Life insurance is a crucial financial tool, and understanding the nuances between revocable and irrevocable policies is essential for making informed decisions. Revocable life insurance, also known as term life or temporary life insurance, offers coverage for a specified period, typically 10, 20, or 30 years. It provides financial protection during this term and can be canceled or modified by the policyholder at any time, making it flexible and suitable for those who may need coverage for a specific period. On the other hand, irrevocable life insurance, often referred to as permanent life insurance, provides lifelong coverage and is designed to remain in effect until the insured individual passes away. This type of policy offers a guaranteed death benefit and can accumulate cash value over time, making it a long-term financial commitment that provides both insurance and savings benefits.

| Characteristics | Values |

|---|---|

| Definition | Revocable life insurance is a type of policy that can be canceled or modified by the policyholder at any time, while irrevocable life insurance is a permanent policy that cannot be canceled once it is in effect. |

| Flexibility | Revocable policies offer more flexibility as they can be adjusted or terminated by the policyholder. Irrevocable policies are permanent and provide long-term coverage. |

| Cost | Revocable policies are generally more affordable initially, as they may have lower premiums. Irrevocable policies can be more expensive due to their permanent nature and the guarantees they offer. |

| Tax Implications | Revocable policies may be subject to income tax when surrendered or canceled. Irrevocable policies are typically tax-free and can be passed on to beneficiaries without taxation. |

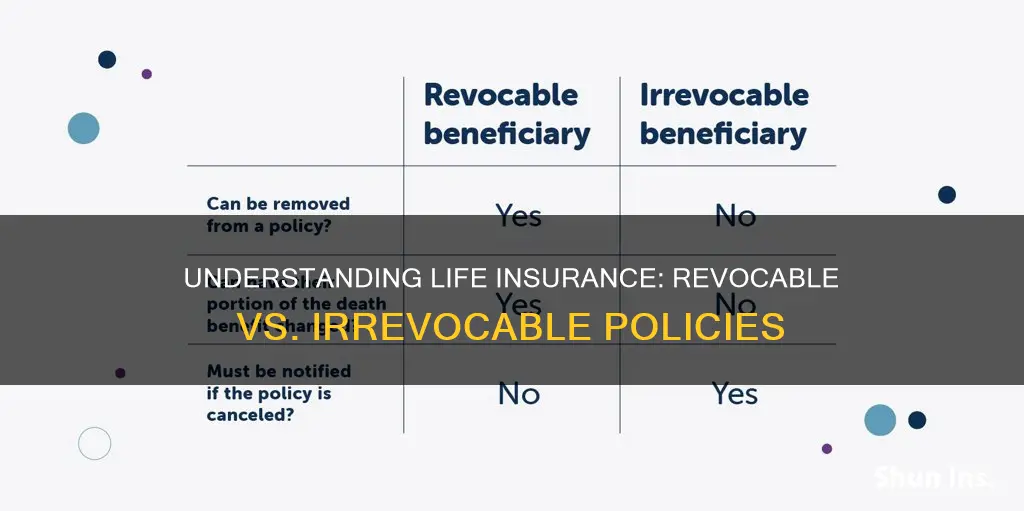

| Beneficiary Selection | With revocable policies, the policyholder can change beneficiaries at any time. Irrevocable policies have a designated beneficiary, and the policyholder's right to change beneficiaries is limited. |

| Investment Component | Revocable policies often include an investment component, allowing the policyholder to grow the cash value. Irrevocable policies may also have an investment aspect, but the focus is more on providing permanent coverage. |

| Longevity | Revocable policies may not provide coverage for a lifetime and can be canceled. Irrevocable policies offer coverage for the insured's entire life, ensuring long-term protection. |

| Irrevocable Nature | The key difference is that irrevocable life insurance is a permanent commitment, providing coverage for the insured's entire life, while revocable policies can be adjusted or canceled. |

What You'll Learn

- Revocable vs. Irrevocable: Revocable life insurance can be canceled, while irrevocable policies are permanent and cannot be terminated

- Lapse Risk: Revocable policies may lapse if premiums are not paid, whereas irrevocable ones offer lifelong coverage

- Flexibility: Revocable insurance offers flexibility in terms of policy changes, while irrevocable policies are set in stone

- Tax Implications: Revocable policies may have tax consequences upon cancellation, while irrevocable ones offer tax-free benefits

- Beneficiary Control: Revocable insurance allows policyholders to change beneficiaries, while irrevocable policies provide fixed beneficiary rights

Revocable vs. Irrevocable: Revocable life insurance can be canceled, while irrevocable policies are permanent and cannot be terminated

When it comes to life insurance, understanding the difference between revocable and irrevocable policies is crucial for making informed financial decisions. These two types of life insurance have distinct characteristics that can significantly impact how you protect your loved ones and your financial goals.

