Life insurance is a financial tool that can be used to provide financial security for your loved ones after your death. It is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. While life insurance premiums are not based on income, they are calculated based on several factors, including age, gender, smoking status, medical history, and lifestyle choices. The amount of coverage is typically determined as a multiple of the policyholder's annual salary, with experts recommending coverage of five to ten times the annual salary. Life insurance can help replace lost income, pay off debts, and cover expenses such as mortgage, education, and funeral costs. It is important to consider the different types of life insurance, such as term and permanent plans, when deciding on a policy that best suits your needs and ensures your beneficiaries are taken care of.

| Characteristics | Values |

|---|---|

| Whether salary affects life insurance premiums | No |

| Recommended coverage | 5 to 10 times annual salary |

| Factors that affect life insurance premiums | Age, gender, smoking status, health, lifestyle |

What You'll Learn

Salary as a factor in life insurance rates

Life insurance is a way to safeguard your loved ones who are financially dependent on you. In the event of your death, your life insurance policy will pay out a lump sum to the person or people you have listed as beneficiaries.

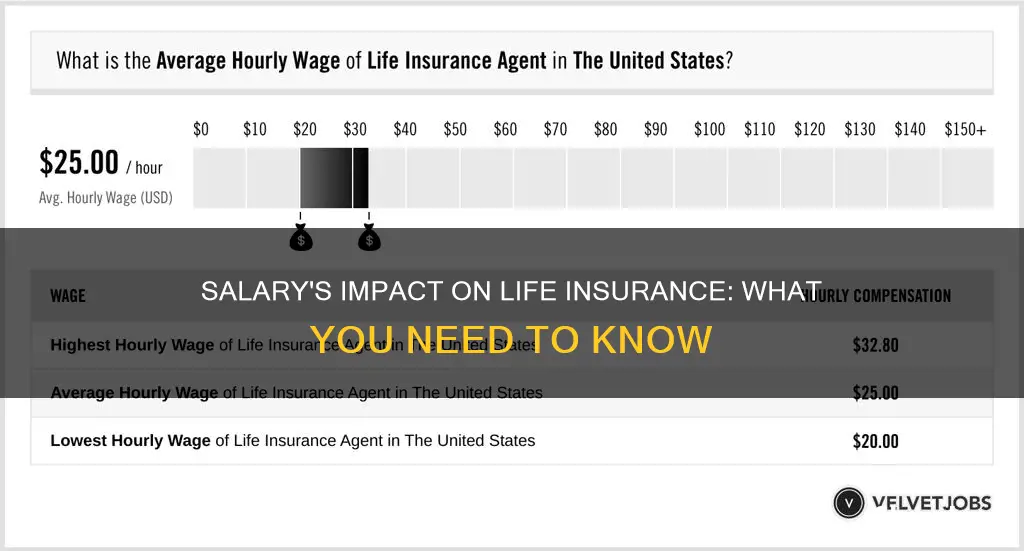

When determining your monthly premiums, life insurance providers take several factors into consideration. However, it is important to note that income is not one of these factors. Life insurance premiums are not based on your salary, and this lack of bias means that insurance companies will not take advantage of your earnings.

While income does not affect life insurance rates, there are other factors that do. Your age is the number one factor that life insurance companies consider when calculating your monthly premiums. The older you are, the more your premiums will be, as older people are generally more prone to health conditions and are closer to the end of their lives. Consequently, there is a greater chance that the insurance provider will have to pay out your coverage.

Another factor that impacts life insurance rates is your gender. On average, women live longer than men, which means they will pay premiums for a longer period. As a result, women usually receive lower rates than men. Whether you smoke is also a significant factor, as smoking increases the risk of serious health conditions and can lower your lifespan. Smokers often pay higher premiums than non-smokers.

Your overall health and lifestyle are also taken into account when determining life insurance rates. A medical exam will assess your height, weight, blood pressure, cholesterol, and other metrics that play a role in determining your health. If you have a serious health condition, you will likely pay a higher premium. Additionally, if you engage in risky activities such as race car driving or skydiving, your premiums will be higher as there is a greater chance of an accident.

When calculating life insurance rates, it is important to consider your salary in relation to your financial goals and needs. The payout from your life insurance policy should be large enough to replace your income and provide financial protection for your dependents. Financial experts often recommend purchasing coverage worth at least 10 times your annual income.

In conclusion, while salary does not directly affect life insurance rates, it is an important consideration when determining the amount of coverage you need. By taking your salary and other factors into account, you can ensure that your life insurance policy provides adequate financial protection for your loved ones.

Life Insurance and Financial Aid: What's the Connection?

You may want to see also

Employer-provided life insurance

The amount of coverage is typically determined by multiplying an employee's annual salary by a certain factor, or it may be linked to an employee's position at the company. Most employers pay all or most of the premiums.

Benefits of employer-provided life insurance

- Convenience: If employee life insurance is offered by your company, starting coverage is simple – just opt in.

- Savings: Because employers usually pay all or most of the premiums, employees can save or use that money for other needs.

