Life insurance is a crucial financial tool that provides peace of mind and security for individuals and their loved ones. While the primary purpose of life insurance is to offer a death benefit, some policies, like whole life and universal life, also accumulate cash value over time. This feature allows policyholders to access and utilise the funds for various purposes during their lifetime. Term life insurance, on the other hand, does not have a cash value component, maintaining fixed premiums and death benefits without the potential for cash accumulation. This paragraph introduces the topic of whether level benefit life insurance, a type of term life insurance, includes a cash value component, and sets the context for further exploration of the features and benefits of different life insurance options.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Cash Value | Can be withdrawn, borrowed against or used to pay premiums |

| Death Benefit | Paid to beneficiaries upon death of the policyholder |

| Tax | Deferred |

| Premium | Fixed |

| Coverage | Lifelong |

| Investment | Interest-bearing savings account |

What You'll Learn

What is cash value life insurance?

Cash value life insurance is a form of permanent life insurance that features a cash value savings component. The policyholder can use the cash value for many purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums. Permanent life insurance policies such as whole life, variable life, and universal life can accumulate cash value over time.

The cash value of life insurance earns interest, and taxes are deferred on the accumulated earnings. While premiums are paid and interest accrues, the cash value builds over time. As the life insurance cash value increases, the insurance company's risk decreases, because the accumulated cash value offsets part of the insurer's liability.

Cash value life insurance is more expensive than term life insurance. This is because, unlike term life insurance, cash value insurance policies don't expire after a specific number of years.

The cash value component serves as a living benefit for policyholders, who may access funds in several ways. Most policies allow partial surrenders or withdrawals, though these reduce the death benefit. Some policies allow for unlimited withdrawals, while others restrict how many draws can be taken during a term or calendar year. Some policies limit the amounts available for removal (e.g. a maximum of $500).

If you withdraw more than the amount you've paid into the cash value, that portion will be taxed as ordinary income. Most cash value life insurance arrangements also allow for policy loans from the cash value. As with any other loan, the issuer will charge interest on the outstanding principal. The outstanding loan amount will reduce the death benefit dollar for dollar in the event of the death of the policyholder before full repayment of the loan.

Cash value may also be used to pay policy premiums. If there is a sufficient amount, a policyholder can stop paying premiums out of pocket and have the cash value account cover the payment.

Genetic Testing: Insurance Coverage and Life Insurance Applications

You may want to see also

How does cash value life insurance work?

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This means that the policy has a savings component that can be invested and withdrawn, in addition to the death benefit. When you make a premium payment, it is split into three parts: the cost of insurance, fees and charges, and the cash value. The cash value component typically earns interest or gains from investments, and this grows tax-deferred.

There are several types of cash value life insurance policies, including whole life, universal life, variable universal life, and indexed universal life insurance. Each policy type accrues cash value differently. For example, with whole life insurance, the cash value builds at a fixed rate determined by the insurer, whereas with universal life insurance, the growth is based on market interest rates and the insurer's performance.

Policyholders can access the cash value in several ways. One option is to take out a loan against the cash value, which can be used for anything from emergencies to supplementing retirement income. Policyholders can also make a partial or full withdrawal of the cash value, although this will reduce the death benefit. Additionally, the cash value can be used to pay policy premiums. If the policy is surrendered, the policyholder will receive the cash value minus any surrender charges and unpaid premiums or outstanding loan balances.

It is important to note that cash value life insurance is more expensive than term life insurance due to the cash value element. It may take several years for the cash value to build up, and it may not be the best option for those who are older as the cost of premiums may outweigh the benefits.

Group Life Insurance: Covering Your Immediate Family?

You may want to see also

What are the pros and cons of cash value life insurance?

Cash value life insurance is a permanent life insurance policy that includes a cash value feature. This means that the policyholder can withdraw or borrow money from their policy while they are alive. There are several pros and cons to this type of insurance.

Pros of Cash Value Life Insurance

- Your beneficiaries will receive a death benefit.

- Participating life insurance policies pay dividends.

- You can add riders for extra coverage.

- It offers tax advantages.

- It builds wealth on top of life insurance protection.

- There are no annual contribution limits.

- You can use the cash value in flexible ways.

Cons of Cash Value Life Insurance

- It is more expensive than term life insurance.

- Withdrawals and loans may reduce the death benefit.

