Life insurance urine tests are a common part of the application process for life insurance. They are used to assess an applicant's health and determine their insurability. The tests can detect markers that indicate the presence of certain medical conditions or underlying health issues, such as urinary tract infections, cystitis, bladder inflammation, kidney disease, liver function, and bladder and kidney infections. They can also detect drug use, including illegal drugs and prescription medications, as well as tobacco and alcohol consumption. Insurance companies use the results of these tests to evaluate an individual's health profile and determine the risk associated with providing them coverage.

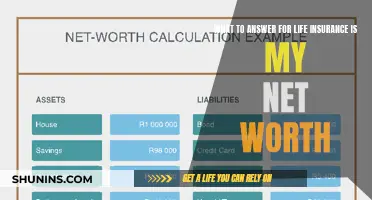

| Characteristics | Values |

|---|---|

| Drug use | Amphetamines/methamphetamines, cocaine, opiates, phencyclidine (PCP), barbiturates, benzodiazepines, methadone, marijuana, opioids, heroin, ecstasy, prescription drugs |

| Nicotine use | Yes/No |

| Health issues | Kidney infection, liver problems, diabetes, kidney disease, bladder and kidney infections, urinary tract disorders, cystitis, bladder inflammation, liver damage, liver disease, high blood pressure, heart disease, cancer, cholesterol levels, triglyceride levels, haemoglobin levels, protein levels, blood in urine, bilirubin levels, creatinine levels, urine acidity, glucose levels, weight and body mass index, blood sugar levels |

| Medication use | Diuretics, blood pressure medication, antidepressants, painkillers, acetaminophen, ibuprofen, antihistamines, cough suppressants, sleep aids, beta-blockers |

| Lifestyle factors | Tobacco use, alcohol consumption, illegal drug use, high-risk sports and hobbies, driving record |

What You'll Learn

Drug use

Life insurance urine tests are used to detect drug use, including both illegal drugs and prescription medications. This is because drug use can significantly impact an individual's health and increase the risk of future claims.

The urine tests can identify a range of illegal drugs, including amphetamines/methamphetamines, cocaine, opiates, phencyclidine (PCP), barbiturates, benzodiazepines, and methadone. These tests can also detect prescription medications such as opioids (e.g. codeine and oxycodone), benzodiazepines (e.g. diazepam and alprazolam), and stimulants (e.g. Adderall and Ritalin). Over-the-counter medications like acetaminophen, ibuprofen, antihistamines, cough suppressants, and sleep aids may also be detected.

The presence of these drugs or medications does not automatically disqualify an individual from obtaining life insurance coverage. However, it may result in higher premiums or further evaluation by the insurance company. It is crucial to disclose any prescription medications or drug use during the application process, as failing to do so could result in the denial or cancellation of coverage.

In addition to drug testing, life insurance urine tests may also screen for alcohol consumption. Elevated levels of alcohol in the urine can indicate excessive drinking and potential health risks associated with alcohol abuse.

Life Insurance: Haven Life and MassMutual Compared

You may want to see also

Nicotine use

Life insurance companies often require a urine test during the application process to evaluate an applicant's health profile. The urine test is part of a comprehensive medical exam that includes a physical, blood test, and prescription drug check. The results of these tests are used to determine how much the applicant will pay in premiums.

Urine tests can detect nicotine and cotinine, which is an alkaloid found in tobacco. Cotinine is more stable and lasts longer in the body than nicotine, so it is a more reliable indicator of tobacco use. The presence of cotinine in the body indicates that nicotine has been processed.

The urine test can show whether an applicant is a regular smoker or an occasional one. It can also indicate whether an applicant has recently quit smoking or is using a nicotine replacement product like gum or a patch. However, the test cannot distinguish between different sources of nicotine, so it may classify someone who is using a nicotine patch or chewing tobacco as a smoker.

The time it takes for nicotine and cotinine to leave the body varies depending on the individual and the type of tobacco used. In general, nicotine will be undetectable in a urine test after 3-4 days, but this may be longer if menthol cigarettes are involved. It is important to note that nicotine can be detected in hair for up to 12 months, so insurers may also use hair tests to detect long-term tobacco use.

Life insurance companies charge higher premiums for smokers due to the increased health risks associated with smoking. Smokers are more likely to pass away while they are covered by insurance, so insurers raise premium prices to compensate for the higher risk. If an applicant lies about their smoking status and the insurer discovers this, it may be considered insurance fraud, and the policy could be voided or the death benefit reduced. Therefore, it is important to be honest about any nicotine or tobacco use during the application process.

Life Insurance for Smokers: What You Need to Know

You may want to see also

Health issues

Life insurance urine tests are a crucial step in the underwriting process, allowing insurance companies to gain a comprehensive understanding of an individual's health and assess the potential risks involved in providing them with coverage.

Diabetes

Urine tests can detect high levels of glucose in the urine, which is a marker for diabetes. Elevated glucose levels indicate an increased risk of various health complications, and insurers will consider this when determining coverage and premiums.

Kidney Disease

Urine tests can assess the presence of protein in the urine, which can be an early sign of kidney disease. Kidney disease can impact an individual's overall health and may require ongoing medical treatment. Insurers will consider the potential impact of kidney disease when evaluating an individual's insurability.

Liver Function

Life insurance urine tests may screen for liver function markers, such as bilirubin and liver enzymes. Abnormal levels of these markers may indicate liver damage or disease, which can affect an individual's insurability and premium rates.

