Universal index life insurance can be a valuable financial tool for those seeking long-term coverage with the potential for investment growth. This type of policy combines the security of life insurance with the opportunity to build cash value over time, which can be borrowed against or withdrawn for various financial needs. It is particularly useful for individuals who want to ensure their loved ones are financially protected while also having a flexible investment option that can adapt to changing financial goals and market conditions. Understanding when and how to utilize the features of universal index life insurance can help individuals make informed decisions about their financial well-being.

What You'll Learn

- Affordable Coverage: Universal index life insurance offers cost-effective protection for those with limited budgets

- Long-Term Growth: It provides potential for long-term growth, outpacing traditional term life

- Market-Linked Benefits: Index-linked policies offer performance tied to stock market indices, enhancing potential returns

- Flexibility: Policyholders can adjust death benefits and premiums to fit changing financial needs

- Risk Management: This insurance helps manage financial risk by providing a safety net for beneficiaries

Affordable Coverage: Universal index life insurance offers cost-effective protection for those with limited budgets

Universal index life insurance can be a valuable financial tool for individuals seeking affordable coverage without the complexity of traditional life insurance policies. This type of insurance is designed to provide a cost-effective solution for those who want to protect their loved ones financially but may have a limited budget. By understanding the unique features of universal index life insurance, individuals can make informed decisions about their insurance needs.

One of the key advantages of universal index life insurance is its flexibility. Unlike term life insurance, which offers coverage for a specific period, universal index policies provide permanent coverage. This means that the insured individual is protected for their entire life, ensuring that their beneficiaries receive the death benefit regardless of when the policyholder passes away. The 'universal' aspect refers to the ability to adjust the policy's cash value over time, allowing policyholders to build a savings component within the insurance product.

For those with limited financial resources, universal index life insurance offers a more affordable alternative to whole life insurance. Traditional whole life policies have fixed premiums and accumulate cash value, but they can be expensive, especially for younger individuals. Universal index life insurance, on the other hand, typically has lower premiums, making it more accessible to a broader range of people. This affordability factor is particularly beneficial for individuals who want to secure their family's financial future without breaking the bank.

The cost-effectiveness of universal index life insurance is further enhanced by its potential for cash value accumulation. Policyholders can allocate a portion of their premium payments into an investment account, allowing the cash value to grow over time. This feature enables individuals to build a financial reserve that can be borrowed against or withdrawn if needed, providing additional financial flexibility. As the cash value grows, it can also contribute to the overall death benefit, ensuring that the policy remains in force even if the policyholder's income fluctuates.

When considering universal index life insurance, it is essential to evaluate your specific financial situation and goals. This type of insurance is particularly useful for individuals who want to provide long-term financial security for their families without incurring substantial costs. By carefully reviewing the policy's terms, investment options, and potential returns, you can make an informed decision about whether universal index life insurance is the right choice for your needs.

Life Events: Understanding Insurance Coverage and Your Policy

You may want to see also

Long-Term Growth: It provides potential for long-term growth, outpacing traditional term life

Universal Index Life Insurance offers a unique and powerful tool for those seeking long-term financial security and growth. This type of policy is designed to provide a safety net for your loved ones while also offering the potential for significant financial gains over time. Unlike traditional term life insurance, which provides coverage for a specific period, universal index life insurance is a flexible and adaptable policy that can evolve with your financial goals.

One of the key advantages of this insurance is its ability to outpace traditional term life in terms of long-term growth. The policy accumulates cash value over time, which can be invested in various investment options offered by the insurance company. These investment options often include stocks, bonds, and mutual funds, allowing the policyholder to potentially grow their money faster than with a fixed-rate investment account. As the policy's cash value grows, it can be used to increase the death benefit, ensuring that your beneficiaries receive a larger payout when you pass away.

The growth potential of universal index life insurance is particularly beneficial for those with long-term financial objectives. For example, it can be an excellent tool for building a substantial retirement fund, as the policy's cash value can grow tax-deferred until it's needed. Additionally, the policy's flexibility allows you to adjust your investment strategy as your financial situation changes, ensuring that your money is always working towards your goals.

