Permanent life insurance policies such as whole life, universal life, variable life, and indexed universal life insurance can accumulate cash value over time. This cash value is a savings component that grows through interest accrued over time. The cash value of a permanent life insurance policy can be used for several purposes, including borrowing or withdrawing cash, or using it to pay policy premiums. The cash value of a life insurance policy can be accessed in several ways, including taking out a loan, making a withdrawal, or surrendering the policy. However, accessing the cash value of a life insurance policy may result in changes to the death benefit or termination of the policy.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Cash Value | A portion of every premium payment goes towards a savings feature that collects interest over time |

| Cash Value Usage | Borrowing money, withdrawing cash, making premium payments |

| Types of Policies | Whole life insurance, universal life insurance, variable life insurance, indexed universal life insurance |

| Term Life Insurance | Does not have a cash value component |

| Cash Value Growth | Whole life insurance has a fixed rate of return, indexed universal life insurance is tied to a stock or bond index, variable universal life is invested in stocks, bonds or mutual funds |

| Cash Value Access | Partial withdrawals, borrow against cash value, withdraw all cash value and surrender the policy, use it to pay premiums |

| Pros | Lifelong coverage, flexible access to funds, reasonable premiums |

| Cons | Higher premiums than term life insurance, managing policies requires a hands-on approach, unpaid loans can reduce the death benefit |

What You'll Learn

Permanent life insurance policies that accrue cash value

Whole Life Insurance

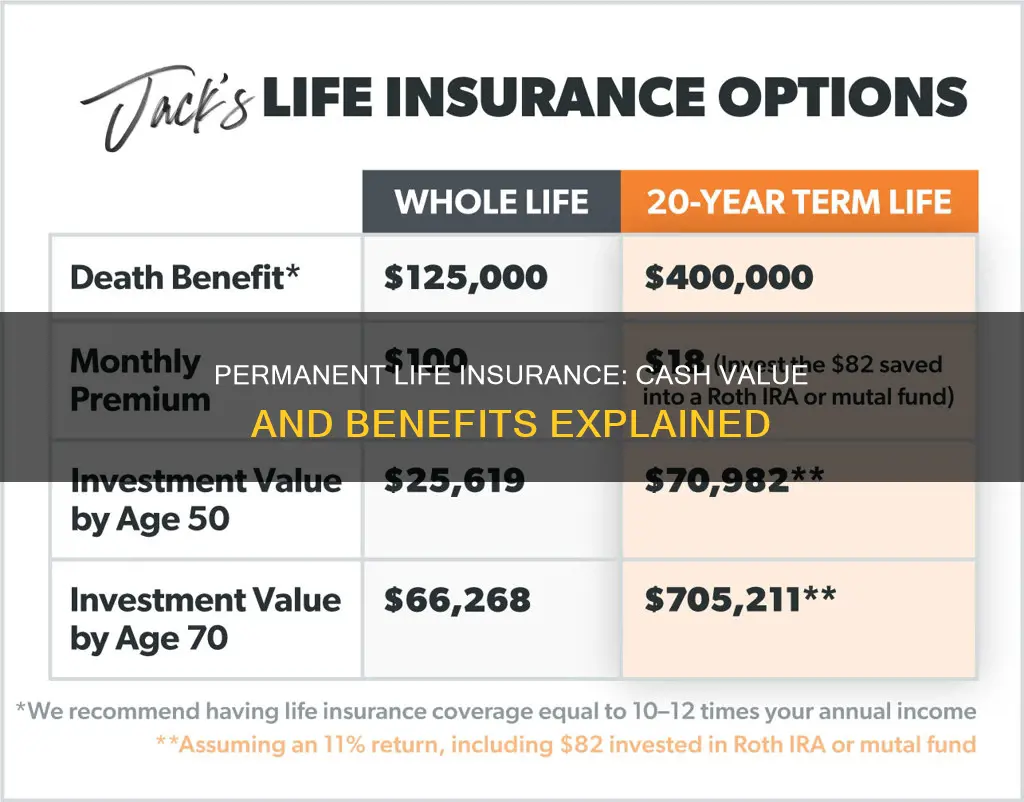

Whole life insurance is a popular form of permanent life insurance that offers guaranteed cash value growth over the long term. The cash value in a whole life policy is guaranteed to increase, providing a sense of certainty for policyholders. Additionally, policyholders can benefit from steady growth, making it a reliable option for those seeking stable returns. Whole life insurance also offers the advantage of fixed premiums, ensuring predictability in payment amounts.