Revocable life insurance is a flexible and customizable option that allows policyholders to make changes or even cancel the policy at any time. This type of insurance is often chosen by individuals who want the freedom to adjust their coverage as their circumstances change. For example, if you take out a revocable life insurance policy and later decide to reduce your coverage amount due to improved health or financial changes, you can simply contact your insurance provider and make the necessary adjustments. The beauty of revocable life insurance is that it provides a safety net without the long-term commitment associated with some other insurance products.

On the other hand, irrevocable life insurance is a permanent fixture in your financial plan. Once you purchase an irrevocable policy, it cannot be canceled or modified. This type of insurance is typically chosen for its stability and the long-term financial security it provides. Irrevocable life insurance is often used to secure a specific financial goal, such as funding a trust or providing a lump-sum payment for a child's education. The permanence of this policy ensures that the intended beneficiaries will receive the death benefit as specified, without the possibility of changes or cancellations.

The key difference lies in the level of commitment and flexibility. Revocable life insurance offers policyholders the ability to adapt and make changes, providing a sense of control and adaptability. In contrast, irrevocable life insurance is a long-term financial decision, offering stability and certainty, but with less flexibility. It's essential to consider your financial goals, the level of commitment you're willing to make, and your future plans when deciding between the two.

In summary, revocable life insurance provides flexibility and the option to adjust or cancel, while irrevocable life insurance is a permanent financial commitment, offering stability and long-term security. Understanding these differences is the first step in choosing the right life insurance policy to meet your unique needs and protect your loved ones.

Statins and Life Insurance: Blood Test Impact

You may want to see also

Lapse Risk: Revocable policies may lapse if premiums are not paid, whereas irrevocable ones offer lifelong coverage

When it comes to life insurance, understanding the difference between revocable and irrevocable policies is crucial, especially when considering the aspect of lapse risk. This risk refers to the possibility of the insurance policy being canceled or terminated if the required premiums are not paid.

Revocable life insurance policies are flexible and customizable, allowing policyholders to adjust their coverage as their needs change. However, this flexibility comes with a potential drawback. If the policyholder fails to make the premium payments, the policy can lapse. This means that the coverage provided by the policy will no longer be in effect, and the insurance company may even require the return of any paid-up premiums. Revocable policies often have a grace period during which the policyholder can pay the missed premium and keep the coverage intact, but if they fail to do so, the policy may be canceled.

On the other hand, irrevocable life insurance policies offer a more permanent and secure form of coverage. Once the policy is in place, it remains valid for the policyholder's entire life, providing lifelong protection. Irrevocable policies are typically more expensive because they guarantee coverage regardless of the policyholder's future financial circumstances. The premiums for these policies are often set for the entire term, ensuring that the coverage is maintained without the risk of lapse. This feature is particularly valuable for those seeking long-term financial security and peace of mind.

The key difference lies in the level of commitment and the associated risks. Revocable policies provide flexibility but carry the risk of lapse, while irrevocable policies offer a more stable and permanent solution, albeit with higher costs. It is essential for individuals to carefully consider their financial situation and long-term goals when choosing between these two types of life insurance to ensure they make an informed decision.

Suicide and Life Insurance: What Cover Does My Dad Have?

You may want to see also

Flexibility: Revocable insurance offers flexibility in terms of policy changes, while irrevocable policies are set in stone

When it comes to life insurance, understanding the difference between revocable and irrevocable policies is crucial for making informed decisions about your financial security. One of the key aspects that set these two types of insurance apart is flexibility.