Another advantage is the ability to access the cash value without incurring penalties, providing financial flexibility. Policyholders can borrow against the cash value or make withdrawals to cover unexpected expenses or take advantage of investment opportunities. This feature is especially useful for those who want to maintain a certain standard of living during their retirement years or who wish to invest in other ventures.

In summary, universal index life insurance is a valuable financial tool for those seeking long-term growth and security. Its potential to outpace traditional term life, combined with its flexibility and investment options, makes it an attractive choice for individuals looking to build a robust financial future for themselves and their loved ones. By understanding the unique features of this policy, you can make informed decisions about your insurance needs and take control of your financial destiny.

Understanding Life Insurance Alternatives to Circumvent Insurability

You may want to see also

Market-Linked Benefits: Index-linked policies offer performance tied to stock market indices, enhancing potential returns

Market-linked life insurance, particularly those tied to stock market indices, presents an attractive investment opportunity for those seeking to enhance their financial returns. These policies are designed to offer a unique blend of insurance protection and market-based growth potential. Here's how index-linked policies can be beneficial:

Performance Linked to Stock Market Indices: One of the key advantages of market-linked life insurance is the direct connection to stock market performance. These policies are structured to provide benefits that are tied to the performance of a specific stock market index, such as the S&P 500 or the NASDAQ. When the underlying index increases in value, the policyholder can benefit from this growth. For instance, if the S&P 500 index rises by 10% over a year, the policyholder might receive a corresponding increase in their policy's value or a guaranteed interest rate based on the index's performance. This feature allows individuals to potentially earn higher returns compared to traditional fixed-rate insurance products.

Potential for Higher Returns: The market-linked nature of these policies can be particularly useful for those seeking to maximize their investment returns. By linking policy benefits to the stock market, individuals can benefit from the potential upside of the market while also having a safety net provided by the insurance component. During periods of market growth, the policyholder can enjoy higher returns, and in a downturn, the insurance protection can provide a level of security. This dual benefit is especially appealing to those who want to take advantage of market opportunities while also ensuring financial security for themselves and their beneficiaries.

Flexibility and Customization: Index-linked policies often offer flexibility in terms of customization. Policyholders can choose the specific index they want to link their policy to, allowing for a tailored investment approach. Additionally, these policies may provide various options for benefit payments, such as a lump sum, periodic payments, or a combination of both. This flexibility enables individuals to align the policy with their financial goals and risk tolerance.

Long-Term Wealth Building: Market-linked life insurance can be a powerful tool for long-term wealth accumulation. The potential for higher returns over time can contribute to significant growth in the policy's value. This can be particularly beneficial for retirement planning or for those looking to build a substantial financial legacy. As the policyholder ages, the potential for increased policy value can provide a more secure financial future, especially when combined with the insurance protection.

In summary, market-linked life insurance, with its performance tied to stock market indices, offers a compelling strategy for individuals seeking to enhance their financial returns. The potential for higher growth, flexibility in customization, and long-term wealth-building capabilities make it a useful tool for those looking to optimize their investment and insurance needs. Understanding the market-linked benefits can help individuals make informed decisions about their financial strategies.

Invest Life Insurance Payouts: A Guide for Surviving Children

You may want to see also

Flexibility: Policyholders can adjust death benefits and premiums to fit changing financial needs

Universal Index Life Insurance offers a unique advantage that sets it apart from traditional life insurance policies: the ability to adapt to your evolving financial circumstances. This flexibility is a powerful feature, especially for those who want to ensure their insurance coverage remains relevant and beneficial over time. Here's how it works and why it's a valuable consideration:

Customizing Death Benefits: One of the key advantages of universal index life insurance is the option to adjust the death benefit amount. This means you can increase or decrease the payout based on your current and future financial goals. For instance, when you first purchase the policy, you might opt for a higher death benefit to cover significant expenses like a mortgage or children's education. As your financial situation improves, you can review and potentially increase the death benefit to align with your new goals, ensuring your loved ones are adequately protected. This flexibility allows you to make informed decisions as your life progresses, providing a safety net that grows with your needs.

