Life insurance proceeds are typically paid out within a few days to a few weeks after a policyholder's death. The exact timeline can vary depending on the insurance company's policies and procedures, as well as the complexity of the claim. In most cases, the insurance company will initiate the payment process as soon as they receive the necessary documentation, such as a death certificate and proof of the policyholder's identity. However, some companies may require additional steps, such as a review of the policy and the beneficiary's information, which can extend the processing time. It's important to note that the schedule for receiving life insurance proceeds is generally much faster than other types of insurance claims, ensuring that the beneficiaries can access the financial support they need during a difficult time.

What You'll Learn

- Payment Timing: Life insurance proceeds are typically paid out within a few weeks of the insured's death

- Policy Terms: The schedule is defined by the insurance policy's terms and conditions

- Beneficiary Selection: The chosen beneficiary determines the payout schedule, often immediate or delayed

- Claim Process: The complexity of the claim process can affect the payout schedule

- Regulatory Compliance: Insurance companies must adhere to regulatory guidelines regarding payout schedules

Payment Timing: Life insurance proceeds are typically paid out within a few weeks of the insured's death

Life insurance proceeds are designed to provide financial support to beneficiaries upon the insured's passing, and the payment timing is a crucial aspect of this process. When an individual purchases a life insurance policy, they agree to pay regular premiums in exchange for a death benefit that will be paid out to their designated beneficiaries when they die. The schedule and timing of these payments are essential to ensure that the intended recipients receive the financial assistance they need during a difficult time.

The payment timing for life insurance proceeds is generally swift and efficient. Once the insured individual passes away, the insurance company is typically required to initiate the claims process promptly. This process involves verifying the death, collecting necessary documentation, and assessing the validity of the claim. Once all the required steps are completed, the insurance company usually pays out the death benefit within a relatively short timeframe, often within a few weeks. This quick payout is a significant advantage of life insurance, providing immediate financial relief to the beneficiaries.

The efficiency in paying out life insurance proceeds is a result of the standardized procedures followed by insurance companies. Upon receiving notice of the insured's death, the company will assign a claims adjuster to handle the case. The adjuster will review the policy, collect necessary documentation, and communicate with the beneficiaries to ensure a smooth process. This streamlined approach allows for a swift resolution, minimizing the time between the insured's death and the payment of benefits.

It is important to note that the exact timeline for receiving life insurance proceeds can vary slightly depending on the insurance company and the specific circumstances of the claim. Some companies may have additional steps or require more documentation, which could potentially extend the processing time. However, in most cases, the payment is expected to be made within a few weeks, providing a relatively quick source of financial support for the beneficiaries.

In summary, life insurance proceeds are designed to be paid out promptly to provide financial security to beneficiaries. The typical payment timing is within a few weeks of the insured's death, ensuring that the intended recipients receive the much-needed financial assistance during their time of grief and loss. This efficient process is a key benefit of life insurance, offering peace of mind and financial stability to those who rely on the policy.

Variable Whole Life Insurance: What You Need to Know

You may want to see also

Policy Terms: The schedule is defined by the insurance policy's terms and conditions

The schedule of life insurance proceeds is a critical aspect of the policy, and it is explicitly outlined in the terms and conditions of the insurance contract. When you purchase a life insurance policy, the policy document is a legally binding agreement between you and the insurance company. This document contains all the details and provisions related to the coverage, including the payment schedule for the proceeds.

The policy terms will specify the conditions under which the insurance company will pay out the proceeds. This includes the amount to be paid, the circumstances under which the payment is made, and any specific requirements or restrictions. For instance, the policy might state that the proceeds are paid out in a lump sum, or it could provide for periodic payments over a certain period. The terms may also define the process of claiming the proceeds, including the necessary documentation and any waiting periods before the payment is made.

In some cases, the policy might offer flexibility in the payment schedule. This could include options to choose between different payment structures, such as a single lump sum or an annuity, which provides regular payments over a defined period. The insurance company may also provide the option to increase or decrease the payout amount based on certain criteria, such as the insured individual's age or health status.

