Ladder Life Insurance is a unique company that offers life insurance through technology. It is a startup that was founded in 2017 and offers competitively priced term life insurance to consumers of most ages. Unlike most life insurance companies, Ladder offers only term life insurance and there are no riders available to customise your coverage. The company provides a streamlined, digital-first approach to life insurance, focusing on term policies with specific eligibility criteria.

| Characteristics | Values |

|---|---|

| Type of insurance | Term life insurance |

| Process | Quoting, purchasing and underwriting is done electronically |

| Medical exam | Only if there is a need for one |

| Riders | None available |

| Eligibility | Specific criteria |

| Age | A young company |

| Underwritten by | Fidelity Security Life |

| Financial ratings | Same as Fidelity Security Life Insurance company |

What You'll Learn

- Ladder Life Insurance is a startup life insurance company

- Ladder offers competitively priced term life insurance

- Ladder's quoting, purchasing and underwriting process is done completely electronically

- Ladder's policies are underwritten by Fidelity Security Life

- Ladder provides a streamlined, digital-first approach to life insurance

Ladder Life Insurance is a startup life insurance company

The company provides a streamlined, digital-first approach to life insurance, focusing on term policies with specific eligibility criteria. This means that Ladder is ideal for people who value a streamlined process and want to be able to easily adjust their coverage as their needs change over time.

Ladder is also unique in that it offers only term life insurance, and there are no riders available to customize coverage. This sets it apart from most life insurance companies, even those that sell direct.

Overall, Ladder Life Insurance is a startup that is taking a technology-focused approach to life insurance, offering a streamlined and innovative process for consumers who prefer to shop online and complete transactions without the need for an agent.

Credit Union Life Insurance: Is It Worth It?

You may want to see also

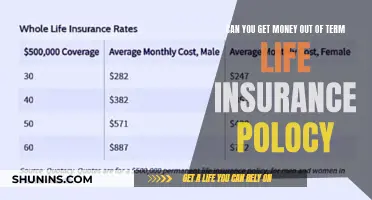

Ladder offers competitively priced term life insurance

Ladder is a life insurance company that offers competitively priced term life insurance to consumers of most ages. The company is unique in that its quoting, purchasing, and underwriting process is done completely electronically, unless there is a need for a life insurance medical exam. Ladder's policies are underwritten by Fidelity Security Life, a well-established and highly-rated insurance company. This means that despite Ladder's young age, its financial ratings are those of Fidelity Security Life Insurance company, which was established in 1969.

Ladder's digital-first approach to life insurance means that it is well-suited to consumers who prefer to shop online and complete transactions without the need for an agent. The company's streamlined process allows customers to easily adjust their coverage as their needs change over time.

Unlike most life insurance companies, Ladder offers only term life insurance, and there are no riders available to customise coverage. This means that Ladder's policies may not be suitable for individuals who require more comprehensive coverage or who wish to customise their policy with additional riders.

Overall, Ladder offers a unique and innovative approach to life insurance, providing competitively priced term life insurance to consumers who value a streamlined and digital experience.

Universal Life Insurance: Term Limits and Permanent Coverage

You may want to see also

Ladder's quoting, purchasing and underwriting process is done completely electronically

Ladder Life Insurance is a startup life insurance company that offers competitively priced term life insurance to consumers of most ages. It is unique in that its quoting, purchasing and underwriting process is done completely electronically, unless there is a need for a life insurance medical exam. This means that consumers can shop online and complete the transaction without the need of an agent.

The company offers a streamlined, digital-first approach to life insurance, focusing on term policies with specific eligibility criteria. This means that consumers can easily adjust their coverage as their needs change over time.

Since Ladder is a young insurance company, all of its policies are underwritten by Fidelity Security Life, a well-established and highly-rated insurance company. This means that Ladder's financial ratings are those of Fidelity Security Life Insurance company, which was established in 1969.

Ladder's electronic process and focus on term policies make it a unique and innovative insurer. Its partnership with Fidelity Security Life also ensures that policyholders can feel confident in the company's financial stability, despite its young age.

Rejected by Life Insurance: What Went Wrong?

You may want to see also

Ladder's policies are underwritten by Fidelity Security Life

Ladder Life Insurance is a startup life insurance company that offers competitively priced term life insurance to consumers of most ages. The company is unique in that its quoting, purchasing, and underwriting process is done completely electronically unless there is a need for a life insurance medical exam. Ladder is also unique in that it only offers term life insurance and there are no riders available to customise your coverage.

Since Ladder is a young insurance company, all of its policies are underwritten by Fidelity Security Life, a well-established and highly-rated insurance company. This means that Ladder's financial ratings are those of Fidelity Security Life Insurance company, which was established in 1969.

Ladder provides a streamlined, digital-first approach to life insurance, focusing on term policies with specific eligibility criteria. This approach is ideal for people who value a streamlined process and who want to be able to easily adjust their coverage as their needs change over time.

Overall, Ladder Life Insurance offers a unique and innovative approach to term life insurance, providing a completely electronic process and the ability to easily adjust coverage. With policies underwritten by Fidelity Security Life, Ladder provides a secure and reliable option for those seeking term life insurance.

Life Insurance Contracts: Signature Requirements and Beneficiaries

You may want to see also

Ladder provides a streamlined, digital-first approach to life insurance

Ladder Life Insurance is a startup life insurance company that offers competitively priced term life insurance to consumers of most ages. The company is unique in that its quoting, purchasing, and underwriting process is done completely electronically unless there is a need for a life insurance medical exam. Ladder provides a streamlined, digital-first approach to life insurance, focusing on term policies with specific eligibility criteria. This means that consumers can shop online and complete the transaction without the need for an agent.

The company is also unique in that it offers only term life insurance and there are no riders available to customise coverage. This means that policyholders can easily adjust their coverage as their needs change over time. Ladder is underwritten by Fidelity Security Life, a well-established and highly-rated insurance company. This means that despite Ladder's young age, policyholders can be confident in the company's financial stability.

Overall, Ladder provides a fresh and innovative approach to life insurance, utilising technology to offer a streamlined and efficient service to its consumers. By focusing on term policies and specific eligibility criteria, Ladder ensures that its services are accessible and adaptable to the changing needs of its customers.

Life Insurance Payments: When Do They End?

You may want to see also

Frequently asked questions

Ladder Life Insurance is a startup life insurance company that offers competitively priced term life insurance to consumers of most ages.

Ladder provides a streamlined, digital-first approach to life insurance. The quoting, purchasing, and underwriting process is done completely electronically unless there is a need for a life insurance medical exam.

Ladder offers term life insurance.

Ladder's policies are underwritten by Fidelity Security Life, a well-established and highly-rated insurance company, so Ladder's young age should not be a concern for policyholders.

Ladder is unique in terms of its quoting, purchasing, and underwriting process, which is done completely electronically. Ladder also offers only term life insurance, with no riders available to customise your coverage.