Universal Life Insurance

Universal life insurance provides policyholders with the flexibility to adjust their premium payments and coverage amounts within certain limits. This type of policy offers a mix of guaranteed protection and cash value growth potential. Universal life insurance is particularly appealing to those with changing financial circumstances, as it allows for adjustments to be made over time.

Variable Life Insurance

Variable life insurance, as the name suggests, introduces an element of variability to permanent life insurance. This type of policy provides access to investment tools, allowing policyholders to invest their cash value in various options such as stocks, bonds, or other securities. While this approach offers the potential for higher returns, it also carries a higher risk, as the cash value will fluctuate based on the performance of the chosen investments.

Indexed Life Insurance

Indexed life insurance is closely tied to the performance of the stock market, with the growth of the cash value directly linked to the chosen index. This type of policy can provide strong returns during bull markets but also carries the risk of decreasing cash value if the indexes perform poorly. Indexed life insurance often includes a guaranteed minimum interest rate to provide some level of protection for policyholders.

Benefits of Cash Value Life Insurance

Cash value life insurance offers several advantages, including lifelong coverage, flexible access to funds, and reasonable premiums. Policyholders can borrow against the cash value or make withdrawals to cover expenses such as college tuition, medical emergencies, or retirement income supplementation. The cash value component can also be used to pay premiums, providing a safety net for policyholders facing financial challenges.

Kobe Bryant's Life Insurance: What Was His Plan?

You may want to see also

Pros and cons of cash value life insurance

Permanent life insurance policies, such as whole life and universal life insurance, have a cash value component. This means that a portion of the premiums paid goes into a cash savings account, which can be invested and grow tax-free. This cash value can then be withdrawn or borrowed against.

Pros

- Wealth-building: Cash value life insurance allows you to build wealth on top of life insurance protection. The cash value grows over time and can potentially grow larger than what you pay in premiums.

- Tax advantages: The cash value accumulates tax-free. If you borrow against the cash value, you generally don't have to pay income tax on the loan.

- No contribution limits: Unlike other investment vehicles like IRAs, there are no annual contribution limits.

- Flexible access to funds: You can borrow or withdraw the cash value, use it to cover premiums, or surrender the policy and receive the cash surrender value.

- Lifelong coverage: Cash value life insurance provides permanent coverage, meaning it lasts your entire life as long as premiums are paid.

Cons

- Higher premiums: Cash value life insurance policies tend to have higher premiums than term life insurance policies.

- Reduced death benefit: Withdrawals and unpaid cash value loans can reduce the death benefit for your beneficiaries.

- Tax and interest complications: Withdrawing more than the total premium payments may result in income tax. Loans against the cash value also accrue interest.

- Time to build cash value: It can take several years to build up a substantial cash value, and the policy may need to be managed actively to achieve this.

- Cash value not paid to beneficiaries: In most cases, the cash value reverts to the insurance company upon the policyholder's death, and beneficiaries only receive the death benefit minus any loans or withdrawals.

- Policy lapse: If too much money is borrowed or withdrawn, the policy may lapse, resulting in a loss of life insurance protection.

Life Insurance and Cirrhosis: What Coverage is Offered?

You may want to see also

How to access the cash value of a life insurance policy

Permanent life insurance policies often contain a cash value component accessible during the policyholder's life. Here are some ways to access the cash value of a life insurance policy:

Using the cash value to pay premiums

Some life insurance plans allow you to tap into the cash value of the account to pay for the premiums. This can be helpful if you are facing new and unexpected financial challenges. However, doing so may impact the value of the death benefit over time. Not all insurance companies allow this, so it is advisable to consult an agent.

Taking out a loan against the cash value

You can borrow against the cash value of your life insurance policy. This allows you to borrow the expected cash value of your plan without surrendering it. However, outstanding loan amounts may reduce the death benefits if the policyholder dies before the loan is fully repaid. It is important to note that not all plans work the same way, so it is crucial to understand how your specific plan works.

Withdrawing money from the policy's cash value savings account

Some insurance companies allow you to withdraw money from the policy's cash value savings account. However, it is recommended that you do not take out more money than you have contributed to the account, as this may reduce the death benefit.

Getting the cash surrender value of the policy

To access the cash value of your plan, you may have to surrender part or all of your life insurance policy. Depending on the company and the plan, you may be able to withdraw money and only surrender part of the plan. However, getting the cash surrender value can also decrease the value of the death benefit.

