Universal life insurance is a type of permanent life insurance that offers flexible premium payments and coverage amounts. It is distinguished by the ability to adjust premium payments, a valuable feature for those with variable cash flow. Universal life insurance policies also have a cash value component, which can be used to pay premiums or borrow against. This cash value grows over time, based on an interest rate set by the insurer, and can be invested in various ways, depending on the type of universal life insurance policy. Compared to term life insurance, universal life insurance premiums are typically higher due to the cash value component and lifelong coverage. While universal life insurance offers flexibility, it may be more complex and require careful monitoring to avoid policy lapse if the cash value drops too low.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance |

| Flexibility | Flexible premium payments and death benefits |

| Cash value | Can accumulate cash value, which can be used to pay premiums or borrowed against |

| Interest | Interest rate set by insurer, but with a guaranteed minimum |

| Comparisons with whole life insurance | More flexible than whole life insurance, but doesn't offer the same guarantees |

| Comparisons with term life insurance | More expensive than term life insurance, but offers lifelong coverage |

What You'll Learn

Universal life insurance offers flexibility in premium payments

Universal life insurance, a type of permanent life insurance, offers lifelong coverage and the ability to build cash value over time. Each premium payment has two components: the cost of insurance, which covers administrative fees and the death benefit; and the cash value, which earns interest and can be used to pay premiums or borrow money. The interest rate on the cash value is usually set by the insurer, but there is often a guaranteed minimum rate.

Compared to whole life insurance, universal life insurance provides more flexibility in premium payments and potential for higher returns. However, it also requires active monitoring to ensure the policy remains in force. Whole life insurance offers fixed premiums, guaranteed cash value growth, and stable interest rates, making it a simpler option.

When considering universal life insurance, it's important to understand the different types, such as guaranteed, indexed, and variable universal life insurance, as they have distinct features and risks. Additionally, working with a trusted financial advisor or experienced life insurance agent can help navigate the complexities of these policies.

Universal life insurance provides the advantage of flexible premium payments, allowing you to adjust the amount and frequency of your payments within certain limits. This flexibility can be particularly useful if your income fluctuates or you want to lower your payments during retirement. However, it is crucial to actively monitor the policy's cash value to ensure sufficient funds and prevent policy lapse.

As a form of permanent life insurance, universal life insurance offers coverage for your lifetime, provided that you pay the premiums. It also includes a cash value component that grows over time and can be utilised in several ways. Each premium payment is divided into two parts: the cost of insurance, which covers administrative fees and the death benefit; and the cash value, which earns interest and provides options for utilisation.

The interest rate applied to the cash value is typically determined by the insurer, but many policies also guarantee a minimum interest rate. This interest rate may change frequently, and during periods of rising interest rates, the cash value of your policy can experience rapid growth. The ability to skip monthly premiums further enhances the flexibility of universal life insurance if the investment component generates sufficient interest.

Compared to whole life insurance, universal life insurance stands out for its flexibility in premium payments and the potential for higher returns. However, it requires active monitoring to ensure the policy remains in force, especially when interest rates fluctuate. In contrast, whole life insurance offers the stability of fixed premiums, guaranteed cash value growth, and consistent interest rates, making it a more straightforward option for those seeking long-term coverage.

When considering universal life insurance, it is important to be aware of the different types available, such as guaranteed universal life, indexed universal life, and variable universal life insurance. These variations have distinct features, risks, and investment options, so understanding these nuances is essential before making a decision. Additionally, consulting a trusted financial advisor or experienced life insurance agent can provide valuable guidance in navigating the complexities of universal life insurance policies.

Permanent Life Insurance: Cash Value and Benefits Explained

You may want to see also

It has a savings component

Universal life insurance is a type of permanent life insurance that has an insurance component and a savings component. It has the potential to accumulate cash value over time that you can borrow from. The savings component, also known as the cash value, is where the premiums paid in excess of the cost of insurance are accumulated. This cash value grows over time, based on an interest rate set by the insurer, and can be used to pay premiums or borrow against.

Universal life insurance policies provide the flexibility to adjust premium payments. The premium consists of two components: the cost of insurance and the savings component. The cost of insurance includes charges for mortality, policy administration, and other associated expenses. The savings component, or cash value, is where the excess premium is added and accumulates interest. This interest is often based on the current market rate or the policy's minimum interest rate, whichever is greater.