- There may be potential tax and interest complications.

- It takes time to build cash value.

- Your policy could lapse if you borrow too much.

- Taxes may apply if you withdraw cash value or terminate the policy.

Globe Life Insurance Rates: Rising or Stable?

You may want to see also

How does cash value life insurance compare to term life insurance?

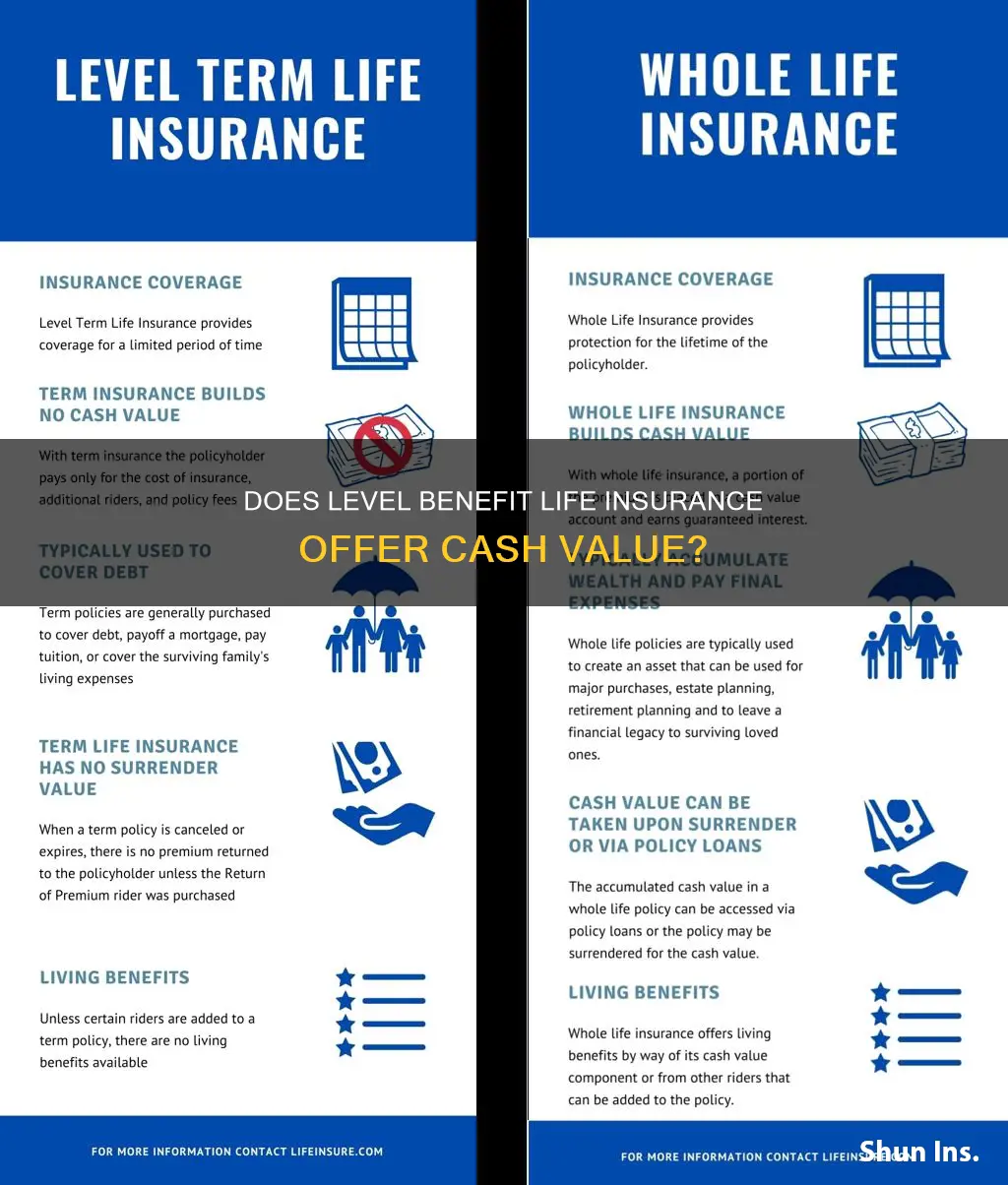

Term life insurance and cash value life insurance are two very different products with distinct advantages and disadvantages. Term life insurance is a much more straightforward product, while cash value life insurance is more complex and acts as a hybrid of insurance and investment.

