Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their families. Among the various types of life insurance policies, some offer additional features that go beyond just providing a death benefit. One such feature is the savings component, which allows policyholders to build a cash value over time. This cash value can be used for various purposes, such as paying for future premiums, taking out loans, or even investing. In this article, we will explore the different life insurance policies that include a savings element and discuss the benefits and considerations of each.

What You'll Learn

- Term Life Insurance: Provides coverage for a set period, offering a cost-effective way to secure loved ones' financial future

- Whole Life Insurance: Combines insurance and savings, offering a guaranteed death benefit and a cash value that grows over time

- Universal Life Insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust their coverage and savings needs

- Variable Universal Life Insurance: Provides investment options, allowing policyholders to potentially earn higher returns on their savings

- Indexed Universal Life Insurance: Tracks market indices, offering potential for higher savings growth while providing a guaranteed death benefit

Term Life Insurance: Provides coverage for a set period, offering a cost-effective way to secure loved ones' financial future

Term life insurance is a type of coverage that provides financial protection for a specific period, typically 10, 20, or 30 years. It is a straightforward and cost-effective way to ensure that your loved ones are financially secure in the event of your untimely passing. This type of insurance is particularly appealing to those who want to provide a safety net for their families without the complexity and potential long-term financial burden associated with other life insurance products.

The beauty of term life insurance lies in its simplicity. You agree to pay a premium for a set period, and in return, your beneficiaries receive a lump-sum payment if you pass away during that term. This payment can help cover various expenses, such as mortgage payments, children's education, or daily living costs, ensuring that your family's financial obligations are met even if you are no longer around. One of the key advantages is that it offers pure protection without any savings or investment components, making it an affordable option.

When considering term life insurance, it's essential to evaluate your specific needs and circumstances. The length of the term should align with your financial goals and the time frame during which your loved ones would require financial support. For instance, if you have a young family and a mortgage, a 20-year term might be suitable, ensuring that your family is protected during the critical years. Additionally, the amount of coverage you choose should be sufficient to cover your family's potential financial needs during that period.

This type of insurance is an excellent choice for those who prioritize financial security and want a straightforward solution. It allows you to provide peace of mind to your loved ones without the added complexity of investment-linked policies. With term life insurance, you can focus on securing your family's future without the pressure of long-term financial commitments.

In summary, term life insurance is a powerful tool for anyone seeking to protect their loved ones financially. Its simplicity, cost-effectiveness, and ability to provide a critical financial safety net make it an attractive option for those looking to secure their family's future without unnecessary complications. By carefully considering your needs and choosing the right term length and coverage, you can ensure that your family is well-protected during the most important years of their lives.

Understanding Voluntary Supplemental Life Insurance: A Comprehensive Guide

You may want to see also

Whole Life Insurance: Combines insurance and savings, offering a guaranteed death benefit and a cash value that grows over time

Whole life insurance is a type of permanent life insurance that offers a unique combination of insurance coverage and savings benefits. It is designed to provide financial security for your loved ones while also allowing you to build a valuable asset over time. Here's how it works:

When you purchase a whole life insurance policy, you make regular premium payments, typically on a monthly, quarterly, or annual basis. These premiums consist of two main components: the death benefit and the cost of insurance. The death benefit is a guaranteed amount that your beneficiaries will receive upon your passing, providing financial support to your family. This aspect ensures that your loved ones are financially protected even in your absence.