Adjusting Premiums: Policyholders also have the freedom to modify their premiums, which can be a significant advantage during life's financial ups and downs. If you experience a period of financial strain, you can temporarily reduce the premium payments without compromising the policy's coverage. Conversely, when your financial situation improves, you can increase the premium to build up more cash value in the policy, which can be used for various purposes, such as loaning against the policy or accelerating the growth of your investment. This adaptability ensures that your insurance policy remains accessible and affordable, even when your financial priorities shift.

The ability to customize both death benefits and premiums provides universal index life insurance with a level of flexibility that is highly desirable for long-term financial planning. It empowers individuals to make proactive decisions, ensuring their insurance coverage remains a valuable asset throughout their lives. This level of control is particularly useful for those who want to maximize the benefits of their life insurance policy while adapting to the ever-changing nature of personal finances.

In summary, the flexibility offered by universal index life insurance allows policyholders to create a tailored financial safety net. By adjusting death benefits and premiums, individuals can ensure that their insurance policy evolves with their changing needs, providing peace of mind and financial security for the long term. This adaptability is a key factor in making universal index life insurance a useful and valuable insurance product.

Becoming a Life Insurance Producer: Steps to Success

You may want to see also

Risk Management: This insurance helps manage financial risk by providing a safety net for beneficiaries

Universal Index Life Insurance is a powerful tool for risk management, offering a safety net for beneficiaries in the event of the insured's death. This type of insurance is particularly useful for individuals who want to ensure their loved ones are financially protected, especially in the face of unexpected life changes or emergencies. By understanding the role of universal index life insurance in risk management, you can make informed decisions about your financial security and the well-being of your family.

The primary benefit of this insurance is its ability to provide a guaranteed death benefit, which is a fixed amount paid out upon the insured's passing. This financial safety net can help cover various expenses, such as mortgage payments, children's education, or outstanding debts, ensuring that your beneficiaries are not left with a financial burden during a challenging time. The insurance policy is designed to grow over time, often with an investment component, allowing it to keep pace with inflation and provide a more substantial benefit as the years pass.

In the context of risk management, universal index life insurance offers a unique advantage. It combines the security of a death benefit with the potential for long-term growth, making it an attractive option for those seeking both immediate and future financial protection. The policy's investment aspect allows the insured to potentially build a substantial cash value, which can be borrowed against or withdrawn if needed, providing a financial resource for various purposes.

For beneficiaries, this insurance is a valuable asset, as it ensures they receive a predetermined amount, providing peace of mind and financial stability. It can be particularly useful for those with dependents, such as children or elderly parents, who rely on the insured's income or support. By having this insurance in place, you can create a secure environment for your loved ones, allowing them to focus on their well-being and long-term goals without the added stress of financial uncertainty.

In summary, universal index life insurance is a practical and comprehensive solution for managing financial risks. It provides a safety net for beneficiaries, ensuring their financial security and peace of mind. With its potential for growth and guaranteed death benefit, this insurance offers a reliable way to protect your loved ones and manage potential financial risks effectively.

Understanding Life Insurance: Quick Cash Value Build Strategies

You may want to see also

Frequently asked questions

Universal Index Life Insurance can be a valuable financial tool in several scenarios. Firstly, it is beneficial for individuals seeking long-term financial security and wealth accumulation. This type of insurance offers a combination of life coverage and an investment component, allowing policyholders to build cash value over time. It is particularly useful for those who want to ensure their loved ones are financially protected in the event of their passing while also having the potential for tax-advantaged growth.

