Mortgage life insurance is a crucial financial tool for homeowners with a mortgage. It provides a safety net by ensuring that your loved ones are protected financially if you were to pass away. This type of insurance offers peace of mind, knowing that your mortgage payments will be covered, and your family's financial stability will be maintained even in the face of tragedy. With various policies available, it's essential to understand the benefits and choose the right coverage to secure your family's future.

What You'll Learn

- Financial Security: Protects loved ones financially if the primary breadwinner dies

- Debt Relief: Pays off mortgage, preventing foreclosure and financial hardship for family

- Peace of Mind: Ensures mortgage payments are covered, reducing stress and worry

- Long-Term Savings: Provides a tax-efficient way to build savings for future financial goals

- Customizable Coverage: Tailor insurance to individual needs and mortgage amount

Financial Security: Protects loved ones financially if the primary breadwinner dies

Mortgage life insurance is a financial tool designed to provide a safety net for families in the event of the primary breadwinner's untimely death. It offers a crucial layer of protection, ensuring that loved ones are financially secure and can maintain their standard of living even in the face of tragedy. This type of insurance is particularly important for those with a mortgage, as the financial burden of a home loan can be significant. When the primary income earner passes away, the remaining family members are often left with substantial mortgage payments, which can be overwhelming and lead to financial strain.

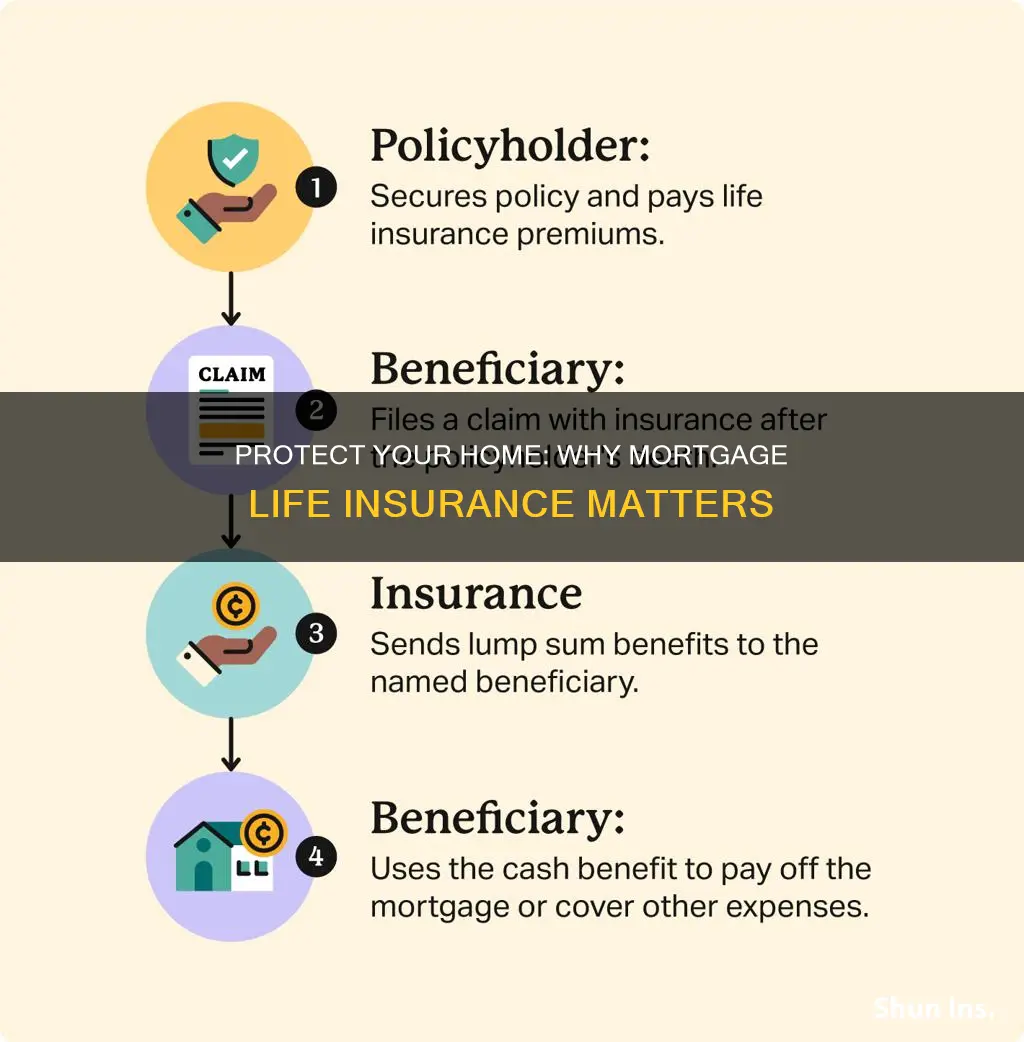

The primary purpose of mortgage life insurance is to alleviate this financial burden. It provides a death benefit, typically a lump sum payment, which can be used to cover the outstanding mortgage balance. This ensures that the family's home remains in their possession, preventing them from losing their primary residence due to financial constraints. By having this insurance, the family can focus on grieving and supporting each other during a difficult time, knowing that their financial obligations are partially or fully covered.