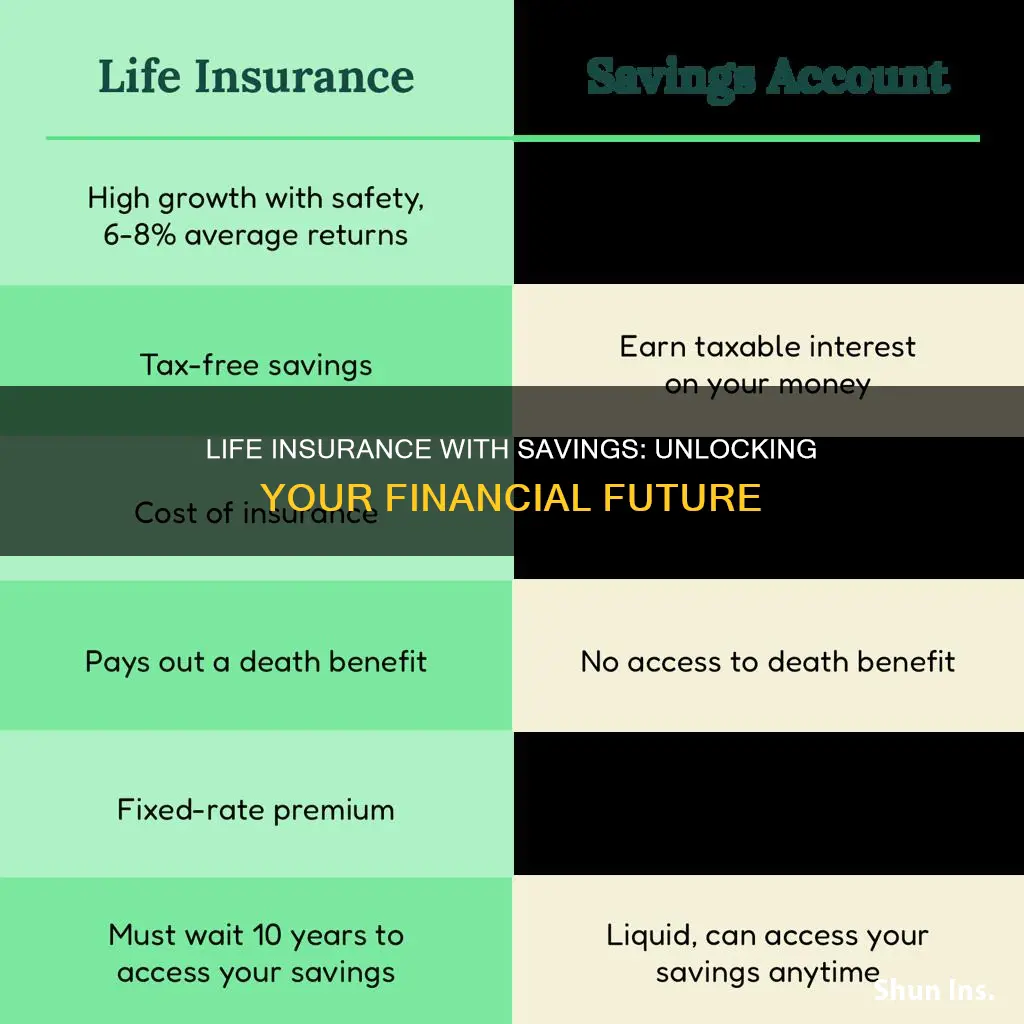

The second crucial element of whole life insurance is the cash value. Unlike term life insurance, which focuses solely on providing coverage for a specific period, whole life insurance includes a savings component. A portion of your premium payments goes into building this cash value, which grows tax-deferred over your policy's lifetime. The cash value accumulates at a guaranteed interest rate, ensuring that your savings grow steadily. This feature makes whole life insurance an attractive option for those seeking long-term financial planning and wealth accumulation.

One of the key advantages of whole life insurance is its predictability. The death benefit and cash value growth are guaranteed, providing stability and peace of mind. This predictability is especially beneficial for long-term financial goals, such as funding your child's education or planning for retirement. Additionally, the cash value can be borrowed against or withdrawn, allowing policyholders to access their savings without penalties, although this should be done cautiously to maintain the policy's integrity.

Over time, the cash value in your whole life insurance policy can become a substantial asset. It can be used to pay for various expenses, such as college tuition, home renovations, or business ventures. The flexibility of accessing your savings without surrendering the policy makes whole life insurance a versatile financial tool. Moreover, the guaranteed death benefit ensures that your beneficiaries receive the intended financial support, even if the cash value is utilized for other purposes.

