Baby boomers, a generation born between 1946 and 1964, are approaching retirement age, and many are realizing the importance of financial planning. While life insurance is a crucial component of retirement planning, it is concerning that a significant portion of baby boomers do not have life insurance. Recent studies indicate that approximately 60% of baby boomers do not have life insurance, which can have serious financial implications for them and their families. This lack of coverage can leave them vulnerable to financial hardship in the event of their passing, highlighting the need for better financial planning and awareness among this generation.

| Characteristics | Values |

|---|---|

| Overall Percentage Without Life Insurance | 40-50% |

| Age Group (50-64 years) | 30-40% |

| Age Group (65-74 years) | 50-60% |

| Gender | Women are less likely to have life insurance compared to men |

| Marital Status | Unmarried or divorced baby boomers are less likely to have life insurance |

| Income Level | Lower-income baby boomers are less likely to have life insurance coverage |

| Health Status | Those with chronic health conditions may be less likely to be insured |

| Geographic Location | Rural areas might have lower life insurance coverage rates |

| Education Level | Lower education levels could be a factor in not having life insurance |

| Employment Status | Unemployed or self-employed individuals may have lower insurance rates |

What You'll Learn

- Demographic Breakdown: Age, gender, and geographic distribution of boomers without life insurance

- Financial Status: Income, savings, and retirement plans of those without coverage

- Health Factors: Pre-existing conditions and overall health affecting insurance decisions

- Marital Status: Impact of marriage/divorce on life insurance ownership among boomers

- Education and Awareness: Knowledge gap regarding life insurance benefits and importance

Demographic Breakdown: Age, gender, and geographic distribution of boomers without life insurance

The baby boomer generation, born between 1946 and 1964, is a large demographic cohort that has had a significant impact on various aspects of society. When it comes to life insurance, understanding the demographics of those without coverage is crucial. Research indicates that a substantial portion of baby boomers do not have life insurance, and this lack of coverage varies across different age groups, genders, and geographic regions.

Age is a critical factor in this context. Older baby boomers, typically those in their late 50s and 60s, are more likely to be without life insurance. This could be attributed to several reasons. Firstly, as individuals age, they may perceive a reduced need for life insurance, assuming that their current coverage is sufficient. Secondly, older individuals might have already passed the age limit for certain life insurance products, which often have more favorable rates for younger applicants. Additionally, the cost of life insurance tends to increase with age, making it less appealing for some older boomers.

Gender also plays a role in this demographic breakdown. Studies suggest that men are slightly more likely than women to be without life insurance. This disparity could be influenced by societal norms and financial responsibilities. Historically, men have often been the primary breadwinners in families, and the pressure to provide financial security might lead them to prioritize other forms of insurance, such as health or disability coverage, over life insurance. However, it's important to note that this gender gap is narrowing, and the trend of women being more likely to have life insurance is gradually reversing.

Geographic distribution is another essential aspect to consider. The percentage of baby boomers without life insurance can vary significantly across different regions. Urban areas, particularly those with higher population densities, might have a higher proportion of uninsured boomers. This could be due to the fast-paced nature of city life, where individuals may be more focused on immediate financial needs and less inclined to prioritize long-term financial planning. In contrast, rural areas might exhibit lower rates of life insurance coverage, possibly due to a different set of economic and cultural factors.

Understanding these demographic patterns is vital for financial advisors, insurance companies, and policymakers. By recognizing the age, gender, and geographic disparities in life insurance coverage among baby boomers, targeted strategies can be developed to encourage and facilitate insurance adoption. This could include tailored marketing campaigns, educational programs, and financial planning services that address the specific needs and concerns of different demographic groups within this large and diverse generation.

Hypothyroidism: A Life Insurance Reportable Disease?

You may want to see also

Financial Status: Income, savings, and retirement plans of those without coverage

The lack of life insurance among baby boomers is a significant concern, especially when considering their financial well-being in retirement. According to recent studies, a substantial number of this demographic do not have life insurance, which can have long-lasting financial implications. This article aims to delve into the financial status of those without coverage, shedding light on their income, savings, and retirement plans.

Many baby boomers without life insurance often face financial challenges that can impact their retirement years. A survey reveals that a significant portion of this generation has limited or no savings, which is a critical factor in their financial vulnerability. Without life insurance, the loss of a primary earner can lead to severe financial strain, especially for those with limited savings. This group may struggle to maintain their standard of living and could face a rapid decline in their financial stability.

Income sources for baby boomers without life insurance coverage are often diverse but may not be sufficient for long-term financial security. Many rely on Social Security benefits, which, while providing a steady income, might not be enough to cover all expenses. Some may also have part-time jobs or small businesses, but these sources of income are typically insufficient to replace the financial role a life insurance policy would provide. As a result, they may find themselves in a position where their income is not enough to support their desired retirement lifestyle.

