Life insurance is a crucial financial safety net for many, but can life insurance providers drop you? The short answer is no, but there are exceptions. Policyholders can cancel their insurance at any time, but insurance companies can only cancel policies under specific circumstances, such as non-payment of premiums or fraud during the application process.

| Characteristics | Values |

|---|---|

| Reasons for cancellation | Non-payment of premiums, fraud or misrepresentation during the application process |

| Grace period | 30-60 days |

| Reinstatement | Possible, but act quickly |

| Avoiding cancellation | Set up automatic payments, ask a trusted friend or relative to help, set up a recurring reminder |

| Contestability period | First 1-2 years of the policy |

| Incontestable clause | Policy cannot be cancelled even if there is a material misrepresentation on the application |

| Misstatements | Failure to disclose a health condition or lifestyle choice |

| Valid reasons for cancellation | None, apart from non-payment of premiums or fraud |

| Invalid reasons for cancellation | Starting an unhealthy habit, getting sick, personal injury, etc. |

What You'll Learn

Non-payment of premiums

Life insurance is a financial safety net for your loved ones after you pass away. However, non-payment of premiums can cause your policy to lapse, leaving your family without the financial security you intended. Here are some detailed tips to help you avoid this scenario and keep your policy active:

Understanding Grace Periods and Policy Lapses

Life insurance policies typically offer a grace period, usually lasting around 30 days, during which your coverage continues even if you miss a premium payment. This grace period provides a safety net, and as long as you make the payment within this timeframe, your coverage remains intact. However, once the grace period passes, the insurer may cancel your policy. You can request reinstatement, but they may require new health information or a medical exam, especially if a significant amount of time has passed.

Strategies to Avoid Non-Payment

To prevent your life insurance policy from lapsing due to non-payment, consider implementing the following strategies:

- Set up automatic payments from your bank account or credit card to ensure timely payments.

- Designate a trusted friend or relative to receive late-payment notifications by filling out a form provided by your insurer. This way, you'll have a backup system in place.

- Set up recurring reminders in your calendar to allow enough time to submit premiums before the deadline.

- If you're close to the end of the grace period, consider paying online, sending your premium by overnight mail, or calling the insurance company to pay over the phone to ensure the payment is received on time.

Options for Financial Hardship

If you're facing temporary financial hardship and struggling to make premium payments, there are a few options to explore:

- Take advantage of the grace period offered by your insurer to temporarily pause payments.

- If you have a waiver of premium rider, you may be able to skip payments while continuing your insurance benefits. These waivers typically apply in cases of disability, but some riders also cover unemployment.

- For whole life insurance policies, use dividends to pay premiums. Dividends are paid out in years when the insurance company performs well, and they can reduce the following year's premiums.

- Utilize the cash value of a permanent life insurance policy to cover payments by making a withdrawal or borrowing against the cash value. However, keep in mind that withdrawals or loans will reduce the death benefit, and interest will accrue on any borrowed amount.

- Consider using the paid-up option, where you use the cash value to convert your policy to paid-up status, allowing you to maintain some coverage without paying additional premiums. This option is more favourable for older individuals who have had more time to build up cash value.

- Contact your insurer to discuss reducing the policy's face value, which will lower your premiums. While this may be challenging, it's important to remember that some coverage is better than none for your loved ones.

- Switch to a level benefit instead of an increasing death benefit to reduce your premiums. This option may be suitable if you initially chose a higher death benefit as an investment for retirement but now need to reduce costs.

Remember, it's essential to review your options carefully and consider seeking advice from a financial advisor or your life insurance agent before making any decisions regarding your life insurance policy.

Understanding Level Benefit Term Life Insurance Policies

You may want to see also

Fraud or misleading information on application

Fraud or misleading information on a life insurance application can have serious consequences. Lying on your application is considered "material misrepresentation", a form of fraud. This includes lying about your health, smoking status, lifestyle, hobbies, and income. The insurer will likely find out during the underwriting process, as they pull third-party records to verify your information. If you are caught lying on your application, the insurer may reject your application or increase your premium.

In addition to application fraud, there are several other types of life insurance fraud that individuals may commit. One common type is death fraud, where someone fakes their own death or the death of a loved one to collect the life insurance payout. Another type is forgery, where someone other than the policyholder changes the ownership or beneficiaries of the policy. This can result in delays in claim processing and even prosecution.

Life insurance fraud can also take the form of staged accidents or faked deaths, where individuals try to collect insurance payouts for non-existent or fake individuals. In rare cases, individuals may even commit murder to cash in on the victim's life insurance policy.

The consequences of committing life insurance fraud can be severe. In addition to application rejection and increased premiums, individuals may also face criminal charges, prosecution, fines, or even jail time. To avoid accusations of fraud, it is important to be truthful and forthcoming on life insurance applications and to work with licensed agents or brokers.

