Rheumatoid arthritis (RA) is a chronic inflammatory disorder that affects about 1-2% of the American population, with 200,000 new cases diagnosed each year, mostly in women. It is triggered by a faulty immune system that attacks the body's joints and tissues, and can sometimes affect other organs. RA has no cure, but treatments can improve quality of life and relieve symptoms. When it comes to life insurance, RA is considered a pre-existing condition that can impact the rates offered to applicants. Life insurance providers view RA as a potential risk and will ask specific questions about an applicant's condition to calculate their premiums or determine their eligibility for coverage.

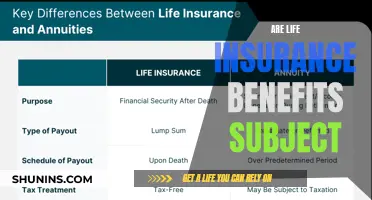

| Characteristics | Values |

|---|---|

| Date of diagnosis | The longer you have been in treatment, the more risk you pose. |

| Duration and frequency of flare-ups | The more frequent and longer the flare-ups, the higher the risk of joint and tissue damage. |

| Deformity | The presence and type of deformity, e.g. mild deformity of wrists or fingers, or major deformity of knees or hips. |

| Disability | The inability to live independently and perform daily tasks negatively affects your life insurance rating. |

| Medication | The type and frequency of drugs used in the treatment plan. Some medications are considered "red flags" by insurance companies. |

| Parts of the body affected | The areas of the body affected and to what degree, e.g. mild wrist pain or lung and kidney damage. |

What You'll Learn

Date of diagnosis

The date of diagnosis is an important factor in determining life insurance rates for people with rheumatoid arthritis (RA). The longer a person has had RA, the more risk they pose for damage to their joints and organs. This is because RA symptoms usually progress over time. The date of diagnosis will often determine whether an individual's RA is considered mild, moderate, or severe by the insurance company.

For example, if an individual has been diagnosed with RA six months ago and has only had one flare-up, they are likely to be considered mild. On the other hand, if someone was diagnosed 20 years ago and requires biologics and steroids to manage pain and inflammation, they are likely to be considered severe.

The date of diagnosis can also affect the type of life insurance policy offered. For instance, someone with a recent diagnosis and mild symptoms may qualify for Standard rates for traditional life insurance coverage. In contrast, someone with a longer history of RA and more severe symptoms may only qualify for a Rated traditional life insurance policy, which comes with a surcharge on premiums.

The date of diagnosis is just one of several factors that life insurance companies consider when assessing the risk of individuals with RA. Other factors include the frequency and duration of flare-ups, the presence and type of deformity, disability status, medications, and the parts of the body affected by RA.

Coronavirus: Life Insurance Impact and Your Coverage

You may want to see also

Frequency of flare-ups

The frequency of rheumatoid arthritis (RA) flare-ups is a key factor that insurance companies consider when determining life insurance coverage and premiums. Underwriters assess the risk associated with an individual's RA by evaluating the duration and frequency of flare-ups, among other factors. The more frequent the flare-ups, the higher the risk of joint and tissue damage, which impacts insurance rates.

RA is characterised by unpredictable symptom flare-ups that can be debilitating. These flare-ups can last from a few hours to several weeks or even months without treatment. During a flare-up, individuals may experience increased joint pain, stiffness, and swelling, as well as a general feeling of being unwell.

The triggers for RA flare-ups vary from person to person and can be unpredictable. However, common triggers include overexertion, poor sleep, stress, infection, emotional or physical stress, certain dietary choices, and standing or remaining stationary for extended periods.

It is important for individuals with RA to be able to recognise the early signs of a flare-up to effectively manage their condition. Keeping a journal or record of symptoms and environmental factors can help identify patterns and triggers. This enables individuals to take proactive measures, such as getting extra rest or adjusting their treatment plan, to reduce the impact of flare-ups on their daily lives.

The impact of RA flare-ups on an individual's functionality and independence is a crucial consideration for insurance companies. Frequent and severe flare-ups that interfere with everyday tasks, work, and social engagements can result in higher insurance premiums or even a decline of standard life insurance coverage.

