Supplementary life insurance is an additional layer of financial protection that complements a person's existing life insurance policy. It is designed to provide extra coverage beyond the standard policy limits, offering a safety net for beneficiaries in the event of the insured individual's death. This type of insurance is often sought by those who want to ensure their loved ones are adequately protected, especially in cases where the primary life insurance policy may not fully cover all financial needs. It can be particularly useful for individuals with significant financial obligations or dependents who require additional financial support.

What You'll Learn

- Definition: Supplementary insurance is additional coverage beyond basic policies

- Purpose: It provides extra financial protection for specific risks

- Benefits: Offers enhanced benefits like critical illness or accidental death

- Cost: Typically, it's an add-on with lower premiums than standalone policies

- Add-on: Designed to complement existing life insurance, not a replacement

Definition: Supplementary insurance is additional coverage beyond basic policies

Supplementary insurance, often referred to as additional or supplemental insurance, is a term used to describe insurance coverage that extends beyond the basic or standard policies one might already have in place. It is an extra layer of protection designed to provide additional benefits and coverage options to individuals or entities. This type of insurance is typically offered as an add-on or supplement to existing policies, hence the name.

In the context of life insurance, supplementary insurance can be seen as a way to enhance the existing coverage. For instance, a person with a basic life insurance policy might opt for a supplementary term life insurance policy, which provides additional financial protection for a specific period. This additional policy can offer a higher death benefit or cover specific risks that the basic policy might not address. Supplementary insurance allows individuals to customize their insurance portfolio to better suit their unique needs and financial goals.

The primary purpose of supplementary insurance is to provide comprehensive coverage and ensure that individuals are protected against a wide range of potential risks. It allows people to tailor their insurance plans to their specific circumstances, such as their age, health status, lifestyle, and financial obligations. For example, a young, healthy individual might choose a supplementary disability insurance policy to protect their income in the event of an illness or injury, while an older person might focus on long-term care insurance to cover potential healthcare expenses.

When considering supplementary insurance, it is essential to understand the terms and conditions of the additional coverage. These policies often have specific exclusions and limitations, and the benefits may vary depending on the insurance provider and the chosen plan. It is advisable to carefully review the policy documents and seek professional advice to ensure that the supplementary insurance aligns with one's insurance needs and objectives.

In summary, supplementary insurance is an additional layer of protection that complements existing policies. It allows individuals to customize their insurance coverage, ensuring they are adequately protected against various risks. By understanding the concept of supplementary insurance, individuals can make informed decisions about their insurance needs and choose the right coverage options to safeguard their financial well-being.

Life Insurance for Pets: Is It Worth It?

You may want to see also

Purpose: It provides extra financial protection for specific risks

Supplementary life insurance is a type of additional coverage that extends the financial protection offered by a primary life insurance policy. It is designed to provide extra security and peace of mind to individuals and their families by addressing specific risks that may not be fully covered by the main policy. This supplementary insurance is often tailored to meet the unique needs of individuals, ensuring that their loved ones are financially secure in the event of unforeseen circumstances.

The primary purpose of supplementary life insurance is to offer an additional layer of financial protection. It targets specific risks that could potentially leave a family in a vulnerable financial position. For instance, it can cover risks associated with critical illnesses, accidents, or disabilities that may require extensive medical treatment and long-term care. By providing extra coverage, this insurance ensures that policyholders' families have the necessary financial resources to manage these situations effectively.

When considering supplementary life insurance, it is essential to identify the specific risks that are not adequately addressed by the primary policy. This may include risks like critical illness, where the main policy might cover basic medical expenses but not the long-term financial implications of a severe illness. Supplementary insurance can bridge this gap by providing additional benefits tailored to these specific risks. For example, it can offer income replacement benefits to cover lost earnings during extended medical treatments or provide additional funds for rehabilitation and recovery.

This type of insurance is particularly valuable for individuals with unique financial obligations or those facing higher-than-average risks. It can be customized to suit individual needs, ensuring that the coverage aligns perfectly with personal circumstances. For instance, a policyholder with a high-risk profession or a family history of critical illnesses might opt for more comprehensive supplementary insurance to address these specific concerns.

In summary, supplementary life insurance serves the crucial purpose of enhancing financial protection by targeting specific risks. It provides an additional safety net, ensuring that individuals and their families are adequately prepared for unforeseen events. By tailoring the coverage to individual needs, this insurance offers peace of mind and financial security, allowing policyholders to focus on their well-being and that of their loved ones.