Bladder and Kidney Infections

Urine tests can detect the presence of bacteria or white blood cells in the urine, indicating bladder or kidney infections. These infections can affect an individual's health and may require medical treatment.

Urinary Tract Disorders

In addition to infections, life insurance urine tests can help identify other urinary tract disorders, such as kidney stones or bladder issues. These conditions may increase the risk of future health complications and impact an individual's insurability and premium rates.

Heart Disease

Urine tests can also be used to detect abnormal liver and kidney functions, which can be indicators of heart disease. Heart disease is a serious condition that can increase the likelihood of future claims, and insurers will consider this when determining coverage and premiums.

PNC Bank: Credit Life Insurance for Vehicles?

You may want to see also

Medication use

The urine tests can also confirm if an individual is taking medications as prescribed. This is important because certain medications may interact with other drugs or have side effects that increase the risk of health complications. For example, the presence of prescription medications such as opioids, benzodiazepines, and stimulants can be detected, and their use must be disclosed during the application process. Failing to do so can result in the denial of coverage or the cancellation of an existing policy.

Additionally, urine tests can reveal prescription drugs that were not disclosed on the application. This helps insurance companies accurately assess an individual's health and determine appropriate coverage and premiums. It is important to be transparent about medication usage to ensure a fair evaluation of insurability and to avoid any issues with the insurance company.

Furthermore, life insurance urine tests can identify the misuse or abuse of prescription medications. For instance, individuals who exceed prescribed dosages or use medications for non-medical purposes may test positive for such misuse. This information is crucial for insurers as it helps them assess the potential risks associated with an applicant's medication usage.

In summary, medication use is a significant aspect of life insurance urine tests. These tests can detect a wide range of medications, including prescription, over-the-counter, and misused drugs. The results provide valuable insights for insurance companies to evaluate an individual's health, confirm medication adherence, identify potential risks, and determine appropriate coverage and premium rates. Transparency about medication usage during the application process is essential for an accurate assessment of insurability.

Group Life Insurance: Church Employee Benefits Explored

You may want to see also

Lifestyle factors

In addition to detecting drug use, medication use, and specific health conditions, life insurance urine tests also take into account various lifestyle factors that can impact an individual’s insurability. These factors provide insurers with insights into an applicant’s overall health and potential risks. Here are some of the key lifestyle factors considered:

Tobacco Use

Life insurance urine tests often screen for nicotine and its metabolites. The presence of nicotine indicates tobacco use, including cigarettes, cigars, and smokeless tobacco. Tobacco use is a significant risk factor for various health conditions, including cancer, heart disease, and respiratory issues. Individuals who use tobacco products typically face higher premiums due to the increased health risks associated with smoking.

Alcohol Consumption

While not directly detected through urine tests, excessive alcohol consumption can impact an individual’s overall health. Insurance companies may ask about alcohol use during the underwriting process and may collect information from other sources to assess an individual’s drinking habits. Excessive alcohol consumption can lead to liver disease, cardiovascular issues, and other health complications that may affect insurability.

Weight and Body Mass Index (BMI)

Although not directly assessed through urine tests, weight and BMI can impact an individual’s insurability. Being overweight or obese is associated with a higher risk of various health conditions, including heart disease, diabetes, and certain cancers. Insurance companies may consider an individual’s weight and BMI as part of their overall health assessment.

Occupational Hazards

Some occupations come with inherent risks that may affect an individual’s health and insurability. Insurance companies may inquire about an individual’s occupation during the underwriting process to assess any potential occupational hazards that could impact their overall risk profile.

Sports and Hobbies

Engaging in high-risk or extreme sports and hobbies may impact an individual’s insurability. Activities such as skydiving, rock climbing, or motorcycle racing carry increased risk, and insurance companies may consider these factors when determining coverage and premiums.

Driving Record

While not directly related to a life insurance urine test, an individual’s driving record can impact their overall insurability. A poor driving history or a record of multiple accidents or DUIs can indicate higher-risk behaviour and may result in higher premiums or denial of coverage.

Life Insurance and Suicide: UK Payout Scenarios

You may want to see also

Frequently asked questions

A life insurance urine test, also known as a urinalysis or urine screening, is a common medical test used by insurance companies to assess an applicant's health and determine their insurability. This test involves providing a urine sample, which is then analysed in a laboratory for a variety of substances and markers.

A life insurance urine test can detect markers that indicate the presence of certain medical conditions or underlying health issues, such as:

- Urinary tract infections

- Cystitis or bladder inflammation

- Kidney disease

- Liver function

- Bladder and kidney infections

- Urinary tract disorders

- Drug use

- Medication use

- Lifestyle factors, such as tobacco or alcohol use

Life insurance companies use urine tests to gain valuable insights into an individual's health profile and assess the potential risks involved in insuring them. The results of the urine test help insurance companies evaluate an individual's health, confirm the information on their application, and determine how much they will pay in premiums.

Here are some tips for preparing for a life insurance urine test:

- Follow the instructions provided by the insurance company or testing facility carefully.

- Stay hydrated by drinking plenty of water in the days leading up to the test.

- Avoid excessive physical activity, especially on the day of the test.

- Be mindful of medications and inform the testing facility of any prescription or over-the-counter drugs you are taking.

- Disclose any relevant information, such as prescribed medications, recent illnesses, or ongoing medical treatments.

- Refrain from consuming alcohol or using recreational drugs in the days leading up to the test.