Medicaid, a federal and state-funded health insurance program, often plays a crucial role in providing healthcare coverage to low-income individuals and families. One common question among enrollees is whether Medicaid covers the deductible from primary insurance. Understanding the relationship between Medicaid and primary insurance is essential for individuals to navigate their healthcare coverage effectively and ensure they receive the necessary medical services without incurring unexpected financial burdens. This paragraph aims to explore this topic, shedding light on the potential coverage options and the implications for individuals relying on both Medicaid and primary insurance.

What You'll Learn

Medicaid Coverage: Understanding Deductibles

Medicaid, a federal and state-funded program, often plays a crucial role in providing healthcare coverage to individuals who might not otherwise be able to afford it. When it comes to healthcare expenses, understanding the intricacies of insurance coverage can be complex, especially regarding deductibles. The question of whether Medicaid covers the deductible from primary insurance is an important one for many enrollees.

Deductibles are a fundamental part of health insurance, representing the amount an individual must pay out of pocket before their insurance coverage kicks in. For those with primary insurance, the deductible is typically a fixed amount that must be met before the insurance company starts covering medical expenses. Medicaid, on the other hand, operates under different guidelines and may have specific rules regarding deductible coverage.

In general, Medicaid's primary goal is to provide essential healthcare services to eligible individuals, ensuring access to medical care. While Medicaid does cover a wide range of medical expenses, the coverage of deductibles from primary insurance can vary. In some cases, Medicaid may cover the deductible, especially if the individual meets certain income and asset requirements. These requirements are designed to ensure that Medicaid resources are utilized by those who need them most. However, it's essential to note that Medicaid coverage rules can differ by state, so it's crucial to check the specific guidelines in your state.