Revocable life insurance, as the name suggests, provides policyholders with the flexibility to make changes to their insurance plan. This type of policy is highly customizable, allowing individuals to adjust coverage amounts, beneficiaries, and other terms according to their evolving needs and circumstances. For instance, if you decide to purchase a larger home or start a family, you can easily increase your insurance coverage to ensure adequate protection for your loved ones. Additionally, if your financial situation improves, you might choose to reduce the coverage, saving money on premiums without compromising the insurance protection. This flexibility is particularly valuable for those who anticipate significant life changes or want to adapt their insurance strategy as their personal goals and responsibilities evolve.

On the other hand, irrevocable life insurance, once issued, cannot be altered or canceled without severe financial consequences. This type of policy is a long-term commitment, providing permanent coverage with fixed terms and conditions. Once you've chosen the coverage amount and other specifications, any changes or modifications become extremely difficult and often costly. Irrevocable life insurance is an excellent choice for those seeking long-term financial security and a stable insurance plan. It is particularly useful for individuals who want to ensure a specific level of coverage for their beneficiaries, especially in cases where the insured party has a fixed income or a stable financial situation.

The flexibility offered by revocable insurance is a significant advantage for those who value adaptability and the ability to respond to life's changing circumstances. It allows individuals to make adjustments as needed, ensuring that their insurance plan remains aligned with their current and future financial goals. In contrast, irrevocable policies provide a sense of permanence and security, ideal for those who prefer a long-term, fixed-term insurance strategy.

In summary, the choice between revocable and irrevocable life insurance depends on your personal preferences and financial goals. Revocable insurance provides the flexibility to adapt to life changes, while irrevocable policies offer long-term stability. Understanding these differences will enable you to make an informed decision regarding the type of life insurance that best suits your needs.

Life Insurance Urine Tests: What Are They Checking?

You may want to see also

Tax Implications: Revocable policies may have tax consequences upon cancellation, while irrevocable ones offer tax-free benefits

When it comes to life insurance, understanding the difference between revocable and irrevocable policies is crucial, especially when considering the tax implications. Revocable life insurance policies, as the name suggests, can be canceled or modified by the policyholder at any time. This flexibility comes with certain tax consequences. If a revocable policy is canceled, the premiums paid may be subject to income tax treatment as a return of premium. This means that the amount paid in premiums, minus any interest or investment gains, will be returned to the policyholder as taxable income. This can result in a significant tax liability, especially if the policyholder has been paying premiums for an extended period.

On the other hand, irrevocable life insurance policies provide a different tax scenario. Once the policy is in force, the death benefit paid to the beneficiaries upon the insured's passing is generally tax-free. This is a significant advantage as it ensures that the entire death benefit can be passed on to the intended recipients without any tax implications for the beneficiaries. Irrevocable policies are typically permanent, meaning they cannot be canceled or modified by the policyholder. This permanence offers a level of security and predictability, especially in terms of tax planning.

The tax-free nature of irrevocable life insurance is a result of the policy's permanent nature and the way it is structured. Since the policyholder cannot cancel or change the terms, the insurance company is more confident in providing the death benefit. This confidence allows for the tax-free treatment of the death benefit, which can be a valuable asset for estate planning and wealth transfer. It is essential for individuals to consider their long-term financial goals and the potential tax benefits when deciding between revocable and irrevocable life insurance options.

In summary, the key tax difference lies in the treatment of premiums and death benefits. Revocable policies may result in tax consequences when canceled, while irrevocable policies offer tax-free death benefits, providing a more secure and predictable financial planning tool. Understanding these implications is vital for making informed decisions regarding life insurance and its role in an individual's overall financial strategy.

Life Insurance: Dividing the Pie of Protection

You may want to see also

Beneficiary Control: Revocable insurance allows policyholders to change beneficiaries, while irrevocable policies provide fixed beneficiary rights

When it comes to life insurance, understanding the difference between revocable and irrevocable policies is crucial, especially when considering the control beneficiaries have over the insurance proceeds. This aspect of control is a significant differentiator between the two types of policies.

