Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the insured, unlike term life insurance, which is only valid for a specific number of years. Whole life insurance policies have a savings component, known as the cash value, which accumulates over time and can be accessed by the policyholder while they are still alive. This cash value grows tax-free and can be used for loans or withdrawals, providing financial security for individuals and their families. While whole life insurance offers several benefits, it also comes with higher costs compared to term life insurance. The decision to choose whole life insurance depends on individual needs and financial situations.

| Characteristics | Values |

|---|---|

| Whole life insurance definition | Whole life insurance provides coverage throughout the life of the insured person. It combines an investment account called “cash value” and an insurance product. |

| Whole life insurance vs. term life insurance | Whole life insurance is more expensive than term life insurance. Term life insurance offers coverage for a specific number of years, whereas whole life insurance offers coverage for the rest of your life. |

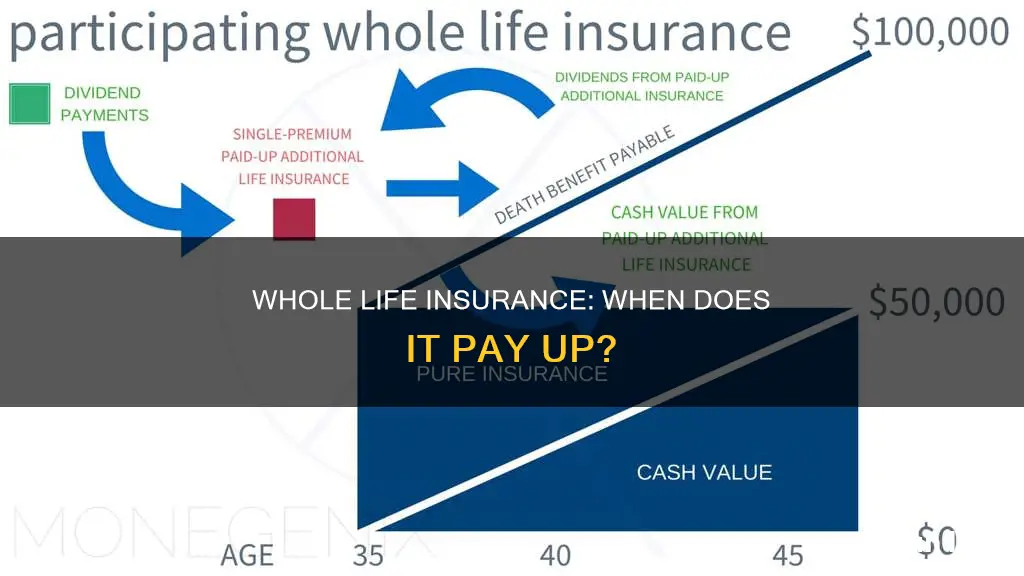

| Whole life insurance cash value | The cash value of a whole life policy typically earns a fixed rate of interest. The cash value of a whole life policy builds up gradually over time. |

| Whole life insurance death benefit | The dollar amount of the death benefit is typically specified in the policy contract. Death proceeds are non-taxable to the beneficiary. |

| Whole life insurance costs | Whole life insurance policies are significantly more expensive than term life insurance policies. |

| Whole life insurance payment options | Premium payments – Once the policy owner reaches the payment amount necessary, the policy will reach paid-up status. Reduce feature – The policy owner can decide to trigger the reduce feature of their whole life policy, which would make it paid-up. |

What You'll Learn

Whole life insurance vs term life insurance

Whole life insurance and term life insurance are two types of life insurance policies with distinct features and benefits. Here is a detailed comparison between the two:

Whole Life Insurance:

- Coverage Period: Whole life insurance provides coverage for the entire life of the policyholder. It is a type of permanent life insurance, meaning it remains in force as long as premiums are paid.

- Premiums: The premiums for whole life insurance are typically fixed and do not change over time. This means policyholders pay the same amount throughout their life.

- Death Benefit: Whole life insurance offers a guaranteed death benefit, ensuring that beneficiaries receive a payout when the policyholder passes away.

- Cash Value: One of the key features of whole life insurance is its cash value component. This allows the policy to accumulate cash value over time, which can be accessed by the policyholder. The cash value grows at a guaranteed rate in a tax-deferred account.

- Dividends: Some whole life insurance policies are "participating" policies, which means they may pay dividends based on the company's financial performance. Policyholders can use these dividends to boost their cash value or receive them as a refund.

- Cost: Whole life insurance tends to be more expensive than term life insurance due to its lifelong coverage and cash value component. The higher premiums reflect the long-term nature of the policy and the accumulation of cash value.

Term Life Insurance:

- Coverage Period: Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. Policyholders can choose the term length that suits their needs.

- Premiums: The premiums for term life insurance are generally lower than those of whole life insurance. However, they may change over time, depending on the policy.

- Death Benefit: Term life insurance offers a guaranteed death benefit during the term of the policy. If the policyholder passes away during the specified term, the beneficiaries receive the payout.

