Life insurance is often taken out to provide peace of mind that loved ones will be financially secure in the event of the policyholder's death. While the proceeds from a life insurance policy are typically not taxable, there are some circumstances where beneficiaries may be taxed on some or all of the proceeds.

What You'll Learn

- Interest on life insurance proceeds is taxable income

- Naming your estate as the beneficiary may trigger estate taxes

- The policy owner and insured being different people may cause tax complications

- Selling your policy may trigger income and capital gains taxes

- Policy loans or payout instalments could trigger taxes

Interest on life insurance proceeds is taxable income

Life insurance proceeds are generally not taxable if you are the beneficiary receiving them due to the death of the insured person. However, interest on life insurance proceeds is taxable income and must be reported.

If the policy was transferred to you for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration you paid, additional premiums you paid, and certain other amounts. There are some exceptions to this rule. Generally, you report the taxable amount based on the type of income document you receive, such as a Form 1099-INT or Form 1099-R.

If you are the policyholder who surrendered the life insurance policy for cash, the proceeds may be taxable if the amount you received is more than the cost of the policy.

It is important to note that the information provided here is general in nature and may not apply to all specific situations. Tax laws can be complex, and it is always recommended to consult with a tax professional or the Internal Revenue Service (IRS) for specific guidance on your tax obligations.

Credit Life Insurance: Can You Cancel Your Policy?

You may want to see also

Naming your estate as the beneficiary may trigger estate taxes

When it comes to life insurance, the death benefit your beneficiaries receive isn't typically taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their future. However, naming your estate as the beneficiary is one of the exceptions to this rule and may trigger estate taxes.

Firstly, it's important to understand that the proceeds from a life insurance policy that you receive as the beneficiary are generally not considered gross income and do not need to be reported on your income taxes. This is true whether you receive the payout as a lump sum or in installments. However, if you receive the payout in installments, any interest that accumulates on those payments will be taxed as regular income. Therefore, if your estate is the beneficiary and receives the payout in installments, it will be subject to higher taxes.

Additionally, naming your estate as the beneficiary can cause non-probate assets to become subject to probate. This can result in delayed distributions, additional administrative costs, and unfavorable income tax treatment. For IRAs and qualified retirement plans, naming your estate as the beneficiary can lead to unfavorable income tax consequences. The required minimum distribution (RMD) rules generally allow an individual beneficiary to "stretch" distributions over their life expectancy. However, an estate has no life expectancy, so taxable distributions must be made over a shorter time frame, typically within five years. This shorter timeline can result in higher taxes, as more money is withdrawn each year.

Furthermore, naming your estate as the beneficiary can increase the potential for a "challenge" from a disgruntled heir. Challenges to a will could be more likely to be successful when the estate is named as the beneficiary, rather than a specific individual. This is another factor that could delay distributions and increase administrative costs.

In conclusion, while naming your estate as the beneficiary of your life insurance policy may seem like a straightforward option, it can trigger estate taxes and lead to several other unwanted consequences. It is generally advisable to carefully consider your options and name a specific individual or individuals as beneficiaries to avoid these potential issues.

Teachers' Pension: Life Insurance Inclusion and Benefits Explained

You may want to see also

The policy owner and insured being different people may cause tax complications

In a life insurance policy, it is common for the owner and the insured to be the same person. However, this is not always the case, and there may be tax implications when the policy owner and the insured are different people.

The owner of a life insurance policy has critical rights and responsibilities. They have control over the policy and are responsible for paying the premiums. The owner has the right to name or change beneficiaries, transfer ownership, and receive dividends and cash value, if applicable. On the other hand, the insured is the person whose life is covered by the policy. Should they pass away while the policy is active, their beneficiary will receive a payout.

When the owner and the insured are different people, it can create a situation known as the Goodman Triangle, where the IRS may view the death benefit as a gift from the policy owner to the beneficiary. This can trigger a gift tax if the amount exceeds the annual exclusion limit, which is $18,000 in 2024. To avoid this complication, financial advisors often suggest having only two parties involved in the policy, with the insured and owner being the same person.

Additionally, if the policy owner receives a payout upon the insured's death, they may have to pay taxes on the proceeds. While life insurance proceeds are typically tax-free, there are exceptions. For example, if the policy owner chooses to receive the payout in installments instead of a lump sum, any interest that accumulates on those payments will be taxed as regular income.

To summarise, while it is possible for the policy owner and the insured to be different people, it is important to be aware of the potential tax complications that may arise. Seeking advice from a financial professional is advisable to understand the specific tax implications and make informed decisions regarding life insurance policies.

Life Insurance and Section 8 Housing: What's the Verdict?

You may want to see also

Selling your policy may trigger income and capital gains taxes

Selling a life insurance policy, also known as a life settlement, may seem like a good option if you no longer need the coverage. However, selling your policy could trigger income and capital gains taxes. If you sell your policy for more than you've paid in premiums, the gain on that amount may be taxed. Here's a breakdown of the taxation on life insurance policy sales:

- The portion of the sale amount equal to what you've paid in premiums (your "cost basis") will not be taxed.

- The portion that exceeds your cost basis but is less than the cash value of the policy is subject to income tax.

- Any amount above the cash value is subject to capital gains tax.

Additionally, the new owner of the policy may face taxes on any death benefit they receive that exceeds what they paid for the policy, plus any premiums they continue to pay.

Strategies to Avoid or Mitigate Taxes

To avoid or mitigate taxes on the sale of your life insurance policy, you can consider the following strategies:

- Choose a lump-sum payout: Receiving the death benefit in a lump sum keeps it income tax-free. Avoiding taxable interest by steering clear of installment payments.

