Term life insurance is a type of coverage that provides financial protection for a specified period, known as the term. The standard rate for term life insurance varies depending on several factors, including age, health, lifestyle, and the desired coverage amount. This type of insurance offers a straightforward and cost-effective way to secure financial support for your loved ones during a specific period, typically 10, 20, or 30 years. Understanding the standard rates can help individuals make informed decisions when choosing the right policy to meet their needs and budget.

What You'll Learn

Cost Factors: Age, health, coverage amount, term length

When considering term life insurance, several factors influence the cost, and understanding these can help you make informed decisions. Age is a critical determinant; younger individuals typically pay lower premiums as they are statistically less likely to require insurance during the policy term. This is because younger people have a longer life expectancy, reducing the risk for insurers. As you age, especially after the age of 50, rates tend to increase significantly due to the higher likelihood of health issues and mortality.

Health plays a pivotal role in determining the cost of term life insurance. Insurers assess your health through medical exams, health history, and lifestyle factors. A healthy individual with no significant medical conditions or habits like smoking will likely pay less. Conversely, those with pre-existing health issues, such as heart disease, diabetes, or cancer, may face higher premiums or even be deemed uninsurable. Additionally, lifestyle choices like excessive drinking or drug use can also impact the cost.

The coverage amount, or the death benefit, is another significant factor. This is the amount the insurance company pays out upon your death during the policy term. Higher coverage amounts result in higher premiums because the insurer is taking on more risk. A larger death benefit indicates a more substantial financial loss for the insurer if you were to pass away during the term. Therefore, when selecting a coverage amount, consider your family's financial needs and ensure the policy adequately protects your loved ones.

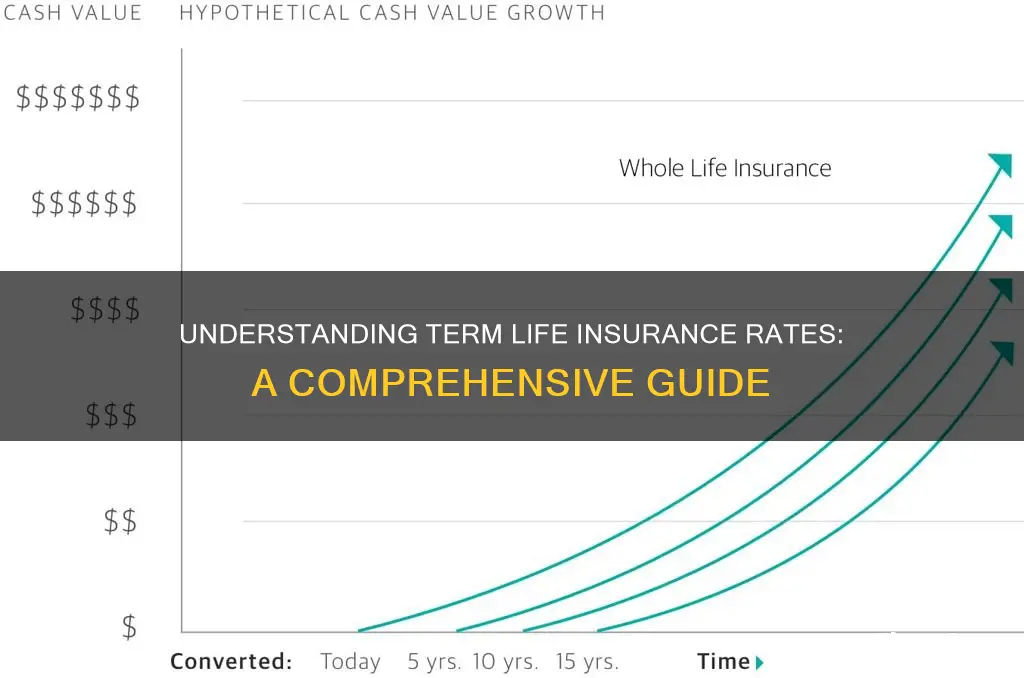

The term length, or duration, of the policy is the final critical factor. Term life insurance is available in various lengths, typically 10, 15, 20, or 30 years. Longer terms generally have lower annual premiums but may not be as cost-effective in the long run. Shorter-term policies are more expensive per year but can provide coverage during specific life stages, such as when you have a mortgage or young children. The choice of term length should align with your financial goals and the duration of your financial obligations.

In summary, the cost of term life insurance is influenced by age, health, coverage amount, and term length. Younger and healthier individuals with lower coverage needs and shorter policy terms typically pay lower premiums. As you age or have specific health considerations, the cost increases. Selecting the right coverage amount and term length is essential to ensure you have adequate protection without overpaying. It is advisable to shop around and compare quotes from different insurers to find the best rates that suit your individual circumstances.

