Life insurance is a valuable benefit offered by many employers to their employees. While it is a convenient and cost-effective way to get some coverage, it is important to understand the limitations of employer-provided life insurance. This type of insurance, often referred to as group life insurance, is typically tied to your job and may not offer sufficient coverage to meet your financial needs. It is important to carefully review the terms and conditions, including the coverage amount, duration, and eligibility requirements. Additionally, consider whether you need to supplement your employer-provided life insurance with a personal policy to ensure adequate protection for your loved ones.

| Characteristics | Values |

|---|---|

| Paperwork | Paperwork is often part of the hiring process and HR can help if you have any questions. |

| Cost | Basic coverage is usually free or offered at a low cost for the employee. |

| Acceptance | Most basic life insurance plans are guaranteed, so even people with serious medical conditions can qualify. |

| Coverage | Coverage is typically capped at low amounts, such as one to two times your annual salary. |

| Coverage tied to job | If you leave your job, your employer-provided coverage ends. |

| Coverage amount | If you have dependents or financial obligations, a group life insurance policy could leave you underinsured. |

| Premium | The premiums for group life insurance go up either annually or every five years. |

What You'll Learn

Employer-provided life insurance is a good starting point

The convenience of employer-provided life insurance is another advantage. Employees can usually opt into coverage by simply filling out some paperwork, and the policy is often guaranteed, meaning acceptance is not dependent on the employee's health status. This can be especially beneficial for those who are early in their careers and may not have the funds for a private policy.

However, it is important to keep in mind that employer-provided life insurance may not offer sufficient coverage for all individuals. The amount of coverage is typically linked to the employee's annual salary, and it may not be enough to meet the financial needs of their dependents in the event of their death. Additionally, employer-provided life insurance is usually tied to one's job, meaning that if the employee leaves or loses their job, they may lose their coverage.

As such, while employer-provided life insurance is a good starting point, individuals should carefully consider their unique circumstances and financial needs. In some cases, it may be necessary to supplement employer-provided coverage with an individual policy to ensure adequate protection.

Critical Life Insurance: What Does It Cover?

You may want to see also

But it's likely you'll need to supplement it

While employer-provided life insurance is a valuable benefit, it may not be enough to meet your financial needs. Here are some reasons why you may need to supplement it with an individual policy:

Coverage Amounts May Be Insufficient

Basic employer-provided life insurance typically offers a death benefit of around $25,000 to $100,000, or one to two times your annual salary. This amount may not be sufficient, especially if you have dependents, a large family, or significant financial liabilities such as a mortgage or student debt. Experts recommend having coverage worth five to ten times your salary to ensure your loved ones are financially protected.

It's Tied to Your Job

Life insurance through your employer is often not portable, meaning it ends when you leave your job. The average length of time people stay with an employer is 4.6 years, and if you change jobs, you may not be able to take your policy with you. While some policies allow you to convert your group policy to an individual one, the price could increase significantly.

Limited Coverage Options

Employer-provided life insurance tends to be a one-size-fits-all group policy, commonly referred to as "group life." It usually doesn't offer the option to customize your coverage or purchase additional protection. If you have specific needs or want a more complex product like whole life insurance, you may need to look beyond what your employer offers.

Coverage May Not Extend to Your Family

While employer-provided life insurance covers the employee, it typically doesn't extend the same level of coverage to spouses or children. If you want to ensure your family is protected, you may need to purchase a separate policy or supplement your employer-provided coverage.

Premiums Aren't Fixed

The premiums for group life insurance tend to increase over time, either annually or every five years. If your employer pays for your coverage, the premiums for coverage over $50,000 may also be subject to income tax.

Health Changes May Affect Coverage

If your health declines and you need to leave your job due to a medical condition, you may struggle to get new insurance. This is because insurers factor in your health when approving you for a policy, and a medical exam is typically required. By having additional coverage outside of your employer's plan, you can minimize the risk of not qualifying for coverage when you need it most.

Superannuation and Life Insurance: What's the Connection?

You may want to see also

Losing your job could mean losing your coverage

Losing your job could mean losing your insurance coverage. This is because employer-provided life insurance is often tied to your job. If you leave your job, your employer-provided coverage will likely end, and your next job may not offer life insurance as a benefit.

The U.S. Bureau of Labor Statistics reports that the average length of time people stay with an employer is 4.6 years, and for employees between the ages of 25 and 34, it's only 3.2 years. This means that there's a good chance you'll be changing jobs at some point, and if you rely solely on employer-provided life insurance, you could be left without coverage.

