Finding good leads is one of the most challenging aspects of being a life insurance agent. In a highly competitive market, agents need to be able to identify and attract prospects who need, want, and can afford life insurance. This involves a combination of marketing strategies, networking, and leveraging technology.

One approach is to market to a specific group of people and create a targeted message that solves a unique problem for that target market. This could be done through social media content, newsletters, workshops, joint ventures with local businesses, or writing articles for local publications. Another strategy is to utilise LinkedIn to build a robust professional profile, engage with groups, and offer knowledge for free.

Additionally, it is important to have a consistent flow of leads by building a large database of prospects, contacting them with tailored offers, and working with those who show interest. This process involves crafting an offer that solves a problem, contacting prospects, and providing excellent service to gain referrals.

Overall, finding life insurance prospects requires a well-thought-out strategy, a strong online presence, and effective communication to build relationships and convert leads into clients.

| Characteristics | Values |

|---|---|

| Marketing strategy | Target a specific group of people, e.g. middle-income families, and market your services to them |

| Social media presence | Use social media accounts as "storefronts" to showcase your expertise and build relationships with people |

| Leverage LinkedIn to find new leads by creating a robust profile, joining groups, offering knowledge for free, and maintaining relationships with connections | |

| Referral programs | Implement a referral rewards program that is easy for clients to use and incentivizes previous clients to work with you again |

| Follow-ups | Consistently follow up with clients and prospects through calls or emails, recapping previous interactions, outlining next steps, and including a call to action |

What You'll Learn

Utilise LinkedIn to find prospects and generate leads

LinkedIn is a powerful tool for generating life insurance leads. Here are some tips to utilise LinkedIn to find prospects and generate leads:

Firstly, ensure your profile is robust and stands out. Use a professional headshot as your profile picture, and write a detailed summary that showcases your professional background, why you got into life insurance sales, and your accomplishments in the field. Make your job history section read like a resume with bullet points highlighting your achievements.

Next, join LinkedIn groups related to your industry, college, or hobbies, and actively engage in discussions. Contribute thoughtful comments to establish yourself as an expert, and don't forget to join the conversation on relevant posts. This will help build trust and showcase your expertise.

Offer your knowledge and industry advice in LinkedIn forums without being too salesy. As you contribute more, people will reach out to you based on your demonstrated expertise.

Maintain relationships with your connections by reaching out and checking in, even when you're not specifically asking for referrals or leads. Celebrate their milestones, and keep an eye on important life changes they share on their feed, as these can be opportunities to offer your services.

Additionally, investigate your competitors' networks. Study their content strategies, events they organise or participate in, and the interactions on their posts. You can also browse their connections and filter them to find potential prospects.

Make use of the "People Also Viewed" or "People Also Viewed" section on LinkedIn profiles to discover similar profiles and potential leads.

Use the alumni search tool to find and connect with people who attended the same school as you, as this shared connection can be a great conversation starter.

Finally, create a search alert for specific job roles in companies you're targeting. This way, you can keep an eye on new hires and build rapport by engaging with their posts or commenting on their achievements.

By consistently implementing these strategies, you will be able to utilise LinkedIn effectively to find prospects and generate leads for your life insurance business.

Whole Life Insurance for Infants: Worth the Investment?

You may want to see also

Network with other professionals

Networking with other professionals is a great way to find life insurance prospects without cold calling, relying on overworked company leads, or spending your own money.

Join a networking group

Most cities have networking groups where professionals from diverse industries meet regularly to socialise, trade marketing strategies, and refer business to each other. These groups are often diverse and may include professionals such as lawyers, accountants, healthcare providers, and financial advisors. By joining one of these groups, you can build relationships with other professionals and offer referrals to each other's clients when appropriate. For example, if a personal trainer in your networking group has a client who expresses concern about their family's financial security, they can recommend your services if they have your business card on hand. In exchange, you can return the favour by recommending the personal trainer's services to your own clients.

Join industry associations

Industry associations, such as the National Association of Insurance and Financial Advisors (NAIFA), provide excellent opportunities for life insurance professionals to network with other like-minded individuals and stay updated with the latest trends in the field. By joining an association related to your field of work, you can also demonstrate your commitment to professional development, which can help you stand out among your peers. These associations often offer valuable resources, such as educational materials, industry information, research data, and exclusive events. Additionally, members of these associations may have the opportunity to attend conferences and connect with potential customers.