In summary, whole life insurance offers a comprehensive approach to financial planning. It provides a guaranteed death benefit to protect your loved ones and a growing cash value for your financial goals. This type of insurance is an excellent choice for those seeking long-term savings and a reliable safety net for their family's future. As with any financial decision, it is advisable to consult with a professional to determine if whole life insurance aligns with your specific needs and objectives.

Life Insurance Payments: Are They Taxable?

You may want to see also

Universal Life Insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust their coverage and savings needs

Universal life insurance is a versatile and flexible type of life insurance that provides both a death benefit and a savings component. Unlike traditional term life insurance, which offers a fixed death benefit for a specified period, universal life insurance allows policyholders to customize their coverage and savings goals. This flexibility is a significant advantage for those seeking a comprehensive financial planning tool.

One of the key features of universal life insurance is the ability to adjust premiums and death benefits over time. Policyholders can choose to pay a fixed premium or a variable premium, which may fluctuate based on market performance. This adaptability is particularly beneficial for individuals who want to ensure their insurance coverage aligns with their changing financial circumstances. For example, a young professional might opt for a lower initial premium, allowing them to build savings over time, and then increase the premium and death benefit as their income and financial situation improve.

The savings element of universal life insurance is a powerful feature. Policyholders can allocate a portion of their premium payments to a cash value account, which grows tax-deferred. This cash value can be used to borrow funds, providing a source of emergency cash or a means to invest in other financial goals. Additionally, the policyholder can make additional contributions to the cash value, further enhancing the savings potential. Over time, the accumulated cash value can become a substantial asset, offering financial security and flexibility.

The flexibility of universal life insurance extends to the death benefit as well. Policyholders can adjust the amount of coverage they want to ensure that it meets their current needs. If a policyholder's financial situation changes, they can increase the death benefit to provide a more substantial financial safety net for their loved ones. This adjustability is particularly important for those with evolving financial goals and responsibilities.

In summary, universal life insurance stands out for its adaptability in both premium payments and death benefits. This flexibility empowers policyholders to tailor their insurance coverage to their unique circumstances and financial objectives. By offering a combination of insurance protection and a savings component, universal life insurance provides a comprehensive solution for individuals seeking to secure their financial future and the well-being of their dependents.

Transferring Life Insurance Policies: Is It Possible?

You may want to see also

Variable Universal Life Insurance: Provides investment options, allowing policyholders to potentially earn higher returns on their savings

Variable Universal Life Insurance (VUL) is a unique and powerful financial tool that offers a combination of life insurance coverage and investment opportunities. This type of insurance provides policyholders with a flexible and customizable way to secure their financial future while also allowing them to potentially grow their savings. Here's a detailed look at how VUL can be an excellent choice for those seeking a saving element in their life insurance:

VUL is designed to offer both immediate protection and long-term savings potential. When you purchase a VUL policy, you pay regular premiums, which are then invested according to your chosen strategy. One of the key advantages is the ability to customize your investment approach. Policyholders can select from various investment options, often including stocks, bonds, and mutual funds. This flexibility allows individuals to align their investments with their risk tolerance and financial goals. For those seeking higher returns, VUL provides an opportunity to potentially earn more on their savings compared to traditional fixed-rate life insurance policies.

The investment aspect of VUL is a significant draw for many. It offers a way to build wealth over time, providing policyholders with the chance to benefit from market growth. The investment accounts within the VUL policy can grow tax-deferred, meaning any earnings or capital gains are not subject to annual taxes as long as they remain in the policy. This feature encourages long-term savings and can be particularly attractive to those who want to maximize their financial growth. Additionally, VUL policies often provide a guaranteed death benefit, ensuring that your beneficiaries receive a specified amount upon your passing, providing financial security for your loved ones.

One of the strengths of VUL is its adaptability. Policyholders can adjust their investment strategy as their financial situation and goals evolve. This flexibility is especially beneficial for those who want to adapt to changing market conditions or adjust their risk exposure. For instance, if the market is performing well, investors can potentially increase their returns. Conversely, during market downturns, they can rebalance their portfolio to minimize risk. This dynamic approach to investing can be a powerful tool for those who want to make the most of their savings.