Selling the policy

If you are willing to end your policy, you can cancel it and receive a surrender cash value payment, which may be a lump sum or paid over time. While this can allow you to access a large portion of your cash value, you will no longer have life insurance coverage, and your beneficiary will not receive a death benefit. Surrender fees and taxes could also reduce the amount you receive.

Alternatively, you can sell your policy through a life settlement or viatical settlement, where you sell your policy to a third party for more than the cash surrender value but less than the death benefit. Once the sale is complete, the buyer becomes responsible for paying your insurance premiums and maintenance fees for the rest of your life and will receive the policy's death benefit when you pass away.

It is important to carefully weigh your options, as the way you access your cash value will impact the amount available to you, your death benefit, and your account's growth. Consulting a financial advisor can help you understand the potential consequences of accessing your cash value.

Life Insurance Rates: The 35-Year Spike Explained

You may want to see also

How permanent life insurance with cash value works

Permanent life insurance with cash value is a type of permanent policy that can build funds over time through the cash value component. Permanent life insurance policies such as whole life, universal life, variable life, and indexed universal life insurance can accumulate cash value over time.

Here's how permanent life insurance with cash value works:

How the Cash Value Grows

The cash value of a permanent life insurance policy grows in a few ways. Firstly, a portion of the premiums paid goes into a cash savings account, which earns interest over time. This can be at a fixed or variable rate, depending on the type of permanent policy. Whole life insurance policies, for example, guarantee a fixed rate of return, while variable universal life insurance invests the cash value in stocks, bonds, or mutual funds, leading to potential gains or losses.

Accessing the Cash Value

The cash value component can be accessed in several ways, providing flexible access to funds. Policyholders can borrow against the cash value, taking out loans that need to be repaid with interest. They can also make partial or full withdrawals, though this will reduce the death benefit. Additionally, the cash value can be used to pay policy premiums, maintaining the policy without out-of-pocket expenses.

Benefits of Cash Value Life Insurance

Permanent life insurance with cash value offers lifelong coverage, ensuring that beneficiaries receive a death benefit payout regardless of when the policyholder passes away. It also provides flexible access to funds, which can be used for various purposes such as retirement, paying down a mortgage, or covering emergencies. The cash value grows tax-deferred, and withdrawals are generally tax-free up to the amount of premiums paid.

Considerations

While permanent life insurance with cash value offers benefits, there are some considerations. These policies tend to have higher premiums than term life insurance due to the cash value component. Additionally, managing these policies may require a more hands-on approach, and unpaid loans can reduce the death benefit paid to beneficiaries.

Suitability

Whether cash value life insurance is right for you depends on your financial situation and goals. If you're seeking lifelong coverage and want to build wealth with flexible access to funds, it can be a good option. However, if you only need short-term coverage, a term life insurance policy may be more suitable and cost-effective.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

Is permanent life insurance with cash value right for you?

Permanent life insurance with cash value is a type of insurance policy that lasts for the lifetime of the holder and features a cash value savings component. This means that a portion of your premium payments goes into a savings account that collects interest over time. This cash value can be used to pay your insurance premiums, borrow money, or withdraw cash.

There are several types of permanent life insurance policies that build cash value, including whole life insurance, universal life insurance, variable life insurance, and indexed universal life insurance. These policies tend to have higher premiums than term life insurance policies, which do not have a cash value component.

So, is permanent life insurance with cash value right for you? It depends on your financial situation and goals. If you want to grow funds over time that you can access while you're still alive and are willing to pay higher premiums, then a cash value policy might be a good option. It can provide a source of funds for retirement, paying down a mortgage, covering an emergency, or other significant expenses.

However, it's important to keep in mind that accessing the cash value of your life insurance policy will generally reduce the death benefit. Additionally, managing these policies can require a hands-on approach, and there may be penalties for withdrawing cash or surrendering your policy. Therefore, it's essential to carefully consider your needs and seek advice from a trusted financial professional before deciding whether permanent life insurance with cash value is the best choice for you.

Cancer and Term Life Insurance: Does Level Death Benefit?

You may want to see also

Frequently asked questions

Permanent life insurance with cash value is a type of insurance that includes a cash value feature. This means that a portion of your premium payments goes towards a savings feature that collects interest over time.

The cash value of permanent life insurance grows over time and can be used for various purposes, such as borrowing cash, withdrawing cash, or paying policy premiums. The cash value component serves as a living benefit for policyholders, who may access the funds in several ways.

Permanent life insurance with cash value offers several benefits, including lifelong coverage, flexible access to funds, and reasonable premiums. It can also be used as a tool to meet various financial needs, such as retirement planning, paying for a child's college education, or covering unexpected expenses.