Life insurance policies are designed to provide financial support to your loved ones after you pass away. While the primary benefit of life insurance is the death benefit paid out to beneficiaries, there are some circumstances in which you can cash out your policy before death. Whether you can cash out your life insurance policy before death depends on the type of policy you have. Some policies, such as term life insurance, do not accumulate cash value and cannot be cashed out. However, certain permanent life insurance policies, like whole life and universal life, build up a cash value that can be accessed while the policyholder is still alive. This cash value is different from the death benefit, which can only be collected by beneficiaries after the policyholder's death. Accidental death and dismemberment (AD&D) insurance is typically added as a rider to a life insurance policy and provides additional coverage for accidental death or loss of limbs or bodily functions. While it supplements life insurance, AD&D insurance is not a substitute for a full life insurance policy due to its limited coverage.

| Characteristics | Values |

|---|---|

| What is accidental death and dismemberment insurance? | Insurance that provides financial protection in the event of a serious accident. |

| How does it work? | It pays out a benefit if you die due to a covered accident or suffer a significant injury that results in the loss of a body part or function. |

| Types | Standalone policy, rider added to a standard life insurance policy, or obtained through an employer as part of a benefits package. |

| Who is it for? | People who work in or around potentially hazardous environments, or those who drive more than average. |

| What does it cover? | Car accident death, slip and fall accidents, fire-related deaths or injuries, crushed by fallen objects, loss or partial loss of a limb, finger, eye or ear, loss or partial loss of function, including eyesight and hearing. |

| What doesn't it cover? | Death from illness, suicide or death related to mental illness, high-risk activities, injuries or death due to war or military combat, death resulting from driving under the influence of alcohol or drugs, death caused by bacterial infections, death during surgery, death of a professional athlete during a sporting event. |

| How much does it cost? | Relatively inexpensive compared to traditional (term) and whole life insurance. |

What You'll Learn

- Accidental death insurance is usually added as a rider to a life insurance policy

- It covers the unintentional death or dismemberment of the insured

- Dismemberment includes the loss or loss of use of body parts or functions

- It is supplemental life insurance and not a substitute for a full life insurance policy

- You can cash out part of your life insurance policy before death in certain situations

Accidental death insurance is usually added as a rider to a life insurance policy

Accidental death insurance is a type of insurance that covers the policyholder in the event of their accidental death or dismemberment. It is usually added as a rider to a life insurance policy, meaning it is an optional extra that provides additional benefits. This type of insurance is particularly relevant for those who work in hazardous environments or engage in certain risky activities.

Accidental death insurance is designed to supplement a regular life insurance policy and is not intended to be a substitute. In the event of an accident resulting in death or dismemberment, the policyholder or their beneficiary will receive benefits from both the accidental death rider and the underlying life insurance policy. This is known as a "double indemnity" rider. The benefit amount is typically equal to or a multiple of the traditional policy's death benefit, so the beneficiary may receive twice the expected payout.

Accidental death insurance covers a range of circumstances, including traffic accidents, homicide, falls, drowning, and accidents involving heavy equipment. It also covers dismemberment, including the loss or loss of use of body parts or functions such as limbs, speech, eyesight, and hearing. The specific benefits and covered circumstances are outlined in a schedule within the policy.

It is important to note that accidental death insurance has significant coverage limitations. It does not pay out if the insured dies from natural causes, illness, or certain high-risk activities. Each insurance provider will have a list of exclusions, so it is crucial to carefully read the terms of the policy.

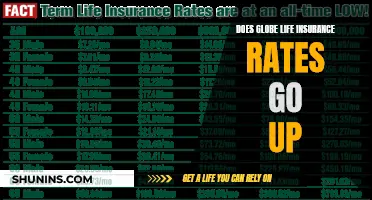

Life Insurance Rates: The Impact of Age on Premiums

You may want to see also

It covers the unintentional death or dismemberment of the insured

Accidental Death and Dismemberment (AD&D) Insurance covers the unintentional death or dismemberment of the insured. This type of insurance is usually added as a rider to a life insurance policy, but it can also be purchased as a standalone policy. It is designed to provide financial protection in the event of a serious accident and typically covers the following:

- Loss of a limb (e.g. arm or leg)

- Loss of vision, hearing or speech

- Loss of fingers, toes or an eye

The payout amount will depend on the severity of the injury. For instance, losing one limb may result in a 50% payout, while losing both limbs or eyesight could lead to a 100% payout. It is important to note that AD&D insurance has limitations and does not cover death from natural causes or illness. Exclusions may also include death related to medical procedures, overdoses, high-risk activities, and military combat.

When adding an AD&D rider to a life insurance policy, the designated beneficiaries will receive benefits from both the rider and the underlying policy if the insured dies accidentally. This is known as double indemnity, and the beneficiary will usually receive a benefit twice the amount of the life insurance policy's face value.