In the event of the insured individual's death, the insurance company pays out the death benefit, which is then used to settle the mortgage. This process can be seamless, allowing the family to maintain their home and avoid the stress of sudden financial responsibility. Moreover, the insurance payout can also cover other essential expenses, such as funeral costs, outstanding debts, and everyday living expenses, providing a comprehensive financial safety net.

One of the key advantages of mortgage life insurance is its customization. Policies can be tailored to fit the specific needs of the family and their financial situation. For instance, the death benefit can be adjusted to match the remaining mortgage balance, ensuring that the insurance provides adequate coverage. Additionally, policyholders can choose between different payment options, such as level term or decreasing term insurance, depending on their mortgage type and future financial goals.

By securing mortgage life insurance, individuals can provide peace of mind to their loved ones. It ensures that the family's financial stability is not compromised in the event of the primary earner's death, allowing them to focus on healing and moving forward. This type of insurance is a valuable consideration for anyone with a mortgage, as it offers a practical solution to a potentially devastating financial situation.

Quicken Loans: Mortgage Life Insurance Options Explained

You may want to see also

Debt Relief: Pays off mortgage, preventing foreclosure and financial hardship for family

Mortgage life insurance is a financial product designed to provide peace of mind and security for homeowners and their families. It is a type of insurance policy that offers a death benefit to the policyholder's beneficiaries in the event of their passing. This insurance is particularly relevant when considering the long-term financial commitments associated with homeownership, such as mortgages.

The primary purpose of mortgage life insurance is to alleviate the financial burden that a family might face if the primary breadwinner were to pass away. When an individual takes out a mortgage, they typically make regular payments over an extended period. If the borrower were to die, the remaining mortgage balance would still need to be paid, which could create a significant financial strain for the surviving family members. This is where mortgage life insurance steps in as a crucial safety net.

By purchasing this insurance, the policyholder ensures that their family is protected in the event of their death. The death benefit from the policy can be used to pay off the outstanding mortgage balance, preventing foreclosure and the subsequent loss of the home. This is especially important for families who rely on the income of the primary earner to cover mortgage payments and other essential expenses. With mortgage life insurance, the financial burden of the mortgage is transferred to the insurance company, providing immediate debt relief and safeguarding the family's most significant asset.

Furthermore, this type of insurance offers a sense of security and financial stability, knowing that the family's home is protected even in the worst-case scenario. It allows individuals to focus on other aspects of their lives without constantly worrying about the potential financial consequences of their passing. The peace of mind that comes with this insurance is invaluable, especially for those with young families or significant financial responsibilities.

In summary, mortgage life insurance is a vital tool for debt relief and financial protection. It ensures that families can maintain their home and avoid the devastating effects of foreclosure in the event of the primary earner's death. By providing a financial safety net, this insurance empowers individuals to take control of their financial future and protect their loved ones from potential hardship. Understanding the benefits of mortgage life insurance can help homeowners make informed decisions about their long-term financial well-being.

Life Insurance Riders: Understanding the Extra Benefits

You may want to see also

Peace of Mind: Ensures mortgage payments are covered, reducing stress and worry

Mortgage life insurance is a powerful tool that provides a sense of security and peace of mind for homeowners. It is designed to protect your financial well-being and that of your loved ones in the event of your untimely passing. The primary benefit of this insurance is the reassurance it offers, knowing that your mortgage payments will be covered, even if you are no longer around to make them. This coverage ensures that your family won't face the burden of financial strain or the stress of sudden debt, especially during an already challenging time.

When you take out a mortgage, it becomes a significant financial commitment. The thought of not being able to meet these payments can be overwhelming, especially for those with families relying on the household income. Mortgage life insurance steps in to bridge this gap, providing a safety net that allows your loved ones to maintain their standard of living and keep the family home. This financial security can be a huge relief, knowing that your family's long-term financial stability is protected.

The peace of mind it offers is invaluable. With this insurance, you can rest assured that your family's financial future is secure. It eliminates the worry of what might happen if something were to happen to you, allowing you to focus on enjoying your life and creating cherished memories. This type of insurance is particularly important for those with young children or elderly parents who depend on a steady income. It ensures that your family can continue to live comfortably and afford the basic necessities, even in your absence.

Furthermore, mortgage life insurance can provide financial flexibility. It enables you to explore other opportunities without the constant fear of financial obligations. Whether it's starting a new business venture, pursuing further education, or simply taking a well-deserved vacation, this insurance gives you the freedom to make choices that enhance your life, knowing your mortgage is protected.

