Gerber Life Insurance offers a range of insurance policies for children, teens, young adults, adults, and seniors. One of their policies, the Grow-Up® Plan, is a whole life insurance policy that can be purchased for children from 14 days to 14 years old. This policy offers lifelong coverage as long as premiums are paid and provides financial protection that can last a lifetime. The policy can be bought by a child's parent, grandparent, or permanent legal guardian.

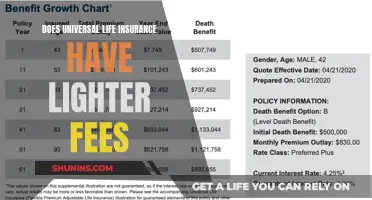

The Grow-Up® Plan has several benefits, including a locked-in premium rate that never increases, even after the child becomes the policy owner at age 21. Additionally, the coverage amount automatically doubles when the child turns 18, with no extra cost. The plan also guarantees the child's right to buy more coverage as an adult, regardless of their health or occupation. Furthermore, the policy builds cash value over time, which can be borrowed against if needed.

However, it's important to note that Gerber Life Insurance policies may not be available in all areas, and some policies may have specific requirements or restrictions. It is always advisable to carefully review the terms and conditions of any insurance policy before purchasing.

| Characteristics | Values |

|---|---|

| Coverage | $5,000 to $2,000,000 |

| Age Range | 14 days to 80 years old |

| Premium Payment Period | Monthly |

| Payment Methods | Checking account, savings account |

| Application Methods | Online, phone |

| Application Time | Minutes |

| Medical Exam Required | No (for most cases) |

| Decision Time | Minutes |

What You'll Learn

Whole life insurance for adults 50-80

Gerber Life Insurance offers whole life insurance for adults aged 50 to 80 years old, with guaranteed acceptance regardless of health. This policy provides all the benefits of whole life insurance without a medical exam, although New York residents have a maximum age limit of 75.

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you pay your premiums. It differs from term life insurance, which only covers you for a set number of years and does not build cash value. Whole life insurance is a good choice if you want lifelong financial protection, to leave an inheritance, or to cover final expenses such as medical and funeral costs.

Gerber's whole life insurance policy offers $50,000 to $1,000,000 in coverage, which you can pick based on your needs and budget. You can choose coverage for just yourself or include your spouse and/or children on the same policy. After the initial policy years, a small portion of your premium payments goes towards building cash value over time, which can provide a financial safety net if needed.

The Gerber Life Insurance College Plan is another option for adults. It combines adult life insurance protection with a savings plan to help pay for college. This plan guarantees a payout of $10,000 to $150,000 when the policy matures, and the money can be used for anything, not just college expenses.

When choosing a life insurance policy, it's important to consider your specific needs, budget, and health. Whole life insurance is generally more expensive than term life insurance, but it offers lifelong coverage and builds cash value over time. If you're over 50, it's also important to note that life insurance coverage typically becomes more costly as you age, and there may be limitations on the types of policies available.

Voluntary Life Insurance: What You Need to Know

You may want to see also

24-hour accident protection

Gerber Life's Accident Protection Insurance is an accidental death and dismemberment (AD&D) policy, which provides financial protection in case of death or disabling injury caused by qualifying accidents. This includes unintentional injuries or fatalities resulting from everyday activities like driving, biking, walking through busy intersections, or taking public transportation.

The Accident Protection Insurance provides 24-hour accident protection, anywhere in the world, for you and your spouse. This means that, regardless of where you are or what time of day it is, you are covered in the event of a qualifying accident.

The plan offers a range of coverage amounts, from $50,000 to $250,000, which can help cover out-of-pocket medical expenses, lost wages, and more. The benefits can be used to pay for out-of-pocket medical bills or replace income lost due to a covered injury or accidental death.

One of the key advantages of this plan is that it is available to anyone between the ages of 18 and 69, with no medical exam or health questions required. Your acceptance is guaranteed, regardless of your health or occupation. Additionally, once you sign up, your monthly rate is locked in for life and will never increase as long as the premiums are paid. This means you don't have to worry about your rates going up due to age or health changes.

Gerber Life's Accident Protection Insurance is a great way to protect yourself and your loved ones from the financial burden of unexpected accidents. It provides worldwide coverage and peace of mind, knowing that you have the support you need if an accident occurs.

Whole Life Insurance Interest: Taxable or Not?

