Term life insurance is a valuable financial tool that provides coverage for a specific period, typically 10, 20, or 30 years. While it offers essential protection during this time, there may come a point when it's no longer necessary or beneficial to maintain this coverage. Understanding when to drop term life insurance is crucial for making informed financial decisions. This paragraph will explore the various factors and life events that could prompt an individual to reconsider their term life insurance policy and discuss the potential benefits of doing so.

What You'll Learn

- Term Life Duration: When should you extend or reduce your term life insurance coverage

- Financial Goals: How does term life insurance align with your financial objectives

- Life Changes: What life events trigger a need to review term life insurance

- Alternative Options: What are the alternatives to term life insurance

- Cost-Benefit Analysis: Is term life insurance still worth it after a certain age

Term Life Duration: When should you extend or reduce your term life insurance coverage?

Term life insurance is a valuable financial tool that provides coverage for a specific period, typically 10, 20, or 30 years. It is designed to offer protection during the years when you have a significant financial responsibility, such as supporting a family or paying off a mortgage. Deciding when to extend or reduce your term life insurance coverage is a crucial aspect of financial planning, ensuring that you have the right amount of protection at the right time. Here are some key considerations to help you navigate this decision:

Assess Your Current Needs: Begin by evaluating your current financial obligations and the level of coverage you currently have. If you have a large family or dependents who rely on your income, extending your term life insurance coverage might be essential. Consider the potential risks and uncertainties associated with your current situation. For example, if you are a young professional with a growing family, a 20-year term policy could provide long-term security. On the other hand, if you have recently paid off your mortgage and your family size has decreased, you may no longer need the same level of coverage.

Life Changes and Milestones: Life events and milestones often trigger the need to review and adjust your insurance policies. Major life changes such as marriage, the birth of a child, or the purchase of a home can significantly impact your financial obligations. For instance, starting a family may require you to extend your term life insurance to ensure financial security for your loved ones. Similarly, reaching a significant age milestone or achieving financial goals, like paying off student loans, might prompt a reduction in coverage as these obligations become less relevant.

Financial Goals and Priorities: Your financial goals and priorities play a crucial role in determining the duration of your term life insurance. If you are saving for retirement or have other long-term financial objectives, you may want to consider extending your coverage to ensure that your loved ones are protected during this period. Conversely, if you have already achieved your financial goals and have a robust financial safety net, reducing or dropping your term life insurance might be a wise decision.

Review Regularly: Insurance needs are not static; they evolve over time. It is essential to review your term life insurance policy regularly, at least annually, or whenever significant life changes occur. As you progress through different life stages, your coverage requirements may change. For instance, a young adult might need extensive coverage to support a growing family, while an older individual may require less coverage as their financial obligations diminish. Regular reviews ensure that your insurance remains aligned with your current circumstances.

Consider Long-Term Financial Strategies: When deciding on the duration of your term life insurance, it's beneficial to consider your long-term financial strategies. If you have a well-diversified investment portfolio and a robust financial plan, you may feel more confident in reducing your term life insurance coverage. However, if your financial situation is less secure, extending the term might provide an additional layer of protection. Consulting with a financial advisor can help you make informed decisions based on your unique circumstances.

In summary, the decision to extend or reduce your term life insurance coverage should be a thoughtful process, taking into account your current needs, life changes, financial goals, and long-term financial strategies. Regular reviews and staying informed about your personal and financial circumstances will enable you to make the right choices regarding your term life insurance duration. Remember, the primary goal is to ensure that your loved ones are protected while also managing your financial resources effectively.

Exam FX Life Insurance: How Many Questions?

You may want to see also

Financial Goals: How does term life insurance align with your financial objectives?

Term life insurance is a powerful financial tool that can significantly contribute to your overall financial strategy, especially when it comes to achieving specific financial goals. Here's how it aligns with various objectives:

Protecting Your Family's Financial Future: One of the primary financial goals for many individuals is to ensure the financial security of their loved ones. Term life insurance provides a safety net by offering a death benefit to your beneficiaries if you pass away during the policy term. This financial cushion can help cover essential expenses like mortgage payments, children's education, or daily living costs, providing peace of mind and stability for your family during a challenging time.