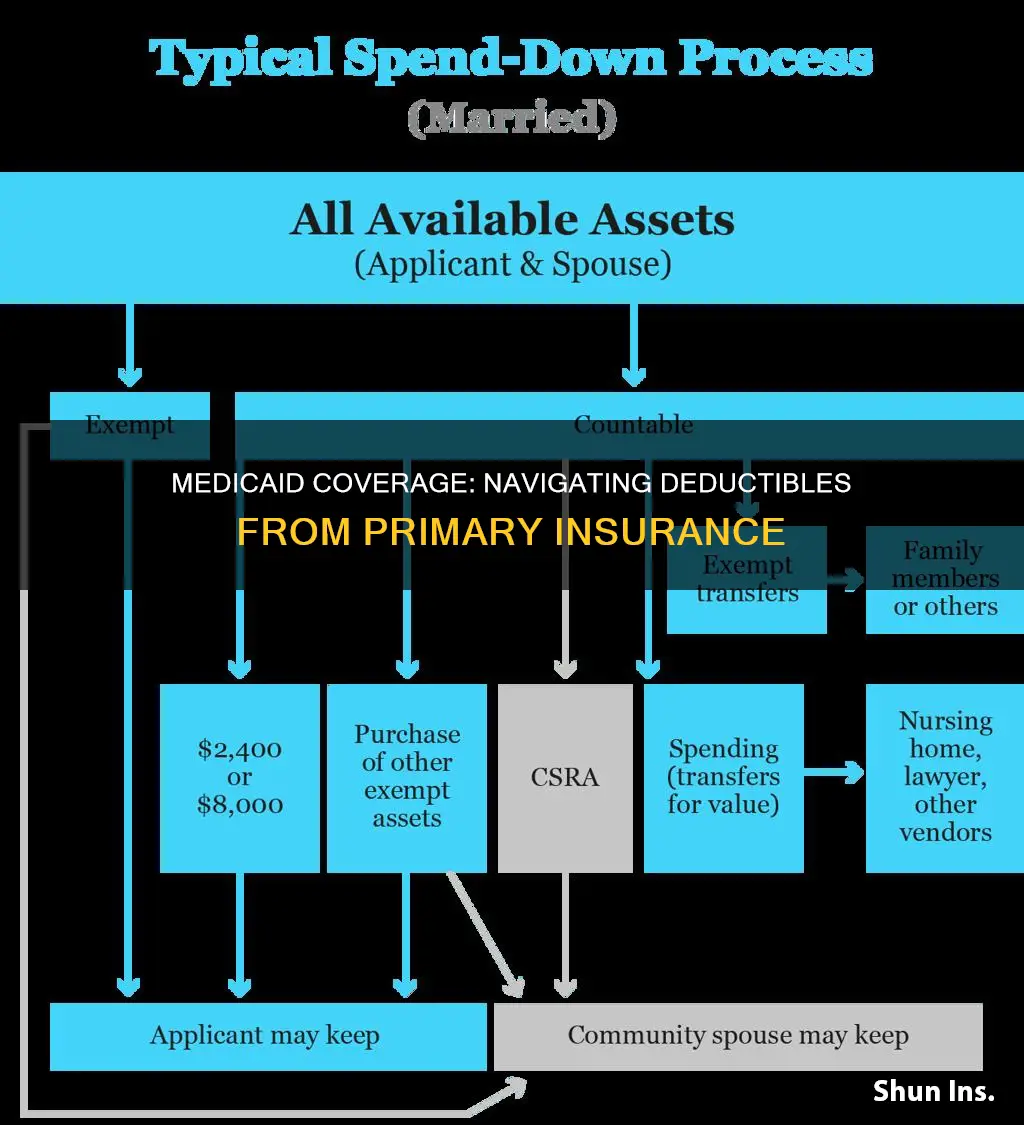

When applying for Medicaid, individuals often undergo a thorough assessment of their financial situation, including income and assets. This process helps determine eligibility and may influence whether Medicaid will cover the deductible from primary insurance. For those who are eligible, Medicaid can step in and cover the deductible, providing financial relief and ensuring that medical care remains accessible.

Understanding the relationship between Medicaid and primary insurance deductibles is essential for effective healthcare management. While Medicaid's coverage of deductibles can provide significant financial benefits, it's important to remember that eligibility criteria and coverage rules may vary. Seeking information from both Medicaid and primary insurance providers can help individuals navigate these complexities and ensure they receive the necessary healthcare support.

Medicaid's Role in Copay Coverage: Navigating Insurance Complexities

You may want to see also

Primary Insurance Deductibles and Medicaid

Medicaid, a federal and state-funded program, often plays a crucial role in covering healthcare costs for eligible individuals. However, when it comes to primary insurance deductibles, the coverage can be a bit complex. Here's a detailed breakdown of how Medicaid addresses these deductibles:

Medicaid's primary objective is to provide essential healthcare coverage to low-income individuals and families. While it offers comprehensive benefits, it typically does not cover primary insurance deductibles directly. Deductibles are the amount of money a policyholder must pay out of pocket before their insurance coverage kicks in. When an individual has both Medicaid and primary insurance, the coverage and payment processes can vary. In many cases, Medicaid will cover the remaining costs after the deductible has been met by the primary insurance. This means that if a person has a high-deductible health plan and also qualifies for Medicaid, they might pay the deductible through their primary insurance, and then Medicaid will cover the subsequent medical expenses.

It's important to note that the specific rules and regulations regarding deductible coverage can differ between states. Some states may have unique policies or programs that offer additional assistance with deductibles, especially for those with low incomes. For instance, certain states might provide financial assistance or subsidies to help individuals cover their deductibles, ensuring that they can access necessary healthcare services.

When enrolling in a new health plan, individuals should carefully review their Medicaid coverage and primary insurance policies. Understanding the deductible requirements and how they interact with Medicaid is essential. In some cases, individuals might need to pay the deductible upfront and then seek reimbursement from their primary insurance company, which can then be covered by Medicaid if the individual is eligible.

For those who are unsure about their coverage, consulting with healthcare professionals or Medicaid representatives can provide valuable guidance. They can help individuals navigate the complexities of primary insurance deductibles and Medicaid coverage, ensuring that they receive the appropriate level of care without incurring unexpected financial burdens.

Summit Medical Group: Uncover Accepted Insurance Plans

You may want to see also

Medicaid's Role in Deductible Reimbursement

Medicaid, a federal and state-funded health insurance program, plays a crucial role in providing healthcare coverage to eligible individuals, often serving as a safety net for those who may not qualify for other insurance options. When it comes to the concept of deductibles, which are the amount a policyholder must pay out-of-pocket before their insurance coverage kicks in, Medicaid's involvement can be complex and varies depending on the specific circumstances.

In many cases, Medicaid does not directly cover the deductible from a primary insurance policy. The deductible is typically an expense that the insured individual must pay first, and it is usually a fixed amount set by the insurance company. Medicaid's primary function is to provide medical assistance to low-income individuals and families, and it often covers a range of healthcare services, including doctor visits, hospital stays, and prescription drugs. However, the program's structure and funding sources mean that it primarily focuses on covering medical expenses after the deductible has been met.

For individuals who are enrolled in both Medicaid and a primary insurance plan, the process of deductible reimbursement can be intricate. When a person incurs medical expenses, they must first pay the deductible, and then they can seek reimbursement from their primary insurance. Medicaid may step in to assist with covering the remaining costs, but it typically does not reimburse the deductible amount directly. Instead, Medicaid's role is to ensure that the insured individual receives the necessary medical care and that their out-of-pocket expenses are minimized.

