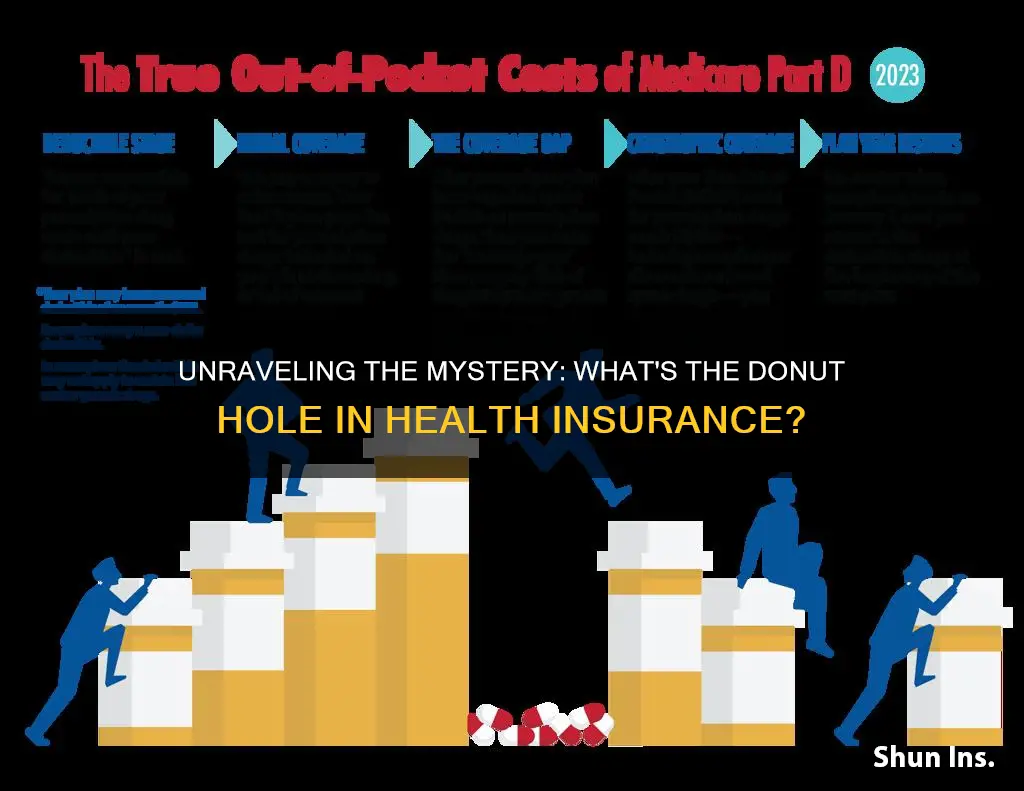

The Medicare Donut Hole was a coverage gap in Medicare Part D that occurred when you and your drug plan reached a certain spending threshold. The gap would occur after you and your drug plan had spent a certain amount for covered medications. As of 2025, the Medicare Donut Hole no longer exists.

| Characteristics | Values |

|---|---|

| Medicare Donut Hole | A colloquial term for a gap in prescription drug coverage in Medicare Part D |

| Coverage Gap | The third of four progressive payment stages in Medicare Part D prescription drug coverage |

| Out-of-pocket cost | The amount a person must pay for care when Medicare does not pay the total amount or offer coverage |

| Catastrophic coverage stage | The deductible stage of Medicare Part D prescription drug coverage is the initial phase in the prescription drug coverage |

| Inflation Reduction Act of 2022 (IRA) | Eliminates the Medicare Donut Hole |

| Medicare Part D | The portion of Medicare that helps a person pay for prescription drugs |

| Prescription drug coverage | The coverage gap would occur after you and your drug plan had spent a certain amount for covered medications |

| Cost cap | Medicare has closed the donut hole and replaced it with a cost cap |

What You'll Learn

Medicare Part D prescription drug coverage

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. Medicare Part D prescription drug coverage is new to many people, and it is important to understand the different stages of coverage.

The Medicare donut hole was a coverage gap that occurred when you and your drug plan reached a certain spending threshold. It was a temporary limit on what the plan would cover for prescriptions. The gap would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage.

The Inflation Reduction Act of 2022 (IRA) eliminated the Medicare donut hole. As of January 1, 2025, the donut hole no longer exists. Medicare has closed the donut hole and replaced it with a cost cap.

Medicare Part D premiums did not count toward closing the coverage gap. The donut hole in Medicare was a coverage gap that occurred when you and your drug plan reached a certain spending threshold.

- Catastrophic coverage stage

- Deductible stage

- Donut hole

- Initial payment stage

The deductible stage of Medicare Part D prescription drug coverage is the initial phase in the prescription drug coverage, where beneficiaries are required to pay a certain out-of-pocket amount for their medications before their plan starts sharing the costs.

Understanding Thyroid Medication Costs: A Guide for the Uninsured

You may want to see also

Coverage gap in prescription drug coverage

The Medicare Donut Hole was a coverage gap that sometimes existed with Part D prescription drug coverage. It was a temporary limit on what the plan would cover for prescriptions. The gap would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage. The Inflation Reduction Act of 2022 (IRA) eliminated the Medicare Donut Hole.

