Many people choose to fund their trust with life insurance as a strategic financial planning tool. This approach offers a way to ensure the trust's assets are protected and can be distributed according to the settlor's wishes. By using life insurance, the trust can benefit from the death benefit payout, which can be used to cover trust expenses, maintain the trust's operations, or even provide additional financial security for beneficiaries. This method can be particularly useful for those looking to minimize tax implications and maximize the value of their estate.

What You'll Learn

- Tax Advantages: Life insurance proceeds are often tax-free, providing a financial benefit

- Legacy Planning: Trust funding ensures a secure legacy for beneficiaries, avoiding potential disputes

- Wealth Transfer: Life insurance can efficiently transfer wealth, bypassing probate and potential estate taxes

- Income Generation: Trust assets can generate income, providing financial security for beneficiaries

- Risk Mitigation: Funding a trust with life insurance reduces financial risk and ensures long-term trust management

Tax Advantages: Life insurance proceeds are often tax-free, providing a financial benefit

Life insurance can be a powerful tool for estate planning, and one of its key advantages is the potential tax benefits associated with trust funding. When an individual purchases life insurance and names a trust as the beneficiary, the proceeds from the policy can be utilized to fund the trust, offering significant financial advantages.

One of the primary tax advantages is that life insurance proceeds are often tax-free. When a life insurance policy is paid out upon the death of the insured individual, the death benefit is typically exempt from federal income tax. This means that the trust, as the designated beneficiary, receives a substantial sum without incurring any immediate tax liabilities. This tax-free status can be particularly beneficial for trust beneficiaries, especially if they are minors or have special needs, as it provides them with a lump sum of money that can be managed and distributed according to the trust's terms.

The tax-free nature of life insurance proceeds allows the trust to grow and accumulate wealth over time without the immediate impact of taxes. This is especially advantageous for long-term financial planning, as the trust can benefit from compound interest and investment growth without the need for frequent tax payments. By utilizing life insurance in this manner, individuals can ensure that their intended beneficiaries receive a substantial financial gift, free from immediate tax burdens.

Furthermore, the tax advantages of funding a trust with life insurance can have a significant impact on estate planning. Life insurance proceeds can be used to pay for estate taxes, ensuring that the trust's assets are not depleted by these obligations. This strategic use of life insurance can help preserve the value of the estate and provide a more substantial inheritance for the trust's beneficiaries.

In summary, the tax advantages of life insurance proceeds being tax-free when paid out to a trust offer a compelling financial benefit. This feature enables individuals to provide their beneficiaries with a substantial financial gift, free from immediate tax consequences, and allows the trust to grow and accumulate wealth over time. By incorporating life insurance into estate planning, individuals can effectively manage their assets and ensure a more secure financial future for their intended beneficiaries.

Life Insurance: Customizable Coverage or Fixed Amounts?

You may want to see also

Legacy Planning: Trust funding ensures a secure legacy for beneficiaries, avoiding potential disputes

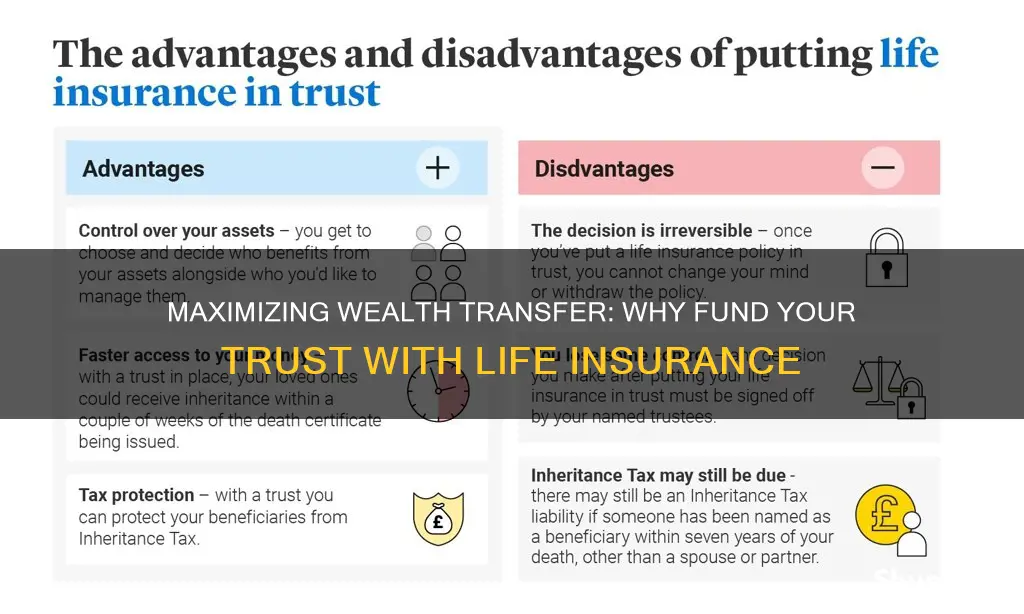

When it comes to legacy planning, trust funding is a powerful tool that can help ensure a secure and smooth transition of assets to beneficiaries. By utilizing life insurance, individuals can create a structured and efficient process for their estate, providing peace of mind and minimizing potential conflicts. This method is particularly valuable for those looking to leave a lasting legacy and maintain control over their assets.