Debt Management: If you have significant debts, such as a mortgage, student loans, or business loans, term life insurance can be a strategic asset. By taking out a policy, you create a financial resource that can be used to pay off these debts if you were to pass away. This ensures that your loved ones won't be burdened with outstanding debts, and your financial objectives related to debt management will be met.

Long-Term Financial Planning: For those with long-term financial aspirations, such as saving for retirement or investing in assets, term life insurance can be a valuable component. It provides a guaranteed death benefit, allowing you to plan for future expenses without worrying about the financial impact of premature death. This enables you to focus on building wealth and achieving your long-term financial goals.

Business Continuity: Entrepreneurs and business owners often have unique financial objectives. Term life insurance can be a strategic move to ensure business continuity. In the event of your passing, the death benefit can be used to cover business-related expenses, maintain operations, or provide a financial safety net for your business partners, thus protecting your hard-earned enterprise.

Education Funding: For families with children, education funding is a critical financial goal. Term life insurance can be utilized to create a dedicated fund for your child's education. The policy's death benefit can be invested or set aside to cover tuition fees, books, and other educational expenses, ensuring your child's financial security during their academic journey.

When considering the timing of dropping term life insurance, it's essential to evaluate your financial situation and goals. As your financial objectives evolve, you may find that the coverage provided by term life insurance becomes less relevant. For instance, once your children are financially independent or your mortgage is paid off, the need for a substantial death benefit may diminish. Regularly reviewing and adjusting your insurance coverage ensures that it remains aligned with your changing financial goals.

Whole Life Insurance: When Does It Pay Up?

You may want to see also

Life Changes: What life events trigger a need to review term life insurance?

Life changes are inevitable, and as your circumstances evolve, so should your insurance coverage. Term life insurance, a popular and cost-effective choice, is designed to provide coverage for a specific period, typically 10, 20, or 30 years. While it offers valuable protection during these years, there are several life events that may prompt a review of your insurance needs, including the decision to drop or adjust your term life insurance policy. Here's an overview of some significant life changes that could trigger this review:

Marriage or Partnership: When you get married or enter into a committed relationship, your financial responsibilities often expand. Your partner's income and assets might be considered in the event of your passing. This could lead to a discussion about whether your term life insurance coverage is still adequate to support your family's financial goals. You might consider increasing the policy amount to ensure your loved ones are adequately protected.

Starting a Family: The arrival of a child or children is a major life milestone. As a parent, your role and responsibilities shift, and your financial obligations increase significantly. Reviewing your term life insurance becomes crucial to ensure that your policy provides sufficient coverage for your family's well-being. You may need to adjust the policy to account for the additional financial needs of raising a child, such as education expenses and future financial security.

Career Progression and Income Changes: Advancing in your career can bring higher income and financial stability. As your earnings increase, so should your insurance coverage to match your current financial situation. A career change or promotion might also impact your risk profile, making it essential to reassess your insurance needs. Additionally, if you start a business or become self-employed, your insurance requirements may differ, and a review can help tailor your policy accordingly.

Home Ownership: Buying a home is a significant financial commitment. As a homeowner, you are now responsible for a substantial asset, and your family's financial security is at stake. Reviewing your term life insurance becomes vital to ensure that your policy covers the value of your home and any associated debts. This is especially important if you have a mortgage, as the bank may require proof of adequate life insurance coverage to secure the loan.

Retirement Planning: As retirement approaches, your financial goals and priorities shift. You may want to review your term life insurance to ensure it aligns with your retirement plans. Consider whether you still need the same level of coverage or if you can opt for a different type of policy that better suits your retirement needs. Additionally, if you plan to retire early or pursue a different career path, your insurance requirements might change, and a review can help you make informed decisions.

In summary, life events such as marriage, family planning, career advancements, home ownership, and retirement planning are significant milestones that should prompt a review of your term life insurance. These changes can impact your financial obligations, risk profile, and long-term goals, making it essential to reassess your insurance coverage accordingly. Regularly reviewing and adjusting your insurance policies ensures that you remain protected throughout life's journey.