Additionally, many group life insurance policies have an "actively at work" requirement, which means that if you're not on the job due to illness, injury, or other reasons, your coverage could be at risk.

To avoid gaps in your life insurance coverage, it's important to consider supplemental coverage or an individual policy that is not tied to your employment. This way, you can ensure that you and your loved ones have the financial protection you need, even if your job situation changes.

Life Insurance Denial: What You Need to Know

You may want to see also

Employer-provided life insurance is unlikely to cover your spouse

Employer-provided life insurance is a benefit offered by employers to their employees. The company provides life insurance for the employee, which includes a lump-sum payment to the employee's beneficiaries if they pass away while employed by the company. This type of insurance is typically group term life insurance, offered as part of an employee benefits package. While it is a valuable benefit, it is unlikely to cover an employee's spouse.

Group life insurance is often not portable, meaning that if an employee leaves their job, they may not be able to take the policy with them. This is because the employer owns the policy, not the employee. Therefore, if an employee's situation changes and they need to leave their job, their coverage will likely end. This could leave the employee's spouse unprotected.

Additionally, group life insurance policies often have low coverage amounts, typically capped at one to three times an employee's annual salary. This may not be sufficient for a spouse's needs, especially if they have financial obligations such as a mortgage or other debts.

Furthermore, employer-provided life insurance is usually only temporary and does not continue beyond the employee's time at the company. This means that if an employee suddenly loses their job, their spouse could be left without insurance coverage.

Therefore, it is recommended that employees consider purchasing a separate, supplemental life insurance policy to ensure that their spouse is adequately protected. This additional policy can be customised to meet their specific needs and will continue even if they change jobs.

Understanding Face Value in Term Life Insurance Policies

You may want to see also

You may want to consider whole life insurance

When considering your life insurance options, you may want to look into whole life insurance. Whole life insurance is a type of permanent life insurance that provides coverage for your entire life cycle. Here are some reasons why you may want to consider it:

Protection for Your Family

Whole life insurance offers death benefit protection that can keep your family financially secure in the event of your passing. It can be a good way to leverage your money as you are fully protected with your first payment.

Cash Value Growth

Whole life insurance allows you to pursue cash value growth that is not subject to market risk. It has guaranteed cash value growth that builds at a steady, dependable pace, allowing it to complement fixed-income investments in your portfolio. You can also set a premium-paying period to pay up your policy faster and accelerate cash value growth.

Replacement for Your Human Capital

Whole life insurance provides a fail-proof way to arrange for the replacement of your "human capital" if you're no longer around to provide for your family. Your human capital includes your wages, benefits, Social Security, and any other unrealized forms of compensation you would typically expect to receive.

Retirement and Asset Safeguarding

Whole life policies are guaranteed to build cash value over time, which can help you pay for big-ticket items like a new home or starting a business. During retirement, when your life insurance needs decrease, you can use the money to supplement your income during down markets without having to sell off portions of your portfolio when prices are depressed.

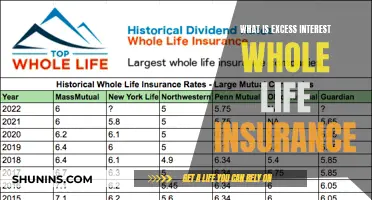

Reinvesting Dividends

When purchasing whole life coverage from a mutual company, you become eligible to receive dividends, which can be used to purchase additional coverage, providing more death benefit protection and increasing the cash value accumulation and dividend-earning potential. Alternatively, you can take your dividends in cash or use them to pay future premiums.

While whole life insurance offers these benefits, it's important to note that it may not be suitable for everyone due to its high premiums and slow cash value growth. It is recommended to consult a financial professional to determine the best option for your specific needs and circumstances.

Life Insurance Rates: Fluctuating Costs and Uncertain Future

You may want to see also

Frequently asked questions

Yes, you will need to fill out any required forms by the deadline provided. This is usually part of the hiring process, and HR can help with any questions.

If you don't fill out the paperwork, you won't be enrolled in the life insurance scheme. It's important to also name a beneficiary, otherwise, the policy payout will automatically go to your estate, spouse or other relatives as determined by law.

Yes, your coverage is tied to your job. If you leave your job, your employer-provided coverage usually ends. Some companies may allow you to keep your policy, but this is not guaranteed.

Yes, you can usually buy more insurance, known as supplemental life insurance, through your workplace plan. This will involve filling out a health questionnaire.

Employer life insurance is convenient and often free or low-cost. It's also guaranteed, so even those with serious medical conditions can qualify. However, the coverage is usually low and may not be enough for your needs. It's also not portable, so you can't take it with you if you leave your job.