Attend live events and join local organisations

Participating in live events and joining local organisations, such as the chamber of commerce, can be a great way to meet potential clients and develop meaningful connections. These events and organisations often attract business owners and professionals from various industries, providing an opportunity to network and build relationships that could lead to referrals.

Utilise digital platforms

In addition to in-person networking, leveraging digital platforms such as LinkedIn, Facebook, and discussion forums can also be effective. LinkedIn, in particular, offers features such as groups and forums where you can connect with other professionals, showcase your expertise, and build your reputation. However, keep in mind that building a robust network on LinkedIn requires engagement and hard work.

RMD Investment in Life Insurance: Is It Possible?

You may want to see also

Target middle-income families

Middle-income families are an important demographic for life insurance companies, as they represent the heart of the nation and often have children and other dependents. Many middle-income families recognise the importance of life insurance, with 70% of middle-income consumers believing they need coverage and 34% planning to purchase it. However, there are also many misconceptions and a lack of knowledge about life insurance within this demographic, which can make them hesitant to purchase coverage. Therefore, it is essential to educate middle-income families about the benefits of life insurance and tailor your message specifically to their needs. Here are some strategies to target middle-income families effectively:

- Understand their concerns and pain points: Middle-income families often worry about burdening their loved ones with final expenses and leaving their dependents in financial difficulty if they pass away prematurely. They may also have concerns about the cost of life insurance and whether they can qualify for coverage. Address these concerns directly in your marketing messages and provide reassurance that life insurance can provide financial security for their families.

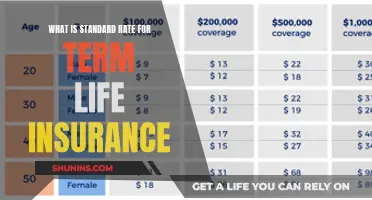

- Offer affordable policy options: Middle-income families may be more price-sensitive, so it is important to offer affordable policy options such as term life insurance, which provides coverage for a specified term and is typically more affordable than permanent life insurance. Emphasise that life insurance can be tailored to their budget and that monthly payment modes are available to fit their financial needs.

- Educate through social media and content creation: Utilise social media platforms to connect with middle-income families and provide valuable, educational content. Share informative blogs and videos that address their concerns and showcase your expertise as a life insurance producer. Make your social media profiles professional and engaging, with a clear bio and consistent branding across platforms.

- Build relationships and trust: Focus on building relationships and trust with middle-income families. Share success stories and testimonials from clients who have benefited from your life insurance services. Show that you understand their unique needs and that your company has their best interests at heart.

- Partner with local businesses: Collaborate with local businesses that cater to middle-income families, such as mortgage brokers, real estate agents, or financial planners. Offer free educational workshops or consultations to attract potential customers and build trust with the community.

- Utilise networking groups: Join or create networking groups with diverse professionals, such as personal trainers, tax accountants, or lawyers. By building relationships with these professionals, you can refer clients to each other and expand your reach within the middle-income demographic.

- Provide clear and transparent information: Middle-income families may have concerns about complicated policies and hidden costs. Ensure that your marketing messages are clear, transparent, and easy to understand. Avoid using industry jargon, and provide straightforward explanations of the benefits and terms of your life insurance policies.

Mailed Life Insurance Checks: Process and Timing

You may want to see also

Create a referral rewards program

A referral rewards program is a powerful tool for insurance companies to generate new business from an existing pool of customers. Here are some tips for creating a successful referral rewards program:

Outline your goals

Build your strategy based on goals that will drive your business. While your long-term goal is to generate sales from your referral program, your short-term goal should be to make connections and build relationships with people before they are ready to buy.

Know what to post

Create targeted, engaging, and informative content. Share relevant, interesting content that showcases your expertise and positions you as a trusted information source. Videos and blogs are great outlets for this.

Set up your social media profiles

Use an image. Your profile picture should be professional and include a header image, such as your company logo. Make sure these images are consistent across each platform. Write your bio. Instead of telling your audience who you are, show them. Avoid industry jargon and be personable.

