When you receive a life insurance settlement, it's important to understand the tax implications. Life insurance surrender proceeds are typically taxable events, and the tax form you need to file depends on the specifics of your situation. This guide will help you navigate the process of reporting these proceeds on your tax return, ensuring you comply with the law and potentially take advantage of any available deductions or credits.

What You'll Learn

- Tax Treatment of Proceeds: Understand how life insurance surrender proceeds are taxed as ordinary income or long-term capital gains

- Exemption Limits: Learn about the annual exclusion limit for life insurance death proceeds and its impact on reporting

- Surrender Charge Impact: Explore how surrender charges on the policy affect the tax treatment of proceeds

- State Tax Considerations: Research state-specific tax rules for life insurance surrender proceeds and their reporting requirements

- Reporting on Tax Returns: Discover which tax forms are used to report life insurance surrender proceeds and when to file

Tax Treatment of Proceeds: Understand how life insurance surrender proceeds are taxed as ordinary income or long-term capital gains

When you surrender a life insurance policy, the proceeds can have significant tax implications, and understanding how they are taxed is crucial for financial planning. The tax treatment of these proceeds depends on several factors, including the type of policy, the time of surrender, and the policy's cash value. Here's a detailed breakdown of how life insurance surrender proceeds are taxed:

Ordinary Income Taxation:

If you surrender a life insurance policy that has accumulated cash value, the proceeds received may be subject to ordinary income tax. This is because the cash value has grown over time, often due to interest or investment earnings. When you surrender the policy, the insurance company typically considers the surrender proceeds as a distribution of the policy's cash value. As a result, the entire amount received may be treated as ordinary income for tax purposes. This means you will owe taxes on the full amount, and the tax rate applied will be based on your income tax bracket. It's important to note that this taxation applies to both whole life and universal life policies with cash value accumulation.

Long-Term Capital Gains Treatment:

In some cases, the tax treatment of life insurance surrender proceeds can be more favorable. If you have held the policy for a significant period, say more than a year, and the proceeds are taken from the policy's cash value, you may qualify for long-term capital gains treatment. This is similar to the tax rules for other long-term capital gains assets. The proceeds received can be excluded from ordinary income, and you will only owe taxes on the gain realized from the policy's growth. The tax rate for long-term capital gains is generally lower than the ordinary income tax rate, providing a potential tax advantage. However, this treatment is not automatic and depends on the specific circumstances of your policy and its holding period.

Policy Type and Surrender Considerations:

The tax treatment can vary depending on the type of life insurance policy. For instance, term life policies do not have cash value accumulation, so the surrender proceeds may be treated differently. Additionally, the time of surrender is crucial. If you surrender the policy early in its term, the proceeds might be taxed as ordinary income. As the policy ages, the potential for long-term capital gains treatment increases. It's essential to consult tax professionals or financial advisors to understand the specific rules and strategies for your situation.

Reporting on Tax Forms:

When reporting life insurance surrender proceeds on your tax return, you will typically use Schedule D (Capital Gains and Losses) of Form 1040. You'll need to calculate the gain or loss realized from the surrender and report it accordingly. The tax form instructions will guide you through the process, ensuring you provide the necessary details. Remember that accurate reporting is essential to avoid penalties and ensure compliance with tax regulations.

Understanding the tax treatment of life insurance surrender proceeds is vital for making informed financial decisions. By recognizing the potential for ordinary income or long-term capital gains taxation, you can plan accordingly and explore strategies to minimize tax liabilities. Consulting with tax professionals can provide personalized guidance based on your specific circumstances.

Life Insurance Basics: Understanding the Difference Between Basic and Optional Coverage

You may want to see also

Exemption Limits: Learn about the annual exclusion limit for life insurance death proceeds and its impact on reporting

The annual exclusion limit for life insurance death proceeds is a crucial aspect of tax reporting for individuals receiving such payments. This limit determines how much of the death benefit can be exempt from taxation, and understanding it is essential for proper tax compliance. As of 2023, the annual exclusion limit for life insurance death proceeds is set at $10,000 per recipient. This means that if an individual receives a death benefit exceeding this amount, they may be required to report the excess on their tax return.

When a life insurance policyholder passes away, the death benefit is typically paid out to designated beneficiaries. The annual exclusion limit applies to each beneficiary, ensuring that the tax system remains fair and equitable. It's important to note that this limit is separate from the overall estate tax exclusion, which determines the amount of an estate that can be exempt from taxation upon death.

Exceeding the annual exclusion limit can have significant tax implications. Any amount over $10,000 must be reported on Form 709, the United States Gift Tax Return. This form is used to report gifts made during an individual's lifetime, and the excess death benefit will be treated as a taxable gift. Beneficiaries should be aware of this limit to avoid unexpected tax liabilities and ensure compliance with tax regulations.

To illustrate, if a life insurance policy has a death benefit of $50,000 and there are multiple beneficiaries, the first $10,000 per beneficiary is exempt. However, if the total death benefit exceeds $40,000, the excess amount will need to be reported. It is advisable to consult tax professionals or refer to the latest IRS guidelines to ensure accurate reporting and understanding of the tax laws surrounding life insurance proceeds.