ADHD and Life Insurance: What You Need to Know

You may want to see also

Alternative Options: What are the alternatives to term life insurance?

When considering the timing of dropping term life insurance, it's essential to explore alternative options that can provide similar financial protection and peace of mind. Here are some alternatives to term life insurance:

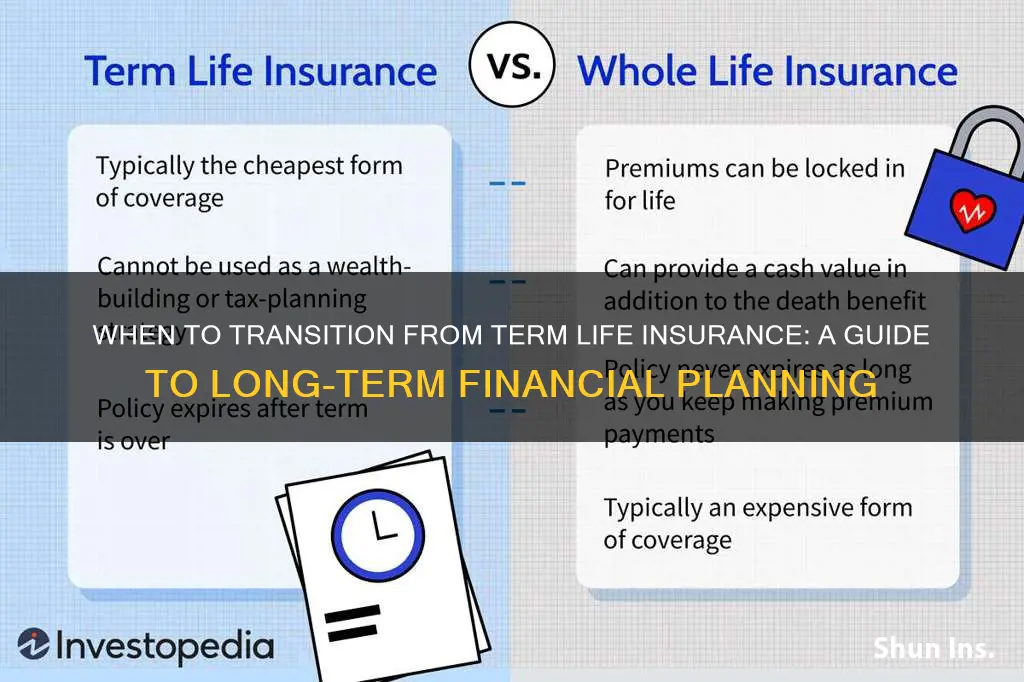

- Permanent Life Insurance: This type of policy offers lifelong coverage and provides a cash value component, which can be borrowed against or withdrawn. Permanent life insurance is more expensive than term life but offers long-term financial security. It can be an excellent choice if you want coverage that remains constant throughout your life, ensuring your loved ones are protected even after your passing.

- Whole Life Insurance: Similar to permanent life insurance, whole life insurance provides permanent coverage with a guaranteed death benefit. It also includes a savings component, allowing your policy to accumulate cash value over time. This option is more comprehensive and can be a good investment, especially if you're looking for a long-term financial strategy.

- Universal Life Insurance: This policy offers flexible premiums and a variable death benefit. It provides permanent coverage and allows you to adjust the amount of coverage and premiums based on your financial goals. Universal life insurance can be tailored to your needs, making it a customizable alternative to term life insurance.

- Annuities: Annuities are financial products that provide a steady income stream for a specified period or for life. They offer guaranteed payments and can be a suitable option for those seeking a consistent income source. Annuities can be an alternative to term life insurance, especially for individuals who prioritize a guaranteed income over a lump-sum death benefit.

- Long-Term Care Insurance: If your primary concern is long-term care expenses, this type of insurance can provide coverage for nursing home care, assisted living, and other related services. It is designed to help individuals manage the costs associated with aging and can be a valuable addition to your financial plan.

When deciding whether to drop term life insurance, it's crucial to evaluate your financial situation, family needs, and long-term goals. Exploring these alternative options can help you make an informed decision and ensure that you have the appropriate level of coverage and financial protection. Remember, the choice should align with your specific circumstances and provide the necessary support for your loved ones.