You may want to see also

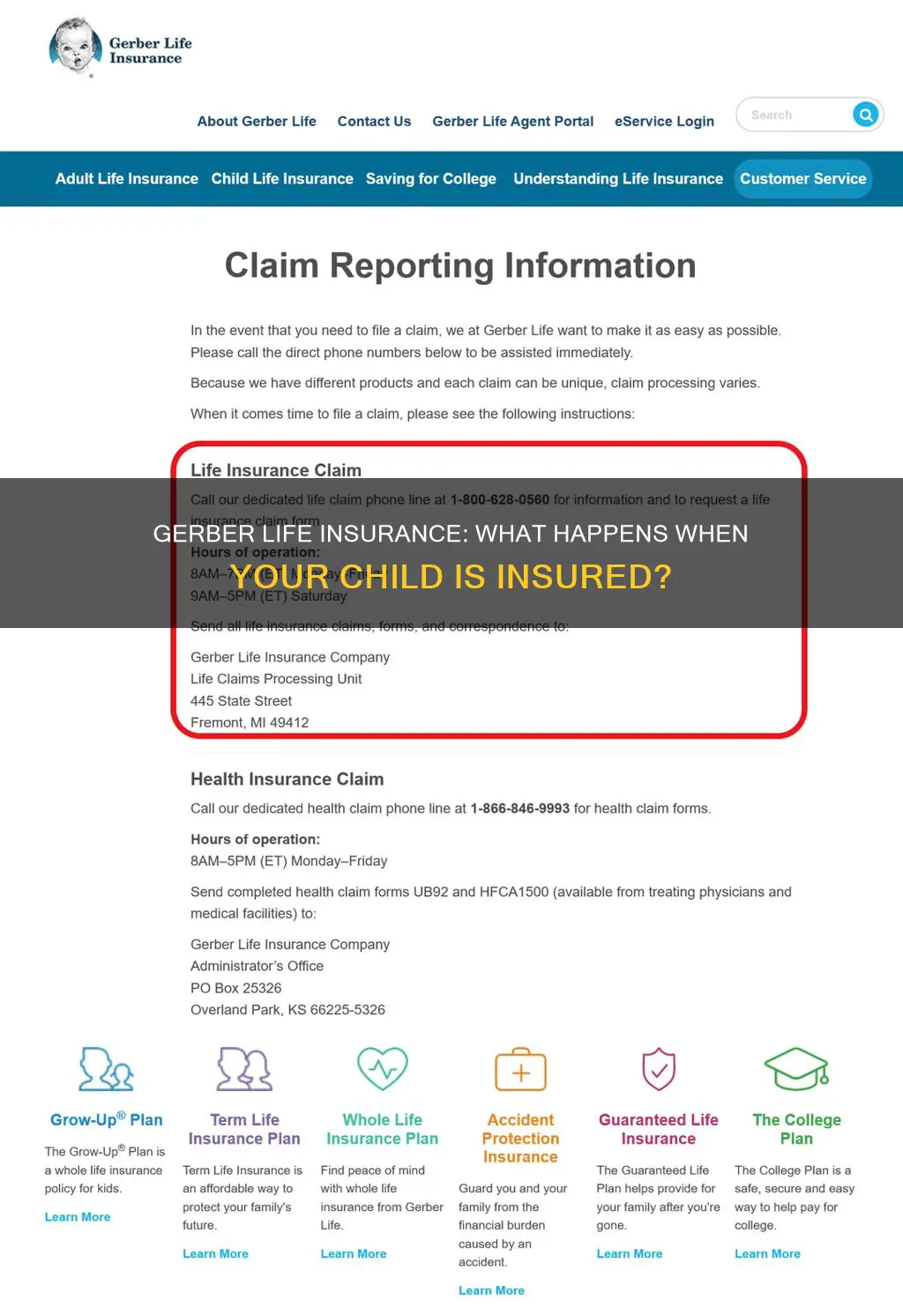

Coverage for children

Gerber Life Insurance offers a whole life insurance policy for children, the Gerber Life Grow-Up Plan, which helps protect and provide for a child's future. The Grow-Up Plan is a simple and cost-effective way to give your child lifelong life insurance protection. For as little as $1 a week, you can secure a plan with a coverage amount of $5,000 for children aged 14 days to 14 years.

