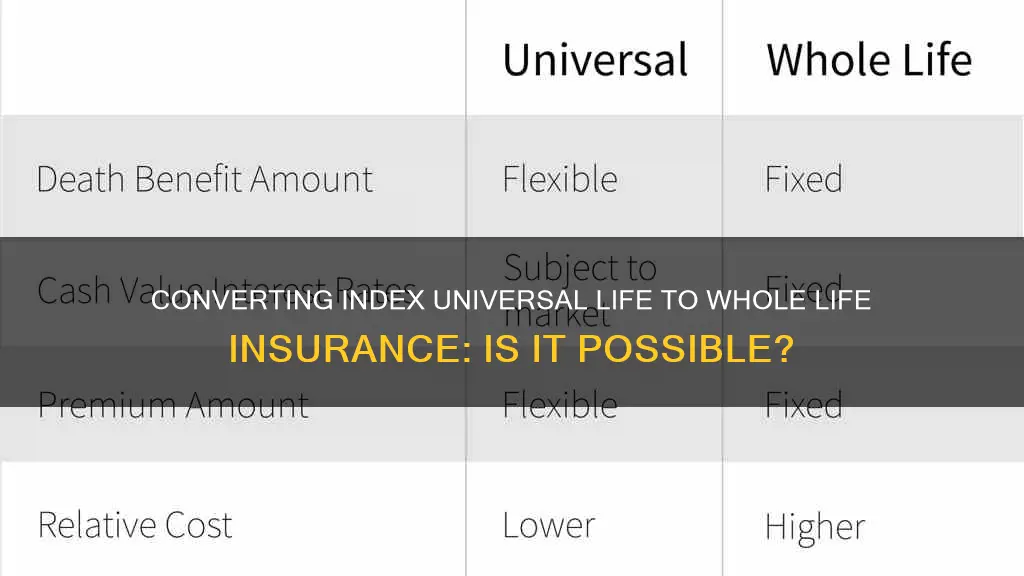

Whole life insurance and indexed universal life insurance (IUL) are both permanent life insurance policies, but they have some key differences. Whole life insurance offers more stability and has a fixed premium and guaranteed death benefit, whereas IUL is more flexible and allows the policyholder to adjust their premium and death benefit. IUL policies also differ in that they tie the cash value to the performance of a stock market index, whereas whole life insurance has a fixed interest rate. This makes IUL potentially more rewarding but also riskier, and it requires more management.

| Characteristics | Values |

|---|---|

| Main difference | How the cash value operates |

| Whole life insurance cash value | Fixed interest rate |

| IUL cash value | Tied to a stock market index's performance |

| Whole life insurance premium | Stable |

| IUL premium | Flexible |

| Whole life insurance death benefit | Fixed |

| IUL death benefit | Flexible |

| Whole life insurance suitability | Those who want a simple, set-it-and-forget-it policy |

| IUL suitability | Savvy investors looking for a flexible policy |

What You'll Learn

Whole life insurance vs. indexed universal life insurance

Whole life insurance and indexed universal life insurance are both permanent life insurance policies, but they have some key differences. Whole life insurance is generally considered more stable and straightforward, while indexed universal life insurance offers more flexibility and investment opportunities.

Whole life insurance provides coverage for the entirety of the policyholder's life, with fixed premiums that never increase. The death benefit is guaranteed and will never decrease as long as the premiums are paid. Whole life insurance also offers a cash value component that grows at a fixed interest rate, allowing policyholders to take out a loan against the cash value. The main benefit of whole life insurance is its stability and predictability, making it a good option for those who want straightforward life insurance protection without the complexity of investment choices.

Indexed universal life insurance, on the other hand, offers more flexibility. Policyholders can adjust their premiums and even skip payments as their cash value grows. The cash value of an indexed universal life insurance policy is tied to the performance of a stock market index, such as the S&P 500 or NASDAQ. This means that the cash value growth can be riskier but also potentially more rewarding than whole life insurance. Indexed universal life insurance may eventually accumulate enough cash value to cover the cost of premiums, resulting in a no-cost policy. Additionally, the death benefit can increase over time, leading to a higher payout for beneficiaries.

One of the main advantages of indexed universal life insurance is its flexibility. It allows policyholders to adjust their premiums and coverage as their lives change. However, this flexibility also comes with additional fees and complexity. Indexed universal life insurance is considered riskier than whole life insurance due to its dependence on market performance.

Whole life insurance is often seen as a safer and more predictable option, especially for those who want to provide for their families after their death. The fixed premiums and guaranteed death benefit provide peace of mind. Whole life insurance is also generally more affordable than indexed universal life insurance.