- Cash Value: Term life insurance does not have a cash value component. It solely provides coverage for a set period without accumulating cash value.

- Cost: Due to its temporary nature and lack of cash value, term life insurance is typically the most affordable option for individuals and families.

Choosing Between Whole Life and Term Life Insurance:

The choice between whole life and term life insurance depends on an individual's financial goals, budget, and needs. Whole life insurance is suitable for those seeking lifelong coverage, guaranteed premiums, and the ability to build cash value over time. On the other hand, term life insurance is ideal for those who want coverage for a specific period, lower premiums, and simplicity in understanding and applying for the policy. It is important to consider factors such as coverage needs, cash value preferences, and cost when deciding between the two types of policies.

RACQ Life Insurance: What You Need to Know

You may want to see also

Whole life insurance as an investment

Whole life insurance is a type of permanent life insurance that provides coverage for an individual's entire life. It is often more expensive than term life insurance due to its built-in cash value component, which allows the policyholder to accumulate savings that can be accessed during their lifetime. This cash value grows at a fixed, guaranteed rate and is tax-deferred, providing a stable investment option. However, the slow growth and lack of control over the investment portfolio are potential drawbacks. Whole life insurance may be a suitable investment for individuals who have maxed out their retirement accounts, have lifelong dependents, want to help their family pay estate taxes, or wish to diversify their investment portfolio with stable returns.

Whole Life Insurance Explained

Whole life insurance is a type of permanent life insurance, which means it provides coverage for the policyholder's entire life as long as they continue to pay the premiums. One key feature that sets whole life insurance apart from term life insurance is the accumulation of cash value. Part of the premium payments goes into a cash value account, which grows over time and can be accessed by the policyholder. This cash value component makes whole life insurance function not only as an insurance product but also as an investment or savings account.

How Whole Life Insurance Works as an Investment

The cash value in a whole life insurance policy grows at a fixed rate that is guaranteed by the insurer. This growth is tax-deferred, so any interest earned is not taxed as long as the funds remain in the policy. Over time, the policyholder can accumulate savings that can be accessed through loans, withdrawals, or surrender of the policy. However, it's important to note that outstanding loans and withdrawals will reduce the death benefit paid out to beneficiaries.

When Whole Life Insurance May Be a Good Investment

While whole life insurance is not suitable for everyone, there are several situations where it may be a good investment option:

- Maxed-out retirement accounts: High-net-worth individuals who have already maximized their contributions to tax-advantaged accounts like 401(k) plans or IRAs can use whole life insurance to further grow their tax-deferred savings.

- Lifelong dependents: Individuals with lifelong dependents, such as parents of children with disabilities, may benefit from the lifelong coverage provided by whole life insurance, offering their families financial stability.

- Estate tax planning: Whole life insurance can help families pay estate taxes without dipping into other accounts. The cash value component serves as a form of "forced savings" that can be used to cover these taxes.

- Diversification: The fixed growth rate of whole life insurance provides stable and dependable returns that are not subject to market volatility. This can help diversify an investment portfolio and hedge against market risk.

Drawbacks of Whole Life Insurance as an Investment

Despite its benefits, whole life insurance may not be the right investment choice for everyone due to several potential drawbacks:

- High premiums: Whole life insurance tends to be much more expensive than term life insurance due to the built-in cash value component. The high premiums may outweigh the low rates of return for some individuals.

- Slow growth: In the initial years of the policy, a significant portion of the premiums goes towards fees, commissions, and administrative costs, resulting in slow growth of the cash value. It can take a decade or longer to build up enough cash value to borrow against.

- Low rate of return: The average annual rate of return on the cash value is typically between 1% and 3.5%, which may be lower than what could be achieved through other investments like stocks, bonds, or real estate.

- Lack of control: The insurance company chooses where to invest the cash value, and policyholders cannot directly control the investment strategy. This lack of control may be unappealing to seasoned investors.

- Tax implications: Withdrawing cash from the policy may trigger tax consequences if the withdrawal exceeds the policy basis (the total amount of premiums paid minus any dividends received).

Life Insurance and Suicide: Royal London's Policy

You may want to see also

Whole life insurance and tax

Whole life insurance is a type of permanent life insurance that provides coverage for an individual's entire life. It also includes a cash value component that the policyholder can access while they are alive. This cash value grows over time and is typically tax-deferred, meaning any interest earned is not taxed as long as the funds remain in the policy. However, if the policyholder withdraws more than the cash value and starts withdrawing gains from interest or dividends, those amounts are subject to income tax.

When it comes to tax implications, it's important to note that life insurance premiums are generally not tax-deductible. However, in certain cases, such as when a business owns or pays for the policy, the premiums may be tax-deductible as a business expense. Additionally, if the policyholder's employer provides life insurance as part of their compensation package, the portion of the premium paid on policy amounts above $50,000 is considered taxable income.