Retirement plans for this demographic can be complex and often inadequate. Some baby boomers might have retirement accounts, but the lack of life insurance could mean they haven't maximized their savings potential. Without insurance, they may also face challenges in accessing certain retirement benefits or in ensuring their estate is managed according to their wishes. Additionally, the absence of life insurance can impact their ability to provide financial support to their families or leave a legacy for future generations.

Addressing the financial status of baby boomers without life insurance is crucial. It involves encouraging them to review their financial plans, consider the value of life insurance, and seek professional advice. By doing so, they can ensure a more secure financial future, even in the absence of traditional retirement benefits. This approach can help mitigate the risks associated with not having life insurance and promote a more stable retirement experience.

Best Life Insurance in Philippines: Top Choices Revealed

You may want to see also

Health Factors: Pre-existing conditions and overall health affecting insurance decisions

The percentage of baby boomers without life insurance is a significant concern, especially considering the potential health factors that could influence their insurance decisions. Pre-existing conditions and overall health play a crucial role in determining insurance eligibility and rates. As the baby boomer generation ages, the prevalence of chronic illnesses and health issues increases, which can directly impact their life insurance options.

One of the primary health factors affecting insurance decisions is the presence of pre-existing conditions. These conditions can vary widely, including heart disease, diabetes, cancer, and respiratory issues. Insurance companies often view these conditions as high-risk factors, as they may lead to increased healthcare costs and a higher likelihood of early mortality. For instance, individuals with a history of heart disease might face higher premiums or even be deemed uninsurable by some companies. Similarly, diabetes, especially if poorly managed, can significantly impact life expectancy and insurance rates.

Overall health and lifestyle choices also come into play when assessing insurance applications. Smoking, obesity, and a sedentary lifestyle are all considered risk factors by insurance providers. These factors can contribute to various health issues, including cardiovascular disease, type 2 diabetes, and certain cancers. As a result, individuals with these health habits may find it more challenging to obtain competitive life insurance rates or may be required to undergo additional medical assessments.

Furthermore, the overall health of an individual, including their medical history and current health status, is carefully evaluated. Insurance companies may request detailed medical records, including lab results, medical procedures, and previous surgeries. A comprehensive understanding of an individual's health can help insurers assess the risk associated with providing coverage. For baby boomers, this could mean that their age-related health concerns, such as arthritis, osteoporosis, or age-related cognitive decline, are taken into account during the underwriting process.

In summary, pre-existing conditions and overall health are critical considerations for insurance companies when determining life insurance coverage for baby boomers. The presence of chronic illnesses, lifestyle choices, and overall medical history can significantly impact insurance eligibility and rates. Understanding these health factors is essential for baby boomers to make informed decisions about their life insurance options and ensure they have adequate coverage to protect their loved ones.

Life Insurance: Comdex's Comprehensive List

You may want to see also

Marital Status: Impact of marriage/divorce on life insurance ownership among boomers

The marital status of baby boomers plays a significant role in their likelihood of owning life insurance. Research indicates that married individuals are more likely to have life insurance compared to their unmarried counterparts. This is primarily due to the shared financial responsibilities and the desire to provide financial security for a family. When a couple is married, they often have a combined income, assets, and resources, making it more feasible to afford life insurance premiums. Additionally, the presence of a spouse can influence an individual's decision to purchase life insurance, as it provides a sense of security and peace of mind for both parties.

Divorce, on the other hand, can have a different impact on life insurance ownership. After a divorce, many individuals may reevaluate their financial priorities and decide to adjust their life insurance coverage accordingly. Some may opt to maintain or even increase their life insurance policies to ensure financial protection for themselves and any dependent children. However, others might choose to reduce or cancel their policies, especially if they feel they no longer need the coverage or can no longer afford the premiums. The decision often depends on individual circumstances, such as changes in income, the presence of new partners, and the overall financial situation post-divorce.

Widowed individuals within the baby boomer generation may also experience a shift in their life insurance ownership. Following the loss of a spouse, many people reevaluate their insurance needs and may opt to adjust their policies. Some may choose to maintain the existing life insurance to honor the deceased's wishes or to provide financial security for any dependent children. Others might decide to increase the coverage to ensure their own financial well-being, especially if they are now solely responsible for any dependent family members.

It is worth noting that marital status is just one of several factors influencing life insurance ownership among baby boomers. Other considerations include age, health, income, and the presence of dependents. For instance, older boomers might have different insurance needs compared to younger ones, and those with pre-existing health conditions may face higher premiums or limited coverage options. Understanding these various factors can help individuals make informed decisions about their life insurance coverage.

In summary, marital status significantly impacts the likelihood of baby boomers owning life insurance. Marriage often leads to increased life insurance ownership due to shared financial responsibilities and the desire for family security. Divorce and widowhood can prompt reevaluation and adjustment of insurance policies, with some individuals maintaining or increasing coverage and others reducing or canceling it. Recognizing the influence of marital status, along with other personal factors, is essential for making informed decisions regarding life insurance coverage.