In summary, the main differences between whole life insurance and indexed universal life insurance lie in their stability and flexibility. Whole life insurance offers fixed premiums, a guaranteed death benefit, and a cash value component that grows at a fixed rate. On the other hand, indexed universal life insurance provides flexibility in premiums and the potential for higher cash value growth tied to market performance. The choice between the two depends on the individual's circumstances, risk tolerance, and financial goals.

Life Insurance Policy Loans: Negative Amortization Explained

You may want to see also

Whole life insurance: pros and cons

Yes, you can convert index universal life insurance to whole life insurance. Here is a detailed overview of the pros and cons of whole life insurance:

Whole Life Insurance: Pros

- Lifelong coverage: Whole life insurance provides coverage for an individual's entire life, with no termination date, unlike term life insurance.

- Fixed premiums: Premiums remain the same throughout the policy, making budgeting easier.

- Cash value growth: Whole life insurance offers a cash value component that grows over time, allowing for withdrawals or borrowing to meet expenses or financial goals.

- Potential for dividends: Depending on the insurance company's performance, whole life insurance policies may be eligible for dividends, providing additional financial benefits.

- Stability and peace of mind: Whole life insurance offers guaranteed benefits and coverage, providing stability and peace of mind for individuals and their families.

- Simplicity and predictability: Whole life insurance is generally simpler to understand than other forms of insurance, with fixed premiums and benefits that do not change over time.

- Tax benefits: The cash value in a whole life policy grows tax-deferred, and life insurance proceeds (death benefits) are typically not taxable.

- Potential loan collateral: Policyholders can borrow against the cash value of their policies, providing financial flexibility during emergencies.

Whole Life Insurance: Cons

- Higher premiums: Whole life insurance comes with higher premiums due to lifelong coverage and the cash value component. This may be challenging for individuals with limited financial resources.

- Complexity: Compared to term life insurance, whole life insurance can be more complex and difficult to understand, requiring careful review of the policy.

- Smaller death benefit: Due to the higher cost of whole life insurance, the death benefit is typically smaller than what could be obtained with the same amount of money in a term life policy.

- Lack of investment control: Insurance companies decide how to invest the cash value portion of whole life policies, limiting the policyholder's investment control.

- Potential tax implications: Borrowing against the cash value of the policy may have tax implications if the loan is not repaid before the policyholder's death.

- Less flexible: Whole life insurance is generally less flexible than other forms of permanent life insurance, as premiums and death benefits cannot be adjusted.

- Potentially lower returns: The growth rate of the cash value in whole life insurance may be lower compared to other investment options or permanent life insurance policies.

Term Life Insurance: 20-Year Policy Explained

You may want to see also

Indexed universal life insurance: pros and cons

Indexed universal life insurance (IUL) is a type of permanent life insurance that provides a cash value component and a death benefit. The cash value in a policyholder's account earns interest by tracking a stock market index, such as the S&P 500 or Nasdaq-100. IUL insurance offers flexibility in adjusting premiums and skipping payments, and the cash value can increase the death benefit. However, it also comes with additional fees and is generally more expensive than other types of life insurance.

Pros

- Flexible premiums and death benefits: IUL insurance offers the flexibility to adjust premiums and skip payments as the cash value in the policy allows.

- Potential for higher returns: IUL insurance offers the potential for higher returns compared to other types of life insurance, such as traditional universal or whole life insurance policies.

- Tax advantages: The cash value accumulates tax-deferred, and the death benefit is tax-free for beneficiaries. Loans against the policy may also be tax-free.

- No Social Security impact: Cash value accumulation from an IUL policy does not count towards Social Security earnings thresholds, and any loan amounts borrowed do not affect benefits.

- Permanent coverage: IUL insurance offers permanent coverage as long as premiums are paid.

- Flexibility: IUL insurance provides flexibility in designing a policy around your risk appetite and investment goals.

Cons

- Higher fees: IUL insurance may have higher fees and charges, including premium expense charges, administrative expenses, insurance costs, and fees and commissions. These fees can impact the rate of return and may make it challenging to maintain the policy over the long term.

- Unpredictable returns: Returns on IUL insurance policies are based on the performance of an underlying stock market index, making them unpredictable.

- No guaranteed returns: While there is a potential for higher returns, larger returns are not guaranteed and may be lower depending on market performance.

- Risk of policy lapse: If premium payments are not made on time, the policy may lapse, negating the purpose of life insurance.

- Limited returns: Insurance companies often set maximum participation rates, and returns on equity indexes may be capped during good years, limiting the actual rate of return.

