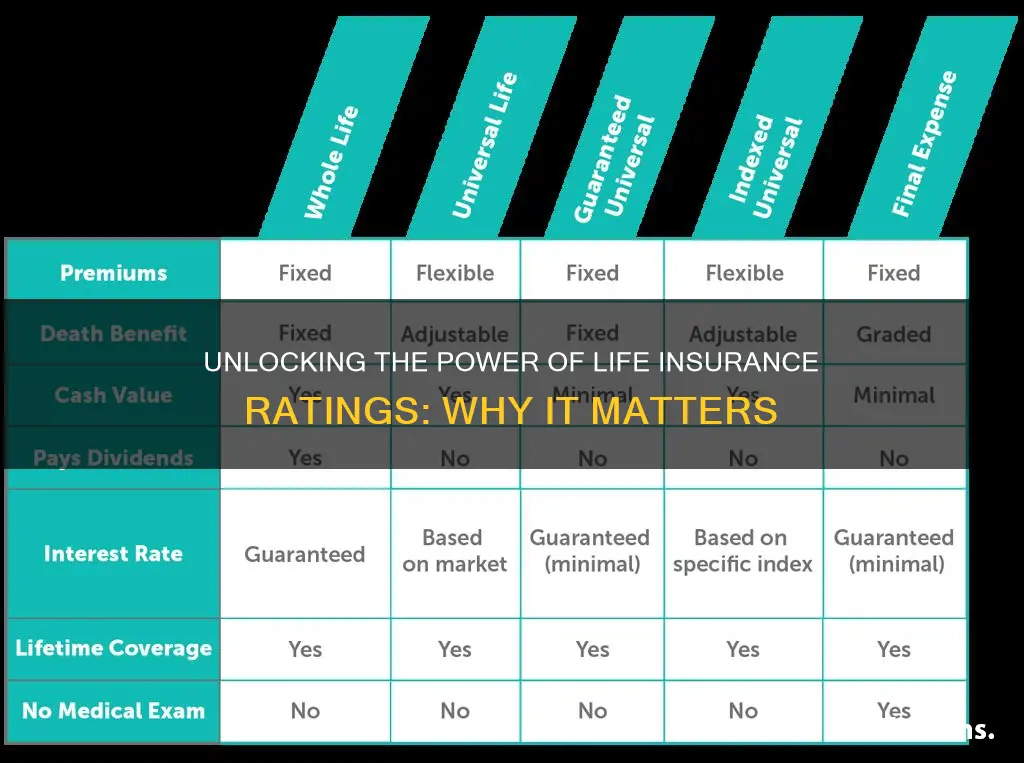

In the realm of long-term planning, life insurance plays a vital role in ensuring financial protection and peace of mind. It provides a safety net for your family, covering expenses such as mortgage payments, education costs, and daily living expenses in the event of your untimely demise. However, not all life insurance policies are created equal, and this is where ratings come into play.

Ratings from reputable credit rating agencies, such as A.M. Best, Moody's, or Standard & Poor's, assess the financial stability and ability of insurance companies to fulfill their obligations. These ratings consider factors like the company's financial resources, management quality, business profile, and operating performance. A higher rating indicates a stronger financial position, suggesting that the insurance company is more likely to honor its commitments over the long term.

By considering these ratings, you can assess the reliability and trustworthiness of different life insurance providers. A highly-rated company is more likely to offer competitive rates, comprehensive coverage options, and efficient customer service. This ensures that your policy will provide the necessary financial support when it matters the most. Moreover, understanding the ratings can help you avoid potential pitfalls and make informed choices, especially when selecting a policy that aligns with your long-term goals.

In the long run, taking the time to research and understand life insurance ratings empowers you to make sound decisions. It allows you to choose a reputable insurer, ensuring that your policy will remain valid and beneficial even as your needs evolve. With a well-rated insurance provider, you can have the confidence that your financial security is in capable hands, providing peace of mind and a solid foundation for your long-term financial plans.

Unraveling the Group Life Insurance Scheme: A Comprehensive Guide

You may want to see also

Frequently asked questions

Life insurance ratings are a crucial aspect of the insurance industry as they provide an independent assessment of an insurance company's financial strength and stability. These ratings help policyholders and prospective clients understand the insurer's ability to fulfill its financial obligations, ensuring that their premiums are invested wisely and that they receive the promised coverage in the event of a claim.

Ratings directly influence the policyholder's experience with their insurance provider. A higher-rated company often indicates better financial stability, which can lead to more competitive premiums, faster claim settlements, and a more reliable service. Policyholders should consider these ratings when choosing a life insurance provider to ensure they receive the best value and protection for their money.

Yes, a low or negative rating should be a red flag for potential policyholders. It may indicate that the insurance company is facing financial difficulties, which could result in delayed payments, reduced benefits, or even insolvency. Low ratings can also make it challenging for the company to attract new customers, which might affect the overall service quality.

It is recommended that policyholders review their life insurance providers periodically, especially when significant life changes occur, such as getting married, having children, or purchasing a home. Additionally, reviewing ratings annually or when considering a policy renewal can help ensure that the chosen insurer remains financially stable and capable of meeting the policyholder's needs over time.