The Medicare Donut Hole was a colloquial term for a gap in prescription drug coverage in Medicare Part D. However, as of 2025, Medicare has closed the donut hole and replaced it with a cost cap. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private or employer-based insurance.

Medicare Part D premiums did not count toward closing the coverage gap. The donut hole in Medicare was a coverage gap that occurred when you and your drug plan reached a certain spending threshold. The deductible stage of Medicare Part D prescription drug coverage is the initial phase in the prescription drug coverage, where beneficiaries are required to pay a certain out-of-pocket amount for their medications before their plan starts sharing the costs.

The Medicare Donut Hole refers to the third of four progressive payment stages in Medicare Part D prescription drug coverage. These four payment stages are:

- Catastrophic coverage stage.

- Deductible stage.

- Donut hole stage.

- Excessive coverage stage.

The Medicare Donut Hole was a coverage gap that sometimes existed with Part D prescription drug coverage. As of Jan. 1, 2025, it no longer exists.

Life Insurance Payouts: Medicaid's Complex Relationship

You may want to see also

Temporary limit on prescription drug coverage

The Medicare donut hole was a coverage gap or temporary limit on what the plan would cover for prescriptions. The gap would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage. The Inflation Reduction Act of 2022 (IRA) eliminated the Medicare donut hole.

The donut hole in Medicare was a coverage gap that occurred when you and your drug plan reached a certain spending threshold. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private or employer-based insurance.

The Medicare donut hole was a colloquial term for a gap in prescription drug coverage in Medicare Part D. However, as of 2025, Medicare has closed the donut hole and replaced it with a cost cap.

Medicare Part D premiums did not count toward closing the coverage gap. The deductible stage of Medicare Part D prescription drug coverage is the initial phase in the prescription drug coverage, where beneficiaries are required to pay a certain out-of-pocket amount for their medications before their plan starts sharing the costs.

The Medicare donut hole refers to the third of four progressive payment stages in Medicare Part D prescription drug coverage. These four payment stages are:

- Catastrophic coverage stage

- Deductible stage

- Donut hole

- Out-of-pocket threshold

Understanding Vasectomy Coverage: Medical Insurance and Your Options

You may want to see also

Catastrophic coverage stage

The Medicare donut hole was a coverage gap that sometimes existed with Part D prescription drug coverage. It was a temporary limit on what the plan would cover for prescriptions. The gap would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage. The Inflation Reduction Act of 2022 (IRA) eliminated the Medicare donut hole.

The Medicare donut hole was a coverage gap that occurred when you and your drug plan reached a certain spending threshold. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private or employer-based insurance.

The Medicare donut hole was a colloquial term for a gap in prescription drug coverage in Medicare Part D. However, as of 2025, Medicare has closed the donut hole and replaced it with a cost cap.

The Medicare donut hole was a coverage gap that sometimes existed with Part D prescription drug coverage. It was a temporary limit on what the plan would cover for prescriptions. The gap would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage. The Inflation Reduction Act of 2022 (IRA) eliminated the Medicare donut hole.

The Medicare donut hole was a coverage gap that occurred when you and your drug plan reached a certain spending threshold. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private or employer-based insurance.

Understanding Medical Insurance: Qualifying Life Events Explained

You may want to see also

Out-of-pocket spending threshold

The Medicare Donut Hole was a coverage gap that occurred when you and your drug plan reached a certain spending threshold. It was a temporary limit on what the plan would cover for prescriptions. The gap would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage. The Inflation Reduction Act of 2022 (IRA) eliminated the Medicare Donut Hole.

The Medicare Donut Hole was a colloquial term for a gap in prescription drug coverage in Medicare Part D. However, as of 2025, Medicare has closed the donut hole and replaced it with a cost cap. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private or employer-based insurance.

Out-of-pocket cost is the amount a person must pay for care when Medicare does not pay the total amount or offer coverage. Medicare Part D premiums did not count toward closing the coverage gap. The deductible stage of Medicare Part D prescription drug coverage is the initial phase in the prescription drug coverage, where beneficiaries are required to pay a certain out-of-pocket amount for their medications before their plan starts sharing the costs.

The Medicare Donut Hole was a coverage gap that sometimes existed with Part D prescription drug coverage. As of Jan. 1, 2025, it no longer exists.

Unraveling Valley Medical's Insurance: A Comprehensive Guide to Coverage

You may want to see also

Frequently asked questions

The Donut Hole refers to a coverage gap in Medicare Part D prescription drug coverage.

The Donut Hole existed until January 1, 2025, when it was replaced with a cost cap.

The Donut Hole would occur after you and your drug plan had spent a certain amount for covered medications. In 2024, the coverage gap began once you and your plan had spent $5,030 on covered drugs. If your total drug costs for the year exceeded that amount, your out-of-pocket spending had to reach $8,000 before you could leave the coverage gap and get catastrophic coverage.