AML Training: Life Insurance's Vital Weapon Against Fraud

You may want to see also

Benefits: Offers enhanced benefits like critical illness or accidental death

Supplementary life insurance is an additional layer of coverage that can be added to an existing life insurance policy. It is designed to provide extra financial protection and benefits to the policyholder and their beneficiaries. One of the key advantages of supplementary life insurance is the ability to offer enhanced benefits, which can provide valuable financial support in specific circumstances.

When it comes to benefits, supplementary life insurance can provide coverage for critical illness and accidental death. Critical illness insurance, also known as critical illness benefit, is a type of insurance that pays out a lump sum or regular income if the insured individual is diagnosed with a critical illness, such as cancer, heart attack, or stroke. This benefit can help cover medical expenses, replace lost income, and provide financial security during a challenging time. It ensures that the policyholder and their family have the necessary financial support to manage the illness and its associated costs.

Accidental death insurance, on the other hand, provides financial protection in the event of the insured person's accidental death. This benefit can offer a tax-free lump sum payment to the beneficiaries, which can be used to cover funeral expenses, outstanding debts, or any other financial obligations left behind by the deceased. Accidental death insurance is particularly valuable as it provides an additional layer of security, ensuring that the policyholder's loved ones are financially protected in the unfortunate event of an accident.

The enhanced benefits offered by supplementary life insurance provide a sense of reassurance and financial security. These benefits can be tailored to the individual's needs and preferences, allowing them to choose the level of coverage that best suits their circumstances. By offering critical illness and accidental death coverage, supplementary life insurance ensures that policyholders and their families are prepared for unforeseen events and have the necessary financial support to navigate through them.

In summary, supplementary life insurance is a valuable addition to any life insurance policy, providing enhanced benefits that offer critical illness and accidental death coverage. These benefits provide financial security and peace of mind, ensuring that individuals and their families are protected in various life-changing situations. It is essential to understand the specific terms and conditions of supplementary life insurance to make an informed decision regarding one's insurance coverage.

Printing Your Life Insurance License: A Step-by-Step Guide

You may want to see also

Cost: Typically, it's an add-on with lower premiums than standalone policies

Supplementary life insurance is an additional layer of coverage that can be added to an existing life insurance policy. It is designed to provide extra financial protection beyond the base policy, often at a more affordable cost. This type of insurance is particularly appealing to those who already have a life insurance policy in place, as it offers an opportunity to enhance their coverage without incurring the higher costs associated with purchasing a standalone life insurance policy.

The cost of supplementary life insurance is one of its most attractive features. Since it is typically an add-on to an existing policy, the premiums are generally lower compared to purchasing a full-fledged life insurance policy. This is because the insurance company is not taking on the risk of insuring someone from scratch; instead, they are extending coverage to an individual who already has a policy in place, which is generally considered less risky. As a result, the insurance provider can offer more competitive rates, making it an economically viable option for policyholders.

