Being overweight can have a significant impact on your life insurance premiums. Body Mass Index (BMI) is a numerical value calculated by dividing an individual's weight in kilograms by the square of their height in meters. While it is not a direct measure of body fat, it serves as a screening tool to categorise individuals into different weight-related health categories, such as underweight, normal weight, overweight, or obese. Insurance companies commonly use BMI charts to assess the health risk associated with potential policyholders and determine their premiums. A higher BMI indicates a greater risk of health issues, which can result in increased medical costs. However, it's important to note that BMI is just one factor among many that insurance companies consider when setting premiums.

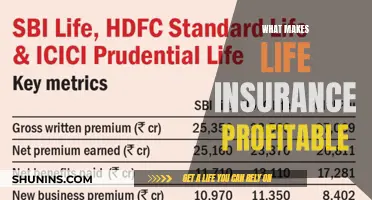

| Characteristics | Values |

|---|---|

| Definition | Body Mass Index (BMI) is a numerical value calculated from an individual’s weight and height. |

| Calculation | BMI = Weight (kg) / Height (m)^2 or Weight (lb) / Height (in)^2 * 703 |

| Categories | Underweight: BMI < 18.5, Normal weight: 18.5 <= BMI < 25, Overweight: 25 <= BMI < 30, Obese: BMI >= 30 |

| Impact on Insurance Premium | A higher BMI indicates a higher risk of health issues, which leads to increased medical spending. This results in higher insurance premiums. |

| Other Factors | Age, family history, tobacco and alcohol use, and athletic build can also influence insurance rates. |

What You'll Learn

Body Mass Index (BMI)

BMI is calculated using the following formula:

BMI = (Weight in kilograms) / (Height in meters)^2

Alternatively, the imperial system can be used:

BMI = (Weight in pounds) / (Height in inches)^2 * 703

Once an individual's BMI has been calculated, it can be categorised as follows:

- Underweight: BMI below 18.5

- Normal weight: BMI between 18.5 and 24.9

- Overweight: BMI between 25 and 29.9

- Obese: BMI of 30 or above

Insurance companies commonly use BMI charts to determine an individual's health risk and set their premium amount. A higher BMI indicates a higher risk of health issues, such as coronary heart disease, diabetes, and other weight-related illnesses. As a result, insurance companies may charge a higher premium to individuals with a higher BMI, as they anticipate higher medical spending for these individuals.

However, it is important to note that BMI is not the sole factor in determining insurance rates. Other factors, such as age, family history, tobacco and alcohol use, and overall lifestyle, also play a significant role in calculating insurance premiums. Additionally, there are cases where BMI may not accurately reflect an individual's health, such as with athletes who have a higher muscle mass. Therefore, while BMI is a useful tool, it is just one of the many factors considered by insurance companies.

Life Insurance and Medi-Cal: How Does Eligibility Work?

You may want to see also

Health risks associated with high BMI

A high BMI is associated with a range of health risks and can effectively shorten your life. Here are some of the health risks associated with a high BMI:

Heart Disease and Stroke

Excess weight, especially around the stomach, increases the likelihood of high blood pressure and high cholesterol, which in turn make heart disease and stroke more probable. Obesity is also linked to high blood sugar and insulin resistance, which can lead to type 2 diabetes. This condition can further increase the risk of heart disease and stroke over time.

Obstructive Sleep Apnea

Obesity is a significant risk factor for obstructive sleep apnea, a breathing condition where the airway narrows during sleep. This can cause heavy snoring and brief periods of stopped breathing, resulting in daytime sleepiness and increased risk of heart disease and stroke.

Cancers

Obesity has been linked to various types of cancers, including those of the colon, breast (post-menopause), endometrium, kidney, esophagus, gallbladder, ovaries, and pancreas. As BMI increases, so does the risk of cancer and death from cancer.

Gallbladder Disease and Gallstones

Excess weight is associated with a higher risk of gallbladder disease and gallstones. However, it is important to note that rapid weight loss can also increase the likelihood of gallstones.

Osteoarthritis

Carrying extra weight places additional pressure on joints, particularly the knees, hips, and back, wearing away the protective cartilage. This can lead to joint pain and osteoarthritis.

Gout

Gout is a form of inflammatory arthritis caused by excess uric acid in the blood, which forms crystals that deposit in the joints and cause pain. Obesity is a risk factor for gout and is often related to insulin resistance.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

Life insurance premiums and weight

Life insurance companies use a variety of health and lifestyle factors to assess how risky an individual is to insure and to determine the cost of their policy. One of these factors is Body Mass Index (BMI) – a numerical value calculated from a person's weight and height. While it does not directly measure body fat, it can be indicative of whether an individual is underweight, a normal weight, overweight, or obese.

How BMI Affects Insurance Premiums

Insurance companies use BMI charts to determine how much an individual will pay in premiums. If your BMI is on the lower side of the overweight range, you can expect to be offered a reasonable premium. However, if your weight is on the higher side of the BMI chart, your life insurance premium will be more expensive. This is because a higher BMI indicates a higher risk of weight-related health issues, which could result in more frequent visits to the hospital and higher medical costs.

Other Factors that Affect Premiums

It's important to note that BMI is not the only factor that insurance companies consider when determining premiums. Age, gender, medical history, family history, and lifestyle factors can also impact the cost of life insurance. For example, younger individuals are often offered better premium rates than older people, as they are seen as less of a liability to the company. Similarly, a person with a high BMI who is otherwise healthy and has no underlying health conditions may be offered a better rate than someone with a lower BMI who has a history of smoking or drinking alcohol excessively.