Term Life Insurance

Term life insurance is a type of insurance that covers the policyholder for a set period, often 10, 20 or 30 years. It is a simple product that pays out a death benefit if the policyholder dies during the term. If the policyholder outlives the term, their beneficiaries will not receive any money. Term life insurance is generally the cheapest option for those seeking life insurance, and it does not build any cash value.

Cash Value Life Insurance

Cash value life insurance, on the other hand, is a permanent form of life insurance that includes a cash value savings component. This type of insurance is more expensive than term life insurance because it lasts for the lifetime of the policyholder and includes the cash value element. A portion of each premium payment goes towards the cost of insurance, while the remainder is deposited into a cash value account. This cash value grows over time and can be used for various purposes, such as borrowing against it or withdrawing cash. The cash value component typically earns interest or investment gains and grows tax-deferred.

Comparison

The main difference between term life insurance and cash value life insurance is that term life insurance is temporary and does not build cash value, while cash value life insurance is permanent and includes a savings component. Term life insurance is generally cheaper and more straightforward, while cash value life insurance is more complex and offers more flexibility. Cash value life insurance can be useful for those looking to build a nest egg over several decades, while term life insurance is sufficient for those who only need coverage for a specific period.

Hostplus Life Insurance: What You Need to Know

You may want to see also

Can you withdraw cash from a cash value life insurance policy?

Yes, you can withdraw cash from a cash-value life insurance policy. However, it's important to understand the mechanics and consequences of doing so.

Firstly, it's important to note that cash-value life insurance is a feature of permanent life insurance policies, such as whole life and universal life insurance. Term life insurance policies do not have a cash value component. Withdrawing cash from a permanent life insurance policy can be done in several ways, each with its own pros and cons.

Withdrawing

Withdrawing cash from your policy is usually distributed as a lump sum or in payments. The pros of this method include the fact that the cash is readily available up to a set limit, which is typically the amount you've contributed. Additionally, withdrawals from the policy basis (the premiums you've paid) are usually not considered taxable income. However, there are also cons to this method. Withdrawing cash may reduce your death benefit, and it may not be an option within the first two years of the policy.

Borrowing

Another option is to borrow funds from your insurance provider, using your policy as collateral, and then pay it back. The pros of this method include lower interest rates compared to personal or home equity loans, and no loan application or credit check is required. However, borrowing funds may incur interest charges, and any unpaid balance will reduce your benefits.

Surrendering

If you surrender your insurance policy, you cancel it and receive the surrender value in cash. The pro of this method is that you'll receive a lump sum payment. However, there are several cons. Surrender fees will reduce the cash you receive, and your beneficiaries will not receive a death benefit from the policy when you die.

Selling

Selling your insurance policy to a life settlement company is another option. The pros include receiving a lump sum payment and no longer owing premiums on the policy. However, your heirs won't receive a death benefit from the policy, you may owe taxes on the sale, and the proceeds from the sale may disqualify you from certain programs like Medicaid. Additionally, it may be difficult to sell a policy if you're younger than 65 and the policy is for less than $100,000.

It's important to carefully consider your options and consult a financial professional before making any decisions regarding your life insurance policy. Withdrawing cash from a cash-value life insurance policy can have significant implications for your financial plan and the benefits available to your beneficiaries.

Cerebral Palsy: Life Insurance Underwriting Considerations

You may want to see also

Frequently asked questions

Cash value life insurance is a form of permanent life insurance that features a cash value savings component. The policyholder can use the cash value for many purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums.

Cash value insurance is permanent life insurance because it provides coverage for the policyholder's entire life. Usually, cash value life insurance has higher premiums than term life insurance because of the cash value element. A portion of each premium payment is allocated to the cost of insurance and the remainder is deposited into a cash value account.

Cash value life insurance offers several benefits, including lifelong coverage, flexible access to funds, and reasonable premiums. It can also be used as a tool to help meet various needs, such as retirement planning or providing financial security for your family.

There are several ways to access the cash value of your life insurance policy, including taking out a loan against the policy, surrendering the policy, or making a withdrawal. However, it's important to note that withdrawing more than the amount you've paid into the cash value may result in taxes and a reduction in the death benefit.