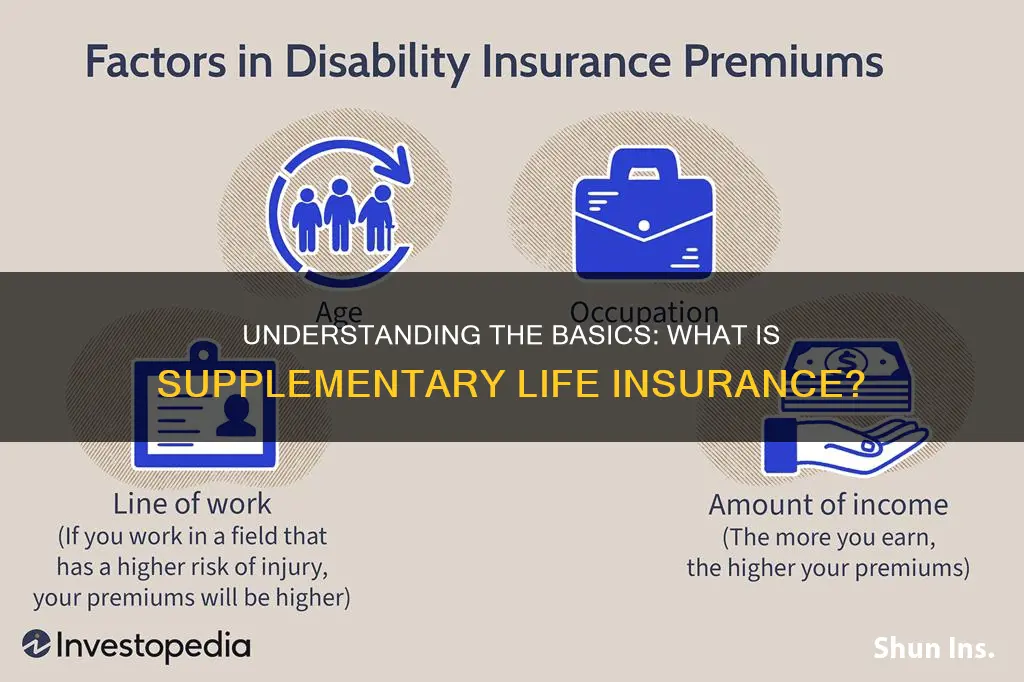

When considering supplementary life insurance, it's important to understand the cost structure. The premium for this add-on coverage is usually calculated based on the individual's age, health, and the amount of coverage being added. Since it is an additional benefit, the cost is often a fraction of what a standalone policy would be. This makes it an excellent choice for those who want to increase their financial protection without significantly increasing their insurance expenses.

For example, let's say an individual has a term life insurance policy and wants to add a supplementary policy for critical illness coverage. The premium for this additional benefit might be a small percentage of the base policy's premium, making it a cost-effective way to protect against critical illnesses. This approach allows policyholders to customize their insurance portfolio, ensuring they have the coverage they need at a price they can afford.

In summary, supplementary life insurance is a strategic way to enhance your financial protection without breaking the bank. Its lower premiums make it an attractive option for those looking to add extra coverage to their existing life insurance policy. By understanding the cost structure and the potential benefits, individuals can make informed decisions about their insurance needs and ensure they have the right level of protection in place.

Life Insurance: Adding Years to Your Life

You may want to see also

Add-on: Designed to complement existing life insurance, not a replacement

Supplementary life insurance, often referred to as an add-on or rider, is a valuable feature that can enhance your existing life insurance policy. It is not a standalone product but rather a customization option that allows you to tailor your coverage to your specific needs. This type of insurance is designed to work in conjunction with your primary life insurance policy, providing additional benefits and ensuring comprehensive protection.

When you purchase a life insurance policy, the base coverage provides a financial safety net for your loved ones in the event of your passing. However, circumstances and financial goals can change over time. That's where supplementary life insurance comes into play. It acts as a complementary layer, allowing you to increase the payout amount or add specific benefits that align with your evolving situation. For instance, if you have a growing family or are planning to take on significant financial responsibilities, an add-on can provide extra financial security.

The beauty of supplementary life insurance is its flexibility. It can be tailored to suit various life stages and personal circumstances. For example, a young professional might opt for an add-on to increase the policy's death benefit, ensuring their family has sufficient funds to cover immediate expenses and ongoing living costs. On the other hand, an older individual with a substantial estate might choose an add-on to provide additional coverage for their beneficiaries, ensuring their legacy is protected.

It's important to understand that supplementary life insurance is not a replacement for your primary policy. Instead, it enhances the existing coverage, providing an extra layer of financial protection. This approach ensures that your insurance strategy remains relevant and effective as your life circumstances change. By regularly reviewing and adjusting your policy, including the add-ons, you can maintain a robust safety net for your loved ones.

When considering supplementary life insurance, it is advisable to consult with a financial advisor or insurance professional. They can help you evaluate your current policy, understand the available add-ons, and determine the most suitable options for your unique situation. This personalized approach ensures that your life insurance strategy is comprehensive and aligned with your long-term goals.

Imputed Life Insurance: FICA Wages Inclusion?

You may want to see also

Frequently asked questions

Supplementary life insurance, also known as supplemental life insurance, is an additional layer of coverage that provides extra financial protection beyond a person's primary life insurance policy. It is designed to supplement the existing coverage and offer additional benefits to the insured individual or their beneficiaries.

Regular life insurance provides a death benefit to the policyholder's beneficiaries upon their passing. Supplementary life insurance, on the other hand, focuses on providing additional benefits during the insured's lifetime, such as critical illness coverage, disability income replacement, or accelerated death benefits.

Individuals who want to ensure their loved ones are financially secure in the event of their passing or who have specific needs for additional coverage may consider supplementary life insurance. It is particularly useful for those with high-risk occupations, pre-existing health conditions, or those seeking to enhance their existing life insurance policy.

Common benefits include critical illness insurance, which provides a lump sum payment if the insured is diagnosed with a critical illness; disability income insurance, replacing a portion of the insured's income if they become unable to work; and accelerated death benefits, allowing the insured to access a portion of their death benefit while still alive if they have a terminal illness.

It is often purchased as an add-on to an existing life insurance policy or as a standalone policy. The insured individual can choose to include supplementary coverage as part of their premium payments, ensuring they have comprehensive protection tailored to their specific needs.