Beagle Street: Does Life Insurance Cover Suicidal Death?

You may want to see also

Cancelling whole life insurance

Whatever the reason, it's important to understand the process and the potential consequences of cancelling a whole life insurance policy. Here are some key points to consider:

Grace Period and Reinstatement

If you miss a premium payment, your policy won't be cancelled immediately. After the payment deadline passes, you will usually have a grace period of around 30 to 60 days to make the payment. If you pay within this grace period, your policy will remain in place. However, if you don't make the payment by the end of the grace period, the insurance company can cancel your policy. You may be able to have your policy reinstated, but it's important to act quickly. The longer the coverage has lapsed, the more likely the insurer will require new health information or a medical exam.

Surrender Fees and Cash Value

When you surrender a whole life insurance policy, you may receive a payout based on the cash value of the policy. However, this payout is often reduced by surrender charges, especially if you haven't held the policy for very long. Surrender fees can be significant in the early years of the policy, so it's important to review the terms of your policy before making a decision.

Impact on Beneficiaries

Before cancelling your policy, carefully consider your beneficiaries and whether they still depend on your income or pension. Cancelling your policy will mean that they will no longer receive the death benefit, so it's essential to evaluate their financial needs and your overall estate plan.

Alternatives to Cancellation

If you're considering cancelling your whole life insurance policy due to financial constraints, there may be alternative options to explore:

- Reduce your coverage: Contact your insurance company to discuss options for temporarily reducing your coverage amount, which may lower your premium payments.

- Withdraw or borrow from cash value: If you have accumulated cash value in your policy, you may be able to withdraw or borrow against it to help cover expenses. However, this will reduce the death benefit your beneficiaries will receive, and any outstanding loans will be deducted from the death benefit if you pass away before repaying.

- Request a new medical exam: If your premiums are high due to poor health when you purchased the policy, you may be able to request a new medical exam. Improved health may make you eligible for more competitive premium rates.