Lying About Smoking: Life Insurance Policy Risks and Consequences

You may want to see also

Term Length: Longer terms typically have higher rates

When considering term life insurance, one of the critical factors that influence the cost is the term length. The term length refers to the duration for which the insurance policy is in effect. Typically, the longer the term, the higher the insurance premium. This is a fundamental principle in the insurance industry, as it directly relates to the risk associated with providing coverage for an extended period.

Insurance companies calculate premiums based on the likelihood of an insured event, such as the death of the policyholder, occurring within the specified term. Longer-term policies provide coverage for an extended period, which increases the potential risk for the insurer. As a result, to ensure they can meet the financial obligations associated with longer-term commitments, insurance providers often charge higher premiums for extended coverage. This is especially true for term lengths of 10, 15, or 20 years, where the risk of the insured event occurring is considered higher compared to shorter-term policies.

For instance, a 10-year term life insurance policy will generally have lower premiums compared to a 20-year term policy. The shorter term reduces the potential financial impact on the insurer if the insured event occurs, making it a less risky proposition. Conversely, a 20-year term policy provides long-term financial security to the beneficiary, but it comes at a higher cost due to the extended coverage period.

It's important for individuals to consider their financial goals and risk tolerance when choosing a term length. While longer terms offer more comprehensive coverage, they can be financially burdensome if one's financial situation changes or if the need for insurance diminishes over time. On the other hand, shorter-term policies might be more suitable for those who want coverage for a specific period, such as until a child's education is funded or a mortgage is paid off.

In summary, when evaluating term life insurance rates, the term length is a significant determinant of the premium. Longer terms provide more extensive coverage but typically come with higher costs. Understanding this relationship can help individuals make informed decisions about their insurance needs and choose the most appropriate term length to suit their circumstances.

Life Insurance: Protecting Your Loved Ones and Their Future

You may want to see also

Health & Lifestyle: Smoking, obesity, occupation impact premiums

When considering term life insurance, it's important to understand how your health and lifestyle choices can impact the cost of your premiums. The standard rates for term life insurance can vary significantly based on several factors, including age, health, and lifestyle habits. One of the most influential factors is smoking. Smokers are generally considered higher risk by insurance companies due to the increased likelihood of developing health issues such as heart disease, lung cancer, and respiratory problems. As a result, smokers often face higher premiums compared to non-smokers. The exact increase can vary, but it's not uncommon for smokers to pay 50% to 100% more in premiums. Quitting smoking can significantly reduce these costs over time, as insurance rates tend to decrease for non-smokers.

Obesity is another critical factor. Being significantly overweight can lead to higher blood pressure, diabetes, and other health complications, all of which can increase the risk of death during the term of the insurance policy. Insurance companies may charge higher premiums for individuals with a Body Mass Index (BMI) above a certain threshold. Maintaining a healthy weight can not only improve your overall health but also potentially lower your insurance premiums.

Your occupation also plays a significant role in determining your insurance rates. Certain high-risk jobs, such as those in construction, mining, or emergency services, can lead to higher premiums. These occupations often involve dangerous conditions or physical demands that can increase the likelihood of accidents or health issues. Insurance companies may consider these jobs as high-risk and charge accordingly. On the other hand, less physically demanding jobs in fields like education or office work may result in lower premiums.

In addition to smoking, obesity, and occupation, other lifestyle factors can also influence your insurance rates. For example, a sedentary lifestyle or a history of significant health issues may also lead to higher premiums. It's essential to maintain a healthy lifestyle to keep your insurance costs as low as possible. Regular exercise, a balanced diet, and managing any pre-existing conditions can all contribute to a healthier profile and potentially lower insurance rates.

Understanding these factors can help you make informed decisions about your lifestyle and insurance coverage. By adopting a healthy lifestyle and being aware of how different choices impact your insurance rates, you can ensure that you are getting the best value for your term life insurance policy.

Understanding Health and Life Insurance Tax Benefits

You may want to see also

Coverage Amount: Higher coverage means higher premiums

When considering term life insurance, the coverage amount you choose directly impacts the cost of your policy. The higher the coverage amount, the more financial protection you provide for your loved ones in the event of your passing. However, this increased coverage comes at a price. Insurance companies calculate premiums based on the risk they assume by insuring a particular individual for a specific amount. Higher coverage amounts equate to a greater risk for the insurer, as they are responsible for a larger payout if the insured individual passes away during the policy term. As a result, the insurance company will charge a higher premium to account for this increased risk.