- Acceptance: Most employee life insurance plans are guaranteed, meaning you'll be accepted regardless of any serious medical conditions.

- Early protection: If you're just starting out in your career, you may not have the funds needed for life insurance. Employee life insurance can provide financial security for those who depend on you.

- Added coverage: You can usually increase your coverage as life events and needs change. An employer may offer the option of paying an additional premium amount to increase basic protection.

- Riders for extra protection: An employer may offer riders (e.g. for certain degrees of illness and disability) to your basic policy that you may purchase for added protection.

Reasons for additional coverage

Although employer-provided life insurance is a good benefit, it may not be sufficient to meet your financial needs. Here are some reasons why you may want to consider additional coverage:

- Your employer may not offer enough life insurance: While basic employer-provided life insurance is usually low-cost or free, the coverage may not be enough. Many employers provide employees with about $50,000 to $100,000 worth of coverage, or about a year's salary. If you have dependents, you may require additional coverage to provide for their needs in the event of your death. Most financial advisors recommend getting coverage worth five to 10 times your salary.

- You can lose your coverage if your job situation changes: As with health insurance, you want to avoid gaps in your life insurance coverage. If you change jobs, are laid off, or are reduced to part-time status, you could lose your employer-provided life insurance.

- Getting coverage is more difficult when your health declines: If you're leaving your job because of a health problem, you may struggle to get new insurance because insurers factor in your health when they approve you for a policy.

- Your plan doesn't provide enough coverage for your spouse: Your employer's benefits package may not provide life insurance for your spouse, or the coverage may be minimal.

- Employer-provided life insurance may not be your cheapest option: The coverage provided by employers tends to get more expensive as you age. You may find a better rate elsewhere.

Supplementing employer-provided life insurance

Taking advantage of any free or inexpensive life insurance offered by your employer is often a wise financial move. However, it may not be in your best interest to rely on it for your only life insurance coverage. Depending on your circumstances, you may want to buy additional coverage. You can purchase other life insurance policies, such as an individual term life policy or a permanent life policy.

Whole Life Insurance: Joint Policies' Value Increase Explained

You may want to see also

Life insurance for high-income earners

Life insurance is an important way to protect your loved ones financially in the event of your death. It's a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. While your income doesn't directly affect your life insurance premiums, it's a crucial factor in determining how much coverage you need. Here's a guide to life insurance for high-income earners:

Factors Affecting Life Insurance Premiums

It's important to note that life insurance premiums are not based on your income. Other factors, such as age, gender, smoking status, health, and lifestyle, are considered when pricing a policy. However, income plays a significant role in determining the amount of coverage you need.

Determining the Right Coverage for High-Income Earners

When it comes to life insurance, the general rule of thumb is to get coverage that is five to ten times your annual salary. This ensures that your dependents will have sufficient financial support in your absence. Here are a few factors to consider when determining the right coverage amount:

- Income Replacement: Calculate the number of years you want to replace your income and multiply it by your annual salary. This will ensure your dependents can maintain their standard of living.

- Debts and Mortgage: Include any debts, such as credit card debt, student loans, or a mortgage, that your loved ones would need to pay off after your passing.

- Children's Education: If you want to ensure your children's college education is covered, add the estimated tuition and related expenses to your coverage amount.

- Final Expenses and Burial Costs: Consider the cost of funeral and burial expenses, which can be significant, and include them in your coverage calculation.

- Spouse's Coverage: Don't forget to factor in the needs of your spouse. Employer-provided life insurance may not be sufficient, so consider purchasing a separate policy to ensure they are financially protected.

- Inflation: To protect against inflation eroding the value of your policy over time, consider adding a buffer to your coverage amount.

- Riders: Life insurance riders allow you to customize your policy with additional benefits. Consider adding riders for specific situations, such as chronic or critical illness.

Types of Life Insurance

When choosing a life insurance policy, you have two main options: term life insurance and permanent life insurance. Term life insurance covers you for a set number of years and is generally more affordable. On the other hand, permanent life insurance covers you for your entire life and often includes a cash value component, allowing you to borrow against the policy. Permanent life insurance is more expensive but offers added benefits and flexibility.

Employer-Provided Life Insurance

Many employers offer group term life insurance as part of their benefits package. While this can be a convenient and cost-effective option, it may not provide sufficient coverage, especially for high-income earners. Additionally, it's important to remember that employer-provided life insurance is usually tied to your job, and you may lose the coverage if you change jobs. Therefore, it's recommended to supplement it with an individual policy to ensure adequate protection.

In conclusion, while your income doesn't directly affect your life insurance premiums, it's a crucial factor in determining the amount of coverage you need. High-income earners should carefully assess their financial situation, including income, debts, dependents, and future goals, to choose the right type and amount of life insurance coverage.

Life Insurance and Suicide: Royal London's Policy

You may want to see also

Life insurance for low-income earners

Life insurance is invaluable to many families, but perhaps none as much as low-income families. The loss of a single income earner can be devastating for a surviving partner or spouse and their children. It is important to note that life insurance premiums are not based on income, and there are options available for low-income earners.