- Avoid the Goodman Triangle: This occurs when three different individuals are involved in a life insurance policy, with one person as the policy owner, another as the insured, and a third as the beneficiary. To avoid a potential gift tax, financial advisors suggest limiting the involvement to only two parties in the policy.

- Use an irrevocable life insurance trust (ILIT): Transfer ownership of the policy from yourself to an ILIT to remove it from your estate. However, note that this type of trust cannot be revoked once established.

- Be aware of gift tax limits: In 2024, the annual gift tax exemption is $18,000, and the lifetime exclusion amount is $13.61 million. Stay within these limits to potentially avoid taxation.

Kroger Life Insurance: What You Need to Know

You may want to see also

Policy loans or payout instalments could trigger taxes

Life insurance death benefits are typically tax-free, but there are exceptions. Certain actions, like policy loans or payout instalments, could trigger taxes.

If you receive the life insurance payout in instalments instead of a lump sum, any interest that builds up on those payments could be taxed. This extra money from interest is considered taxable income, even though the original death benefit is not.

Another exception occurs when a policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary. If the estate's total value is large enough, it may trigger estate taxes, reducing what your loved ones ultimately receive.

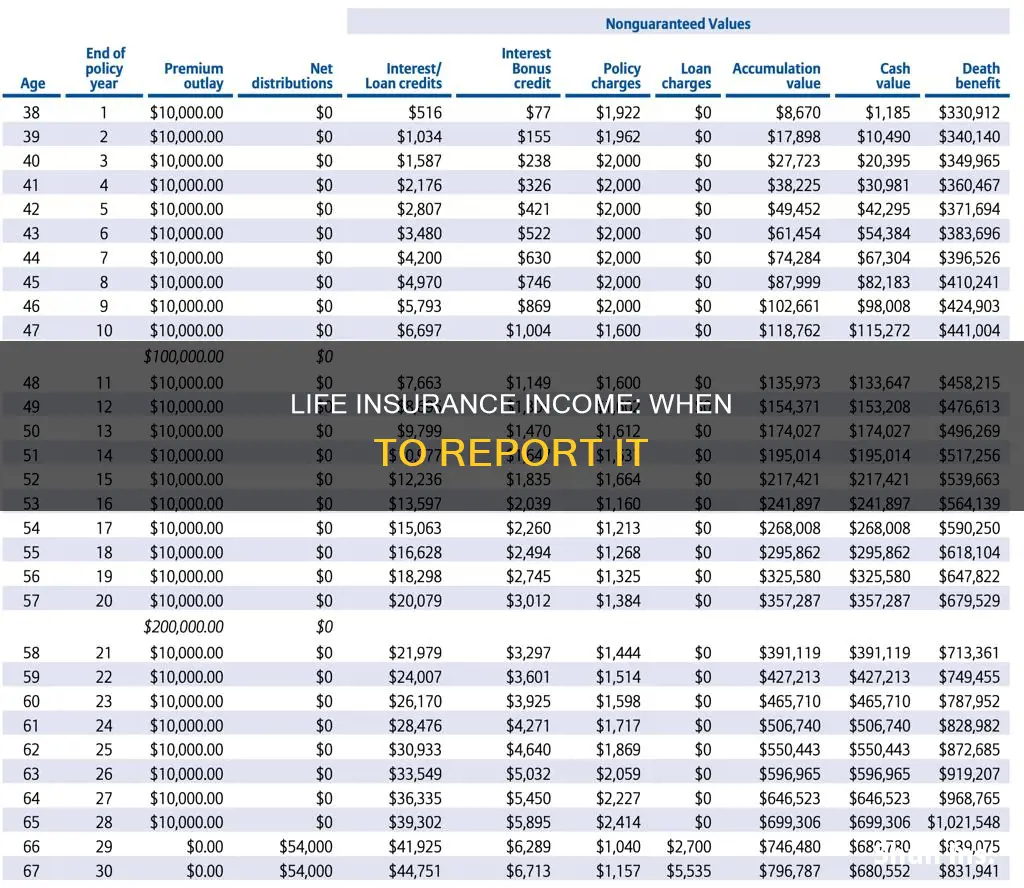

Cash value life insurance, like whole or universal life, also has its own tax rules. Policyholders can generally borrow or withdraw money from the policy's cash value, and as long as they don't take out more than they've paid in, those withdrawals are usually tax-free. However, if there are unpaid loans against the policy, they will be deducted from the death benefit, meaning your beneficiaries get less.

If the policy is a modified endowment contract (MEC), taxes are different. Withdrawals are treated as taxable income until they cumulatively equal all interest earnings in the contract.

To avoid tax complications, it's recommended to regularly review beneficiaries and policy details. Using strategies like an irrevocable trust can also help minimize potential tax liabilities.

Life Insurance Payment: AARP's Missed Payment Policy and You

You may want to see also

Frequently asked questions

Generally, life insurance proceeds received as a beneficiary due to the death of the insured person are not taxable and do not need to be reported as income.

Yes, there are a few exceptions. If you receive any interest on the proceeds, it is considered taxable income and should be reported. If the policy was transferred to you for cash or other valuable consideration, the exclusion for the proceeds is limited and you may have to report a taxable amount. Additionally, if the payout is made to the insured's estate instead of a named beneficiary, it could be subject to estate taxes.

If you choose to receive the life insurance payout in installments, any interest that accumulates on those payments will be taxed as regular income.

In most cases, you do not need to report a life insurance payout on your taxes as a beneficiary since the proceeds are typically not considered taxable income.

Yes, there are a few strategies you can consider. One option is to choose a lump-sum payout instead of installments to avoid taxable interest. Another strategy is to use an irrevocable life insurance trust (ILIT) to keep the death benefit out of your taxable estate. It's important to review and update your beneficiaries regularly and ensure proper planning to minimize potential tax liabilities.