The relationship between coverage amount and premium is directly proportional. If you opt for a higher coverage amount, you can expect to pay more each month or year for your term life insurance policy. For example, insuring your life for $500,000 might cost more than insuring it for $250,000, even if the term length and other policy details are the same. This is because the insurer is taking on a larger financial obligation with the higher coverage amount.

It's important to strike a balance between the desired level of coverage and your financial capabilities. While it's essential to provide adequate financial protection for your family, you should also consider your budget and long-term financial goals. Choosing a coverage amount that is too high might lead to unnecessary financial strain, while a coverage amount that is too low might not provide sufficient protection.

When evaluating different term life insurance policies, compare the coverage amounts and the corresponding premiums. Look for a policy that offers a good balance between the desired coverage and your budget. You can also consider increasing your coverage amount over time as your financial situation improves. This way, you can ensure that your loved ones are adequately protected without compromising your financial stability.

In summary, when determining the standard rate for term life insurance, it's crucial to understand the direct correlation between the coverage amount and the premium. Higher coverage amounts result in higher premiums due to the increased risk for the insurer. By carefully considering your financial situation and the level of protection needed, you can make an informed decision about the appropriate coverage amount for your term life insurance policy.

Creating a Trust for Life Insurance: A Comprehensive Guide

You may want to see also

Age & Gender: Younger, healthier individuals often pay less

When it comes to term life insurance, age and gender play a significant role in determining the cost of the policy. Younger, healthier individuals often benefit from lower premiums, and this is a crucial factor in the insurance industry. The reason behind this is quite straightforward: younger people generally have a longer life expectancy, and their risk of developing health issues or dying prematurely is lower compared to older individuals. Insurance companies use these factors to calculate the likelihood of paying out a death benefit, and thus, set their rates accordingly.

For instance, a 25-year-old male with no significant health issues might find that their term life insurance policy costs significantly less than a 45-year-old male with a history of smoking or obesity. This is because the insurance company views the younger individual as a lower-risk candidate. They are more likely to outlive the term of the policy, and therefore, the insurance provider can offer a more competitive rate.

Gender also plays a part in this equation, although the impact is less pronounced in recent years due to more comprehensive underwriting practices. Historically, women have often been offered lower rates due to their generally longer life expectancies and lower mortality rates. However, with advancements in medical science and a better understanding of health risks, insurance companies now consider individual health factors more than gender alone.

Younger individuals can further reduce their insurance rates by maintaining a healthy lifestyle. Non-smokers, regular exercisers, and those with a balanced diet are often considered even lower-risk candidates. These healthy habits not only improve overall well-being but also contribute to a more favorable insurance profile. As a result, younger, healthier individuals can secure term life insurance at more affordable rates, ensuring they have adequate coverage without breaking the bank.

In summary, age and gender are critical considerations in the pricing of term life insurance. Younger, healthier individuals often benefit from lower premiums due to their reduced risk profiles. By understanding these factors and taking steps to improve their health, individuals can secure competitive insurance rates and protect their loved ones without compromising their financial stability.

Helicopter Pilots: Life Insurance Availability for Private Fliers

You may want to see also

Frequently asked questions

The standard rate for term life insurance can vary depending on several factors, including your age, gender, health, lifestyle, and the insurance company's underwriting guidelines. Generally, term life insurance rates are based on a premium calculation that considers the risk factors associated with insuring your life. Younger and healthier individuals often pay lower rates, while older individuals or those with health conditions may face higher premiums.

The premium calculation involves assessing the risk the insurance company takes by insuring your life. Factors like your age, height, weight, smoking status, medical history, family medical history, occupation, and hobbies can influence the premium. Insurance companies use complex algorithms and statistical data to determine these rates, ensuring they can pay out the death benefit when the policy term ends.

Yes, many insurance companies offer no-exam or simplified issue term life insurance policies. These policies typically have lower coverage amounts and may not be available for very long terms. The rates are often higher compared to standard term life insurance, but they don't require a medical exam, making them convenient for quick coverage.

The standard rate is the most common and applies to individuals who are considered standard risks by the insurance company. Preferred rates are usually lower and offered to individuals with excellent health and a low-risk profile. Preferred rates may be available for those with pre-existing conditions or lifestyle factors that could impact their long-term health.

To get the best rate, consider the following: maintain a healthy lifestyle, avoid smoking or excessive alcohol consumption, manage any pre-existing health conditions, shop around and compare quotes from multiple insurance providers, and consider taking a medical exam to get a more accurate assessment of your health, which can lead to lower premiums. Additionally, increasing your coverage amount and choosing a longer term policy can also impact the overall cost.