Philam Life Insurance: Quick and Easy Policy Checks

You may want to see also

Education and Awareness: Knowledge gap regarding life insurance benefits and importance

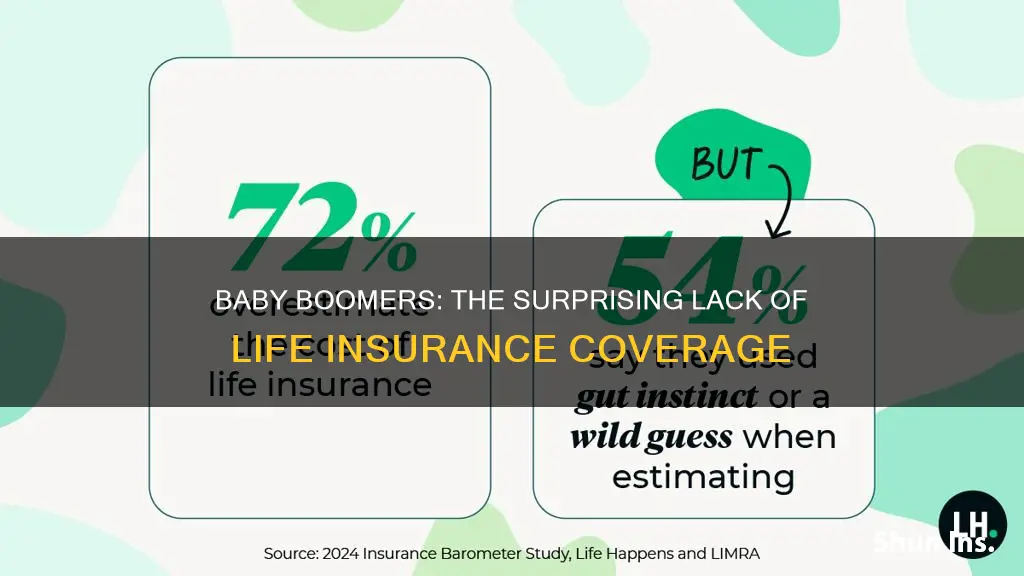

The lack of awareness about life insurance among baby boomers is a significant concern, as it highlights a knowledge gap that could have long-term financial implications. Many older adults in this generation may not fully understand the value and benefits of life insurance, which can lead to a sense of financial vulnerability. This is a critical issue, especially considering the potential financial impact of not having adequate coverage.

A recent study revealed that a substantial number of baby boomers are not adequately prepared for their retirement years. The study found that a significant percentage of this demographic lacks the necessary financial resources and, more importantly, the knowledge to make informed decisions about life insurance. This knowledge gap is a major barrier to securing their financial future. For instance, many might not be aware that life insurance can provide financial security for their loved ones in the event of their passing, ensuring that their family's financial needs are met.

Education and awareness are key to addressing this issue. Many baby boomers may not have had life insurance as a priority in their younger years, and now, as they approach retirement, they might realize the importance of having such coverage. However, without the right information, they may not know where to start or how to navigate the various life insurance options available. This is where financial advisors and insurance professionals can play a crucial role. These experts can provide personalized guidance, helping baby boomers understand the different types of life insurance policies, their benefits, and how they can be tailored to individual needs.

To bridge this knowledge gap, it is essential to offer educational resources and workshops specifically tailored to this age group. These sessions could cover topics such as the different types of life insurance, the importance of coverage for various life stages, and how to choose the right policy. By providing this information, individuals can make more informed decisions and ensure they have the necessary financial protection. Additionally, sharing real-life success stories and case studies of how life insurance has benefited others can be a powerful motivator for baby boomers to consider this essential financial tool.

In summary, addressing the knowledge gap regarding life insurance benefits and importance is crucial for baby boomers to secure their financial future. By providing education and resources, they can make informed decisions and ensure their loved ones are protected. It is a vital step towards a more financially secure retirement for this generation.

Maid Insurance and Life Insurance: How Are They Linked?

You may want to see also

Frequently asked questions

According to a 2022 survey, approximately 60% of baby boomers (born between 1946 and 1964) do not have life insurance. This is a significant number, considering the demographic's influence on the economy and their potential impact on the insurance industry.

There are several reasons for this trend. Some baby boomers may feel they are too young to die, and thus, don't see the immediate need for insurance. Others might be concerned about the cost, especially if they are on a fixed income or have limited financial resources. Additionally, a lack of awareness about the benefits of life insurance or the complexity of the process could also be factors.

Yes, certain subgroups are more likely to be without life insurance. For instance, women tend to be less likely to have life insurance compared to men, and this trend is more pronounced among baby boomers. Additionally, lower-income individuals or those with less education might face financial barriers to purchasing insurance. Age is also a factor, as older baby boomers (those closer to retirement age) may be more inclined to skip life insurance due to perceived lower life expectancy.