Furthermore, VUL policies often come with various riders and additional benefits. These can include additional death benefits, long-term care riders, or even annuity options. These features provide further customization and can enhance the overall value of the policy. For example, a long-term care rider can provide financial assistance for healthcare expenses, ensuring that your savings are utilized efficiently.

In summary, Variable Universal Life Insurance offers a compelling solution for individuals seeking a saving element in their life insurance. With its investment options, VUL allows policyholders to potentially earn higher returns, build wealth, and secure their financial future. The flexibility and customization it provides make it an attractive choice for those who want control over their savings and insurance needs. By combining life insurance coverage with investment opportunities, VUL empowers individuals to make informed decisions about their financial well-being.

Life Insurance: When to Include Your Corporation as a Beneficiary

You may want to see also

Indexed Universal Life Insurance: Tracks market indices, offering potential for higher savings growth while providing a guaranteed death benefit

Indexed Universal Life Insurance is a unique and innovative type of life insurance policy that combines the security of a traditional life insurance policy with the potential for higher savings growth. This type of insurance is designed to offer a way for individuals to build wealth over time while also ensuring financial protection for their loved ones. Here's a detailed look at how it works and its benefits:

This insurance policy is structured to track market indices, typically the S&P 500 or other benchmark indices. These indices represent the performance of a group of stocks or financial assets. By linking the policy to these indices, the insurance company can offer policyholders the opportunity to benefit from market growth. During favorable market conditions, the policy's cash value can grow at a rate that is directly proportional to the performance of the chosen index. This means that if the market index increases, the policyholder's savings can grow significantly, potentially outpacing the returns of traditional savings accounts or fixed-income investments.

One of the key advantages of Indexed Universal Life Insurance is the guaranteed death benefit. Unlike some other investment-based insurance products, this policy provides a fixed amount of coverage in the event of the insured's death. This guarantee ensures that the beneficiaries receive a predetermined sum, providing financial security for their future needs. The death benefit is typically set at the time of policy inception and remains constant throughout the policy's duration, offering long-term protection.

The savings component of this insurance is designed to be flexible and adaptable. Policyholders can choose to allocate a portion of their premium payments to the cash value account, which is linked to the market indices. Over time, the cash value can accumulate, providing a source of funds that can be borrowed against or withdrawn, allowing for potential investment opportunities or financial flexibility. Additionally, some policies offer the option to increase the death benefit or policy value, providing an opportunity to enhance coverage as the policyholder's financial situation improves.

It's important to note that while Indexed Universal Life Insurance offers the potential for higher savings growth, it also carries some risks. Market volatility can impact the policy's performance, and there are caps on the growth rate that can be achieved. Policyholders should carefully consider their risk tolerance and financial goals before investing in this type of insurance. Additionally, understanding the policy's terms, fees, and potential penalties is crucial to making an informed decision.

In summary, Indexed Universal Life Insurance provides a unique approach to life insurance by combining guaranteed death benefits with the potential for market-linked savings growth. It offers individuals a way to build wealth while also ensuring financial protection for their families. As with any financial product, thorough research and understanding of the policy's features are essential to make the right choice for one's specific needs and circumstances.

Borrowing Against Universal Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

The savings element in life insurance refers to the investment component of certain policies, typically whole life or universal life insurance. It allows policyholders to build a cash value over time, which can be used for various purposes, such as borrowing funds, paying for college expenses, or even as a retirement nest egg. This feature is an attractive option for those seeking both financial protection and the potential for long-term savings.

When you purchase a policy with a savings component, a portion of your premium goes towards building cash value. This cash value grows tax-deferred and can earn interest. You have the option to borrow against this cash value, providing access to funds without surrendering the policy. Additionally, you can make additional payments, known as "extra payments" or "surrenders," to accelerate the growth of the cash value.

While the savings element offers potential financial benefits, it's important to understand the associated risks. The investment performance of the policy's cash value is not guaranteed and can fluctuate. Market conditions and investment choices made by the insurance company can impact the growth of your savings. It's crucial to carefully review the policy terms, understand the investment options, and consider seeking professional advice to ensure you are making informed decisions regarding your life insurance with a savings component.