It is essential for policyholders to carefully review and understand the policy terms, especially the section related to the payment schedule. This ensures that they are aware of their rights and the conditions under which the proceeds will be received. The terms and conditions are the legal framework that governs the relationship between the insured and the insurance provider, and they play a crucial role in managing expectations and ensuring a smooth claims process.

Additionally, the policy terms might include provisions for changes or modifications to the payment schedule. This could be due to various factors, such as policyholder requests, changes in the insured's circumstances, or updates to the insurance company's policies. Any such changes would be subject to the approval of the insurance provider and would be documented in the policy, ensuring transparency and compliance with legal requirements.

Baby Boomers: The Surprising Lack of Life Insurance Coverage

You may want to see also

Beneficiary Selection: The chosen beneficiary determines the payout schedule, often immediate or delayed

When it comes to life insurance, the beneficiary selection process is a crucial aspect that can significantly impact the payout schedule. The beneficiary is the person or entity designated to receive the death benefit or proceeds from the insurance policy upon the insured individual's passing. This individual plays a vital role in determining how and when the insurance company disburses the funds.

The chosen beneficiary has the authority to specify the payout schedule, which can be tailored to their specific needs and circumstances. One common option is an immediate payout, where the beneficiary receives the full death benefit amount as soon as the insured person's death is confirmed. This option provides financial support to the beneficiary promptly, ensuring they have the necessary resources to cover any immediate expenses or obligations. Immediate payouts are often preferred when the beneficiary requires quick access to the funds, such as in the case of funeral expenses or to provide financial security for dependent family members.

Alternatively, beneficiaries can opt for a delayed payout schedule. This arrangement allows the insurance company to hold the death benefit for a predetermined period, which can range from a few weeks to several months. During this time, the insurance provider may require additional documentation or verification to ensure the accuracy of the claim. Delayed payouts are sometimes chosen when the beneficiary wishes to have more control over the funds or when there are specific conditions that need to be met before the payment is released. This option provides a layer of flexibility and can be beneficial in situations where the beneficiary requires the funds for long-term financial goals or investments.

The selection of the payout schedule is a personal decision and should be aligned with the beneficiary's financial goals, obligations, and preferences. It is essential to consider the potential tax implications and any legal requirements associated with different payout options. Consulting with a financial advisor or insurance professional can provide valuable guidance in making this decision, ensuring that the chosen schedule aligns with the beneficiary's best interests.

In summary, the beneficiary's selection of the payout schedule is a critical aspect of life insurance. Whether it's an immediate or delayed payout, the chosen option should be carefully evaluated to meet the beneficiary's unique needs. Understanding the available schedules and their implications empowers individuals to make informed decisions regarding the distribution of life insurance proceeds.

California Life Insurance: Top Choices for Comprehensive Coverage

You may want to see also

Claim Process: The complexity of the claim process can affect the payout schedule

The claim process for life insurance proceeds can vary significantly, and its complexity often determines the speed and schedule of the payout. When a policyholder or their designated beneficiary files a claim, the insurance company initiates a series of steps to verify the death, assess the policy, and ultimately distribute the benefits. This process can be intricate and time-consuming, especially in cases where the policy details are unclear, or there are disputes regarding the validity of the claim.