The primary benefit of funding a trust with life insurance is the ability to provide a clear and immediate source of funds for the trust. Upon the insured individual's passing, the life insurance policy's death benefit is paid out directly to the trust, bypassing the complexities of the probate process. This ensures that the assets are distributed according to the trust's terms, which can be tailored to the specific wishes of the grantor. By avoiding probate, the trust can be funded swiftly, allowing the beneficiaries to access the intended inheritance without unnecessary delays.

In the context of legacy planning, trust funding offers a level of control and flexibility that is hard to replicate. The grantor can specify the conditions and terms of the trust, including the distribution of assets, the appointment of trustees, and the eligibility criteria for beneficiaries. This level of customization ensures that the legacy is aligned with the grantor's intentions and values. For example, a trust might be structured to provide an education fund for grandchildren, a retirement fund for a spouse, or a charitable contribution to a favorite cause.

Moreover, trust funding with life insurance can help mitigate potential disputes among beneficiaries. In the absence of a well-defined trust, heirs may have differing interpretations of the deceased's wishes, leading to conflicts and legal battles. By clearly outlining the distribution of assets in the trust, the grantor can minimize the chances of such disputes. The trust's terms can be made public, providing transparency and reducing the likelihood of beneficiaries challenging the estate's distribution.

In summary, funding a trust with life insurance is a strategic approach to legacy planning. It provides a secure and efficient method for distributing assets, ensuring that the grantor's wishes are respected and minimizing potential conflicts among beneficiaries. With this approach, individuals can leave a lasting legacy, knowing that their assets are protected and their intentions are honored.

Overdose Death: Life Insurance Payouts and Consequences

You may want to see also

Wealth Transfer: Life insurance can efficiently transfer wealth, bypassing probate and potential estate taxes

Life insurance is a powerful tool for wealth transfer, offering a strategic approach to ensure that your assets are distributed according to your wishes while also providing financial security for your beneficiaries. One of the key advantages of using life insurance in this context is the ability to efficiently transfer wealth without the complexities and delays often associated with the probate process.

When an individual passes away, their estate typically undergoes probate, which is a legal process that validates the will and distributes the assets accordingly. However, this process can be lengthy and costly, and in some cases, it may even be avoided entirely. By funding a trust with life insurance, you can create a seamless transition of wealth to your intended recipients. The insurance policy becomes a valuable asset within the trust, and upon your passing, the death benefit is paid directly to the trust, bypassing the probate court. This ensures that your beneficiaries receive their inheritance promptly, often within days or weeks, rather than months or even years.

Moreover, life insurance can be a strategic way to minimize or even eliminate potential estate taxes. Estate taxes can significantly reduce the value of your estate, and in some jurisdictions, they can be substantial. By utilizing life insurance, you can create a trust that holds the policy, and upon your death, the death benefit is paid to the trust, which then distributes the funds to your beneficiaries. This strategy allows you to control the distribution of your wealth while potentially reducing the tax burden on your estate. The insurance proceeds can be used to pay off any debts or final expenses, and the remaining amount can be distributed tax-free to your heirs.

The use of life insurance in wealth transfer also provides flexibility and control. You can choose the amount of coverage that aligns with your financial goals and the needs of your beneficiaries. This ensures that the insurance policy is tailored to your specific requirements, providing a reliable source of funds for various purposes, such as paying off debts, funding education, or supporting a business. Additionally, you can decide how the trust is structured, allowing you to specify the distribution of assets and the roles of different beneficiaries, ensuring that your wishes are respected.

In summary, funding a trust with life insurance is a strategic approach to wealth transfer, offering a swift and efficient way to distribute your assets while providing financial security. By bypassing the probate process and minimizing estate taxes, you can ensure that your beneficiaries receive their inheritance promptly and with minimal legal fees. This method of wealth transfer allows for flexibility, control, and the potential to achieve your financial goals while also providing a safety net for your loved ones. It is a valuable tool for anyone looking to make a significant impact on their family's financial future.

Leaving Life Insurance: Who Gets the Payout?

You may want to see also

Income Generation: Trust assets can generate income, providing financial security for beneficiaries

Trusts can be a powerful tool for income generation, offering a structured approach to financial security for beneficiaries. When you fund a trust with life insurance, the trust's assets can generate income in several ways, ensuring a steady financial stream for those who depend on it.

One primary method is through the investment of trust assets. Once the insurance policy is assigned to the trust, the proceeds from the policy can be invested in various financial instruments. These investments can include stocks, bonds, mutual funds, or real estate, depending on the trust's strategy and the trustee's discretion. The income generated from these investments can then be distributed to the trust's beneficiaries, providing them with a regular financial influx. This approach is particularly beneficial for those who rely on a consistent income stream, such as retirees or individuals with special needs.

