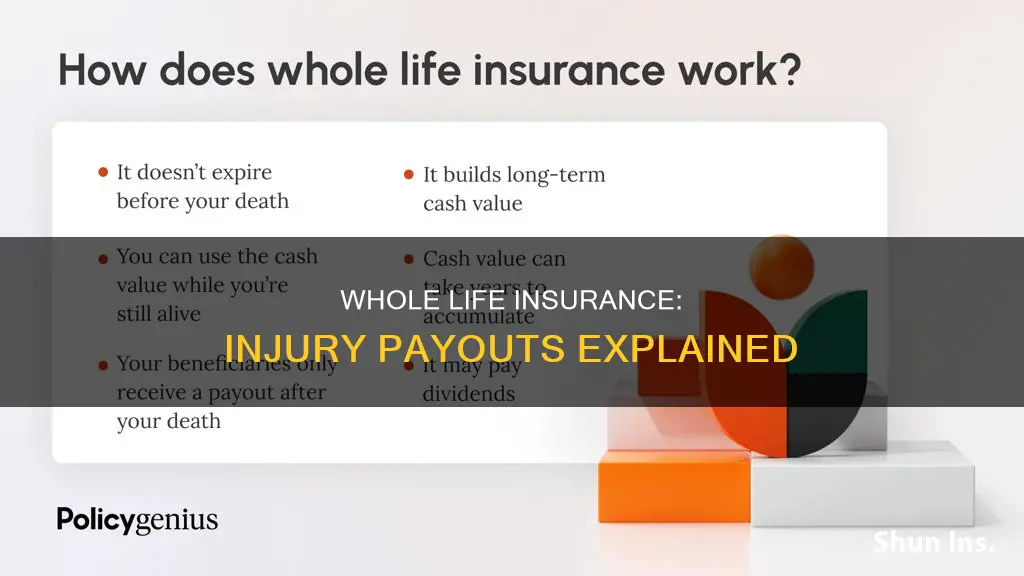

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured person's life. It combines an insurance product with an investment account, known as the cash value, which can be drawn upon by the policyholder. Whole life insurance policies also offer a guaranteed death benefit, which can be claimed by beneficiaries when the insured person passes away.

Whole life insurance policies are generally more expensive than term life insurance policies, as they offer lifelong coverage and the cash value component. However, the cash value of a whole life policy can be used to take out loans or make withdrawals, although this will reduce the death benefit.

| Characteristics | Values |

|---|---|

| Type | Whole life insurance |

| Coverage | Lifelong |

| Payout | Death benefit |

| Payout Process | Beneficiary contacts the insurance company |

| Payout Options | Lump-sum, Installment payments, Retained asset account, Interest-only payout, Lifetime annuity, Fixed-period annuity |

| Taxation | Non-taxable to the beneficiary |

| Cost | More expensive than term life insurance |

| Features | Cash value component, Level premiums, Dividends |

| Riders | Accidental death benefit, Waiver of premium, Accelerated death benefit, Chronic and critical illness, Long-term care |

What You'll Learn

Whole life insurance: what it covers

Whole life insurance is a type of permanent life insurance that covers the insured for their entire life, as long as they keep up with premium payments. It has a cash value component that functions as a savings account, which the policyholder can draw on or borrow from. This cash value grows at a fixed rate of interest and is tax-deferred.

Whole life insurance guarantees the payment of a death benefit to beneficiaries in exchange for level, regularly due premium payments. The death benefit is established when the policy is issued and remains the same as long as the policy is active. The policy also includes a savings portion, known as the "cash value", which grows over time through interest accumulation. The cash value offers a living benefit to the policyholder, who can access it while they are still alive through withdrawals or loans. Withdrawals are tax-free up to the value of the total premiums paid, while loans are not taxed but come with an interest rate. However, withdrawals and unpaid loans reduce the cash value of the policy and, depending on the remaining cash value, can even wipe out the death benefit.

Whole life insurance policies are generally more expensive than term life insurance policies, as they accumulate cash value and cover the insured for their whole life. They also have higher premiums than universal life insurance policies, which allow the policyholder to adjust the death benefit and premiums.

Whole life insurance is best for people who have a lifelong need for coverage and those interested in steady cash value growth and a guaranteed payout when they die. It may also be a good option for those who have maxed out their retirement accounts, want to treat their life insurance policy as a cash asset, or have lifelong dependents.

Ezlynx Life Insurance Support: What You Need to Know

You may want to see also

Whole life insurance: how it works

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured person's life. It combines an insurance product with an investment account, known as the "cash value". This means that, as long as you continue to pay the premiums, your beneficiaries will receive the policy's death benefit when you pass away, and you can also tap into the cash value while you're alive.

Whole life insurance policies offer three kinds of guarantees: a guaranteed minimum rate of return on the cash value, the promise that premium payments won't increase, and a guaranteed death benefit amount. This makes whole life insurance more expensive than term life insurance, which only covers a specific period, such as 20 or 30 years, and does not include a cash value component.

Whole life insurance policies are further distinguished as participating and non-participating plans. With a non-participating policy, any excess of premiums over payouts becomes profit for the insurer, whereas a participating policy redistributes this excess to the insured as a dividend. Dividends are not guaranteed and depend on the company's financial performance, but they can be used to make payments or increase policy coverage limits.