In summary, mortgage life insurance is a wise investment that provides a crucial layer of protection for homeowners. It offers peace of mind by ensuring that mortgage payments are covered, reducing financial stress and worry. This insurance is a practical way to safeguard your family's future and allow you to live life to the fullest, knowing that your financial commitments are secure.

Understanding Fiduciary Duty: Life Insurance's Ethical Core

You may want to see also

Long-Term Savings: Provides a tax-efficient way to build savings for future financial goals

Mortgage life insurance is often misunderstood as a product primarily designed to cover debt in the event of death. However, it offers a unique and powerful tool for long-term financial planning, particularly in the context of building savings. This type of insurance can be a strategic asset for those looking to secure their financial future and achieve their long-term goals.

One of the key advantages of mortgage life insurance is its ability to provide a tax-efficient savings mechanism. When you pay into a mortgage life insurance policy, the premiums are typically tax-deductible, especially for those with a high income. This means that a significant portion of your premium payments can be subtracted from your taxable income, reducing your overall tax liability. Over time, this can result in substantial savings, as the tax benefits compound, allowing your money to grow faster.

The tax efficiency of this insurance is particularly beneficial for long-term savings. As you build up your savings through regular premium payments, the tax benefits ensure that a larger portion of your money remains in your pocket. This is especially advantageous for those with long-term financial aspirations, such as purchasing a home, funding education, or planning for retirement. By utilizing mortgage life insurance, you can direct more funds towards these goals, accelerating your progress.

Furthermore, the structured nature of mortgage life insurance premiums can be tailored to fit various financial situations. Policies often offer flexibility in premium payment options, allowing policyholders to choose a payment schedule that aligns with their income and cash flow. This adaptability ensures that long-term savings through this insurance are accessible and manageable for a wide range of individuals and families.

In summary, mortgage life insurance serves as a valuable tool for long-term savings, offering a tax-efficient approach to building financial security. By taking advantage of the tax benefits associated with this insurance, individuals can accelerate their savings and work towards their future goals. It is a strategic financial decision that can provide peace of mind and financial stability for years to come.

Understanding Globe Life Insurance: Contestability Period Explained

You may want to see also

Customizable Coverage: Tailor insurance to individual needs and mortgage amount

Mortgage life insurance is a powerful tool that allows individuals to protect their loved ones and ensure financial security in the event of their passing. One of the key advantages of this type of insurance is its highly customizable nature, which sets it apart from other life insurance policies. This customization is particularly beneficial when it comes to tailoring the coverage to individual needs and the specific mortgage amount.

When considering mortgage life insurance, policyholders can choose the coverage amount based on their unique circumstances. This flexibility ensures that the insurance provides adequate financial protection for the mortgage debt. For instance, if an individual has a substantial mortgage, they might opt for a higher coverage amount to ensure that the remaining debt is fully covered in the event of their death. Conversely, those with smaller mortgages may select a lower coverage amount, balancing financial security with potential cost savings.

The ability to customize the policy also extends to the term length. Policyholders can decide on the duration of the insurance coverage, which can be tailored to match the mortgage term. For example, if an individual is taking out a 15-year mortgage, they can choose a 15-year term life insurance policy, ensuring that the coverage ends when the mortgage is fully paid off. This approach prevents the insured from paying for unnecessary coverage beyond the mortgage's duration.

Furthermore, customizable mortgage life insurance policies can be adjusted to accommodate changing circumstances. Life events such as marriage, the birth of a child, or a career change might require an individual to reassess their insurance needs. With a customizable policy, adjustments can be made to increase or decrease the coverage amount, ensuring that the insurance remains relevant and appropriate over time.

In summary, the customizable nature of mortgage life insurance empowers individuals to take control of their financial security. By tailoring the coverage to individual needs and mortgage amounts, policyholders can ensure that their loved ones are protected, and their financial obligations are met, even in the face of unforeseen circumstances. This level of customization is a significant advantage, providing peace of mind and a sense of control over one's financial future.

Double Life Insurance: Is It Legal or Fraud?

You may want to see also

Frequently asked questions

Mortgage life insurance is a type of insurance that provides financial protection for your loved ones if you pass away during the term of your mortgage. It ensures that your outstanding mortgage balance is paid off, preventing your family from facing financial hardship and potential loss of their home. This insurance is particularly important if you have a long-term mortgage and want to ensure your family's financial security in the event of your untimely death.

When you take out a mortgage, the lender often offers mortgage life insurance as an optional add-on. This insurance policy typically covers a portion of your mortgage balance, and the premium is added to your mortgage payments. In the event of your death, the insurance company pays out a lump sum to your designated beneficiary, which can be used to settle the remaining mortgage debt. The policy usually remains in force as long as the mortgage is active.

Yes, there are generally two main types: level term and decreasing term. Level term insurance provides a fixed amount of coverage for the entire mortgage term, ensuring a consistent payout if you pass away. Decreasing term insurance, on the other hand, starts with a higher coverage amount and decreases over time to match the reducing mortgage balance. The choice between the two depends on your specific needs and the length of your mortgage term.