Tips for Overweight Individuals

If you are overweight, there are several things you can do to improve your chances of securing life insurance and getting a reasonable premium:

- Compare policies from different insurance companies, as underwriting standards and rate structures vary.

- Work with an insurance agent who can guide you through the application process and help you find the best rates.

- Consider specialist insurers that cater to individuals with specific health conditions, including those related to weight.

- Make positive lifestyle changes, such as adopting a balanced diet and engaging in regular physical activity, to improve your overall health and potentially lower your insurance premiums over time.

Life Insurance Payouts After Suicide: What Spouses Need to Know

You may want to see also

Losing weight before applying for life insurance

- Understanding Body Mass Index (BMI): BMI is a numerical value calculated from an individual's weight and height, which is used by insurance companies to assess health risks. While it is not a perfect indicator of health, it is a common tool used by insurers. A BMI above 25 is considered overweight, and a BMI above 30 is considered obese.

- Impact of Weight on Insurance Premiums: Insurance companies use BMI charts to determine your premium. If your BMI is on the lower end of the overweight range, you can expect reasonable premiums. However, if your BMI is on the higher end, your life insurance premium will be more expensive. This is because individuals with higher BMIs are considered to have a higher risk of health issues, which may result in more frequent hospital visits and higher medical expenditures.

- Long-Term Weight Loss: If your BMI falls in the obese range, long-term weight loss can help lower your premiums. Insurance companies consider not just your current BMI but also your weight loss or gain within the past 12 months. Losing a significant amount of weight just before applying for life insurance may not help lower your rate, but maintaining a lower weight for a longer period will be beneficial.

- Health Improvements: Making positive lifestyle changes, such as adopting a balanced diet and engaging in regular physical activity, can improve your overall health and potentially lower your insurance premiums over time. Improving your health can reduce your risk of obesity-related illnesses, such as diabetes, heart disease, and respiratory issues, which are taken into account by insurance companies.

- Shopping Around: Different insurance companies have varying underwriting standards and rate structures. It's advisable to compare quotes from multiple insurers to find the most favourable rates for your situation. Some companies may have more lenient guidelines regarding weight, while others may offer better rates for individuals with a similar height and weight profile to yours.

- Working with an Agent: Consider working with a licensed insurance agent who can guide you through the application process. They can provide insights into which insurers are more lenient with overweight applicants and help you secure the best possible rates.

Remember, while losing weight can help improve your insurance rates, it's important to focus on long-term health improvements rather than short-term weight loss strategies. Maintaining a healthy weight and improving your overall health will not only help with your insurance premiums but also benefit your overall well-being.

Life Coaching: What's Covered Under Sutter Health Insurance?

You may want to see also

Other factors that determine life insurance rates

While weight is a factor in determining life insurance rates, there are several other factors that play a role in the calculation of life insurance premiums. These factors are used by insurance companies to assess the risk associated with insuring an individual and to determine the cost of coverage. Here are some of the key factors that influence life insurance rates:

Age

Age is one of the most significant determinants of life insurance rates. The younger an individual is, the lower the premiums tend to be. This is because younger people generally have a longer life expectancy and are less likely to become ill. As a result, the likelihood of insurance companies having to pay out a claim during the policy term decreases with the age of the insured.

Gender

Gender also influences life insurance rates, with women typically paying lower premiums than men. This is due to the fact that, on average, women have a longer life expectancy than men. According to statistics, women tend to live roughly five to six years longer than men, which translates to lower insurance rates for women.

Health Status

The health status of an individual is a critical factor in determining life insurance rates. The presence of certain health conditions, such as high blood pressure, anxiety, depression, diabetes, or sleep apnea, can lead to higher premiums. Insurance companies often conduct medical examinations, review medical records, and assess prescription drug histories to evaluate the health of the applicant.

Family Medical History

The medical history of an individual's family can also impact life insurance rates. A family history of serious medical conditions, such as cancer, cardiovascular disease, or stroke, may increase the likelihood of developing these ailments. As a result, insurance companies may view this as a higher risk and charge higher premiums.

Lifestyle Choices

Lifestyle choices, such as tobacco and alcohol use, can significantly affect life insurance rates. Smoking, in particular, is considered a high-risk factor and can lead to substantially higher premiums. Even occasional smoking or the use of other nicotine products can result in higher rates.

Occupation and Hobbies

An individual's occupation and hobbies can also play a role in determining life insurance rates. Dangerous occupations, such as working in law enforcement or mining, are often viewed as riskier to insure and may lead to higher premiums. Similarly, risky hobbies, such as scuba diving, skydiving, or piloting planes, can also increase insurance rates.

These factors, along with weight, contribute to the overall assessment of an individual's health and risk profile, which insurance companies use to set life insurance rates. It is important to note that each insurance company may weigh these factors differently, so it is beneficial to compare rates and policies from multiple insurers.

FCCU: Life Insurance Options and Availability

You may want to see also

Frequently asked questions

Your weight is one of several factors that life insurance companies consider when assessing your health and, consequently, your insurance premiums. A higher weight can lead to higher premiums because, according to insurance underwriting calculations, people who weigh more tend to have a lower life expectancy.

Insurance companies commonly use Body Mass Index (BMI) charts to assess an individual's health risk. These charts take into account an individual's weight and height to determine whether they are underweight, normal weight, overweight, or obese. While BMI is a widely used indicator, it is not the sole factor, as family history, lifestyle choices, and other medical conditions are also considered.

Maintaining a healthy weight is beneficial not only for securing lower insurance premiums but also for improving your overall health. If you are concerned about your current weight, consider making positive lifestyle changes, such as adopting a balanced diet and engaging in regular physical activity. These changes can not only improve your health but also potentially lower your insurance premiums over time.