Whole life insurance policies typically feature level premiums, meaning the amount you pay every month won't change. However, there are also limited payment and modified whole life insurance policies, where you pay higher premiums for a set number of years, or lower premiums for the first few years that then increase for the remainder of your lifetime, respectively.

The cash value of a whole life policy usually earns a fixed rate of interest, and you can borrow against it or withdraw from it. However, withdrawals and outstanding loan balances will reduce death benefits.

Whole life insurance is best for people who have a lifelong need for coverage and those interested in steady cash value growth and a guaranteed payout. However, it may not be the best option for those who cannot comfortably afford the higher premiums or those who only need coverage for a specific period.

Term Life Insurance: Residual Value and Its Benefits

You may want to see also

Whole life insurance: cost

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured person's life. It is more expensive than term life insurance, which only covers a specific amount of years. Whole life insurance also has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value of a whole life policy typically earns a fixed rate of interest.

The cost of whole life insurance varies based on several factors, such as age, occupation, and health history. Older applicants typically have higher rates than younger applicants. People with a stellar health history normally receive better rates than those with a history of health challenges. The face amount of coverage also determines how much a policyholder will pay; the higher the face amount, the higher the premium. Additionally, certain companies have higher rates than others, independent of the applicant and their risk profile.

For example, a $500,000 whole life insurance policy costs an average of $451 per month for a 30-year-old non-smoker in good health. The same policy for a 30-year-old smoker would likely be more expensive due to the various medical conditions smoking can cause.

Whole life insurance is generally more expensive than term life insurance because it covers the insured person for their entire life and offers cash value growth. Commission fees may also be rolled into the total cost if the policy is purchased through a life insurance agent.

- $7,440 for a 40-year-old man

- $6,512 for a 40-year-old woman

- $4,940 for a 30-year-old man

- $2,940 for a 30-year-old woman

Life Insurance and Skiing: What Coverage is Offered?

You may want to see also

Whole life insurance: pros and cons

Whole life insurance is a type of permanent life insurance that lasts your entire life, as long as you pay your premiums. It combines life insurance with an investment component. Here are some pros and cons of whole life insurance:

Pros:

- Lifetime coverage: Whole life insurance provides coverage for your entire life, unlike term life insurance, which only covers a specific period.

- Cash value: Whole life insurance has a cash value component that grows over time and can be borrowed against or withdrawn. This can be useful for large purchases or retirement income.

- Guaranteed death benefit: The death benefit amount is established when you sign up for the policy and remains the same as long as the policy is active.

- Predictable premium payments: Premium payments are typically fixed and do not change over time.

- Tax benefits: The cash value grows tax-deferred, and withdrawals up to the total premiums paid are tax-free.

Cons:

- Expensive: Whole life insurance is significantly more expensive than term life insurance due to the lifelong coverage and cash value component.

- Limited flexibility: Whole life insurance does not allow adjustments to the premium or death benefit, unlike universal life insurance.

- Slow cash value growth: The growth rate of the cash value is fixed and may be slower than other policies, such as universal life insurance.

- Complex: Whole life insurance can be complex, with different types of policies, riders, and tax implications.

- Surrender charges: Cancelling the policy early may result in surrender charges, which can be high in the initial years.

Life Insurance and Suicide: What's Covered?

You may want to see also

Whole life insurance: alternatives

Whole life insurance is a type of permanent life insurance that combines an investment account with an insurance product. It is more expensive than term life insurance, but it offers lifelong coverage and a cash value component. Here are some alternatives to whole life insurance:

- Universal life insurance: This is another type of permanent life insurance that offers lifelong coverage and the flexibility to adjust premiums and the death benefit. It is typically cheaper than whole life insurance but may not offer the same level of guarantees.

- Variable life insurance: This type of permanent life insurance allows the policyholder to choose how to invest the policy's cash value. It offers more investment options than whole life insurance but may come with higher risks.

- Survivorship life insurance: This type of insurance covers two individuals, usually a married couple, under a single policy. The death benefit is paid out after the second insured person passes away. It can be a cost-effective way to provide financial security for loved ones.

- Self-funding: Individuals can create a savings account for their family to use after their passing. However, there are no rules governing when the money can be used, so there may be a temptation to dip into the funds.

- Annuities: Annuities are savings accounts offered by life insurance companies that can provide a lifetime stream of income. If set up correctly, they can provide an income stream and a death benefit for your family. However, the payout is taxable.

- Term life insurance: This type of insurance only lasts for a set number of years and does not build cash value. It is much cheaper than whole life insurance and is sufficient for most families.

Munich Re's Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

No, whole life insurance pays out a death benefit to beneficiaries when the policyholder dies.

Whole life insurance is a type of permanent life insurance that lasts the entirety of the policyholder's life, provided that premiums are paid. It also includes a cash value element that grows over time, which the policyholder can borrow from or withdraw.

The beneficiary must contact the insurance company and provide a death certificate and any other necessary documentation to initiate the payout. The insurer will then review the claim and process the payout.

Yes, there are several ways that whole life insurance can be paid out, including lump-sum payments, installment payments, annuities, and retained asset accounts.