In summary, the annual exclusion limit of $10,000 for life insurance death proceeds is a critical consideration for beneficiaries and policyholders alike. Being aware of this limit helps individuals navigate the tax reporting process effectively and ensures compliance with the Internal Revenue Service (IRS) regulations. Proper understanding and adherence to these limits can prevent potential tax issues and penalties.

Accordia Life Insurance: What You Need to Know

You may want to see also

Surrender Charge Impact: Explore how surrender charges on the policy affect the tax treatment of proceeds

When it comes to reporting life insurance surrender proceeds, understanding the impact of surrender charges is crucial. These charges, often associated with the early termination of a life insurance policy, can significantly influence the tax treatment of the proceeds received. Here's an in-depth look at how surrender charges affect the tax landscape:

Surrender charges are typically levied by insurance companies when a policyholder decides to cancel or surrender their life insurance policy before the end of the term. These charges are designed to compensate the insurer for the potential loss of future premiums and benefits. The amount of surrender charge can vary depending on the policy type, the time of surrender, and the insurer's policies. It is essential to recognize that surrender charges are not a tax but rather a fee imposed by the insurance company.

The tax implications of surrender proceeds are directly tied to the nature of these charges. When a policyholder surrenders a life insurance policy, the proceeds received are generally considered taxable income. However, the presence of surrender charges can complicate this process. The key consideration is whether the surrender charge is considered a return of premium or a penalty. If the surrender charge is a return of premium, it may be tax-free, as it represents the policyholder's original investment. However, if the charge is deemed a penalty, it could be taxable as ordinary income.

To navigate this complexity, policyholders should carefully review their insurance policies and consult tax professionals. The tax treatment of surrender proceeds can vary based on the specific surrender charge structure. In some cases, the charge may be a flat percentage of the premium paid, while in others, it could be a percentage of the policy's cash value. Understanding these nuances is vital to ensure accurate tax reporting.

For instance, if the surrender charge is a percentage of the policy's cash value, the tax treatment might differ from a flat charge. In the former case, the tax implications could be more complex, potentially requiring the calculation of the taxable portion of the proceeds. It is advisable to seek professional advice to determine the exact tax consequences, especially when dealing with large surrender amounts.

In summary, surrender charges on life insurance policies have a direct impact on the tax treatment of proceeds. Policyholders must be aware of these charges and their potential tax implications to ensure compliance with tax regulations. Consulting tax experts and carefully reviewing insurance policies can help individuals make informed decisions regarding the reporting and taxation of life insurance surrender proceeds.

Navigating Life Insurance: Unlocking the Best Policy for Your Needs

You may want to see also

State Tax Considerations: Research state-specific tax rules for life insurance surrender proceeds and their reporting requirements

When it comes to state tax considerations, the tax treatment of life insurance surrender proceeds can vary significantly from one state to another. It's crucial to research and understand the specific rules in your state to ensure compliance with tax regulations. Here's a breakdown of what you need to know:

State-Specific Tax Rules: Each state has its own tax laws and regulations regarding life insurance proceeds. Some states may consider life insurance surrender proceeds as taxable income, while others might exempt them. For instance, in certain states, the proceeds from the surrender of a life insurance policy may be treated as ordinary income and subject to state income tax. On the other hand, some states might offer tax benefits or exclusions for these proceeds, especially if the policy was held for a specific period or met certain criteria.

Reporting Requirements: The reporting requirements for life insurance surrender proceeds can vary across states. In some states, you may need to file a separate tax form or schedule to report these proceeds. For example, you might need to complete a state-specific tax form that details the amount of surrender proceeds received and any applicable tax deductions or credits. It's essential to check the state's tax agency website or consult a tax professional to obtain the correct forms and understand the reporting process.

Exemption and Deduction Opportunities: Some states provide exemptions or deductions for life insurance surrender proceeds under specific circumstances. For instance, if the policy was owned by an individual for a certain period and the proceeds are used for certain qualified expenses, it may be exempt from taxation. Researching the state's tax code and consulting with a tax advisor can help identify any available exemptions or deductions that can reduce your tax liability.

State Tax Forms and Instructions: To accurately report life insurance surrender proceeds, you'll need to refer to the state tax forms and instructions provided by the relevant tax authority. These forms often include detailed guidance on how to calculate and report the proceeds, including any necessary schedules or attachments. Staying updated with the latest tax forms and instructions is essential to ensure you are using the correct version and providing all the required information.

Remember, tax laws can be complex, and each state's regulations may have nuances. It is highly recommended to consult a tax professional or accountant who specializes in state tax matters to ensure you accurately report your life insurance surrender proceeds and take advantage of any available tax benefits or exemptions specific to your state.