Educate and engage with content

Provide content that's fun and interesting but also educates and informs. As a life insurance producer, you can provide content that surprises your audience about life insurance, highlights a benefit they probably don't know is available, and answers the question of when the best time to buy is and why.

Create an insurance referral landing page on your website

Design a dedicated webpage explaining the referral program, highlighting the benefits, rewards, and how referrals work. Include a simple form for clients to submit referrals online.

Determine which customers to promote your program to first

Look for customers who are likely to be most eager to share with friends. These could be your most loyal customers or those who have already referred friends to your agency without prompting.

Offer valuable rewards

Offer cash or gift cards to both current and new customers. You could also offer discounts on premiums. You might also consider a multi-step reward, where customers get a small reward when one of their referred leads gets qualified, and a larger reward when that lead purchases a policy.

Use referral software to track, manage, and automate your program

Manually tracking referrals can be difficult and inefficient. Referral software streamlines the program creation process, tracks the source of every referral, and automates reward payouts and promotions.

Promote your program

Promote your program consistently and on multiple channels. Add a hero image or banner on your homepage, and place CTA buttons in your top and bottom menus that lead to your program page. Send dedicated referral program emails, add referral program info in invoice emails, and include a promotional section in your email newsletters.

Ask for referrals at the right times

Take advantage of moments when clients are happiest and you are top of mind. For example, after they post a positive review or social media comment, give you positive feedback on a survey, or recommend you to friends outside of the referral program.

Write notes of appreciation for successful referrals

Send personal thank-you notes to existing clients when one of their friends becomes your new client. You could also publicly thank them in your email newsletters and social media posts.

Beagle Street: Does Life Insurance Cover Suicidal Death?

You may want to see also

Use social media to educate and engage with prospects

Social media is a great way to educate and engage with life insurance prospects. Here are some tips to help you get started:

Outline your goals

Firstly, you need to outline your goals. While your ultimate goal may be to generate sales, this is the long game. On social media, your goal should be to make connections and build relationships with people before they are ready to buy. Focus on making yourself memorable so that when they are ready to purchase life insurance, they will think of you.

Know what to post

It is important to be strategic about the content you post on social media. It should be targeted to your audience's needs, offering a fresh and engaging take on the topic of life insurance. Your content should be informational and can be either original or curated from other authoritative sources. By sharing valuable content, you will position yourself as a subject-matter expert and gain your audience's trust.

Set up your profile

Choose the social media platforms you want to use and create a profile. Your profile picture should be professional and include a header image, such as your company logo. Ensure that these images are consistent across all platforms. Write a bio that showcases what you're all about. Avoid industry jargon and be personable. Let your audience see your personality as well as your intelligence and skill. Share a story that is relevant to your audience and tie it in with their pain points.

Educate and engage with content

Provide content that is fun and interesting but also educates and informs. You can use blogs and videos to grab your audience's attention and showcase your expertise. Share surprising facts about life insurance, highlight benefits that most people may not know about, and discuss the best time to buy and why. In addition to creating your own content, you can also share articles from other trusted sources.

Look at your social media accounts as "storefronts"

Your social media profile is like a shop window. It allows people to see what you have to offer before they decide to make a purchase. Make sure your profile is tidy and enticing to give people a true sense of who you are and what you can do for them.

Life Term Insurance: Gaining Cash Value?

You may want to see also

Frequently asked questions

Make sure your profile is robust and stands out. Upload a professional photo and write a detailed summary of your professional background. Make your job history read like a resume with bullet points of your accomplishments. Join groups related to your industry and contribute thoughtful comments to gain the trust of others in the group.

Outline your goals and the type of content you want to post. Make sure your bio showcases what you're all about and use a professional profile picture. Your social media profile is akin to a storefront, so give your audience an enticing picture of what you're all about.

You can ask your family, friends, and customers for referrals. You can also host free educational workshops or write articles for newspapers, bulletins, and local associations.

The best prospects for life insurance are individuals with families and good incomes, as well as executives and small to large employers.

You can use lead generation strategies such as email marketing campaigns, cold calling, and follow-up emails and calls. You can also create a referral rewards program and master the art of following up with clients and prospects.