Revocable life insurance policies offer policyholders the flexibility to modify or even cancel the policy at any time. This means that the policyholder can change the beneficiaries named in the policy, ensuring that the insurance proceeds can be directed to the intended recipients. For instance, if a policyholder decides to update their will and wishes to name a new beneficiary, they can simply notify the insurance company and make the necessary changes. This flexibility is particularly appealing to those who want to adapt their insurance coverage as their personal circumstances evolve.

In contrast, irrevocable life insurance policies provide a fixed set of beneficiary rights that cannot be altered by the policyholder. Once the beneficiaries are named, they remain in place unless the policy is surrendered or the insurance company agrees to changes. This lack of flexibility ensures that the beneficiaries' rights are protected and that the insurance proceeds are distributed according to the original specifications. Irrevocable policies are often chosen by individuals who want to provide a secure financial legacy for their beneficiaries, as the designated recipients can rely on receiving the insurance money as intended.

The key advantage of revocable insurance in this context is the ability to adapt to changing life circumstances. Policyholders can ensure that their beneficiaries are always the ones they intend to support, whether it's family members, charitable organizations, or other individuals. This adaptability is especially valuable for those who frequently move, get married, or experience other life changes that might affect their original beneficiary choices.

On the other hand, irrevocable policies offer a sense of security and finality. Once the beneficiaries are set, they are protected from any future changes that the policyholder might make. This can be beneficial for those who want to provide a stable and predictable financial future for their loved ones, knowing that the insurance proceeds will go to the intended recipients without the risk of alteration.

In summary, the choice between revocable and irrevocable life insurance policies significantly impacts the level of control beneficiaries have over the insurance proceeds. Revocable policies offer flexibility, allowing policyholders to change beneficiaries as needed, while irrevocable policies provide a fixed and secure beneficiary structure, ensuring that the intended recipients receive the insurance money as specified. Understanding these differences is essential for individuals to make informed decisions about their life insurance coverage and the financial legacy they wish to create.

Life Insurance: Retirement Money or Separate Savings?

You may want to see also

Frequently asked questions

The key distinction lies in the level of flexibility and the finality of the policy. Revocable life insurance, often referred to as term life insurance, is a temporary policy that can be canceled or modified by the insurer or the policyholder at any time. It provides coverage for a specified period, such as 10, 20, or 30 years, and offers a straightforward way to secure financial protection for a defined period. On the other hand, irrevocable life insurance is a permanent policy that cannot be canceled or modified once it has been issued. This type of insurance provides lifelong coverage and is often used for long-term financial planning, estate preservation, or as a funding vehicle for trusts.

Revocable life insurance is highly flexible, allowing policyholders to adjust their coverage as their needs change. It is ideal for those who want a customizable policy and may not require long-term coverage. Policyholders can typically increase or decrease the coverage amount, change beneficiaries, or even convert the policy to a different type of insurance if needed. Irrevocable life insurance, however, is less flexible. Once the policy is in force, changes are generally not allowed, making it a more permanent commitment. This type of insurance is often used when the insured party wants to ensure a consistent level of coverage for their beneficiaries over their lifetime.

Yes, tax considerations differ between revocable and irrevocable life insurance. Revocable life insurance is typically treated as a general asset for tax purposes, meaning it may be subject to estate taxes upon the insured's death. In contrast, irrevocable life insurance can offer tax advantages. Since the policy is irrevocable, it is considered an asset of the trust or the insured's estate, which can help reduce the overall taxable estate. Additionally, the death benefit of an irrevocable life insurance policy is generally not subject to income tax for the beneficiaries.

Revocable life insurance is advantageous for those seeking affordable coverage for a specific period. It is often more cost-effective than permanent policies and can be a practical solution for individuals who want coverage for a particular stage of life, such as when they have young children or a mortgage. Irrevocable life insurance, on the other hand, provides long-term financial security. It ensures that the death benefit is locked in at a specific amount, which can be beneficial for estate planning, business continuity, or funding long-term care plans.

Yes, combining revocable and irrevocable life insurance can be a strategic approach to meet various financial goals. For instance, an individual might purchase a large amount of irrevocable life insurance to secure a substantial death benefit for their beneficiaries and estate planning purposes. Simultaneously, they could opt for a smaller, revocable policy to cover any remaining needs or to provide additional coverage during a specific period. This combination allows for a tailored approach to insurance, ensuring both flexibility and long-term financial protection.