Getting Life Insurance for Your Parents: What You Need to Know

You may want to see also

Reporting on Tax Returns: Discover which tax forms are used to report life insurance surrender proceeds and when to file

When it comes to reporting life insurance surrender proceeds on your tax return, understanding the process and the relevant tax forms is crucial. Life insurance surrender proceeds can be a significant financial event, and proper reporting ensures compliance with tax regulations. Here's a comprehensive guide to help you navigate this aspect of tax reporting.

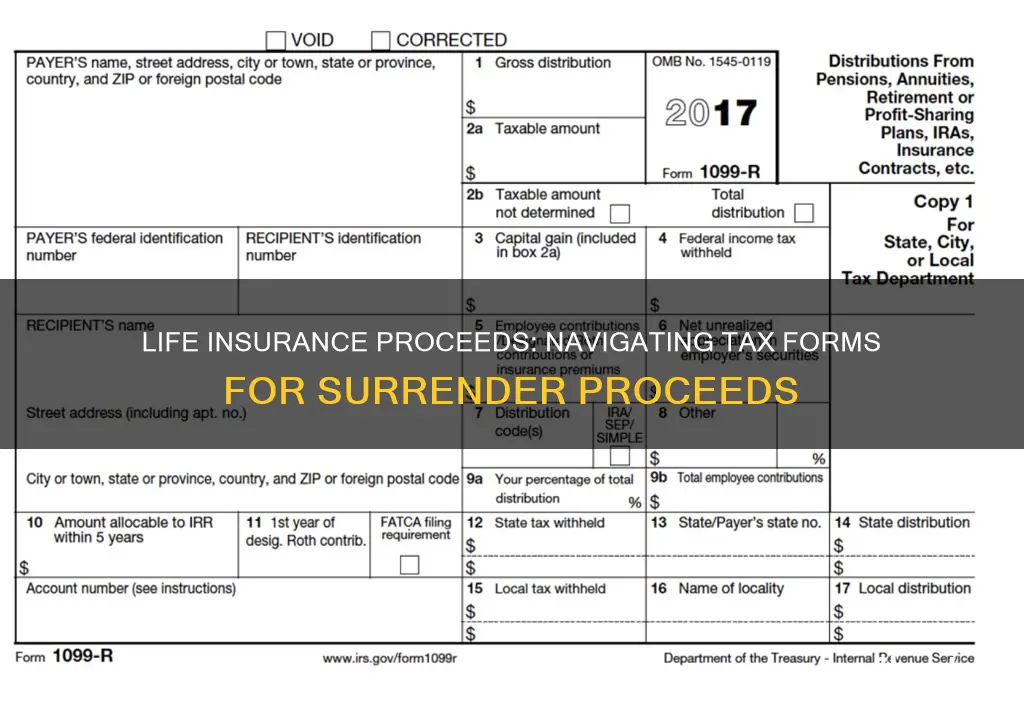

The tax form you'll use to report life insurance surrender proceeds depends on the nature of the proceeds and your overall financial situation. For individuals, the most common form for this purpose is Form 1040, the U.S. Individual Income Tax Return. If you receive a lump sum or a series of payments from a life insurance policy surrender, you'll need to report these proceeds as ordinary income. This is because life insurance surrender proceeds are generally considered taxable income.

To report these proceeds on Form 1040, you'll need to fill out Schedule 1 (Additional Income and Adjustments to Income) and select the appropriate boxes for the surrender proceeds. You may also need to provide details about the life insurance policy, such as the policy's cash value and any surrender charges. It's essential to accurately report these amounts to avoid potential penalties and ensure a smooth tax filing process.

In some cases, you might also need to file Form 8949, Sales and Other Transactions, to report the specific details of the life insurance surrender. This form is particularly useful if you have multiple transactions or if the proceeds are significant. Additionally, if you are self-employed or a business owner, you may need to consider the tax implications on your business tax return, which could be Form 1040-SR or a similar business tax form, depending on your business structure.

Timing is also critical when filing tax returns for life insurance surrender proceeds. You should report these proceeds for the tax year in which they were received. It's advisable to consult with a tax professional or accountant to ensure accurate reporting and to understand any potential tax benefits or deductions related to life insurance. Proper reporting will help you stay compliant with the IRS and potentially save on taxes.

Incarcerated and Insured: Life Insurance for Prisoners

You may want to see also

Frequently asked questions

When you surrender a life insurance policy, the proceeds received can be considered a taxable event. You will typically report this on Form 1099-G, "Certain Government Payments." This form is used to report various types of payments, including refunds of health insurance premiums, and in this case, it helps you report the surrender proceeds as income.

Yes, you must report the entire amount received from the life insurance surrender. This includes any cash value or other benefits you receive when you surrender the policy. The proceeds are generally taxable as ordinary income, so you should include this amount on your tax return, usually on Schedule 1 of Form 1040.

In some cases, if the surrender proceeds are less than $1,000, you may not need to report it on your tax return. However, it's essential to consult the IRS guidelines or seek professional advice, as there might be specific rules depending on the circumstances. Additionally, if the policy has been in force for a certain period and meets certain conditions, the proceeds might be tax-free or partially exempt.