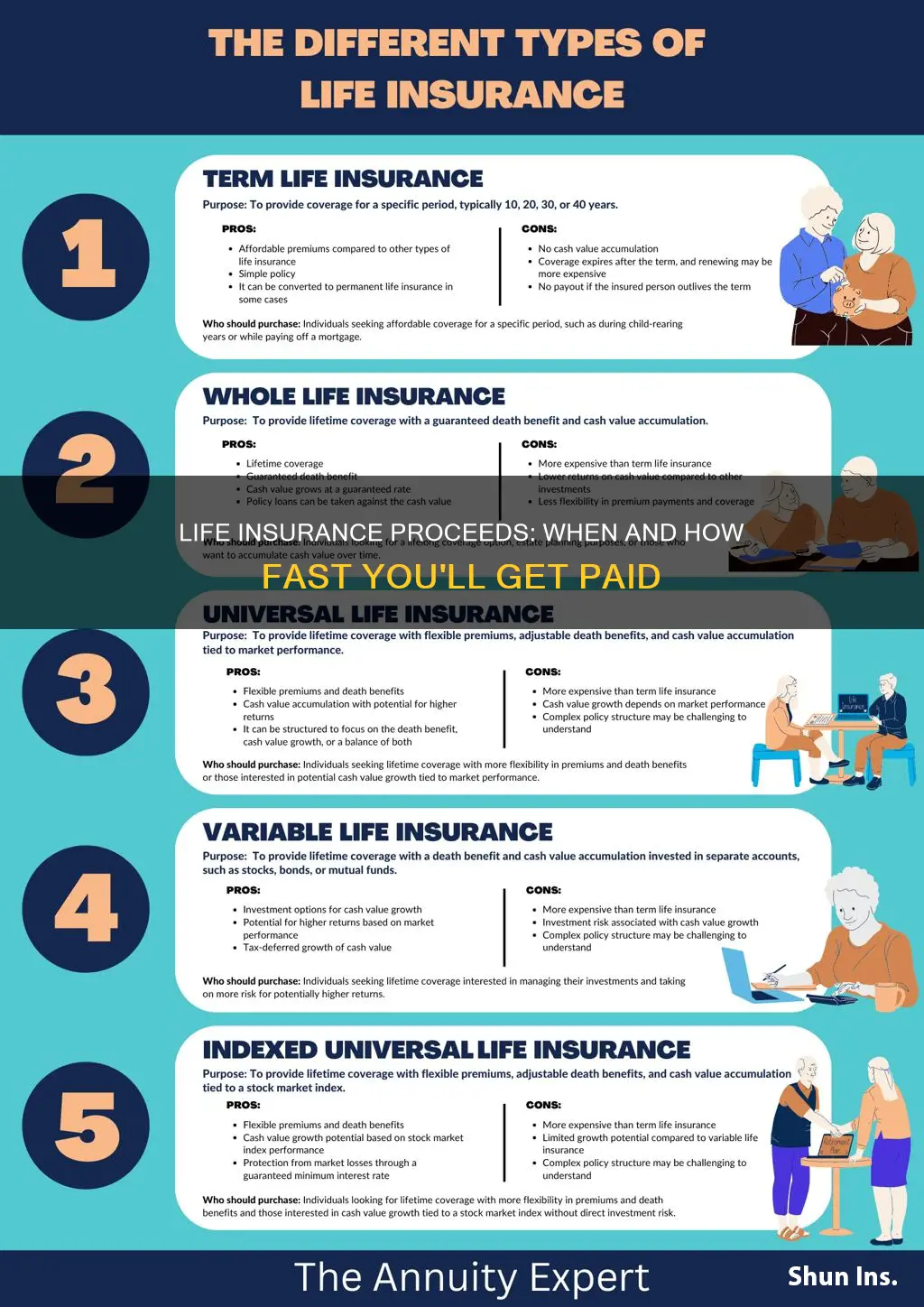

One of the primary factors influencing the claim's complexity is the type of policy. Term life insurance, for instance, is generally straightforward to settle, as it involves a simple payout upon the insured's death. However, permanent life insurance policies, such as whole life or universal life, can be more intricate due to their long-term investment components. These policies require a thorough examination of the policy's value, investment growth, and any outstanding loans or withdrawals, which can extend the claim processing time.

The claim process often involves multiple stages. Initially, the insurance company will request and verify the necessary documentation, including death certificates, policy documents, and beneficiary information. This step is crucial to ensure the accuracy of the claim and the rightful distribution of proceeds. After verification, the company will assess the policy's value and determine the payout amount. This assessment may involve complex calculations, especially for policies with variable benefits or those that have been in force for an extended period.

In cases of disputed claims, the process can become even more complex and time-consuming. Disputes may arise due to questions about the insured's death, such as the cause or timing, or there might be disagreements among beneficiaries regarding the distribution of proceeds. These disputes often require legal intervention and can significantly delay the payout schedule. The insurance company may need to engage legal counsel and potentially undergo a court-supervised settlement process, which can take months or even years to resolve.

