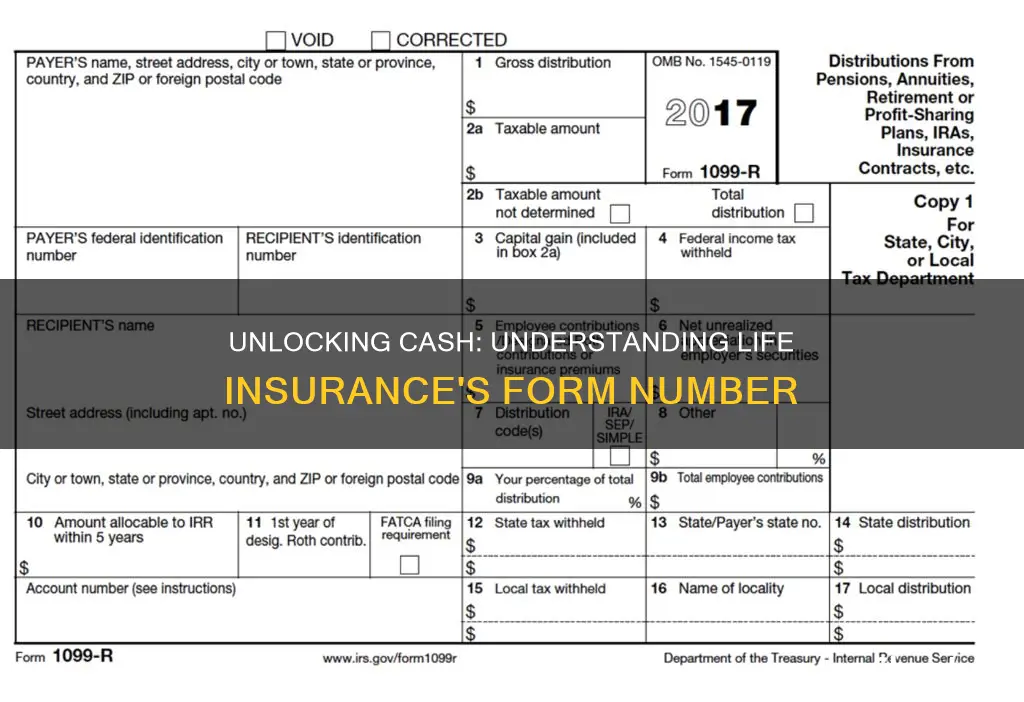

Life insurance cash out, also known as surrender or surrender value, is a feature that allows policyholders to receive a lump sum payment from their life insurance policy before the end of the term. This option is particularly useful for those who need immediate financial resources or wish to access the cash value of their policy. Understanding the form number for life insurance cash out is essential for policyholders to navigate the process efficiently. The form number is a unique identifier assigned to each policy, and it plays a crucial role in processing the cash out request. This paragraph will explore the significance of the form number and its role in the life insurance cash out process, providing valuable insights for policyholders seeking to access their policy's financial benefits.

What You'll Learn

- Policy Cash Value: Understand how life insurance cash value is calculated and what it represents

- Lapse Prevention: Learn strategies to prevent policy lapse when cashing out

- Tax Implications: Explore tax consequences of cashing out life insurance benefits

- Loan Options: Discover how to use policy loans for cashing out

- Surplus Distribution: Understand how insurance companies distribute surplus cash values

Policy Cash Value: Understand how life insurance cash value is calculated and what it represents

Life insurance policies, particularly those with a cash value component, offer a unique financial benefit that can be utilized in various ways. Understanding how the cash value is calculated and what it represents is crucial for policyholders who may consider accessing this value. The policy cash value is essentially the accumulated savings or investment portion within a life insurance policy, providing a financial asset that can be borrowed against or withdrawn from.

When you purchase a life insurance policy with a cash value feature, a portion of your premium payments goes towards building this cash value. This process is similar to saving money in a bank account, where the insurance company acts as the financial institution. Over time, as you make regular payments, the cash value grows through a combination of interest earned and investment gains. The calculation of this value is based on the policy's investment performance and the interest rates guaranteed by the insurance company.

The formula for calculating the policy cash value involves several factors. Firstly, the insurance company invests a portion of the premiums in various investment vehicles, such as stocks, bonds, or mutual funds. These investments generate returns, and a portion of these returns is allocated to grow the policy's cash value. Secondly, the guaranteed interest rate set by the insurance company is applied to the policy's cash value, ensuring a minimum rate of return. This rate is typically higher than what one might earn in a traditional savings account, making it an attractive feature for long-term savings.

The policy cash value can be a valuable financial asset for several reasons. Firstly, it provides a source of funds that can be borrowed against, allowing policyholders to access cash without selling the policy or taking out a loan. This feature is particularly useful for individuals who want to utilize their life insurance policy's value without disrupting their financial plans. Secondly, the cash value can be withdrawn as a lump sum, providing financial flexibility during emergencies or for significant life events.

