Teachers in the UK usually receive death-in-service benefits through the Teachers' Pension scheme, which is similar to life insurance. This means that if they die while employed, their loved ones will receive a lump sum, usually three times their salary. However, this death-in-service benefit is not the same as having a life insurance policy, and teachers might want to consider taking out personal life insurance to complement the benefit provided by their employer.

| Characteristics | Values |

|---|---|

| Teachers' pension scheme includes life insurance | No |

| Teachers' pension scheme includes death benefits | Yes |

| Teachers' pension scheme includes death-in-service benefit | Yes |

| Teachers' pension scheme includes critical illness cover | No |

| Teachers' pension scheme includes ill health cover | Yes |

What You'll Learn

What is included in the teacher's pension scheme?

The Teachers' Pension Scheme (TPS) is a pension scheme that pays members an income in retirement based on their earnings over their career. The scheme was subject to major changes in April 2015, and the benefits one is eligible for depend on when one joined the scheme.

Contributions

The amount one contributes to the pension scheme depends on when one joined the scheme. Both full-time and part-time workers pay a percentage of their gross salary into their pension each month. This is topped up by employer contributions, and one also receives pension tax relief on their contributions.

Benefits

The benefits of the scheme include:

- A substantial contribution from one's employer to one's pension (28.6% of one's salary) alongside one's own contribution.

- A regular income after one retires and the right to a tax-free lump-sum payment at retirement.

- Ill-health benefits if one becomes too unwell to teach.

- Financial protection for one's family and other dependents after one dies.

- Death benefits, which allow a payment to be made to one's spouse in the event of one's passing during retirement.

- Death grants, which are paid out if one dies while in pensionable employment.

Types of Schemes

There are two types of pension schemes:

- Final Salary Scheme: This scheme calculates one's pension based on one's salary at or near retirement.

- Career Average Scheme: This scheme calculates one's pension based on one's salary over their career.

Life Insurance

The Teachers' Pension Scheme does not include life insurance. However, teachers can obtain life insurance from most UK insurance companies. Teachers may also be offered something called a 'death in service' benefit, which is a payout from one's employer if one passes away during their time in service.

Globe Life Insurance Rates: Rising or Stable?

You may want to see also

Do teachers need life insurance?

Life insurance pays out a cash lump sum if you die, and it works the same way for teachers as it does for anyone else. You choose a policy that suits your needs and pay premiums to keep the protection in place.

Teachers don't usually get standard life insurance through their employer, but they may be offered something called a 'death in service' benefit, which is often offered alongside pension plans. While this is valuable, it's not the same as a life insurance policy. Death in service benefits usually pay out a set amount, typically three times your annual salary, whereas with life insurance, you can choose your level of cover.

Whether you need life insurance as a teacher depends on your personal circumstances. You only really need life insurance if you have financial dependents—people who rely on your income, such as a partner or children. If you have no dependents, you may not need life insurance. However, if you have a family, it makes sense to have some form of life cover to ensure they are provided for in the event of your death.

The best type of life insurance for you will depend on your personal circumstances. There are several options to choose from, including:

- Term life insurance—covers you for a set amount of time; ideal if your financial liabilities will eventually disappear (e.g. your mortgage will be paid off, or your children will become financially independent).

- Whole life insurance—covers you for your whole life and pays out when you die; ideal if you know your financial liabilities will never go away or if you always want to leave a lump sum behind.

- Family income benefit—a type of term life insurance that pays out monthly instead of a lump sum; ideal if your loved ones would need a manageable way to support themselves financially.

The cost of life insurance for teachers depends on various factors, including age, health, and lifestyle. However, being a teacher should not affect the price you pay for your cover. Life insurance for teachers can start from as little as £5 per month or 20p per day.

Life Insurance and Acts of War: What's Covered?

You may want to see also

What type of life insurance is best for teachers?

Life insurance is available for teachers through most of the UK's top life insurance companies. While teachers often receive a 'death in service' benefit, this isn't the same as a life insurance policy and would end if you left teaching or retired. Therefore, it's recommended that teachers also take out a personal life insurance policy to ensure their family has sufficient financial protection.

There are several types of life insurance available in the UK, and the best one for you will depend on your individual needs and circumstances. Here are some of the most common types of life insurance policies available:

- Level term life insurance: This type of policy covers you for a specified period, usually up to 40 years. It provides a fixed lump sum payout to your loved ones if you pass away during the term. The payout can be up to £1,000,000, making it ideal for teachers who want to protect large assets such as an interest-only mortgage and future family living costs. Level term life insurance is typically affordable, with prices starting from as little as £5 per month or 20p per day.

- Decreasing term life insurance: Similar to level term life insurance, this policy covers you for a specified period, usually up to 40 years. However, the payout amount reduces over time, making it ideal for protecting a repayment mortgage as the cover amount can decrease in line with your remaining mortgage balance. This type of policy is also very affordable, with prices starting from as little as 20p per day.