For policyholders and beneficiaries, understanding the potential complexity of the claim process is essential. It is advisable to maintain accurate and up-to-date policy documentation and to promptly notify the insurance company of any changes in personal or policy information. By being proactive and providing all the necessary details, the claim process can be streamlined, potentially reducing the time it takes to receive the life insurance proceeds.

Universal Life Insurance: What's Guaranteed and What's Not

You may want to see also

Regulatory Compliance: Insurance companies must adhere to regulatory guidelines regarding payout schedules

Insurance companies are subject to strict regulatory frameworks when it comes to the distribution of life insurance proceeds, ensuring fair and transparent practices. These regulations are designed to protect the interests of both the policyholders and the beneficiaries, providing a structured approach to the payout process. The specific guidelines can vary by region and jurisdiction, but they generally aim to standardize and streamline the payment of insurance benefits.

Regulatory bodies often mandate that insurance companies follow a specific schedule for disbursing life insurance payouts. This schedule typically involves a series of steps and timeframes to ensure the process is efficient and compliant. For instance, after a claim is filed and approved, the insurance company must initiate the payment within a certain period, often within a few days or weeks. This prompt payout is crucial to provide financial support to the beneficiaries during a challenging time.

The regulatory compliance regarding payout schedules is essential for several reasons. Firstly, it ensures that insurance companies do not unduly delay payments, which could cause financial strain for the beneficiaries. Secondly, it promotes transparency and accountability in the industry, allowing policyholders and beneficiaries to understand their rights and the expected timeline for receiving benefits. By adhering to these guidelines, insurance companies demonstrate their commitment to ethical practices and build trust with their customers.

In many jurisdictions, insurance regulators require companies to provide clear and detailed information about the payout process, including the expected schedule. This information is typically disclosed in the insurance policy documents, ensuring that policyholders are well-informed about their rights and the procedures involved. Additionally, insurance companies must maintain accurate records of all payout activities, including the dates and amounts paid, to facilitate regulatory audits and ensure compliance.

Furthermore, regulatory compliance in this area often extends to the handling of complex claims and special circumstances. Insurance companies must have procedures in place to manage cases that require additional review or investigation, ensuring that these processes do not unduly delay the final payout. By adhering to these guidelines, insurance providers can maintain a high level of integrity and efficiently manage the distribution of life insurance proceeds.

Life Insurance for Police Officers: Is It Possible?

You may want to see also

Frequently asked questions

The timing of receiving life insurance proceeds depends on the type of policy and the claims process. Typically, after the death of the insured individual is confirmed, the insurance company will initiate the claims settlement process. This process usually involves verifying the death, providing necessary documentation, and settling any outstanding claims. The proceeds are often paid out within a few weeks to a few months, depending on the complexity of the case and the insurance company's procedures.

While there isn't a universal schedule, many insurance companies follow a standard process. After the claim is approved, the proceeds are often paid out in a lump sum. However, some policies may offer options for periodic payments, such as monthly, quarterly, or annual payments, especially for long-term care or income replacement policies. It's best to check the policy documents or consult the insurance provider for the exact payout schedule.

In some cases, yes. Certain policies allow policyholders to select the payment frequency and amount. For instance, you might opt for a larger lump sum or choose to receive smaller, regular payments over time. However, this option may vary depending on the insurance company and the type of policy. It's essential to review the policy terms and conditions or consult a financial advisor to understand your choices.

Yes, some policies, especially those with a cash value component, may have a waiting period before the full death benefit is paid out. This waiting period is typically a few weeks or months and allows the insurance company to ensure the policy is in force and to verify the insured's death. After the waiting period, the proceeds are usually paid out as scheduled.

The tax treatment of life insurance proceeds can vary depending on the jurisdiction and the type of policy. In many countries, the first $500,000 of life insurance death benefits paid to the beneficiary(s) are typically tax-free. However, any amount exceeding this threshold may be subject to income tax. It's advisable to consult a tax professional or financial advisor to understand the tax implications specific to your situation.