Understanding the policy cash value is essential for making informed decisions about your life insurance policy. It represents a long-term savings strategy that can offer financial security and flexibility. By calculating and monitoring the cash value, policyholders can assess the growth of their investment and make adjustments as needed. This knowledge empowers individuals to make the most of their life insurance policy, ensuring they have a valuable financial asset that can be utilized according to their specific needs and goals.

Life Insurance: Individual vs. Group Plans: What's the Difference?

You may want to see also

Lapse Prevention: Learn strategies to prevent policy lapse when cashing out

When considering cashing out a life insurance policy, it's crucial to understand the potential risks, especially regarding policy lapse. Lapse prevention is a critical aspect of maintaining the value of your insurance investment and ensuring financial security. Here are some strategies to help you navigate this process effectively:

Understand the Cash-Out Process: Before proceeding with a cash-out, thoroughly comprehend the implications. Cashing out typically involves taking a loan against the cash value of your policy or withdrawing funds. This action can impact the policy's future benefits and coverage. It's essential to know the specific terms and conditions of your policy, including any restrictions and potential consequences of cashing out.

Evaluate Your Financial Needs: Assess your current financial situation and future goals. Determine if the cash-out amount is necessary for your immediate needs or if there are alternative solutions. Sometimes, exploring other options like policy loans or taking out a separate loan can provide the required funds without compromising the insurance coverage. By understanding your financial requirements, you can make informed decisions to prevent policy lapse.

Consider Policy Loans: Instead of cashing out, consider taking a policy loan. This option allows you to borrow money from the cash value of your policy without selling or cashing out the entire policy. Policy loans typically have lower interest rates compared to traditional loans, and the funds can be repaid over time without affecting the policy's coverage. This strategy ensures that your insurance remains in force while providing the necessary financial flexibility.

Review and Adjust Premiums: If you decide to cash out, carefully review the premium adjustments. When you withdraw funds, the policy's cash value may decrease, impacting the premiums. Ensure that you can afford the new premium amount to avoid lapse. Consider increasing the premium payment frequency or exploring other premium financing options to maintain the policy's validity.

Seek Professional Advice: Consult with a financial advisor or insurance specialist who can provide tailored guidance. They can help you navigate the complexities of cashing out and offer solutions to prevent policy lapse. These professionals can assess your financial situation, review policy options, and recommend strategies to ensure the continuity of your insurance coverage.

By implementing these strategies, you can effectively manage the process of cashing out a life insurance policy while minimizing the risk of lapse. It is essential to approach this decision with a comprehensive understanding of your financial goals and the potential impact on your insurance coverage.

Life Insurance and Blood Type: What's the Connection?

You may want to see also

Tax Implications: Explore tax consequences of cashing out life insurance benefits

When it comes to cashing out life insurance benefits, understanding the tax implications is crucial to making informed financial decisions. The process of cashing out involves withdrawing the accumulated cash value from a life insurance policy, which can have significant tax consequences. Here's an overview of the tax considerations:

Tax Treatment of Life Insurance Proceeds: In general, life insurance proceeds received as a result of a policyholder's death are typically exempt from federal income tax. This means that the beneficiary of the policy does not have to pay taxes on the death benefit amount. However, the situation changes when it comes to cashing out the policy's cash value. The cash value of a life insurance policy is considered a taxable event when withdrawn. This is because the cash value has grown over time due to investment gains and interest, and the IRS considers this growth as taxable income.

Taxable Event: When you cash out a life insurance policy, the entire amount withdrawn is generally subject to income tax. The tax treatment depends on the type of policy and the reason for the cashout. For instance, if you surrender a whole life insurance policy for its cash value, the entire amount may be taxable. On the other hand, if you take a loan against the policy's cash value, only the interest portion of the loan may be taxable. It's important to note that the tax rate applied to this taxable event will depend on your income tax bracket at the time of the cashout.

Taxable Gain: The cash value of a life insurance policy often grows over time, and when you cash out, this growth can result in a taxable gain. The gain is calculated by subtracting the original investment amount (the premium paid) from the total cash value. This gain is treated as ordinary income and will be taxed at your regular income tax rate. For example, if you invested $10,000 in a policy and it grew to $20,000 over the years, and you cash out the entire amount, you would report a $10,000 gain, which is taxable income.

Tax Strategies: To minimize the tax impact of cashing out life insurance benefits, consider the following strategies. First, understand the tax rules specific to your jurisdiction, as tax laws can vary. Second, if possible, avoid cashing out the entire policy's value in one go. Instead, consider taking a policy loan or using the policy's cash value to pay for qualified expenses, such as education or business purposes, which may offer tax advantages. Finally, consult with a tax professional or financial advisor to explore options that align with your financial goals and tax situation.

In summary, cashing out life insurance benefits can have tax implications, especially when it comes to the cash value. Understanding the tax treatment, recognizing taxable events, and implementing strategic financial planning can help individuals navigate these tax consequences effectively. It is always advisable to seek professional guidance to ensure compliance with tax laws and to make informed decisions regarding life insurance policies.