In summary, the frequency of RA flare-ups plays a significant role in determining life insurance rates. The more frequent the flare-ups, the higher the perceived risk, which translates to higher premiums or potential denial of coverage. Effective management of RA symptoms, including flare-ups, can help individuals secure more favourable insurance options.

Understanding Post-Mortem Dividends: Form 706 and Life Insurance

You may want to see also

Deformity

The presence of deformities will negatively impact the rate you pay for life insurance. Underwriters will need to know what body parts are affected and how severe the deformities are. For instance, insurance companies will want to know if you have a mild deformity of the wrists or fingers, or a major deformity of the knees or hips.

The severity of deformities will also determine the rating underwriters give to an applicant with rheumatoid arthritis. Most underwriting guides classify severity as mild, moderate, or severe. Here is how they differ:

- Mild: Minimal pain, slight pain or stiffness in peripheral joints, no or minimal swelling, and no deformity.

- Moderate: Moderate pain and stiffness, more extensive joint involvement, and slight deformity or limitation of movement in affected joints.

- Severe: Chronic active disease, no complete freedom from pain, moderate or marked deformities with serious restrictions of movement and impairment of function.

If you have rheumatoid arthritis, the presence and severity of deformities will be a key factor in determining your life insurance premiums and your ability to qualify for life insurance.

Life Insurance and Short-Form Death Certificates: What's Accepted?

You may want to see also

Disability

Life insurance underwriters assess the extent to which RA affects an individual's ability to live independently and perform daily activities of living. They consider whether the person can walk or stand for extended periods, and if they require assistance with basic tasks. The presence of a disability indicates an increased risk for the insurance company, which may result in higher premiums or a decline of coverage.

For example, let's consider the case of Monica, who was diagnosed with RA 10 years ago and experienced frequent flare-ups. Due to toe joint deformities caused by RA, Monica had to leave her job as she was unable to stand for extended periods. Monica would likely receive a decline for traditional life insurance. However, other life insurance policies, such as graded benefit life insurance, are still available to her.

Another example is Janet, who was diagnosed with RA 10 years ago and experiences monthly flare-ups. She has deformities on her toes and fingers and is considered disabled as she has difficulty walking and performing daily tasks. Janet would likely be declined for fully underwritten life insurance due to the severity of her symptoms and side effects. However, she can explore alternative options like a graded benefit life insurance policy or a guaranteed issue life insurance policy to financially protect her loved ones.

In summary, disability resulting from RA can significantly impact life insurance rates and eligibility. The inability to work or perform daily activities due to RA-related disabilities increases the risk for insurance companies, leading to potential increases in premiums or, in some cases, a decline of standard coverage. However, it's important to note that alternative life insurance options are usually available for individuals with disabilities caused by RA.

Life Insurance for Marathon Runners: What's Covered?

You may want to see also

Medication

Insurance companies are particularly interested in the long-term effects of RA medications on the body. They consider the potential side effects and view certain drugs as "red flags". For instance, the long-term use of steroids can sometimes have a more significant impact on insurance rates than RA itself.

When evaluating medication usage, insurance companies typically classify RA cases as mild, moderate, or severe.

Mild RA

Individuals with mild RA are usually treated with simple medication regimens, including non-steroidal anti-inflammatory drugs (NSAIDs), aspirin, hydroxychloroquine, and minocycline. In such cases, insurance companies typically do not impose any extra charges or rating adjustments.

Moderate RA

Moderate RA cases often involve abnormal lab results and higher medication usage, including longer-term steroid treatment. This classification usually results in a 50% to 100% extra premium charge for the policyholder.

Severe RA

Severe RA is characterised by functional disability, wheelchair use, or the involvement of major organs. Individuals in this category are typically declined coverage by insurance companies.

It is important to note that the classification of RA severity is not standardised across insurance companies. One insurer may place an individual in the moderate-risk class, while another may classify them as mild risk. This discrepancy can lead to significant differences in insurance rates offered by different carriers.

Overall, medication plays a crucial role in determining life insurance rates and eligibility for individuals with RA. The specific medications prescribed, their potential side effects, and the severity of the condition all factor into the insurance company's assessment of risk.

Term Life Insurance: Does GEICO Offer This?

You may want to see also