Finding a Life Insurance Agent: The Ultimate Guide

You may want to see also

Cost-Benefit Analysis: Is term life insurance still worth it after a certain age?

When considering whether to continue with term life insurance beyond a certain age, a cost-benefit analysis is essential to ensure you're making the right financial decision. This analysis will help you weigh the advantages of maintaining the policy against the potential costs and determine if the coverage remains a valuable asset. Here's a breakdown of the factors to consider:

Benefits of Term Life Insurance:

- Affordable Coverage: Term life insurance is generally more affordable than permanent life insurance, especially for younger individuals. This is because the risk of death is lower, and insurance companies can offer competitive rates.

- Temporary Needs: It is often purchased to cover specific financial obligations, such as mortgage payments, children's education, or business debts. Once these obligations are met, the need for the policy may diminish.

- Peace of Mind: Knowing that your loved ones are financially protected in the event of your passing can provide significant peace of mind.

Age-Related Considerations:

As you age, several factors come into play that might influence the decision to continue with term life insurance:

- Decreasing Dependents: If you've reached a stage in life where your family's financial needs are no longer dependent on your income, the primary reason for the policy may have disappeared. For example, children might be financially independent, and the mortgage might be paid off.

- Changing Health: Older individuals may face higher health risks, which could lead to increased insurance premiums or even difficulty in obtaining new coverage. A medical examination is often required for policy renewals, and pre-existing conditions might impact the terms.

- Alternative Savings: With age, you may have accumulated substantial savings or investments, reducing the immediate financial risks. In this case, the need for term life insurance as a primary financial safety net might be reduced.

Cost Analysis:

- Premium Costs: Term life insurance premiums tend to increase with age, making it more expensive over time. If you've already invested in a policy, consider the long-term cost implications.

- Alternative Investment Opportunities: Evaluate if the money spent on insurance premiums could be better utilized elsewhere, such as in retirement savings or other investment vehicles.

- Long-Term Financial Goals: Assess your long-term financial objectives. If you've achieved significant milestones, the policy might no longer align with your overall financial strategy.

Making the Decision:

After conducting this analysis, you might find that the benefits of term life insurance no longer outweigh the costs. Alternatively, you may decide to review and adjust your policy to suit your current circumstances. It's crucial to regularly review and update your insurance coverage to ensure it remains relevant and cost-effective.

In summary, the decision to continue with term life insurance after a certain age should be based on a comprehensive cost-benefit assessment. It's a personal choice that depends on individual financial situations, health, and life goals. Consulting with a financial advisor can provide valuable insights tailored to your specific needs.

Gerber Life Insurance: Annuity or Not?

You may want to see also

Frequently asked questions

The decision to drop term life insurance should be based on your current financial situation and long-term goals. If you've paid off your mortgage, have no dependents, and have sufficient savings or assets to provide for your family in case of your passing, you may no longer need the coverage. Additionally, if you've found alternative financial safety nets, such as a robust emergency fund or a permanent life insurance policy, it might be a good time to review your insurance needs.

Yes, you typically have the flexibility to cancel your term life insurance policy at any time, especially if you're still within the initial term period. However, it's essential to review the policy's terms and conditions, as there may be penalties or fees associated with early cancellation. It's advisable to consult with your insurance provider to understand the specific rules and any potential financial implications.

Dropping term life insurance early can provide financial freedom and flexibility. You can use the funds you would have allocated for insurance premiums to invest in other financial instruments or savings. This decision might be particularly beneficial if you've achieved your initial financial goals, such as building an emergency fund or paying off debts, and no longer require the insurance coverage for your intended purpose.

While dropping term life insurance can be advantageous in certain situations, there are potential drawbacks to consider. Term life insurance provides a level of financial security and peace of mind, especially during the early years of a mortgage or when supporting a family. If you cancel the policy, you'll lose the coverage, and your beneficiaries won't receive any death benefit. It's crucial to evaluate your financial situation, risk tolerance, and the potential long-term benefits of maintaining the insurance before making a decision.