The specific rules and regulations regarding deductible reimbursement can vary by state and insurance provider. Some states may have unique programs or policies that offer additional assistance to Medicaid enrollees, helping them manage the deductible and out-of-pocket costs. It is essential for individuals to understand their specific coverage and the processes in place to navigate these complexities effectively.

In summary, while Medicaid provides comprehensive healthcare coverage, it generally does not cover the deductible from a primary insurance policy directly. Instead, it focuses on ensuring access to medical services after the deductible has been met. Understanding the interplay between Medicaid and primary insurance is crucial for individuals to manage their healthcare expenses and navigate the reimbursement process effectively.

Understanding Dermatologist Coverage: Unlocking Insurance Benefits for Skin Health

You may want to see also

Policy Implications of Deductible Coverage

The concept of deductibles and their coverage by Medicaid is a complex issue with significant policy implications, especially when considering the relationship between primary and secondary insurance. When an individual has both Medicaid and a primary insurance plan, the question of whether Medicaid covers the deductible from the primary insurance is crucial for understanding the financial responsibilities of enrollees.

Medicaid, a joint federal and state program, provides health coverage for low-income individuals and families. One of its key features is the ability to cover medical expenses that might otherwise be unaffordable. However, Medicaid's coverage can vary widely depending on state policies and individual circumstances. In many cases, Medicaid does not cover the deductible amount of a primary insurance plan, which can lead to unexpected financial burdens for enrollees. The deductible is the amount a person must pay out of pocket before their insurance coverage kicks in, and this can be a significant barrier to accessing healthcare.

The policy implications of this situation are far-reaching. Firstly, it can discourage individuals from enrolling in primary insurance plans, as the deductible may be prohibitively expensive without additional financial assistance. This could lead to a decrease in the overall health coverage of the population, as individuals might opt for less comprehensive or no insurance at all. Moreover, it may create a disincentive for people to seek necessary medical care, especially if they are unaware of the specific coverage details or if the deductible is not covered by Medicaid.

To address these issues, policymakers could consider several strategies. One approach is to implement policies that mandate the coverage of deductibles by Medicaid, ensuring that enrollees are not left with unexpected out-of-pocket expenses. This could involve negotiating with insurance providers to include deductible coverage as a standard benefit or providing additional financial assistance to low-income individuals to help them afford primary insurance deductibles. Another potential solution is to educate enrollees about their rights and the specific coverage details of their insurance plans, empowering them to make informed decisions about their healthcare.

In summary, the policy implications of deductible coverage, especially in the context of Medicaid and primary insurance, are critical to ensuring accessible and affordable healthcare for all. By addressing the financial barriers created by deductibles, policymakers can encourage enrollment in comprehensive insurance plans and promote better health outcomes for the population. This requires a careful examination of current policies and the implementation of strategies that prioritize the well-being of enrollees and their access to essential medical services.

Ophthalmologists and Medical Insurance: Navigating Coverage and Costs

You may want to see also

Medicaid and Insurance Deductible Interaction

Medicaid, a federal and state-funded health insurance program, often interacts with private health insurance plans, leading to potential complexities regarding insurance deductibles. When an individual has both Medicaid and a primary insurance plan, understanding how these programs work together is crucial to ensure proper coverage and cost-sharing.

In many cases, Medicaid is designed to cover specific services and may not be responsible for paying the deductible of a primary insurance plan. The deductible is the amount a policyholder must pay out of pocket before the insurance company starts covering the costs. When a person has both Medicaid and a primary insurance plan, the primary insurance's deductible is typically the responsibility of the individual, even if they have Medicaid coverage. This means that the individual must pay the deductible to their primary insurance company before Medicaid can start covering their eligible expenses.

For example, if a person has a primary insurance plan with a $1,000 deductible and they also qualify for Medicaid, they will need to pay the $1,000 deductible to their primary insurance provider. Once this deductible is met, Medicaid can then cover the remaining eligible medical expenses. It's important to note that the specific rules and regulations regarding deductible payments can vary depending on the state and the individual's circumstances.

To navigate this interaction effectively, individuals should review their Medicaid benefits and primary insurance policies carefully. Understanding the coverage gaps and the order of payment for medical services is essential. In some cases, individuals may need to coordinate with both Medicaid and their primary insurance providers to ensure that their deductibles are properly addressed and that they receive the necessary medical care without financial hardship.

Additionally, individuals should be aware of any state-specific programs or initiatives that might assist with deductible payments. Some states offer financial assistance or subsidies to help individuals with high-deductible plans, ensuring that they can access necessary healthcare services. By staying informed and exploring available resources, individuals can better manage the interaction between Medicaid and their primary insurance deductibles.

Marriage Counseling: Navigating Insurance Coverage and Financial Support

You may want to see also