The cash value in a universal life insurance policy can be utilised in several ways. Firstly, it can serve as a surrender value, where the policyholder can surrender the policy and receive the accumulated cash value. Secondly, it can be used as collateral for loans from the insurance company, with interest rates set by the insurer. Thirdly, the cash value can be utilised to pay premiums, ensuring continued coverage even during periods of financial strain.

The savings component of universal life insurance offers several benefits. It provides the potential for cash value growth, allowing policyholders to build a substantial sum over time. Additionally, policyholders can take out a portion of the cash value through withdrawals or loans. Universal life insurance also offers the advantage of tax-deferred growth on the savings component, providing an attractive investment opportunity.

However, it is important to monitor the cash value regularly. If the cash value depletes, policyholders may be required to make larger payments to maintain coverage. Additionally, the interest rates on the cash value can fluctuate, impacting the growth of the savings component. Therefore, while universal life insurance offers a savings component, careful management and regular monitoring are necessary to maximise its benefits.

Credit Life Insurance: Cash Value or Not?

You may want to see also

It can be cheaper than whole life insurance

Universal life insurance is often cheaper than whole life insurance. This is mainly because the death benefit and cash value growth are not guaranteed in universal life insurance, as they are in whole life insurance. Whole life insurance, therefore, offers more stability and consistency, but it comes at a higher price.

Universal life insurance policies are also initially cheaper because they have flexible premiums. Policyholders can adjust their premium payments, making it easier to manage costs during different financial periods. Whole life insurance, on the other hand, has fixed premiums that remain the same for life. This means that you'll never have to worry about sudden rate hikes down the road, but it also means that whole life insurance is generally more expensive.

Universal life insurance policies also have the potential to be cheaper because they offer adjustable death benefits. Policyholders can increase or decrease the death benefit as their needs change, though this may require a medical exam. Whole life insurance policies, on the other hand, have a guaranteed death benefit that will never decrease as long as premiums are paid.

Finally, universal life insurance policies can be cheaper because they offer access to the cash value through loans or withdrawals. Policyholders can borrow against the cash value, with the option to withdraw any remaining cash value upon surrender of the policy. However, it's important to note that withdrawals may be subject to taxes, and any outstanding loans or withdrawals will reduce the death benefit.

New York Life: Exploring No-Underwriting Insurance Options

You may want to see also

It has a cash value that can be used as loan collateral

Universal life insurance is a type of permanent life insurance that offers flexible premiums, a cash savings component, and a death benefit. It allows you to borrow against or cash in on the savings portion, which grows tax-deferred over your lifetime. This type of insurance is ideal for those who want lifelong coverage, the ability to build cash value, and the flexibility to adjust their premiums and death benefits.

One of the key advantages of universal life insurance is its cash value component. This means that a portion of your premium payments goes into a savings account that accumulates interest over time. The interest rate on this cash value is set by the insurance company and can change frequently, although there is usually a guaranteed minimum rate. The cash value can be used as loan collateral, providing a simple way to access cash with few restrictions.

When you take out a loan using your universal life insurance policy as collateral, you are essentially borrowing from yourself. There are no loan requirements or qualifications beyond the available cash value, and the funds can be used for any purpose. The interest rates on these types of loans are typically lower than those for personal loans or credit cards, and there is no mandatory monthly payment. Additionally, the loan is not recognised by the IRS as income, so it remains tax-free as long as the policy stays active.

However, it's important to carefully manage the cash value and pay off the interest to avoid potential pitfalls. If you default on the loan, you could lose your policy and its cash value, and you may end up with a large tax bill. Therefore, while universal life insurance offers the benefit of loan collateral, it is crucial to weigh the pros and cons before making any decisions.

Understanding PA's Tax on Employer-Provided Group Term Life Insurance

You may want to see also

It offers lifelong coverage

Universal life insurance offers lifelong coverage, which means it can last for your entire life as long as you pay your premiums. This is different from term life insurance, which only covers you for a set period, such as 10 or 20 years. Universal life insurance is a form of permanent insurance, and both individuals and employers can buy it.

Universal life insurance policies typically last until a certain age, such as 95 or 120, and offer flexibility that other permanent policies don't. For example, you can adjust the amount you pay in premiums, which may be appealing to those with fluctuating incomes.

Universal life insurance also has a cash value component that is separate from the death benefit. Each time you make a premium payment, a portion is put toward the cost of insurance (such as administrative fees and the death benefit), and the rest becomes part of the cash value. The cash value can be used in several ways:

- Surrender value: If you decide you no longer want the policy, you can give it back to the company, and they will pay you the cash value.