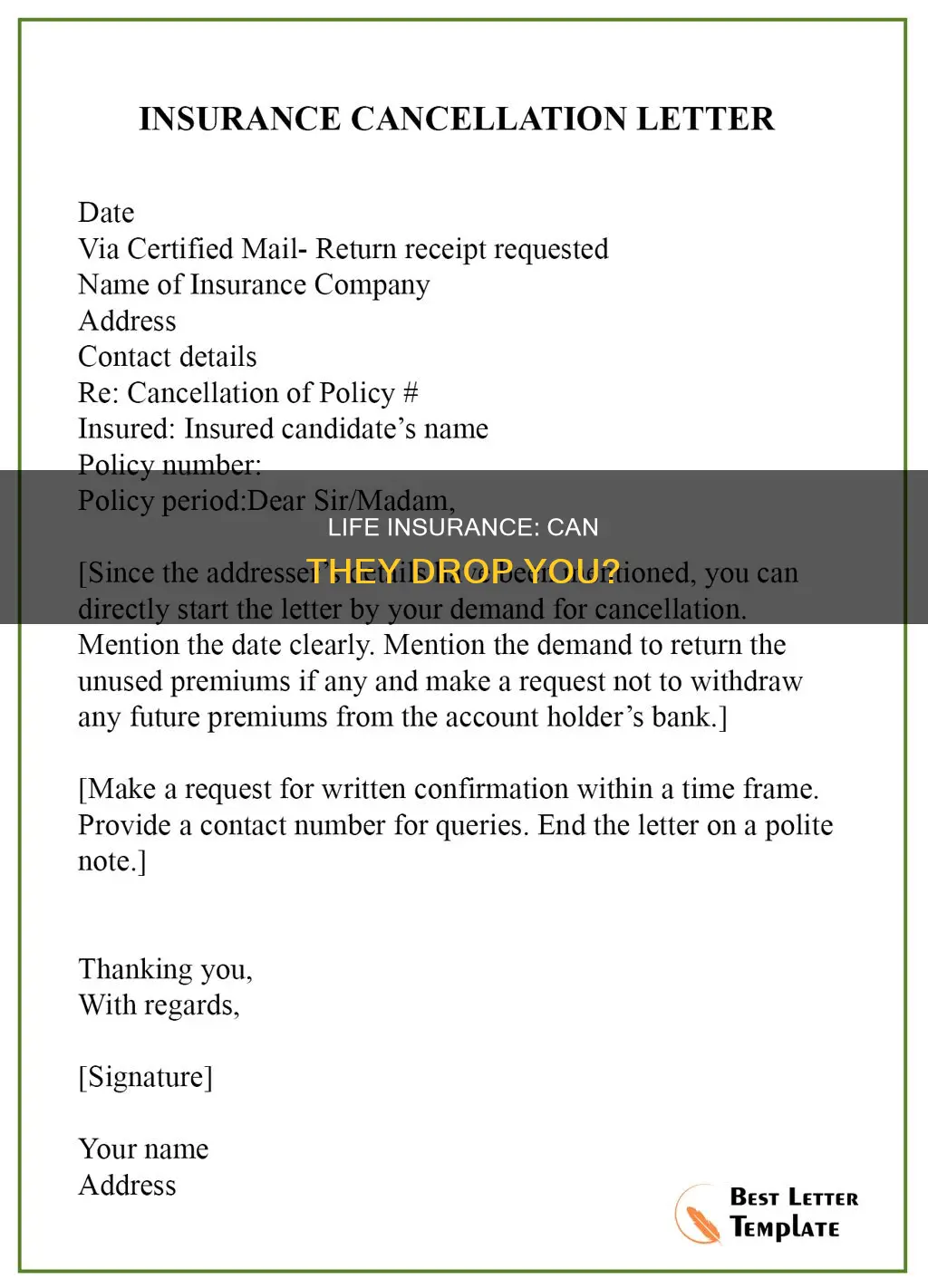

Steps to Cancel Whole Life Insurance

If, after considering your options, you decide to cancel your whole life insurance policy, here are the steps you can take:

- Evaluate your reasons: Consider your reasons for cancellation and the importance of life insurance coverage for your situation.

- Contact your insurance provider: Inform your insurance provider of your decision to terminate the policy. They may require you to fill out a cancellation form.

- Understand the cash value and surrender fees: If you have an older policy with considerable cash value, find out the accumulated cash value and any applicable surrender fees.

- Fill out surrender forms: Provide any necessary documentation and submit the required forms to process the surrender of your policy.

- Wait for confirmation: Once you have submitted the forms, you should hear back from the insurance company regarding the status of your policy cancellation.

Remember, cancelling whole life insurance is a significant decision that can have financial implications. It's important to carefully review your policy, consider alternatives, and understand the consequences before proceeding.

Who Are Your Life Insurance Beneficiaries? Inform Them Now!

You may want to see also

Cancelling term life insurance

Step 1: Understand the Implications

Before cancelling your term life insurance, it's important to consider the implications of doing so. Cancelling your policy means that your loved ones will no longer have the financial protection provided by the policy. Additionally, if you decide to purchase life insurance again in the future, your premiums may be higher due to changes in your age, health, or other factors.

Step 2: Review Your Policy

Before initiating the cancellation process, carefully review the terms and conditions of your policy. Pay close attention to any specific requirements or guidelines outlined by your insurance provider for cancelling the policy. This will help you understand the potential consequences and ensure you follow the correct procedure.

Step 3: Contact Your Insurance Provider

Step 4: Stop Premium Payments

If you have automatic premium payments set up, be sure to cancel them. You can do this by calling your bank or financial institution and requesting to end the automatic transfers to your insurance provider. This will ensure that no further payments are made after the cancellation of your policy.

Step 5: Consider Alternatives

Before cancelling your term life insurance, it's worth exploring alternative options. If you're considering cancellation due to financial constraints, you may be able to reduce the policy's face amount, which can lower your premium payments while still providing some level of coverage. Additionally, many term policies include a conversion rider that allows you to switch to a permanent policy without a new medical exam.

Step 6: Follow Up

After completing the cancellation process, it's a good idea to follow up with your insurance provider to ensure that the cancellation has been finalised and that you have no further obligations. This will give you peace of mind and help prevent any potential issues or misunderstandings in the future.

Life Insurance: Sickness, Coverage, and Your Options

You may want to see also

Cancelling during the free look period

A "free look period" is a legally mandated time during which policyholders can review and cancel their life insurance without penalty and receive a full refund of premiums paid. This period usually lasts for 10 to 30 days from when the policy is delivered, but this can vary from state to state. All 50 states and Washington, D.C., require free look periods, and the minimum length varies from 10 to 30 days depending on state law.

The free look period is designed to support you when purchasing an insurance policy. It gives you the confidence that you can cancel the policy for a full refund if you need to. You can cancel for any reason, including if you find better coverage or your financial situation changes.

To cancel your life insurance policy during the free look period, simply contact your insurer. If you want to keep your life insurance coverage, continue to pay your premiums as normal.

Universal Life Insurance: Cash Surrender Policyowner's Guide

You may want to see also

Frequently asked questions

No, a life insurance company can only drop you under specific circumstances, such as non-payment of premiums or fraud.

If you stop paying your premiums, your policy will enter a grace period, typically lasting 30 days, during which you can make up missed payments. If you don't make the payments within this period, your policy will be cancelled.

No, your life insurance provider cannot drop you due to changes in your health, even if you start an unhealthy habit like smoking. However, they can cancel your policy if you provided false or misleading information on your application.

If your life insurance provider drops you, you should first reach out to them to explain your side of the story. If they do not reinstate your policy, you may need to contact an attorney to pursue legal action.