People living with HIV can get life insurance, but it may be costly and challenging to secure. Insurers consider those with HIV high-risk, and thus they can expect to pay high rates. Several factors determine eligibility and premium rates, including age, health status, and viral load. While some insurers may deny coverage or charge higher premiums due to the risk associated with HIV, others have adjusted their underwriting guidelines to accommodate people effectively managing their condition. It is essential to shop around and compare different providers to find the best plan.

| Characteristics | Values |

|---|---|

| Can you get life insurance with HIV? | Yes, but it may be more costly and complicated. |

| What affects eligibility and premiums? | Age, health status, viral load, CD4 count, lifestyle factors, and adherence to antiretroviral therapy (ART). |

| Application process | In-depth questionnaire, medical exam (sometimes), and underwriting by the insurer. |

| Types of life insurance available | Term life, whole life, no-medical-exam policies, HIV-specific policies, group life insurance, final expense insurance, and guaranteed issue life insurance. |

| Maintaining good health | Regular doctor visits, adherence to medication, healthy CD4 count, and low viral load are important for HIV-positive individuals. |

| Underwriting considerations | HIV treatment plan, time since diagnosis, ART medication, viral load, CD4 levels, drug resistance, and side effects. |

| HIV and other insurance types | HIV status generally doesn't affect car, home, building, gadget, or pet insurance. Travel insurance is available but requires disclosure. |

What You'll Learn

- People with HIV can get life insurance, but it may be more costly

- Insurers consider viral load, CD4 count, overall health and ART adherence

- Maintaining good health is key for HIV-positive people seeking insurance

- Types of life insurance coverage for HIV include term life, whole life, and no-medical-exam policies

- HIV-specific policies are available but may have stricter terms and conditions

People with HIV can get life insurance, but it may be more costly

People living with HIV can get life insurance, but it may be more challenging and costly. While several major life insurance companies don't offer traditional life insurance coverage to people with HIV, you still have coverage options. You could get a smaller policy through your employer, or apply for a policy that doesn't have medical requirements for approval, such as final expense or guaranteed issue life insurance.

When applying for life insurance, the insurer evaluates your age, gender, health, and other lifestyle factors to determine the risk of insuring you. People living with HIV can be at greater risk for other health conditions, including heart disease, kidney disease, or diabetes. Without treatment, HIV can also progress into AIDS. As a result, insurance companies consider having HIV a high insurance risk, and you can expect to pay some of the highest rates on the market.

The application process for life insurance typically involves completing an in-depth questionnaire about your health, habits, medical conditions, and medical history, including disclosing your HIV status. You may also be required to take a medical exam. It is important to be honest and disclose your HIV status, as withholding information or lying can result in insurance cancellation and non-payment of benefits.

To enhance your chances of getting life insurance with HIV, it is recommended to work with an experienced insurance agent and maintain good health. This includes regular doctor visits, adherence to prescribed medication regimens, and keeping a healthy CD4 count and low viral load. These factors indicate effective management of the disease and can positively influence premium rates.

In summary, while people with HIV can obtain life insurance, it may come with higher costs and a more complicated application process. Maintaining good health and working with an agent can improve the chances of securing coverage.

Gerber Life Insurance: Adult Coverage Options Explored

You may want to see also

Insurers consider viral load, CD4 count, overall health and ART adherence

Insurers consider several factors when assessing life insurance applications from individuals living with HIV, including viral load, CD4 count, overall health, and ART adherence. These factors play a crucial role in determining the level of risk associated with providing coverage and can influence the terms of the policy, such as premiums, policy length, and payout amount.

Viral load refers to the amount of HIV virus present in a blood sample and is an important indicator of HIV progression and the effectiveness of treatment. A higher viral load suggests more active HIV replication and a greater impact on the immune system. Insurers will consider an individual's viral load when evaluating their application, as it provides insight into the severity of the condition and the potential impact on life expectancy.

CD4 count, or CD4+ cell count, measures the number of CD4 cells in the blood, which are a type of white blood cell that plays a crucial role in the immune system. HIV targets and destroys these cells, weakening the body's ability to fight infections. A low CD4 count indicates more advanced HIV infection and a higher risk of developing opportunistic infections. Insurers will take CD4 count into account when assessing an individual's overall health and the potential impact on life expectancy.

Overall health and ART adherence are also crucial factors considered by insurers. ART, or antiretroviral therapy, is a critical component of HIV treatment, as it helps control the amount of virus in the body and slows down the progression of the disease. Insurers will evaluate an individual's overall health, including the presence of any other medical conditions, and their adherence to ART. Adherence to ART can significantly impact viral load and CD4 count, so consistent and proper use of medication is essential for managing HIV.

In conclusion, insurers carefully assess viral load, CD4 count, overall health, and ART adherence when considering life insurance applications from individuals living with HIV. These factors provide valuable insights into the progression of the disease, the effectiveness of treatment, and the potential impact on life expectancy, all of which are crucial in determining the level of risk and the terms of the life insurance policy.

Mass Mutual Life Insurance: Drug Testing Requirements

You may want to see also

Maintaining good health is key for HIV-positive people seeking insurance

Medical Treatment

Adhering to your prescribed medical treatment is crucial. This includes consistently taking any antiretroviral therapy (ART) medications as directed by your doctor. Staying on top of your treatment can help you control the progression of the virus and increase your chances of approval for life insurance.