Locating Your Health and Life Insurance Numbers: A Guide

You may want to see also

Loan Options: Discover how to use policy loans for cashing out

When considering cashing out your life insurance policy, one of the key methods available is through policy loans. This financial tool allows you to access a portion of your policy's cash value as a loan, providing a means to utilize the funds without surrendering the policy. Here's a detailed guide on how policy loans can be a viable option for cashing out:

Understanding Policy Loans:

A policy loan is a loan that you take out against the cash value of your life insurance policy. The loan is secured by the policy itself, meaning the insurance company holds the policy as collateral. This type of loan offers several advantages, including the potential to borrow a significant amount, often up to a certain percentage of the policy's cash value, and the flexibility to repay the loan over time.

The Process:

- Loan Application: You initiate the process by submitting a loan application to your insurance company. This typically involves providing personal and financial information to assess your eligibility and determine the loan amount.

- Loan Approval and Disbursement: Upon approval, the insurance company will disburse the loan amount to you. The funds can be used for various purposes, such as paying for education, starting a business, or any other financial need.

- Repayment: Repayment terms are usually structured to align with your financial capabilities. You'll make regular payments, including both the principal and interest, until the loan is fully repaid. It's important to note that if the policy's cash value is insufficient to cover the loan, the insurance company may take appropriate action.

Benefits of Policy Loans:

- Accessibility: Policy loans provide quick access to funds without the lengthy process of selling the policy or taking out a separate loan.

- Tax Advantages: In many jurisdictions, policy loans are treated favorably for tax purposes, meaning the interest paid may be tax-deductible.

- Flexibility: Borrowers can use the funds for various purposes, offering financial flexibility.

- Preservation of Policy: Unlike surrendering a policy, a loan allows you to keep the policy intact, potentially maintaining its long-term value.

Considerations:

While policy loans offer a convenient way to access cash, it's crucial to approach them with caution. Late payments can result in penalties and may impact the policy's value. Additionally, defaulting on the loan could lead to the insurance company taking control of the policy, potentially reducing its value or even canceling it.

In summary, policy loans are a strategic way to cash out your life insurance policy, providing financial flexibility while preserving the policy's long-term benefits. Understanding the process and potential risks is essential for making an informed decision.

How Life Insurance Inheritance Works for Children

You may want to see also

Surplus Distribution: Understand how insurance companies distribute surplus cash values

Insurance companies often hold surplus cash values, which are the excess funds they accumulate over and above their policy obligations. These surplus cash values can be significant and represent a valuable asset for the company. When it comes to distributing these surplus funds, insurance firms follow a structured approach to ensure fairness and transparency.

The process of surplus distribution is a critical aspect of insurance company management. It involves a series of steps to identify, calculate, and allocate the surplus cash to various stakeholders. This distribution is typically done in a manner that prioritizes policyholders, shareholders, and the company's long-term financial health.

One common method of surplus distribution is through dividends. Insurance companies may declare dividends on their common stock, which are essentially a portion of the surplus cash allocated to shareholders. These dividends can be paid out regularly or as a one-time special distribution. Policyholders may also benefit from dividends if the company has a policy of reinvesting surplus cash into the business or distributing it to policyholders in the form of reduced premiums or increased benefits.

Another approach is to reinvest surplus cash into the company's operations. This can include funding new business ventures, expanding the company's infrastructure, or investing in research and development. By reinvesting, insurance firms can ensure the long-term growth and stability of the business, which ultimately benefits policyholders through improved financial performance.

In some cases, insurance companies may also distribute surplus cash through share buybacks. This involves purchasing their own shares from the market, which can increase the value of remaining shares and provide a return to shareholders. Share buybacks can be an effective way to manage the company's capital structure and enhance shareholder value.

Understanding surplus distribution is essential for insurance policyholders and investors alike. It provides insight into how insurance companies manage their financial resources and ensures that surplus cash is utilized in a way that benefits all stakeholders. By following a structured approach, insurance firms can maintain financial stability, support policyholders, and drive sustainable growth.

Life Insurance Income: When to Report It

You may want to see also

Frequently asked questions

The form number for life insurance cash out typically refers to the application or request form that an individual needs to complete to access the cash value of their life insurance policy. This process is often called "surrender" or "lapse" of the policy. The specific form number can vary depending on the insurance company and the type of policy, but it is usually a standardized document that outlines the terms and conditions of the cash surrender.

Most life insurance policies, especially those with a whole life or universal life component, offer a cash surrender option. You can check the policy documents, including the contract or rider, to see if there is a clause related to cash surrender or policy loans. If you are unsure, contacting your insurance provider or a financial advisor is recommended to confirm the availability of this feature.

When filling out the cash surrender form, you will typically need to provide personal details such as your name, policy number, and contact information. You may also need to specify the reason for surrender, the desired surrender amount, and any relevant financial information. It is essential to review the instructions provided by your insurance company carefully to ensure you submit all the required documentation.

Yes, insurance companies often charge fees or penalties for cashing out a policy early. These fees can include surrender charges, administrative fees, or a reduction in the death benefit. The specific charges depend on the policy type, the time since the policy was issued, and the insurance company's policies. It is crucial to understand the terms and conditions of your policy and consult with a financial professional to evaluate the potential costs before making a decision.