- Complexity: IUL insurance policies can be complex compared to other types of life insurance, making it important to work with an experienced agent or broker to understand the risks and costs involved.

U.S.A.A. Life Insurance: Spouse Coverage Options Explained

You may want to see also

How does indexed universal life insurance work?

Indexed universal life insurance is a type of permanent life insurance that provides a cash value component along with a death benefit. The cash value in a policyholder's account can earn interest by tracking a stock market index selected by the insurer, such as the Nasdaq-100 or the Standard & Poor's 500. The interest rate derived from the equity index account can fluctuate, but the policy does offer an interest rate guarantee, which limits losses. It may also cap gains.

Indexed universal life insurance works similarly to a standard universal plan with a death benefit, but it allows the policyholder to grow their cash value based on a certain equity index. When the policyholder passes, the beneficiary only receives the death benefit, and the cash value goes back to the insurance company.

Part of the funds from a premium goes to the basic functioning of the plan, and the other part goes into a saving account and earns interest based on an equity index. The chosen index's performance determines how much interest will be added to the total cash value. This is typically re-evaluated at the start of each month, but it varies depending on the company.

Indexed universal life insurance offers permanent, lifelong coverage when premiums are kept up to date. It also offers flexible premiums and a flexible death benefit. The accumulated cash value can be used to lower or potentially cover premiums without subtracting from the death benefit.

Some policies may allow the policyholder to select multiple indexes and decide the percentage allocated to the fixed and indexed accounts. The value of the selected index is recorded at the beginning of the month and compared with the value at the end of the month. If the index increases during the month, interest is added to the cash value. The index gains are credited back to the policy, either on a monthly or an annual basis.

People who need permanent life insurance protection but wish to take advantage of possible cash accumulation via an equity index might use indexed universal life insurance as key person insurance for business owners, premium-financing plans, or estate-planning vehicles.

Salary's Impact on Life Insurance: What You Need to Know

You may want to see also

Whole life insurance and indexed universal life insurance: who are they right for?

Whole life insurance and indexed universal life insurance are both permanent life insurance policies that offer lifelong coverage. However, they differ in terms of their flexibility, cash value growth, premiums, and risk. So, which type of insurance is right for you? Let's explore the features of each to help you decide.

Whole Life Insurance:

Whole life insurance is a straightforward and stable option that offers permanent coverage with a fixed premium and death benefit. The cash value of a whole life policy grows at a guaranteed fixed interest rate, providing predictability and ease of understanding. This type of insurance is ideal for individuals who value guarantees and don't mind paying higher premiums for the stability it offers. Whole life insurance is also a good choice for those who want to "set it and forget it," knowing their loved ones will be protected and have access to the cash value when they pass away. Additionally, whole life insurance may be suitable for those who want a safe reserve of cash value to use during their lifetime, such as for unexpected medical costs or a grandchild's college tuition.

Indexed Universal Life Insurance (IUL):

IUL, on the other hand, offers more flexibility. It is a specific type of universal life insurance where the cash value is tied to the performance of a stock market index, such as the S&P 500 or NASDAQ. This means that the cash value growth has the potential to be higher than that of whole life insurance, but it is also riskier and more complex. IUL allows you to adjust your premium and even skip payments as your cash value grows. It is a good option for those who want to take advantage of possible cash accumulation through an equity index and are comfortable with the associated risk. IUL may also be suitable for those who have maxed out their Roth IRA and other retirement accounts and are looking for an additional retirement-income vehicle.

Who Are They Right For?

Whole life insurance is ideal for individuals who value stability and guarantees. It is a good choice for those who want their life insurance policy to be simple and predictable, with a fixed premium, death benefit, and cash value growth rate. On the other hand, IUL is suitable for those who prioritize flexibility and are comfortable with taking on more risk. It appeals to individuals who want to actively manage their policy and take advantage of potential higher returns.

Life Insurance: Legal Fees Coverage and Benefits

You may want to see also

Frequently asked questions

The main difference is that whole life insurance offers more stability, with fixed premiums and a guaranteed death benefit, whereas indexed universal life insurance is more flexible, allowing you to adjust your premium and even skip payments.

Whole life insurance has a fixed interest rate, meaning the cash value grows at a guaranteed, steady rate. On the other hand, indexed universal life insurance ties the cash value growth to the performance of a stock market index, which means returns may fluctuate.

Whole life insurance provides stability and is generally more affordable. It also offers a fixed premium and a guaranteed death benefit.

Yes, you can purchase an indexed universal life insurance policy online, through a life insurance agent, or directly from an insurer.