Features of Life Insurance Policies for Low-Income Families

Low-income families should look for certain features when purchasing life insurance, including:

- Affordability: Whole life insurance and term life insurance are the two types of life insurance policies offered to low-income families. Whole life insurance has two components: the death benefit and the cash value, while term life insurance is temporary and provides coverage for a set period. Term life insurance is generally more affordable and recommended by financial advisors.

- Convenient payment mode: Most life insurance companies offer multiple payment options, with monthly payments being the preferred mode for low- and middle-income families as it reduces the risk of non-payment due to emergencies.

- Financially sound insurance company: It is important to select a reputable and financially stable insurance company to ensure the policy's reliability.

Free and Low-Cost Life Insurance Options for Low-Income Families

Both free and low-cost life insurance options are available for low-income families. People between the ages of 18 and 35 can find life insurance for as little as $9 per month. Additionally, some employers offer free or low-cost group insurance policies as part of their employee benefits package.

For those who don't have access to employer-provided insurance, there are life insurance companies that offer free coverage for low-income families, such as MassMutual's LifeBridge program. This program offers a $50,000 life insurance policy at no cost to eligible low-income individuals.

Tips for Finding the Best Life Insurance Policy for Low-Income Families

Low-income families may face challenges when purchasing life insurance due to lower sales commissions for agents. Here are some tips to help navigate this process:

- Start online: Researching prices and companies online before meeting with an agent can provide valuable information and the option to apply directly on the company's website.

- Work with an independent agent: Independent agents represent multiple companies and can provide quotes from more than one insurer, helping to find the best coverage at a reasonable rate.

- Have a medical exam: Policies that don't require a medical exam are usually more expensive and have restricted coverage amounts.

- Stay within your budget: Only purchase the amount of coverage you need, and be cautious of agents who pressure you to buy more than necessary.

Alternatives to Life Insurance for Low-Income Families

For low-income family members who are uninsurable due to medical conditions, financial advisors recommend two alternatives: self-funding and fixed annuities. Self-funding involves setting up a separate savings or investment account to build a pool of money that can help cover expenses in the event of death. Fixed annuities are products offered by insurance companies that provide tax-deferred growth at a set interest rate.

Companion Life Insurance: What Vision Benefits Are Covered?

You may want to see also

Life insurance for those with no income

Life insurance is a contract between an individual and an insurance company, where the company agrees to pay a specified amount, also known as a death benefit, after the death of the insured party. The insurance company pays this amount as long as the insured party has been paying their premiums.

While life insurance is a valuable financial tool, it is not always affordable. About 83% of potential life insurance buyers find it too expensive. However, there are options available for those with no income or low income. Here are some tips for securing life insurance if you have no income:

- Start online: Begin by researching the prices and types of life insurance available. This will give you a sense of the market and help you make an informed decision.

- Work with a broker: Captive and independent agents can guide you through the complex process of purchasing life insurance. They can help you navigate the underwriting process, medical exam requirements, and policy delivery.

- Avoid your car insurance agent: While it may be tempting to go with what you know, your car insurance agent may not be an expert in the life insurance field. Instead, consider working with a broker who specializes in life insurance and can offer you a wider range of options.

- Don't skip the exam: No-exam life insurance policies are convenient, but they tend to be more expensive. By undergoing the medical exam, you may qualify for a lower premium.

- Maintain good health: The healthier you are, the lower your premiums are likely to be. This includes not only physical health but also maintaining a positive mindset and a good sense of humour.

- Stay within your budget: Choose a policy that you can comfortably afford now and in the future.

- Explore group life insurance: Group life insurance is often offered by employers and can provide coverage at a lower cost. This type of insurance is based on employment and can be a more affordable option.

If you have no income, you may also want to consider the following options:

- Non-profit organizations: Some non-profit organizations offer affordable life insurance options specifically designed for low-income individuals and families. These organizations may have eligibility criteria and tailored policies to meet the unique needs of this demographic.

- Government programs: In some countries, there may be government-sponsored programs or assistance available to help low-income families obtain life insurance. Contact your local government agencies or social service organizations to inquire about such programs.

- Compare quotes: Shop around and compare quotes from multiple insurance providers. This will help you find the most competitive rates and ensure that you get the best value for your money.

- Consider term life insurance: Term life insurance policies are generally more affordable than permanent life insurance. They provide coverage for a specific period, such as 10, 15, or 20 years, and tend to have lower premiums.

Remember, life insurance is not just for those with high salaries. By exploring the options above and working with a knowledgeable broker, you can secure life insurance coverage even with no income.

Life Insurance and Suicide in Australia: What's Covered?

You may want to see also

Frequently asked questions

No, life insurance premiums are not based on your income.

The cost of life insurance depends on several factors, such as age, gender, smoking status, health, lifestyle, type of policy, amount of the death benefit, and riders.

The amount of coverage depends on your financial goals and needs, such as income replacement, mortgage payments, debt repayment, and education expenses. A common rule of thumb is to have five to ten times your annual salary in coverage.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers you for a specific number of years, while permanent life insurance covers you for your entire life as long as premiums are paid.