- Whole of life insurance: This type of policy covers you for your entire life and provides a fixed lump sum payout when you pass away. The payout can be up to £1,000,000, making it ideal for guaranteeing your loved ones a payout and providing funds to cover funeral costs or leave an inheritance. However, this policy can become costly if taken out at a young age and is better suited to older teachers who are still in good health. Prices for whole life insurance start from around £8 per month.

- Family income benefit: This policy provides coverage for a specified period, usually up to 40 years. If you pass away during this time, your loved ones will receive monthly income payments for the remainder of the policy term, which can be up to £5,000 per month. This type of policy is ideal for teachers with young families, as it helps with long-term family budgeting after your passing. Family income benefit is very affordable, with prices starting from as little as 20p per day.

When choosing a life insurance policy, it's important to consider your personal circumstances, such as your age, health, lifestyle, and financial obligations. You may also want to consider additional protection, such as income protection or critical illness cover, which can provide financial support if you are unable to work due to illness or injury.

Additionally, teachers may be eligible for complimentary life insurance or discounts on life insurance through organisations such as the NEA or union memberships. These benefits can provide additional financial protection for your loved ones in the event of your death or a serious accident.

Maid Insurance and Life Insurance: How Are They Linked?

You may want to see also

How much does life insurance cost for teachers?

The cost of life insurance for teachers depends on several factors, including age, health, lifestyle, and the amount of cover required. Teachers can get life insurance through most of the UK's top insurance companies, and prices can start from as little as £5 per month. Some companies offer discounts to teachers, such as Zurich, which typically offers 5% or 10% off.

The cost of life insurance for teachers can vary depending on the provider and the level of cover. For example, Reassured offers life insurance for teachers starting from 20p per day, while another company offers term life insurance starting from £1.25 per week for an 18-year-old non-smoker with £100,000 in coverage.

It's important to note that while teachers may have some protection through their pension scheme, many choose to purchase additional personal protection. This is because the level of cover provided by the pension scheme may not be sufficient for the teacher's loved ones in the event of their death. When deciding on the amount of cover, it's recommended to consider factors such as mortgage payments, daily family living costs, additional childcare, outstanding debts, and funeral costs.

Genworth Life Insurance: What You Need to Know

You may want to see also

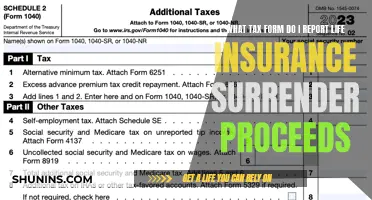

What is the difference between life insurance and death-in-service cover?

Teachers in the UK are often offered a 'death in service' benefit as part of their employment package, which is similar to life insurance. However, there are several differences between the two.

Death in service is a benefit provided by an employer, whereas life insurance is a separate policy that an individual buys to protect their family financially in the event of their death. Life insurance usually runs for a specific term, such as the length of a mortgage, whereas death in service cover only applies while you are employed by the company offering it.

Another difference is that you are automatically accepted for death in service cover if you are eligible as an employee, with no forms to fill in. However, with a standard life insurance policy, you will need to provide information about your health and lifestyle, which will determine the cost of the cover.

Death in service cover is typically calculated as a multiple of your annual salary, usually between two and four times your salary, and is paid out as a tax-free lump sum. With life insurance, you can choose the level of cover you want, which could be up to £1,000,000.

While death in service cover is a valuable benefit, it may not be enough to cover all circumstances or provide sufficient financial support for your family if you were to pass away. For example, the payout may not be enough to cover your mortgage debt or other financial commitments. Life insurance, on the other hand, can be tailored to your specific needs and can be used to pay off a mortgage or other debts.

Additionally, death in service cover is tied to your employment, so if you leave your job or retire, you will lose this benefit. In contrast, life insurance can be kept regardless of your employment status, providing ongoing protection for your family.

In summary, while death in service cover is a valuable benefit, it may not provide sufficient financial protection on its own. Life insurance offers greater flexibility and coverage, allowing you to choose the level of cover and how the payout is used. However, it is important to consider the cost of life insurance, as premiums can increase with age.

Therefore, it may be beneficial to have both types of cover to ensure your family is adequately protected.

Pennsylvania Life Insurance: Overage Tax Implications

You may want to see also

Frequently asked questions

The teacher's pension scheme doesn't include life insurance, but it does include death benefits and death in service.

Death benefits will allow a payment to be made to your spouse in the event of your passing during retirement. The amount paid out will depend on how much pensionable service you have and what agreement you're a part of.

Death in service is a benefit that is provided by an employer. It pays out a lump sum to your loved ones if you pass away while in service with your employer.

Life insurance for teachers can start from as little as 20p a day. The exact price depends on the level of risk you pose to the insurer. Factors such as occupation, age, health, and lifestyle are taken into consideration when calculating the cost of premiums.