Additionally, trusts can also generate income through the rental or leasing of assets. If the trust owns property, it can be leased to generate rental income. This income can then be paid out to the beneficiaries, providing them with a steady cash flow. Similarly, if the trust holds intellectual property or other valuable assets, they can be licensed or sold to generate revenue, which can be distributed to the beneficiaries.

Another strategy is to utilize the trust's assets to make loans or provide financing. The trust can lend money to individuals or businesses, generating interest income. This approach can be especially lucrative if the trust has a diverse portfolio of investments, allowing for a steady stream of loan repayments. The income generated from these loans can then be directed towards the beneficiaries, ensuring their financial security.

Furthermore, the trust can also benefit from the tax advantages associated with certain types of investments. For example, tax-efficient investments like municipal bonds can provide income exempt from federal and state taxes. By strategically investing in such instruments, the trust can maximize the income generated while minimizing tax liabilities, ultimately benefiting the beneficiaries.

In summary, funding a trust with life insurance opens up various avenues for income generation. Through strategic investments, leasing assets, lending, and tax-efficient strategies, trust assets can provide a reliable source of financial security for beneficiaries. This approach ensures that the trust's purpose is fulfilled, providing stability and support to those who depend on it.

Life Insurance: A Must-Have for SBA Loans?

You may want to see also

Risk Mitigation: Funding a trust with life insurance reduces financial risk and ensures long-term trust management

Funding a trust with life insurance is a strategic approach to risk mitigation and long-term financial planning. This method ensures that the trust's assets are protected and managed effectively, even in the event of the trust creator's (grantor's) passing. By utilizing life insurance, the grantor can provide a financial safety net for the trust's beneficiaries, ensuring that the trust's objectives are met and the intended legacy is preserved.

The primary benefit of this strategy is the reduction of financial risk. When a trust is funded with life insurance, the insurance policy becomes a valuable asset within the trust. This asset can be used to cover any potential debts or expenses associated with the trust's administration, ensuring that the trust's remaining assets are not depleted prematurely. For instance, if the trust has specific goals, such as providing education funds for beneficiaries, the insurance proceeds can be utilized to meet these objectives, even if the grantor passes away before the trust's initial funding period ends.

Moreover, this funding method provides long-term trust management. Life insurance ensures that the trust's capital is preserved and can continue to grow over time. The insurance policy's death benefit can be structured to pay out a lump sum or periodic payments, allowing the trust to maintain its intended distribution schedule. This is particularly important for trusts that have complex distribution requirements or those established for charitable purposes, as it guarantees that the trust's purpose is fulfilled as originally intended.

In the event of the grantor's death, the insurance proceeds are typically paid out to the trust, becoming part of the trust's assets. This ensures that the trust's value remains intact, and the beneficiaries can continue to receive the intended benefits. The trust can then be managed according to its terms, with the insurance policy's value providing an additional layer of security. This approach is especially valuable for families with complex financial situations, as it offers a way to protect assets and provide for loved ones without the need for frequent re-evaluation of the trust's structure.

In summary, funding a trust with life insurance is a powerful risk mitigation strategy. It provides financial security, ensures the trust's longevity, and guarantees that the grantor's intentions are met. By incorporating life insurance into the trust's structure, grantors can leave a lasting legacy, knowing that their assets are protected and their wishes will be honored. This method is a valuable tool for anyone looking to create a robust and secure trust for their beneficiaries.

Whole Life Insurance: Evaluating Your Coverage Options

You may want to see also

Frequently asked questions

Funding a trust with life insurance is a powerful strategy to ensure the efficient transfer of assets to beneficiaries while also providing financial security for your loved ones. Life insurance can be used to create a trust fund that grows over time, offering a steady stream of income and assets for the trust's beneficiaries.

Life insurance provides a financial safety net. When you name the trust as the beneficiary, the death benefit from the insurance policy is paid directly to the trust upon your passing. This amount can then be used to cover expenses, pay off debts, or be invested to grow the trust's assets.

Yes, life insurance can be an effective tool for estate tax reduction. By funding a trust with a life insurance policy, you can potentially avoid or minimize estate taxes. The insurance proceeds paid to the trust are often exempt from estate taxes, allowing more of your estate to pass tax-free to the intended beneficiaries.

Life insurance in a trust offers several benefits. It provides a guaranteed death benefit, ensuring that the trust receives a specific amount of money. This can be especially useful for funding long-term financial goals, such as education expenses or retirement income for beneficiaries. Additionally, the growth of the trust's assets can be accelerated through strategic investments of the insurance proceeds.

While funding a trust with life insurance is a valuable strategy, it's important to be aware of potential drawbacks. The trust's beneficiaries may have limited control over how the insurance proceeds are used, and the trust's administration can be complex. It's crucial to work with experienced financial advisors and legal professionals to ensure the trust is set up correctly and managed effectively.