- Loan collateral: You can borrow money from the company and use the cash value as collateral.

- Premium payments: You can use the cash value to pay some or all of a premium. However, policies will lapse if the cash value drops to zero, so you must keep close track.

A universal life insurance policy's premiums are split between the cost of coverage and the cash value. So, you can choose how much to pay within the minimum and maximum premium amounts. Many people choose to pay the maximum for the first several years of coverage to build a large cash value, which can be used to pay premiums later on. This can be a good strategy if you want permanent coverage, even with a smaller income during retirement. However, if your cash value runs out, you may get stuck paying the full cost of insurance, and your policy could lapse.

When shopping for coverage, it's important to note the difference between the guaranteed performance of a policy and the projected performance. The guaranteed performance indicates the worst-case scenario of minimum returns and maximum fees. Universal life insurance policies mature when you reach a certain age, and you generally receive a payment, and the coverage ends. However, this can be problematic if you live past the maturity date and have used most of the cash value to pay premiums, as you could end up with no coverage and little money returned. Therefore, it's crucial to choose a policy with a maturity date that aligns with your needs and reasons for purchasing the coverage.

Life Insurance and Mental Illness: What's Covered?

You may want to see also

Frequently asked questions

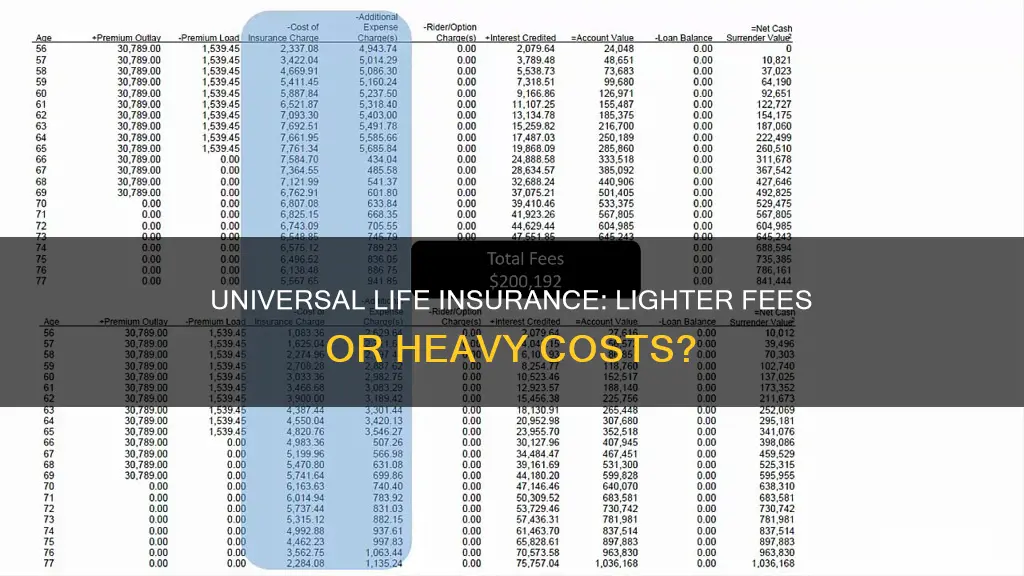

Universal life insurance fees can be lower or higher than other types of insurance, depending on various factors. It offers more flexibility in terms of premium payments and death benefits, but the fees are generally higher compared to term life insurance due to the cash value component and lifelong coverage.

The fees for universal life insurance depend on age, gender, health, lifestyle choices, and personal habits. Smokers, for example, can expect to pay higher premiums. Other factors include geographic location, occupation, and driving record.

The cash value component, which earns interest over time, can be used to pay premiums. If the cash value is insufficient to cover the cost of insurance and expenses, the policy may lapse, and the insured may need to make large payments to maintain coverage.

Yes, there are several types of universal life insurance, including guaranteed universal life, indexed universal life, and variable universal life. Guaranteed universal life offers the lowest rates as it has minimal cash value growth, while indexed and variable universal life offer potential for higher cash value growth but also carry higher risks and fees.

To get a quote, you'll need to provide personal details such as age, gender, health status, location, and lifestyle choices. This information, along with the desired coverage amount and any additional policy riders, will determine the fees for universal life insurance.