The Grow-Up Plan offers a range of benefits. Firstly, it provides financial protection in the form of a death benefit, which doubles when the child turns 18 at no extra cost. For example, a $25,000 policy becomes $50,000 when the child reaches 18. This benefit can cover final expenses and outstanding medical bills in the unfortunate event of a child's passing. Additionally, the policy builds cash value over time, which can be borrowed against to cover unexpected expenses or used to provide a nest egg for future expenses like college. The cash value aspect of the plan gives it an advantage over traditional term life insurance policies, which do not build cash value.

Another advantage of the Grow-Up Plan is that it guarantees the child's right to purchase additional life insurance coverage as an adult, regardless of their health or occupation. This is especially beneficial if the child develops health issues that would otherwise make it difficult or impossible to obtain life insurance. The Grow-Up Plan also offers locked-in premium rates, meaning the premium amount will never increase as long as the premiums are paid in full and on time.

While the Grow-Up Plan provides valuable protection and benefits, it's important to consider the ongoing cost of premiums, which, although affordable, is an additional expense to the family's budget. Additionally, the maximum death benefit of $100,000 may not be sufficient for an adult with dependent children, so additional coverage may be needed in the future.

Overall, the Gerber Life Grow-Up Plan offers a comprehensive whole life insurance policy for children, providing both financial protection and the opportunity to build cash value.

Cancer and Life Insurance: What Coverage is Offered in Canada?

You may want to see also

Term life insurance

Gerber Life Insurance offers term life insurance for adults, which provides coverage for a specific period of time, known as a "term". This type of insurance is popular because it is often more affordable than other types of life insurance and allows the policyholder to choose the coverage period.

Gerber Life offers term life policies for 10, 20, or 30-year terms, with rates starting at $15.42 a month. This rate stays locked for the entire term, and the policyholder can choose a coverage amount ranging from $100,000 to $300,000, with options for higher coverage available by contacting the company.

The application process for Gerber Life's term life insurance is simple and easy, with most people receiving a decision on their application within a minute. There is usually no medical exam required, but a medical exam is necessary for those aged 51 and over who apply for more than $100,000 in coverage.

If you outlive your term life policy, you have two options: you can let the policy end, or you can renew it. Renewal can be done annually at the premium rate for your age at the time, without the need for a physical exam. However, your age at renewal may impact your premiums.

Life Insurance: Sickness, Coverage, and Your Options

You may want to see also

Permanent life insurance for adults 18-70

Gerber Life offers permanent life insurance for adults aged 18-70, with locked-in premium rates. This means that the monthly rate is locked in and will never increase.

Whole life insurance provides permanent coverage for your entire life as long as you pay your premiums. It also builds cash value over time, which can be used as a financial safety net. This differs from term life insurance, which is typically lower cost but only provides coverage for a set number of years.

Gerber Life's whole life insurance offers $50,000 to $1,000,000 in available coverage, which can be picked to best fit your needs and budget. You can choose coverage for just yourself, or include your spouse and/or kids, all on the same policy. After the initial policy years, a small amount of your premium payments goes towards your cash value, which builds over time. The longer you have the policy, the more cash value it builds. If needed, and as long as premiums are paid, you can borrow against the cash value or turn in your policy for the available cash value.

Gerber Life's whole life insurance is available to adults aged 18-80, and offers lifelong protection that builds cash value. It is a good choice if you want lifelong financial protection, to leave an inheritance or legacy to your loved ones, or to cover final expenses.

Life Insurance and TSP: What You Need to Know

You may want to see also

Frequently asked questions

Gerber Life Insurance offers plans for both children and adults, with options to include your spouse and/or kids on the same policy. Their plans include Whole Life Insurance, Term Life Insurance, Accident Protection Insurance, and a College Plan.

Whole Life Insurance provides permanent coverage for your entire life as long as you pay your premiums. It also builds cash value over time. Term Life Insurance, on the other hand, offers coverage for a specific period, such as 10, 20, or 30 years, and does not build cash value. Whole Life Insurance is more expensive, while Term Life Insurance offers lower premiums.

The cost of Gerber Life Insurance depends on various factors, including age, health, length of term, and coverage amount. Whole Life Insurance for adults can provide coverage from $25,000 to $150,000 or $50,000 to $1,000,000, depending on the source. Term Life Insurance rates start at $15.42 a month, with coverage options ranging from $100,000 to $300,000 or up to $1,000,000.