The cash value of whole life insurance policies is not taxed until the policy is cashed out or surrendered. At that point, the policyholder pays taxes on the difference between the cash value received and the total amount paid in premiums. It's worth noting that taking out a loan against the cash value of the policy is not considered taxable income, even if the loan amount exceeds the total premiums paid.

Whole life insurance can also be useful for tax planning in certain situations. For example, for individuals who have maxed out their retirement accounts, whole life insurance can provide additional tax-deferred savings. It can also help diversify an investment portfolio since the cash value grows at a fixed rate and is not subject to market volatility. Additionally, for those with lifelong financial dependents, such as children with disabilities, whole life insurance can provide a sense of financial stability.

In summary, while whole life insurance offers some tax advantages, it's important to carefully consider the tax implications and consult with a financial advisor or tax professional before making any decisions.

Freedom Life Insurance: Prep Coverage and Benefits Explained

You may want to see also

Whole life insurance and death benefits

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire life. It combines an investment account, known as the "cash value", with an insurance product. As long as the premiums are paid, the policy guarantees a death benefit to the beneficiaries upon the policyholder's death.

The cash value component of whole life insurance functions as a savings account, allowing the policyholder to withdraw or borrow funds during their lifetime. Interest accrues on a tax-deferred basis, and withdrawals up to the value of the total premiums paid are tax-free. However, withdrawals and outstanding loan balances reduce the death benefit.

Whole life insurance policies typically feature level premiums, meaning the amount paid remains the same throughout the duration of the policy. The death benefit amount is also guaranteed and does not change.

In contrast to term life insurance, which only provides coverage for a specific number of years, whole life insurance offers lifelong coverage and includes a cash value component. While whole life insurance is more expensive, it provides the advantage of guaranteed death benefits and the ability to build cash value over time.

Whole life insurance policies can be further categorised into participating and non-participating plans. With a non-participating policy, any excess of premiums over payouts becomes profit for the insurer. On the other hand, a participating policy redistributes the excess of premiums to the insured as dividends, which can be used to increase coverage limits or make payments.

Prudential's Drug Testing: Life Insurance Requirements and Protocols

You may want to see also

Whole life insurance and dividends

Whole life insurance dividends are annual payments made to the policyholder based on the insurer's financial performance. Dividends are not guaranteed but may be paid out if the insurer performs well in areas like investment returns and operational costs. If you receive dividends, you can use them in several ways:

- Receive the dividends as cash and spend it as you wish.

- Leave the dividends in a separate savings account with the insurer to earn interest.

- Use the dividends to pay for your policy by putting them toward future premiums.

- Purchase additional insurance or prepay your policy to increase your death benefit.

- Pay down policy loans by putting the dividends toward your policy loan balance.

Dividends are generally not subject to taxes for most uses since they are considered a refund of overpaid premiums. However, if you leave dividends in the policy to earn interest, those gains may be taxable.

When considering a dividend-paying whole life insurance policy, it's important to evaluate your coverage needs, budget, and the insurer's performance and credit rating. These policies often come with higher premiums, so it's essential to ensure that the potential benefits align with your financial goals and situation.

- Whole life insurance is a type of permanent life insurance that provides lifelong coverage, a death benefit, and a cash value component.

- Dividends are based on the insurer's financial performance, including investment returns, claims paid out, and operational costs.

- Policyholders can use dividends for various purposes, such as additional insurance coverage, reducing premiums, or paying down policy loans.

- Dividends are generally not taxable, as they are considered a refund of overpaid premiums.

- The amount of the dividend is often tied to the price of premiums paid, with higher dividends corresponding to more expensive policies.

- Dividends may be guaranteed or non-guaranteed, with policies offering guaranteed dividends typically having higher premiums.

- When choosing a whole life insurance policy, it's important to consider the insurance company's credit rating and sustainability of dividend payments.

Universal Life Insurance: Lighter Fees or Heavy Costs?

You may want to see also

Frequently asked questions

A whole life insurance policy provides coverage for the entire life of the insured person. It includes a savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value typically earns a fixed rate of interest on a tax-deferred basis. Whole life insurance policies also guarantee payment of a death benefit to beneficiaries.

Whole life insurance offers several advantages, including:

- Lifetime coverage: It provides coverage until the death of the insured person.

- Cash value: Policyholders can use the cash value for loans, withdrawals, or premium payments.

- Guaranteed death benefit: The death benefit amount is established when the policy is issued and remains the same.

- Predictable premium payments: Premiums are typically fixed and do not change over time.

Whole life insurance policies offer multiple options for receiving payments. These include:

- Withdrawals: Policyholders can withdraw funds from the cash value of the policy. Withdrawals up to the total amount of premiums paid are typically tax-free.

- Loans: Policyholders can borrow against the cash value of the policy. Policy loans are not taxed.

- Surrender value: Policyholders can choose to surrender the policy and receive the entire available cash value, minus any surrender fees. However, this terminates the policy and the death benefit will no longer be available to beneficiaries.