AD&D insurance is particularly relevant for individuals in high-risk professions or those who engage in hazardous hobbies. It can provide additional peace of mind and financial security in the event of an accident. However, it is important to carefully review the terms and conditions of any policy before purchasing, as coverage limitations and exclusions may apply.

Weight's Impact: Life Insurance Premiums and Health

You may want to see also

Dismemberment includes the loss or loss of use of body parts or functions

Accidental Death and Dismemberment (AD&D) insurance covers the loss or loss of use of body parts or functions. This includes the loss of limbs, speech, eyesight, and hearing. The loss of use of body parts or functions can include paralysis, loss of vision, hearing, or speech.

The payout for AD&D insurance depends on the severity of the loss. For example, losing one limb or partial function might result in a 50% payout, while losing both limbs or full function could result in a 100% payout. The payout percentage for specific injuries is typically outlined in the policy. The policy will also specify whether the benefit is paid to the insured person or their beneficiary.

It's important to note that AD&D insurance has significant coverage limitations, and it's not a substitute for a full life insurance policy. AD&D insurance only covers accidental death or dismemberment and does not pay out for deaths due to natural causes or illnesses. Additionally, it may not cover high-risk activities or deaths related to medical procedures, drug use, or criminal activities.

When considering AD&D insurance, carefully reviewing the policy terms is essential to understanding the specific coverage and exclusions.

Life Insurance Denial: Overweight and Uninsured?

You may want to see also

It is supplemental life insurance and not a substitute for a full life insurance policy

Supplemental life insurance is an optional coverage that provides an extra layer of protection on top of the group policy provided by an employer. It is also known as voluntary life insurance. It is purchased in addition to a standard life insurance policy and is usually available through an employer's benefits package or directly from an insurer.

Supplemental life insurance is not meant to replace a full life insurance policy but rather to enhance it. It is designed to fill the coverage gaps that an existing policy may lack. For example, if your employer's basic group life insurance has a complimentary $50,000 death benefit, you may choose to purchase $200,000 in supplemental life insurance coverage to provide your beneficiaries with a payout to replace five years of your income.

Supplemental life insurance can also be useful if you want to cover a spouse or child as part of your policy, or if you have health challenges that may disqualify you from a private life insurance policy. It can also be beneficial if you work in a dangerous environment or drive more than average, either professionally or as a commuter.

Supplemental life insurance is typically associated with a much lower payout than traditional life insurance policies. It may also be limited in terms of coverage options and may not be portable, meaning it will likely end when you leave your job.

Therefore, it is important to carefully consider your needs and weigh the pros and cons of supplemental life insurance before deciding if it is the right choice for you.

Life Term Insurance: Gaining Cash Value?

You may want to see also

You can cash out part of your life insurance policy before death in certain situations

Whether you can cash out your life insurance policy before death depends on the type of policy you have. If you have a "term life" policy, you cannot cash out your insurance as it does not build cash value. However, if you have a "whole life", "universal life", or other "permanent" life insurance policy, you can cash out part of your policy before death. This is because these policies accumulate a "cash value" that can be withdrawn, borrowed against, or used to pay premiums.

The "cash value" of a life insurance policy is the sum of money that accumulates over time from a portion of your payments. This fund grows with interest and can be worth hundreds or thousands of dollars. While you cannot cash out the full stated value of your policy before death, you can withdraw or borrow against the "cash value" that has accumulated.

There are several options for cashing out part of your life insurance policy before death if you have a permanent policy. One option is to withdraw your entire cash value. This option requires you to surrender your policy, which means your coverage will end. You will also likely have to pay "surrender charges" and income taxes on the money. Another option is to make a partial withdrawal, where you take out some but not all of the cash value. In this case, your policy will still be active, but the death benefit will likely be reduced. A third option is to borrow money from your insurance company using your policy's cash value as collateral. This option does not require you to pay taxes on the money, but the insurance company will deduct interest payments from your cash value balance.

It is important to note that accidental death benefits are typically added to basic life insurance policies as a rider or clause and are not the same as life insurance policies. Accidental death and dismemberment (AD&D) insurance provides a death benefit to the beneficiary if the insured dies from an accident or a partial benefit if they lose a body part. This type of insurance can be purchased as a standalone policy or as a supplement to a life insurance policy.

Health and Life Insurance: TN-VA Reciprocity

You may want to see also

Frequently asked questions

It depends on the type of policy you have. If your policy has a cash value or you have a terminal illness, you may be able to cash out your policy early.

Accidental death benefits provide financial protection in the event of a serious accident or death. This type of policy is particularly useful for people who work in hazardous environments or drive more than average.

An accidental death benefit is usually a clause or rider connected to a life insurance policy. It pays out in addition to the standard benefit if the insured dies of accidental causes.

An accidental death benefit covers death or serious injuries resulting from accidents, including car accidents, slips, fires, and drowning. It may also cover partial or total loss of limbs, burns, paralysis, and other similar cases.