Regular Doctor Visits

Regular check-ups with your doctor are important. These visits demonstrate your commitment to effectively managing your condition and can be a positive factor when insurance companies evaluate your application.

Healthy Habits

Incorporating healthy habits into your lifestyle can help strengthen your immune system, which is particularly important for HIV-positive individuals. This includes:

- Eating a healthy and nutritious diet with adequate protein, carbohydrates, healthy fats, fruits, and vegetables.

- Avoiding drugs and alcohol, as they can compromise your immune system and impair your judgment, leading to risky behaviours.

- Practicing good oral hygiene by brushing, flossing, and visiting the dentist regularly.

- Reducing stress through yoga, meditation, exercise, or therapy.

- Getting regular exercise to keep physically fit and help manage stress and depression.

- Getting sufficient sleep to allow your body to recharge.

Prevent Infections

HIV weakens your immune system, making you more susceptible to infections. Take precautions to prevent infections and illnesses by washing your hands frequently, staying away from sick people, and staying up-to-date on your vaccinations.

Safe Sex

Practicing safe sex is essential to protect yourself and your partner. Use condoms to avoid the spread of HIV and to protect against other sexually transmitted diseases (STDs) and infections (STIs).

By following these tips and maintaining good health, you can improve your eligibility for insurance and potentially reduce your insurance premiums.

Jackson National Life Insurance: Contacting the Company

You may want to see also

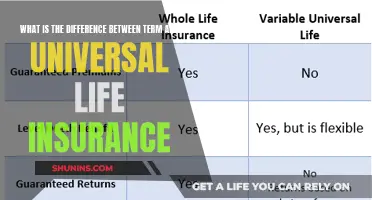

Types of life insurance coverage for HIV include term life, whole life, and no-medical-exam policies

If you have HIV, you can still get life insurance coverage. However, you may have to pay higher premiums due to insurers considering HIV a high insurance risk. While several major life insurance companies don't offer traditional life insurance coverage to people with HIV, you still have a few coverage options. These include term life insurance, whole life insurance, no-medical-exam policies, HIV-specific policies, final expense insurance, and group life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 20 or 30 years, and is usually the most affordable option. Traditional term life insurance policies require full underwriting, including a medical exam, but some insurers offer no-exam term life options. If your health declines during the term, renewing or extending your policy could be challenging and costly.

Whole Life Insurance

Whole life insurance offers lifelong coverage and accumulates cash value over time. It typically comes with higher premium costs compared to term life policies. Policyowners may access the cash value of the policy through withdrawals or loans.

No-Medical-Exam Policies

No-exam life insurance policies, also known as guaranteed issue life insurance policies, offer easier accessibility. They usually have lower coverage limits and higher premiums due to the increased risk for insurers. While these policies may not provide as much coverage as other types, they can be a good option for end-of-life expenses.

HIV-Specific Policies

Some companies offer specialized HIV-specific policies for individuals who struggle to find traditional coverage. However, these policies often come with stricter terms and conditions, so thorough research is imperative before choosing this option.

Life Insurance: Sensible or Not?

You may want to see also

HIV-specific policies are available but may have stricter terms and conditions

While some life insurance companies do offer policies to HIV-positive applicants, there are also HIV-specific policies available. These policies are designed for people who struggle to find traditional coverage. However, HIV-specific policies often come with stricter terms and conditions. It is highly recommended to thoroughly investigate all available options before deciding on a policy.

HIV-specific policies are available from specialist brokers and advisers, who offer tailored advice to people with pre-existing health conditions. This can make the process of applying for life insurance easier. Some insurance brokers specialising in cover for people with pre-existing conditions include Cura, Moneysworth and Unusual Risks.

When applying for an HIV-specific policy, you will be asked detailed questions about your health. You will need to give permission for the insurance company to obtain more information from your doctors. You will likely be asked:

- When you were diagnosed

- What your CD4 count and viral load are

- What and how much medication you are taking

- What other health conditions you have

- If you have had any symptoms, now or in the past

It is important to note that insurers are not allowed to have blanket policies of refusing to provide insurance or only providing insurance on certain terms to people living with HIV. This would be considered unlawful discrimination under the Equality Act. If you think you have been discriminated against when applying for insurance, you have the right to make a complaint.

Life Insurance and Divorce: What's the Verdict?

You may want to see also

Frequently asked questions

Yes, it is possible to get life insurance if you have HIV. However, you may face higher premiums and more complex application processes.

Insurance companies evaluate your eligibility based on health status and lifestyle factors. For people with HIV, insurers specifically consider viral load, CD4 count, overall health conditions, and adherence to antiretroviral therapy (ART). Maintaining good health, regular doctor visits, and a controlled viral load can increase your chances of approval.

People with HIV may qualify for term life insurance, whole life insurance, no-medical-exam policies, and HIV-specific policies. Term life insurance provides coverage for a specific period and is usually more affordable. Whole life insurance offers lifelong coverage but at a higher cost. No-medical-exam policies, also known as guaranteed issue life insurance, do not require a medical assessment and are easier to obtain, but they have lower coverage limits and higher premiums. HIV-specific policies are offered by some companies but may come with stricter terms and conditions.

The application process typically involves completing an in-depth questionnaire about your health, habits, medical conditions, and history. You will likely be asked detailed questions about your HIV diagnosis, treatment, and health profile. It is recommended to work with an experienced insurance agent to navigate the application process and increase your chances of approval.