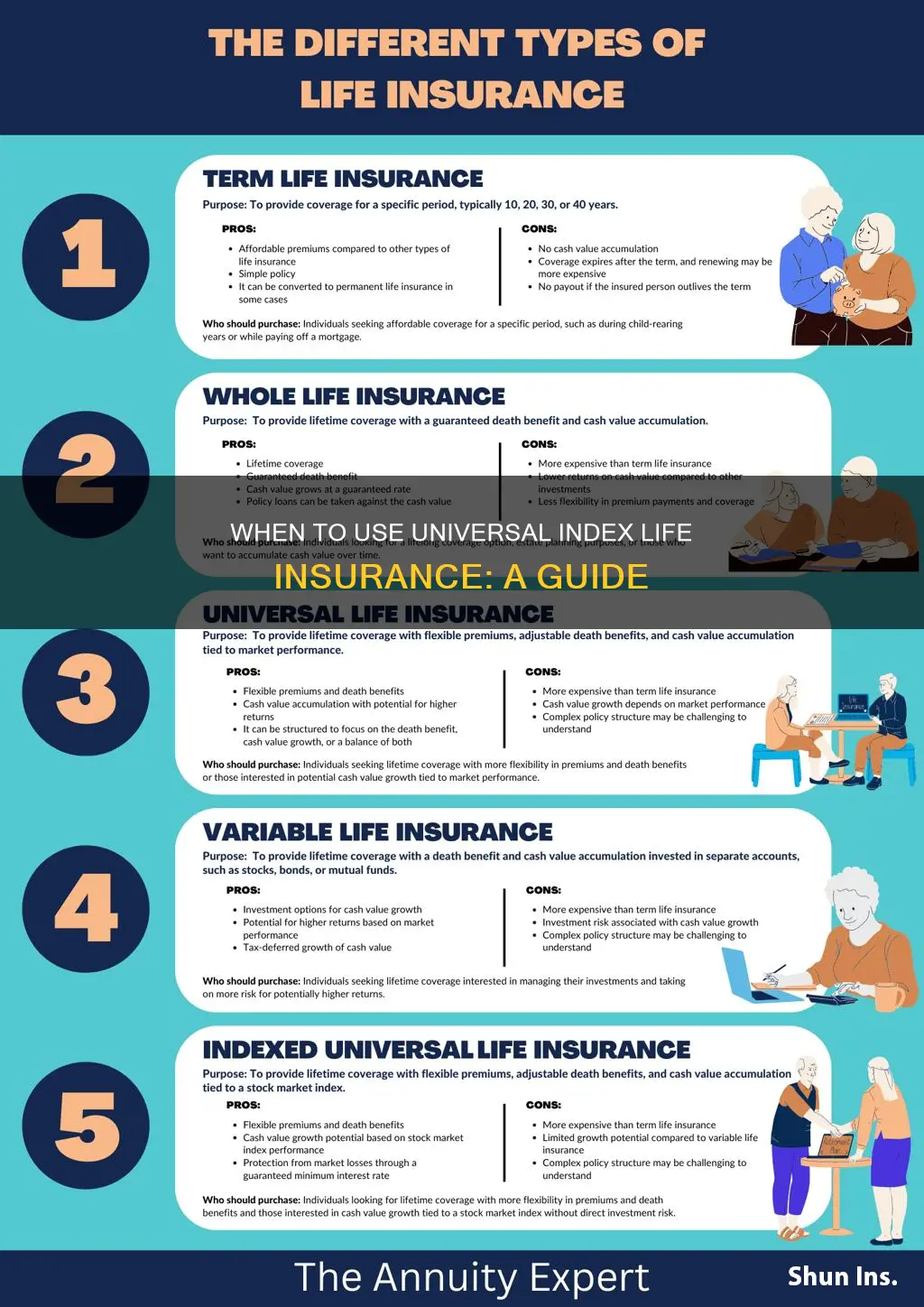

Traditional life insurance, such as term life or whole life, primarily provides a death benefit to beneficiaries upon the insured's passing. In contrast, Universal Index Life Insurance offers both a death benefit and an investment feature. The investment aspect allows the policy to grow cash value, which can be borrowed against or withdrawn, providing financial flexibility. This makes it a more comprehensive and adaptable choice for those seeking both insurance and investment solutions.

While Universal Index Life Insurance has its advantages, it may not be the best fit for everyone. One potential drawback is the complexity of the policy, which can make it challenging to understand and manage. Additionally, the investment component may not perform as expected, and policyholders bear the risk of investment losses. It is essential to carefully review the policy terms, fees, and potential risks before making a decision, ensuring it aligns with your financial goals and risk tolerance.